Notes: taxes

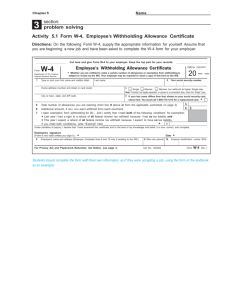

advertisement

S HE ’ S THE W HOLE PACKAGE U NDERSTANDING TAXES Taxes Payments YOU make to the government to support/pay for government services Taxes are collected by the IRS Internal Revenue Service W HY DO WE HAVE TAXES ? To raise revenue (money) to fund new and ongoing programs Law enforcement Transportation/Roads – building and maintenance Military Defense Education/School Funding Health Postal Services To regulate business activities Certain foreign goods are taxed. Higher taxes on alcohol and tobacco, VARIOUS Progressive Proportional TAX SYSTEMS …. • Graduated • Make more, take more • Based on ‘ability to pay’ • Example: Federal Income Tax • Aka: Flat Tax • Pay same rate, regardless of income • State Income Tax • Name other taxes that are Flat…… W HAT MUST YOU PAY TAXES ON ? Income Profits or earnings Interest Who is collecting? State and Federal Withhold Employer deducts from paycheck W HAT PAY TAXES ON ? Sales Tax (Flat Tax) Retail: price of goods and services Collected at the State and City level Excise Tax YOU tax on specific goods such as alcohol/tobacco Property Tax Material goods owned Collected at the local level Based on the value of property—generally land and buildings Main source of money for local governments W-4 W-4 Hired VS . W-2 W-2 Personal Info From Employer Allowances Deadline Deductions January 31st Exempt Verify Info Sign & Date Wages, Taxes C OMPLETE W HEN H IRED W-4 F EDERAL TAX F ORM W-2 R ECEIVE A Control Number W-2 January 31st FROM E MPLOYER B Employer Identification Number 1 Wages, Tips, Other Compensation $3,900.00 2 Federal Income Tax W/held $ 196.00 C Employer’s name, address and ZIP code 3 Social security wages 4 Social security tax w/held 5 Medicare wages and tips 6 Medicare tax w/held 7 Social security tips 8 Allocated tips D Employee’s social security number 376-19-1411 9 Advance EIC Payment 10 Dependent care benefits E Employee’s name, address, and ZIP code Laura Lou 1411 Stanton Avenue Lansing, Illinois 46004 11 Nonqualified plans 12 Benefits included in box 1 13 See Instrs. for box 13 14 Other 16 St Employer’s state ID 17 State wages, tips, etc. 15 Statutory Deceased Deferred employee compensation 18 State Inc tax Illinois $ 142 19 Localit y name Pension Legal plan rep. 20 Local wag es, tips 21 Local inc. tax DO You make $305 a week in salary for 52 weeks. THE M ATH ….. You pay the following taxes in a year $1770 federal income tax $482 in state income tax $218 in sales tax $373 in property tax $990 in FICA (social security tax) $132 A variety of other taxes What is your yearly income? What is the total amount of taxes paid during the year? How many weeks must you work just to pay taxes? A NSWERS Yearly income 305*52=$15,860 Total Taxes = $3,965 3965 / 305 = 13 weeks K EY Voluntary compliance TERMS TO KNOW … It is left up to the taxpayer to keep the necessary records, file a return on time pay required taxes etc. Pay-As-You-Go methods Taxpayer must pay the tax as income is earned or received during the year. Gross Pay vs. Net Pay R EDUCE YOUR TAX L IABILITY An exemption is a fixed amount of money that is excused from taxes. A dependent is someone you support financially Son, daughter, grandchild, niece etc. – under 19, and 24 if a student, provided ½ of their support, lived w/ you for at least ½ of the year (see page 19 of the manual). R EDUCE Y OUR TAX L IABILITY A deduction is an expense that taxpayers are allowed to subtract from their income when figuring the amount of tax they must pay, such as certain medical or business costs, student loan interest. Standard Deductions single: $6,200 married:$11,600, or head of household: $8,500 or Itemized Deductions. Look at the schedule A Understanding Taxes The three levels of government are: federal (the whole country), state (the 50 states), and local (counties, cities, and towns). Understanding Taxes Tax forms can be completed on the IRS Web site and then submitted to the IRS. Taxes paid to the IRS go into the U.S. Treasury. Income Taxes Income is calculated as a percentage of the taxable income you earn. Taxable income is your income after you subtract certain permitted amounts. Income Taxes Currently, the federal income tax ranges from 15 to 39.6 percent. The higher your income, the higher the rate of income tax you must pay. Income Taxes In most states, people also pay state income tax. Many cities also have income taxes. Income Taxes If you are self-employed, you are responsible for withholding your own taxes. Income Taxes The IRS requires self-employed people to pay