Chapter 39 - University of North Florida

advertisement

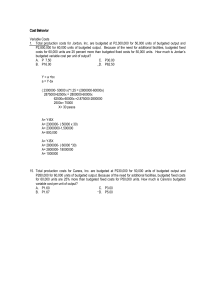

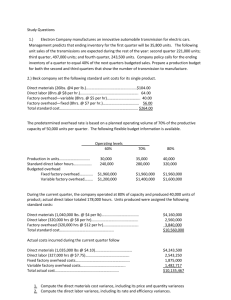

Chapter 39 Managerial Accounting Other Operating Budgets Prepared by Diane Tanner University of North Florida Direct Labor Budget Budgeted direct labor = Number of units to be produced × Labor hours per unit × Rate per hour If labor hours are given in minutes, you must convert to hours. Example: 12 minutes = 0.20 hours Fringe benefits are included as part of the labor wage rate. 2 Direct Labor Budget Example At Dinker Co. each coffee mug of product requires 3 minutes of direct labor. Workers are paid $18.50 per hour. Fringe benefits are $1.50 per hour. The company plans to produce 26,000 mugs in May. Units to be produced Direct labor hours (3/60) Labor hours required Hourly wage rate Budgeted direct labor cost 3 26,000 0.05 1,300 $20 $ 26,000 From production budget Manufacturing Overhead Budget Normal Costing Example AT, Inc. produced 26,000 units and sold 25,000 of them in April. applies manufacturing overhead rate of $1.50 per unit produced. Production in units Manufacturing overhead rate Budgeted manufacturing overhead costs 4 26,000 $ 1.50 $39,000 Manufacturing Overhead Budget Actual Costing Budgeted MOH = Variable costs + Fixed costs = Cost per unit × of production Number of units to be produced Fixed + Total Costs Remains constant at all activity levels 5 Selling & Administrative Expense Budget Includes only operating costs i.e., Period costs Selling costs General and administrative costs Corporate costs Salaries Advertising Office expenses Rent Insurance 6 Selling and Administrative Budget Format During May, AT, Inc. produced 6,400 units and sold 6,600 units during May. It estimated administrative supplies would cost $0.50 per unit, and sales clerk wages would cost $1.60 per unit. Additionally, it estimated $5,000 for corporate depreciation, $11,000 for utilities, $7,000 for office admin costs, and $4,000 for insurance. Variable expenses: Supplies expense ($0.50 x 6,600) $ 3,300 Wages expense ($1.60 x 6,600) 10,560 Fixed expenses: Corporate depreciation $ 5,000 Utilities expense 11,000 Office administrative costs 7,000 Insurance expense 4,000 Total fixed expenses Total budgeted selling & administrative expenses 7 $13,860 27,000 $40,860 Capital Expenditures Budget Based on capital budgeting decisions that are deemed acceptable Property, plant and equipment Shows how much cash will be paid out to buy plant assets and intangible assets Must be carefully planned Consume substantial cash reserves The End 9