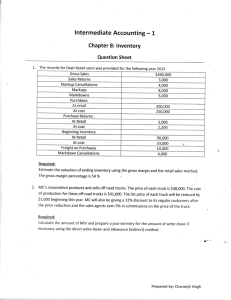

Inven - Estim

advertisement

Inven - Est - 1 INVENTORY Alternative Valuation Methods Remember! 3 spaces = LCM 4 spaces = DV LIFO Retail 11 spaces = FISH!! Inven - Est - 2 10- LOWER OF COST OR MARKET (LCM) Inventories must be carried at original cost or current “market” value, whichever is lower. LCM is a departure from historical cost and is a conservative accounting method. Inven - Est - 3 LOWER OF COST OR MARKET Application Procedure “MARKET” COST GAAP Lower of Cost or Market Inven - Est - 4 Lower of Cost or Market (LCM) “Market” is the current replacement cost of an item in inventory. Constraints on “market” – Net Realizable Value (NRV) = “CEILING” • Estimated selling price less the costs of completion and disposal. • Market cannot be more than this amount. – NRV less “normal profit margin = “Floor” • Market cannot be less than this amount Inven - Est - 5 LOWER OF COST OR MARKET Ceiling NRV Application Procedure Not More Than MARKET COST “Constrained” Replacement Cost Not Less Than GAAP Lower of Cost or Market NRV less Normal Profit Margin Floor Inven - Est - 6 LOWER OF COST OR MARKET “Constrained Market” Value If replacement cost falls between the ceiling and floor, select replacement cost as market. If replacement cost is below the floor, select the floor as market. If replacement cost is above the ceiling, select the ceiling as market. Inven - Est - 7 “MARKET” CONSTRAINTS Rationale n Ceiling Prevents overstatement of ending inventory and failure to recognize full extent of loss in the current year n Floor Prevents recognizing large inventory losses in one year followed by abnormally large profits in the following year Inven - Est - 8 APPLICATION OF LCM Compare cost and market separately for each item of inventory. Compare cost and market separately for each classification of inventory. Compare total cost with total market for the entire inventory. Inven - Est - 9 REPORTING LCM Direct Inventory Reduction Method – Record and report inventory holding loss each accounting period. Inventory Allowance Method – Record holding loss in a contra inventory account, “Allowance to Reduce Inventory to LCM.” Inven - Est - 10 ESTIMATING INVENTORY Because of the cost and time required to take a complete physical inventory, it is sometimes necessary to estimate the cost of ending inventory. Two popular methods are . . . – Gross Margin Method – Retail Method Inven - Est - 11 GROSS MARGIN METHOD Assumes that the historical gross margin rate is reasonably constant in the short run. We must know the following: – – – – Net sales for the period. Cost of beginning inventory. Net purchases for the period. The historical gross margin rate. Inven - Est - 12 GROSS MARGIN METHOD • Estimate historical Gross margin % • Compute Cost of goods available • Beg. inventory + Net purchases • Compute CGS % = 100% - Gross margin % • % must be based on sales • Compute estimated CGS = Sales x CGS % • Compute estimated Ending inventory • Cost of goods available – Estimated CGS Inven - Est - 13 RETAIL METHOD This method was developed for retail operations like department stores. Uses both the retail value and cost of items for sales to calculate a cost to retail ratio. Convert ending inventory at retail to ending inventory at cost. Inven - Est - 14 RETAIL METHOD To use this method we must know: – Sales for the period. – Beginning inventory at retail and cost. – Net purchases at retail and cost. – Adjustments to the original retail price: • Additional markups and markdowns, markup and markdown cancellations, employee discounts Inven - Est - 15 RETAIL METHOD MARKUPS AND MARKDOWNS • Markup - Increase in sales price above the original sales price. • Markup Cancellation - cancellation of some or all of an additional markup. • Markdown - reduction in original sales price. • Markdown Cancellation - increase in sales price after a markdown. RETAIL METHOD STEPS TO FOLLOW Inven - Est - 16 • Determine cost of goods available in retail and cost terms • Appropriate consideration of markups and markdowns • Calculate the cost/retail percentage. • Subtract sales from retail value of goods available = ending inventory at retail. • Cost/retail percentage x ending inventory at retail = estimated ending inventory at cost Inven - Est - 17 RETAIL METHOD “Conventional” Method Approximates Average Cost (LCM) Cost ratio = Cost of beginning inventory + net purchases Retail value of beginning inventory + net purchases + NET markups NET markdowns are NOT considered Inven - Est - 18 RETAIL METHOD AN EVALUATION Can be used in financial statements and for income tax purposes. Of value for interim financial reporting. Company must still take a physical inventory periodically. Provides an overall test for reasonableness of inventory counts. Inven - Est - 19 RETAIL METHOD Dollar-Value LIFO BASIS Dollar Value LIFO (DV LIFO) is the only acceptable method of converting retail data to a LIFO basis. We previously discussed DV LIFO Remember how we established a LIFO base for the first year, and added or deducted layers for each subsequent year. Inven - Est - 20 RETAIL METHOD DOLLAR-VALUE LIFO BASIS 1. Compute ending inventory in both retail and cost terms • Appropriate consideration of markups and markdowns 2. Calculate the cost/retail % Cost of net purchases Cost ratio = Retail value of net purchases + net markups - net markdowns COST % IGNORES BEGINNING INVENTORY Inven - Est - 21 RETAIL METHOD DOLLAR-VALUE LIFO BASIS 3. Convert to LIFO Retail Cost • Compute ending inventory at base retail prices Utilize an internal or external conversion price index for the appropriate period • Determine changes in layers using base retail prices • Use appropriate cost/retail ratios to convert to Dollar-value LIFO retail Inven - Est - 22 INVENTORY. . . Enough Said!