Welcome to the Year-End Accounting Workshop

advertisement

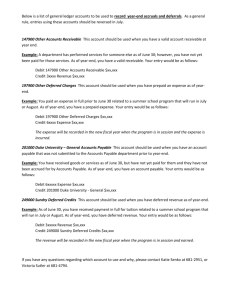

1 WELCOME TO THE YEAR-END ACCOUNTING WORKSHOP Andrea Napoli, Manager Accounting Ops Gary Maccarone, Sr. Staff Accountant/Outreach Specialist Anthony Robinson, Sr. Staff Accountant 2 Today’s Objectives • Familiarize you with: • Importance & timing of fiscal year-end processes • Accounting for FY 15 expenses paid after June 30th (accruals) • Accounting for FY 16 expenses paid before June 30th (prepaid) • Accounting for FY 16 income received before June 30th (deferred income) • Significant year-end processing dates • Who to call for assistance 3 Importance of RIT’s Fiscal Year-End • Impact of events in the external environment (“corporate America”) on RIT • RIT environment • No history of regulatory violations • Culture isn’t tolerant of fraudulent accounting • While risk for fraud exists in all organizations, management’s overall assessment is that RIT’s internal control & accounting environment is strong 4 Importance of RIT’s Fiscal Year-End - Ethics (continued) • RIT is committed to governing our community in a way that is both ethical and honest, and serves as a role model to our students by demonstrating honest stewardship of university assets and resources. • Anonymous whistleblower system to report possible misconduct relative to financial reporting, accounting, internal control, regulatory compliance, and use of Institute resources. • Phone 866-294-9358/866-294-9572 TTY • http://www.ethicspoint.com 5 Importance of RIT’s Fiscal Year-End • Goal is accurate & timely financial statements • Timely closing process • Appropriateness of accounting transactions • Accruals • Prepaids • Deferred Income • Thorough documentation • Complete balance sheet account reconciliations (continued) 6 Importance of RIT’s Fiscal Year-End (continued) • Fiscal year is July 1st - June 30th • NTID departments follow RIT closing processes at June 30th • Accounting sends memo regarding year-end processes to RIT managers in early June • Information posted on Controller’s Office web page 7 Importance of RIT’s Fiscal Year-End (continued) • Auditors arrive in mid August to begin the year-end audit • Audit continues for 3 - 4 weeks • Financial statements are ready for distribution & presentation to the RIT Board of Trustees 8 Significant Year-End Dates • June 26th 4:30 p.m. – Last day Accounts Payable will accept Purchase Order Invoices, Invoice Payment Forms, Online Employee Expense Reimbursements • June 29th 4:30 PM – Last day for cash deposits and petty cash expenses to be included in FY 15 • June 30th 4:30 PM – Last day for Oracle online payroll entries – (Summer Salary, Add Pays, Special Assignments,) for work completed prior to July 1st to be entered and approved to be included on the prelim statements 9 Significant Year-End Dates • June 30th 4:30 PM – Last day AP will enter PO invoices, Invoice Payment Forms • June 30th 4:30 PM – Employee Expense Reimbursements (I-Expenses) must be approved in Oracle & documentation must be received in AP • July 2nd 4:30 PM – Last day for departments to enter journal entries for preliminary statements • July 6th 4:30 PM – Last day to enter invoices in Accounts Receivable 10 Significant Year-End Dates (continued) • July 1st – July 13th AP will prepare Year-End Accrual entries for goods received, services rendered or travel taken on or before June 30th • DR Department expense account • CR 01.15199.32900.00.00000.00000 11 Significant Year-End Dates (continued) • Departmental Action Required • Departments will only prepare Year-End Accrual JEs for goods and/or services received on or before June 30th for which the vendor Has Not Provided An Invoice by July 10th • DR Department expense account • CR 01.15199.32900.00.00000.00000 • When invoice is received, indicate on Invoice Payment Forms “Accrued FY 15” 12 Significant Year-End Dates (continued) • Email documentation to postmyje@rit.edu, indicating batch name, JE name • Appropriate documentation – packing slip, estimate of the completed work, the date received 13 Significant Year-End Dates (continued) • July 7th – Preliminary Closing • July 8th – Preliminary statements • Departments review June transactions & make corrections before final closing • Use the special June department statement (RIT FY 2015 Dept Stmt) • Encumbrances aren’t included in “Available Balance Column” 14 Significant Year-End Dates (continued) • July 14th 4:30 PM – Last Day for department’s to enter journal entries for Final department statements • July 16th – Final Closing for Departments • Accounting continues to process significant FY 15 transactions through Aug 5th • July 17th – Final Department Statements • Accounting & Financial Reporting prepare year-end schedules & financial statements for external auditors 15 Who to Call for Assistance • Invoice Payment Forms Yancey Moore 5-4900 Jackie Hughes 5-7679 Catrina Sapp 5-2885 Kitty Stappenbeck 5-5580 Mary Kay Tyner 5-7221 Yancey Moore 5-4900 Janet Bristol 5-2372 Gary Maccarone 5-2237 • ProCard, CTA & GTA Valerie Russell 5-4491 • Payroll Expenses Kitty Stappenbeck 5-5580 Christa Abugasea 5-2418 Gary Maccarone 5-2237 • Online Employee Expense Reimbursements • Purchase Order Invoices • JE, Petty Cash, Deposits & All File Feeds • Dept Stmts, Encumb 16 Who to Call for Assistance • Special & Designated • • • • • • Gary Maccarone (continued) 5-2237 Projects (1XXXX) Grants & Contracts Sponsored Programs See SPA (3XXXX projects) Accounting Directory https://www.rit.edu/fa/controller/sponsored/assignments.html Gift & Endowment Projects Pricilla Schiffhauer 5-7872 (2,6 & 7XXXX) Agency Accts 9XXXX Gary Maccarone 5-2237 Capital Equipment (84200) Kerry Phillips 5-2297 Plant & Fixed Assets Jane McGrath-Briggs 5-4933 Budget Entries Chris Monaco 5-5982 17 Year-End Accounting Review 18 Accrual Based Accounting • Expenditures are recognized in the year goods are received or services rendered; not when ordered or paid for • Services rendered or goods received on or before June 30th are charged to FY 15 • Services rendered or goods received after July 1st are charged to FY 16 19 Purchase Orders • Goods must be received or services rendered on or before June 30th • Fax Receiving documentation (i.e. packing slip or invoice) if items are delivered directly to your department • Steve Lipson; fax 5-6815, e-mail - snlpre@rit.edu • June 30th – last day to match invoices to Purchase Orders 20 Purchase Orders (continued) • Purchase Orders • July 1st – Procurement Services runs Uninvoiced Receipts Report • Creates Accrual Journal Entry and Accrual Encumbrance Entry • If goods are received or services are rendered by June 30th but not received in Oracle, send AP the invoice with proof of receipt, AP will prepare the Year-End Accrual entry 21 Encumbrances • Encumbrances • Run Encumbrance Detail Report through May 31st and compare to department statement • “Finally close” old purchase orders • e-mail - purchase@rit.edu • Open encumbrances at June 30th will automatically be carried over to FY 16 22 Invoice Payment Forms • June 30th – • Last day for AP to enter Invoice Payment Forms in Oracle to charge goods & services received by June 30th directly to FY 15 • July 1st – July 13th • FY 15 expenses will be accrued by AP with a year- end accrual entry 23 Travel Expense Reports • June 26th • Last day to enter Oracle online employee reimbursements for trips taken prior to July 1st • Must have completed supervisory approval in order to be included on prelim statements • July 1st – July 13th • FY 15 expenses will be accrued by AP on a year- end accrual entry 24 Procurement Card Purchases • Closing date for PNC ActivePay is June 30th • Transfer to G/L July 6th – 8:30 a.m. • Last minute purchases might not be charged to your June p- card statement • Accounting will process Year-End Accrual entries for a transaction date of June 30th or prior and a post date of July 1st or later • Change the default account number in ActivePay before July 6th at 8:30am 25 Accrual Example JE Category – Use “YEAR-END ACCRUAL” FY 15 Statement DR 01.63100.73150.35.00000.00000 $200.00 CR 01.15199.32900.00.00000.00000 $200.00 FY 16 Statement DR 01.15199.32900.00.00000.00000 $200.00 CR 01.63100.73150.35.00000.00000 $200.00 26 Payroll & Benefit Accrual • Payroll & benefit expenses incurred in June, but not paid until July, are automatically accrued by Accounting (includes Add Pays) • Accrued = charged to FY 15 • Actual payroll expense is posted in FY 16 & accrual is reversed • Effect on department budget in FY 16 is -0- 27 Payroll & Benefit Accrual Example • Wages earned during the bi-weekly pay period 5/29/15 - 6/11/15 (FY 15) • Pay on 6/19/15 (FY 15) • Wages earned on 6/12/15 – 6/25/15 • Will be paid on 7/02/15 (FY 16) • Whole payroll will be accrued for FY15 • Wages for 6/26 - 6/30 (5 days) will be accrued to FY 15 based on the 25th payroll • Fringe benefits are also accrued 28 Prepaid Expenses • Prepaid expenses – Expenses paid in FY 15 for goods or services that will be received in FY 16 • Charge to a prepaid account in FY 15 & charged to an expense in FY 16 on a Prepaid Journal Entry by AP • Indicate FY 16 expense on Invoice Payment Form • If you prepaid an expense using your p-card, prepare a Journal Entry – JE Category = “PREPAID” • Email documentation to postmyje@rit.edu, indicate batch name