What are Stocks?

advertisement

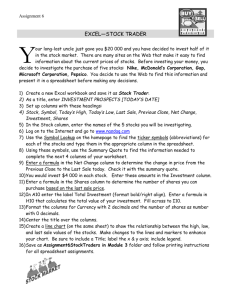

SECURITIES Securities a contract that can be assigned a value and traded. instruments representing ownership (stocks), a debt agreement (bonds) or the rights to ownership (derivatives). Source: Investopedia STOCKS/SHARES /EQUITIES A few things to remember ... Individuals and groups of people doing business as a partnership, have 1........... liability for debts, unless they form a limited company. If the business cannot pay its 2..........., any creditor can have it declared 3............ In order not to lose their personal 4..........., most people doing business form 5........... companies, i.e. legal 6........... separate from their owners and only 7........... for the amount of capital that has been 8........... in it. If a limited company goes 9..........., it is wound up and its assets are 10........... (i.e. sold) to pay the debts. If the 11........... do not cover the liabilities or the debts, they remain unpaid and 12........... simply do not get all their money back.Based on MacKenzie (2002), p.91 A few things to remember ... Individuals and groups of people doing business as a partnership, have unlimited liability for debts, unless they form a limited company. If the business cannot pay its 2 debts, any creditor can have it declared 3 bankrupt. In order not to lose their personal 4 assets, most people doing business form 5 limited companies, i.e. legal 6 entities separate from their owners and only 7 liable for the amount of capital that has been 8 invested in it. If a limited company goes 9 bankrupt, it is wound up and its assets are 10 liquidated (i.e. sold) to pay the debts. If the 11 assets do not cover the liabilities or the debts, they remain unpaid and 12 creditors simply do not get all their money back. Based on MacKenzie (2002), p.91 A few things to remember ... Most companies begin as 13… limited companies. Their owners have to put capital themselves, or 14 ….. from friends or a bank. A growing company can apply to a stock exchange to become a 15 … limited company (GB)/listed company (US). Very successful companies can be quoted/listed on major stock exchanges. Public companies fulfill a large number of requirements including publishing independently audited annual reports for their 16…. Based on MacKenzie (2002), p.91 A few things to remember ... Most companies begin as 13 private-limited companies. Their owners have to put capital themselves, or 14 borrow from friends or a bank. A growing company can apply to a stock exchange to become a 15 public-limited company (GB)/listed company (US). Very successful companies can be quoted/listed on major stock exchanges. Public companies fulfill a large number of requirements including publishing independently audited annual reports for their 16 shareholders. Based on MacKenzie (2002), p.91 STOCKS/SHARES /EQUITIES Selling Who? Why? Buying Who? Why? Trading Where? ISSUERS (COMPANIES) issuing shares – raising funds for expansion public limited companies (Plc) public companies *Attention!What does ’public’ mean here? to list shares at a stock exchange listing / quotation listed companies / quoted companies ISSUERS (COMPANIES) going public (e.g. They went public last year.) flotation / IPO (Initial Public Offering) to float a company underwriting new share issues IPO IN PRIVATISATIONS … INA IPO starts today 13 Nov 2006 ‘Croatia has set the price range for local investors seeking to buy shares in oil company INA at between 1,400 kuna and 1,900 kuna. The IPO will start today, when subscription will open for local buyers. A roadshow for investors will start next Monday. The books will close on November 23 for private individuals and four days later for institutional investors from Croatia. The government hopes to fetch up to 2.85 billion kuna from the sale of 15 percent of INA's stock and may float a further two percent, depending on investor interest.’ …OR BY FAMOUS COMPANIES ‘Nine years ago today, Google started trading on the public markets at $85 a share. The stock price has since risen by more than 900% through Friday’s close, and at last glance was trading north of $870.’ Source: http://blogs.wsj.com/moneybeat/2013/08/19/ (Aug, 2013) Facebook’s newly public shares are losing an average of about $1 per trading day since their offering. If that lasts, the social-networking company would be worth nothing before the end of June, and Chief Executive Mark Zuckerberg’s trips to McDonald's will seem less chic and more necessary…. Some newly public companies actually had worse first days than Facebook did. …Like Facebook, many initial public offerings were overvalued by traditional measures. Source: http://online.wsj.com/news/articles (30 May, 2012) …OR BY FAMOUS COMPANIES ‘Nine years ago today, Google started trading on the public markets at $85 a share. The stock price has since risen by more than 900% through Friday’s close, and at last glance was trading north of $870.’ Source: http://blogs.wsj.com/moneybeat/2013/08/19/ (Aug, 2013) Facebook’s newly public shares are losing an average of about $1 per trading day since their offering. If that lasts, the social-networking company would be worth nothing before the end of June, and Chief Executive Mark Zuckerberg’s trips to McDonald's will seem less chic and more necessary…. Some newly public companies actually had worse first days than Facebook did. …Like Facebook, many initial public offerings were overvalued by traditional measures. Source: http://online.wsj.com/news/articles (30 May, 2012) SHAREHOLDERS/STOCKHOLDERS investors purchasing shares - taking part of the ownership small shareholders vs. majority shareholder retail shareholders vs. institutional investors Shareholders’ rights: to vote at AGM (AMS) to receive a dividend to claim the company's assets (in case of liquidation) to sell shares on the secondary market TRADING trade in shares secondary market stock market: stock exchanges, OTC traders: market makers,dealers, brokers different types of shares (e.g. ordinary shares/common stock, preferential shares/preferred stock) The «Farm» Bulls Bears Chicken Pigs Stags bull market / bear market bullish market / bearish market Bulls make money, bears make money, but pigs just get slaughtered. Questions based on MK, p.87 1. Stocks – definition? 2. What banks are engaged in issuing stocks? 3. Nominal value - definition? 4. Measures of the value of stock markets? 5. Bull/bear market – definition? 6. Syn: common stock, buying/selling prices Stock table What does the table show? (Find it below: http://www.investopedia.com/university/stocks/stocks6.asp Assignment Find the current information for the stocks you checked in class (the Financial Times, October 2008: a)price b)yield, c)price/earnings ratio – P/E). Do the same for the stocks of three famous companies of your choice if you were not in class. Write a report (handwritten) on the comparison of stock performance (in April 2013 vs October 2008 or compare the current performance of the stocks of the three famous companies). Make a recommendation as to which of the three stocks should be bought. The website below may help your search (“Get quotes” box): http://uk.finance.yahoo.com What are Stocks? http://www.investopedia.com/video/play/what-are-stocks 1. Definition of a stock? 2. What do stockholders have claim on? 3. What assets are mentioned in the video? 4. What major stock exchanges are mentioned in the video clip?