File - Ppn Nsu

advertisement

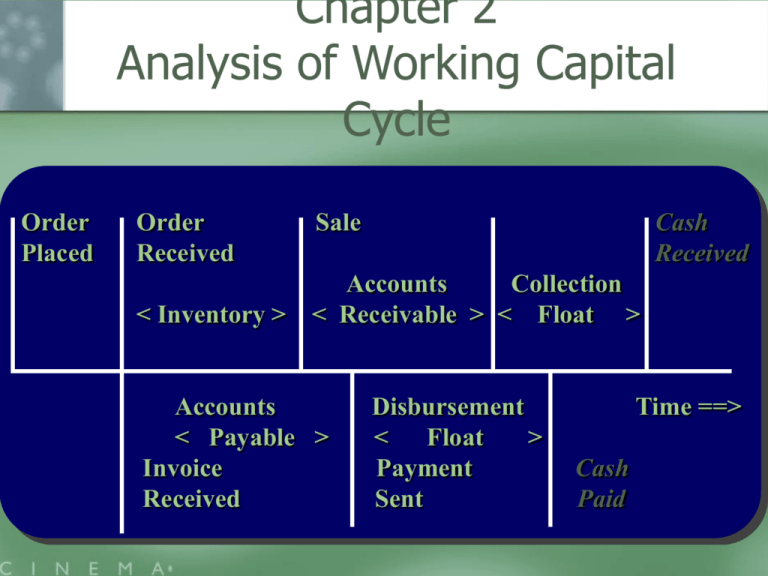

Chapter 2 Analysis of Working Capital Cycle Order Placed Order Received < Inventory > Sale Cash Received Accounts Collection < Receivable > < Float > Accounts < Payable > Invoice Received Disbursement < Float > Payment Sent Time ==> Cash Paid Solvency Vs. Liquidity Solvency concerns whether assets exceed liabilities, whereas liquidity refers to the firm’s ability to meet short-term obligations with cash while remaining a going-concern Solvency Measures Current Ratio Quick Ratio Net Working Capital Working Capital Requirements Financial Statements - Basic Source of Information Balance Sheet Income Statement Statement of Cash Flows Net Working Capital Implication of positive NWC Implication of negative NWC Larger value- Adequate solvency and less default risk For larger firms, the absolute value of NWC will always be higher. Standardization of NWC by either assets or revenue Traditional NWC figure includes accounts that are not directly related to the operating component of the working capital cycle. Specifically, cash holdings and notes payable result from internal financial decisions or policies enacted by management. Decomposing the NWC into operating and financial components can be useful to management when assessing working capital policies. NWC and its Component Parts CA CL CA CL Cash Cash CA CL Cash Mkt Sec A/P Mkt Sec A/P Mkt Sec A/P A/R N/P A/R N/P A/R N/P Inventory CMLTD Inventory CMLTD Inventory CMLTD Prepaid Accruals Prepaid Accruals Prepaid Accruals NWC = CA - CL Net Working Capital WCR = A/R + INV +Pre - A/P - Accruals NLB = Cash + M/S - N/P - CMLTD Working Capital Requirements Net Liquid Balance Working Capital Requirements The working capital requirement (WCR) is the difference between current operating assets (i.e., noncash current assets) and current operating liabilities (e.g., accounts payable and operating accruals). These accounts represent spontaneous uses and sources of funds generated over the working capital cycle. All other factors constant, an increased WCR implies that the working capital cycle requires additional financing A negative WCR implies that the working capital cycle provides financing for long-term assets, positively impacting solvency. Trend in the WCR indicates a substantial increase in net operating working capital. For each year, the observed WCR shows that more funds are tied up in receivables and inventory than is provided by spontaneous financing. For example, the WCR in 2012 implies that this business will need either internal or external funding in the amount of $3,994 to cover the gap in operating working capital. Working Capital Requirements ($2,481+$273+$404) - ($2,397+$355+$943) WCR/S = ----------------------------------------------------------$18,243 ($537) = ----------- = -0.029 $18,243 WCR/S 1995 .055 1996 .082 1997 -.030 1998 -.039 1999 -.029 Current Ratio Current assets Current ratio = ------------------------Current liabilities $6,339 Current ratio = ----------- = 1.72 $3,695 Current ratio 1995 1.96 1996 2.08 1997 1.66 1998 1.45 1999 1.72 Values exceeding 1 imply that current assets exceed current liabilities. Relationship between the current ratio and NWC: Positive NWC means that the current ratio exceeds 1, and a negative NWC implies a current ratio of less than 1. The current ratio will equal 1 only if NWC is $0. Similar to the interpretation of the NWC, increased values for the current ratio traditionally imply improved solvency and reduced default risk. Despite this interpretation, keep in mind that higher receivables and inventory, while increasing the current ratio, also reduce operating cash flow. Quick Ratio Current assets - Inventories Quick ratio = ------------------------------------Current liabilities $6,339 - $273 Quick ratio = -------------------- = $3,695 Quick ratio 1995 1.57 1996 1.63 1.64 1997 1.51 1998 1.36 1999 1.64 Shortcomings of Traditional Working Capital Measures First, although typically referred to as measures of liquidity, the ratios presented earlier are more properly classified as solvency measures. A second problem is the static nature of the aforementioned measures as the various balance sheet accounts are assumed to have equal “time-tocash” conversion rates. A third shortcoming concerns interpretation of the current and quick ratios, as can have counterintuitive impacts depending on ratio’s initial level. THE CASH CONVERSION PERIOD represents the time needed to convert $1 of disbursements into $1 of cash receipts. Days Inventory Held (DIH) Calculation of the CCP involves three measures, including days inventory held (DIH), days sales outstanding (DSO), and days payables outstanding (DPO). Conceptually, the DIH represents the average number of days inventory sits idle. Also, given that COGS represents inventory production costs, the DIH can be interpreted as the number of days of inventory held on the balance sheet at a given point in time. Days Sales Outstanding (DSO) DSO represents the average number of days it takes for a supplier to collect on credit sales, which reflects the efficiency of the credit and collections department. DSO is also referred to as the average collection period and it is common to compare the DSO to the trade credit terms offered by suppliers. Days Payable Outstanding DPO is the elapsed time between receipt of inputs and when payments are made to suppliers. the CCP represents the length of time over which management must arrange for nonspontaneous financing. Longer CCPs require increased financial resources, reducing firm liquidity Implications of CCP A positive CCP implies that additional financing is needed to fund the cash cycle. A negative CCP occurs when the trade credit period received exceeds the operating cycle. A negative CCP implies that suppliers provide financing for the firm’s working capital cycle and for non-operating working capital assets. This desirable working capital position is attributable to the strong demand for both firms’ products (short inventory holding periods), quick repayment by customers (to retain a favorable relationship), and generous trade credit terms received from suppliers. Practice Math 1 Suppose that a firm currently has a CCP of 87 days and DIH equals 50 days. Management would like to reduce the CCP by 5 days through changes in inventory policy. That is, the extension and use of trade credit policies will remain unchanged. With this goal in mind, and assuming that the firm has annual revenues of $500M with COGS representing 40% of revenues, the treasury department wants to estimate the implied reduction in inventory and the subsequent increase in cash flow. The Cash Conversion Period and Firm Value The CCP directly impacts the value of the firm as the gap between the operating cycle and the DPO can be financed with either debt or equity An increased cash cycle implies increased interest expense. Practice Math 2