Financial Statement Analysis

advertisement

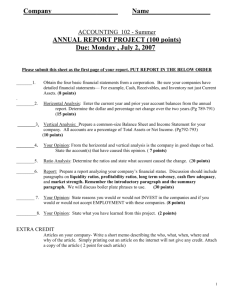

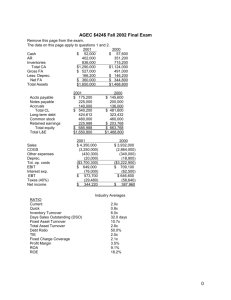

CHAPTER 13 Never answers questions by themselves They do however ◦ Raise questions to answer ◦ Point to opportunities for further analysis Also include: ◦ ◦ ◦ ◦ ◦ Industry trends Technological changes Changes in consumer tastes Changes in broad economic factors Changes within company Examines changes in accounts over time Select a year as the “BASE YEAR” = 100% Every year is a % of that year. New #/Base Year Usually over 5 or 10 years Can compare any account to see how it has changed over the years Page 586 McDonalds(#s), Graph When“Super size Me”? Change over two years in $ and % page 606 13-1 Exercise 13-10 Trend % pg 610 Relationship between accounts Balance Sheet - % of Total Assets pg 585 Income Statement - % of Sales pg 586 Change over two years in $ and % page 606 13-1 Accounting 101 ◦ Liquidity, Profitability, Long Term Solvency, Market Strength Accounting 102 – Users ◦ Common Stockholders, Short-Term Creditors, Long Term Creditors ◦ Summary of Ratios Exhibit 13-6 page 600 Numerator Denomiator Num goes up ratio goes up Dem goes up ratio goes down Num goes down ratio goes down Dem goes down ratio goes up Gross Margin % Gross Margin/Sales Earnings Per share (EPS) Net Income-Preferred Div/Avg Common Stock O/S Price Earning Ratio Market Price/ EPS Dividend Payout Dividends per share/ EPS Dividend Yield Dividend per share/Market Price per share Return on Assets (simple version) Net Income / Average Total Assets Return On Equity (simple version) Net Income/ Average Total SE Book Value Per Share Stockholder’s Equity/ Shares Outstanding EXERCISE 13-2 Page 608 Basically--- ability to borrow money at a lower rate 7% (pay your creditors)than your net income percentage 10% (rate of return) Working Capital Current Assets – Current Liabilities Current Ratio Current Assets/Current Liabilities Acid-Test (Quick) Ratio Cash+Market Sec+A/R+ Short Term Invest/CL A/R Turnover Credit Sales/Avg A/R Avg Collection Period 365/ A/R Turnover Inventory Turnover Average Sales Period Payables Turnover Average days Payables Operating Cycle in days Financing Requirement Cost of Goods Sold (COGS)/ Avg Inventory 365/ inventory Turnover COGS + or – Change in Inventory/Average A/P 365/Payables Turnover Average collection period(Days uncollectible) + Average Sales Period (Inventory on hand) ◦ Operating Cycle – Average Days Payable ◦ EXERCISE 13-3 PG 608 Times Interest Earned EBIT/ Interest Expense Debt to Equity Total Liabilities/ Stockholder’s Equity EXERCISE 13-4 PG 608 SUMMARY OF RATIOS Pg 600