CSS Profile

advertisement

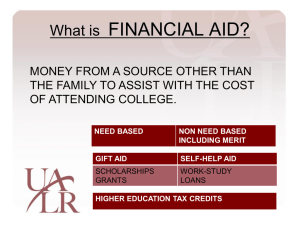

Eric J. Hill College & Career Education Specialist eric.hill@apsva.us Tonight’s Topics What is Financial Aid Types of Financial Aid How Financial Aid is Awarded The Financial Aid Process Scholarships To be Eligible for Federal Financial Aid Be a citizen or eligible non-citizen of U.S. Have a high school diploma or GED Be enrolled at least half-time at an eligible institution Register with Selective Service (men only) Not be in default on any federal education loans or owe a refund on any grants Types of Financial Aid Three types of Financial Aid: Gift Money Earned Money Borrowed Money Gift Money Grants Based on Financial need Federal, State, and University Grants Scholarships Based on various criteria From Colleges and other organizations Earned Money Federal Work-Study Program Students work part-time, usually on campus Money earned helps pay for college Borrowed Money Two types of loans Federal Personal Must be paid back Federal Loans - Perkins Borrower: Student Based on Need: Yes Interest Rate: Fixed Repayment Begins: 9 months after graduating or dropping below half-time Federal Loan - Stafford Borrower: Student Based on Need Subsidized = Yes Based on Need: Unsubsidized = No Interest Rate: Fixed every July 1, Repayment Begins: 6 months after graduating or dropping below half-time Federal Plus Loan Borrower: Parent Based on Need: No Interest Rate: Fixed every July 1, Cost of Attendance William & Mary Tuition $6,785 Room $2,985 Board $1,642 Books, Travel and incidentals $1,400 Total (Per Semester) $12,722 How is Financial Aid Awarded? Expected Family Contribution (EFC) The EFC is the amount you may be expected to contribute You don’t pay it up front Used to determine how much aid you’re eligible for Calculated from information you provide Applying for Financial Aid To apply(FAFSA)www.fafsa.ed.gov FREE Free Application for Federal Student Aid Apply for a Department of Education PIN (www.pin.ed.gov) Apply regardless of family income What is the CSS Profile ? The profile is an online application that collects information used by certain colleges and scholarship programs to award institutional aid funds. The CSS PROFILE also asks for more information than the FAFSA. For example, the CSS PROFILE asks for detailed information pertaining to investments and home worth— two areas the FAFSA does not cover in-depth. Using both of these tools allows University to gain a more accurate picture of a family’s financial standing. How much does the CSS PROFILE Cost? There is a $25 fee for the initial application, and a $16 fee for each institution that receives it thereafter. A limited number of fee waivers are granted automatically to first-year, first-time applicants from low-income families, based on the financial information provided on the PROFILE. When do I file the FAFSA & CSS Profile FAFSA: January 1, 2013 CSS Profile: October 15, 2012 However, you should file no later than two weeks before the earliest priority filing date specified by your colleges or programs. Student Aid Report (SAR) Sent to you after FAFSA is processed If you provided an email you get a notification containing a link to it online Paper version via mail Contain your Expected Family Contribution(EFC) Information sent automatically to colleges you listed In order to be considered for certain types of aid at UVA Required application materials are: the FAFSA the CSS Profile a signed copy of the parent 2012 federal tax return including all schedules* (If the parent did not file a 2012 federal tax return, the parent must complete the Parent Non-Tax Filer form parent 2012W-2 form(s) a signed copy of the student 2012 federal tax return including all schedules* (If the student did not file a 2012 federal tax return, the student must complete the Student Non-Tax Filer form In order to be considered for aid at William & Mary Required application materials are: the FAFSA the CSS Profile Stanford University The Parent Contribution We use an institutional formula to calculate an expected parent contribution toward educational costs. Our goal is to treat families equitably while still maintaining flexibility to recognize unusual situations. When we review your family’s finances, we make allowances for: living expenses (based on household size) federal and state taxes unusually high medical expenses college costs (undergraduate) for siblings private school tuition and college savings for younger siblings We also consider your family’s assets, including home equity, savings, investments and real estate, but not retirement accounts. Stanford University In cases of separation or divorce, we expect both parents to participate in paying for your education. We will compute separate contributions for your custodial and non-custodial parents. Stanford University Zero Parent Contribution for Parents with Income Below $60,000 For parents with total annual income below $60,000 and typical assets for this income range, Stanford will not expect a parent contribution toward educational costs. Students will still be expected to contribute toward their own expenses from their summer income, part-time work during the school year, and their own savings. Stanford University Tuition Charges Covered for Parents with Income Below $100,000 For parents with total annual income below $100,000 and typical assets for this income range, the expected parent contribution will be low enough to ensure that all tuition charges are covered with need-based scholarship, federal and state grants, and/or outside scholarship funds. Stanford University Tuition Charges for Parents with Income Below $200,000 Families with incomes at higher levels (typically up to $200,000) may also qualify for assistance, especially if more than one family member is enrolled in college. We encourage any family concerned about the ability to pay for a Stanford education to complete the application process. If we are not able to offer need-based scholarship funds we will recommend available loan programs. Financial Aid Deadline Very from school to school Early Decision students at William & Mary need to complete the CSS Profile by December 7, 2012 Institutional payment plan available Award Letters and Offers Received from the financial Aid Office Compare offers Amount of Aid vs. cost of attendance Gift money vs. borrowed money Types of loans Comparing Award Offers Type of Aid Brown University University of Penn Federal Grant $5,000 $5,000 Institution Based Grant $35,000 $38,658 Perkins Loan Un-Sub $1,000 Stafford Loan Sub $3,000 Work-Study $3,000 $3,000 Parent Plus Loan $9,000 $4,000 Total Aid $53,500 $50,658 Scholarships Washington -Lee high school, class of 2012 received more than $5.2 million in grants and scholarships. Ivy League Institutions Merit Scholarships No Merit Scholarships Cornell University Columbia University Dartmouth College Harvard University Brown University Princeton University Yale University University of Pennsylvania University of Alabama Out-Of State Scholarship Students who have 32-36 ACT or 1400-1600 and at least a 3.5 cumulative GPA will receive out-of-state tuition for four years. Students who have 30-31 ACT or 1330-1390 SAT and at least a 3.5 cumulative GPA will receive two-thirds the cost of out-of-state for four years. How to Locate Scholarships The student or the parent can login naviance family connection and search for scholarships. If you receive e-mails from me, you having a naviance family connections account. If you have forgotten your password or never registered, please e-mail me with your son or daughter's full name and I will reset your password. Eric J. Hill College & Career Education Specialist eric.hill@apsva.us