in the subject line • Debit 01.15199.09000.00.00000.00000, line description: date of event, name of vendor & invoice # • Credit your department expense account 29 Prepaid Example (continued) • In May 2015, you send an Invoice Payment Form to AP for a service contract for 7/1/15 - 6/30/16; payment is due by 6/30/15 • AP will charge a prepaid account in FY 15 • AP will create a Prepaid Journal Entry to charge your FY 16 budget in July • In May 2015 you charge a conference registration fee being held in July 15 on your procard • Prepare a Prepaid Journal entry, email documentation to postmyje@rit.edu, indicate batch name in the subject line • Debit 01.15199.09000.00.00000.00000, line description: date of event, name of vendor & invoice # • Credit your department expense account 30 Accounts Receivable • All income for goods or services provided to an organization outside of RIT during FY 15 should be recorded by June 30th, even if payment has not been received from the customer • Many departments are using Oracle Accounts Receivable System to invoice customers (JE’s are automatic) • If you are not using A/R, when the customer is invoiced, the department prepares a JE to debit Accts Receivable & credit the appropriate Income account 31 Accounts Receivable Example • IPI provided research testing for 3M Corporation on May 20th • When the invoice was sent in May, a JE was recorded to debit A/R 01.66500.04000.00.00000 & credit Corporate Contracts Income 01.66500.52100.00.00000.00000 • In July 14 when the payment is received, debit cash & credit A/R 01.66500.04000.00.00000 to clear the A/R account 32 Deferred Income • Deferred Income – Income is recorded in the year service is rendered, not when the cash is received • Cash is received in advance in FY 15 and the service will be provided in FY 16 • Charge to a deferred account in FY 15 & record as income in FY 16 on a Journal Entry 33 Deferred Income Example • In June 15 several alumni made reservations & paid by check to attend the 2015 Brick City Weekend in Oct 15 • Deposit the checks to Deferred Income account 01.94420.36280.00.00000.00000 • In October 15, Alumni Relations will record a JE to record the income • Debit 01.94420.36280.00.00000.00000 – Deferred Income • Credit 01.94420.59000.35.00000.00000 – Misc Income 34 Documentation Requirements • Email supporting documentation for all prepaid, accrual,& deferred income journal entries to postmyje@rit.edu • Indicate batch name in the subject line • Line description: date of event, vendor name & invoice # • Documentation must be received by July 15th or the journal entry can’t be processed for FY 15 35 Account Reconciliations • Balance sheet account reconciliations • Accounts Receivable, Inventory, Suspense, Prepaid, Deferred Income • Reconciliations for June due July 10th • Reconcile to preliminary balances • Use new format • Make correcting entries by July 14th • Reconciliations for final balances due July 24th • Use new format • Complete confirmation/certification 36 Account Reconciliations (continued) • Accounts Receivable – Prepare a list of unpaid invoices & an aging • Inventory – Physical count taken at June 30th provide details, GL = Count • Prepaid Expense – List of invoices paid in FY 15, show FY 16 date • Deferred Income – List of customers who paid in FY 15 for FY 16 services/goods 37 Most Important Things to Remember • NTID follows all RIT year-end processes • Accrual based accounting – Goods received or services rendered by June 30th are charged to FY 15 and paid in FY 16 (date is non-negotiable) Purchase Orders, Invoice Payment Forms, Employee Expense Reimbursements, Procurement Card Transactions, Payroll & Benefits 38 Most Important Things to Remember (continued) • Prepaid Expenses – Paid in FY 15 for services rendered after July 1st (date is non-negotiable) – Prepaid Account FY 15; FY 16 Expense Account by Journal Entry • Accounts Receivable – Service is rendered before June 30th & paid after July 1st – A/R & Income in FY 15; Cash & A/R in FY 16 • Deferred Income – Cash is received before June 30th, the service is provided after July 1st – Cash & Def Inc in FY 15; Def Inc & Misc Inc in FY 16 39 Most Important Things to Remember (continued) • Fiscal Year 2015: Year-End Closing Procedures are available on the Controller’s web page: https://www.rit.edu/fa/controller/accounting Fiscal Year 2015 closing memo • Accounting and/or external auditors may ask for additional information to meet new external audit requirements 40 Questions? • Contacts • Gary Maccarone, Sr. Staff Accountant/Outreach Specialist • Ext. 5-2237 • Email: gpmatg@rit.edu • Anthony Robinson, Sr. Staff Accountant • Email: adratg@rit.edu