income taxes quarterly (four times a year) based on the income they estimate they will make that year. Social Security Taxes Workers pay Social Security taxes so that they can receive benefits when they retire. • Social Security taxes are figured as a percentage of the money you earn. •Your paycheck stub shows the money withheld in a box labeled “FICA.” •FICA stands for Federal Insurance Contribution Act, or “Social Security.” Graphic Organizer 23.1 Taxes FEDERAL STATE LOCAL income tax income tax* income tax* sales tax* sales tax* Social Security tax *Not all jurisdictions levy these taxes. Chapter 23 • Taxes and Social Security property tax Succeeding in the World of Work It’s Your Responsibility We all have to split the bill for the services the government provides. Since we all share the benefits, we should all contribute our fair share of taxes. It’s Your Responsibility Some people disagree on what’s fair. Some people think that high-income people should pay a larger share of their income than low- or middle-income people. It’s Your Responsibility You can influence how federal, state, and local governments spend tax money. You can also influence tax laws. How? By voting. It’s Your Responsibility It’s your responsibility as a citizen to vote for officials who represent your beliefs. A Good Tax System The features of a good tax system are: The system should be fair. Tax laws should be clear and simple. Taxes should be collected at a convenient time. The system should be stable. The system should be flexible. Understanding Federal Income Tax Returns An income tax return is a form that shows how much income a person received from working and other sources and how much tax that person must pay. Understanding Federal Income Tax Returns If your employer withheld more money from your paychecks than you owe, you’ll get a tax refund. If your employer didn’t withhold enough, you will have to pay the difference. How Do You File a Return? Generally, if you’re single and earn at least $6,400 in a calendar year, you must file an income tax return. How Do You File a Return? To prepare a return, you’ll need Form W2, which your employer will send to you. A W-2 shows how much money you earned and how much was withheld by your employer for taxes. How Do You File a Return? The three basic federal income tax forms are: 1040EZ 1040A 1040 How Do You File a Return? To relieve themselves of paying excessive taxes, many people try to reduce the amount of income they report. Putting money in a 401(k), or donating to charity, can legally reduce your taxes. How Do You File a Return? Resorting to illegal methods to lessen taxable income is called fraud or tax evasion. The most common form of tax evasion is not declaring income. How Do You File a Return? To deter illegal tax reporting, the IRS performs random audits. During an audit, the IRS requires a business or individual to prove that the information on a tax return is accurate. How Do You File a Return? You can file Form 1040EZ if: You’re single and earned less than $50,000 during the year. You had no other income. You are not claiming an exemption for being over 65 or for being blind. You have no dependents. How Do You File a Return? The steps to completing the 1040EZ form include: Add up your total income from work and other sources. Subtract your standard deduction and personal exemption. continued How Do You File a Return? Use the tax table to find out how much tax is due on your income. By comparing this amount with the taxes withheld on your Form W-2, you’ll see whether you owe taxes or will get a refund. How Do You File a Return? The IRS provides free publications that help you fill out your tax return. You can also get help over the phone, on the Internet, and from books at the library. How Do You File a Return? You can pay a tax-preparation service or an accountant to prepare your tax forms for you. SECTION 23.1 REVIEW Key Concept Checkpoint Comprehension 1. List five characteristics of a good tax system. Why are these features desirable? continued SECTION 23.1 REVIEW Key Concept Checkpoint Comprehension 2. How does the money you earn and the amount withheld determine whether you owe income tax? continued SECTION 23.1 REVIEW Key Concept Checkpoint Comprehension 3. How will understanding such terms as exemption, dependent, and deduction help you complete a tax return? continued SECTION 23.1 REVIEW Key Concept Checkpoint Critical Thinking 4. Why do you think the taxation process involves so much paperwork? SECTION OPENER / CLOSER INSERT BOOK COVER ART End of Section 23.1 All About Taxes