MGMT227-Class-7

advertisement

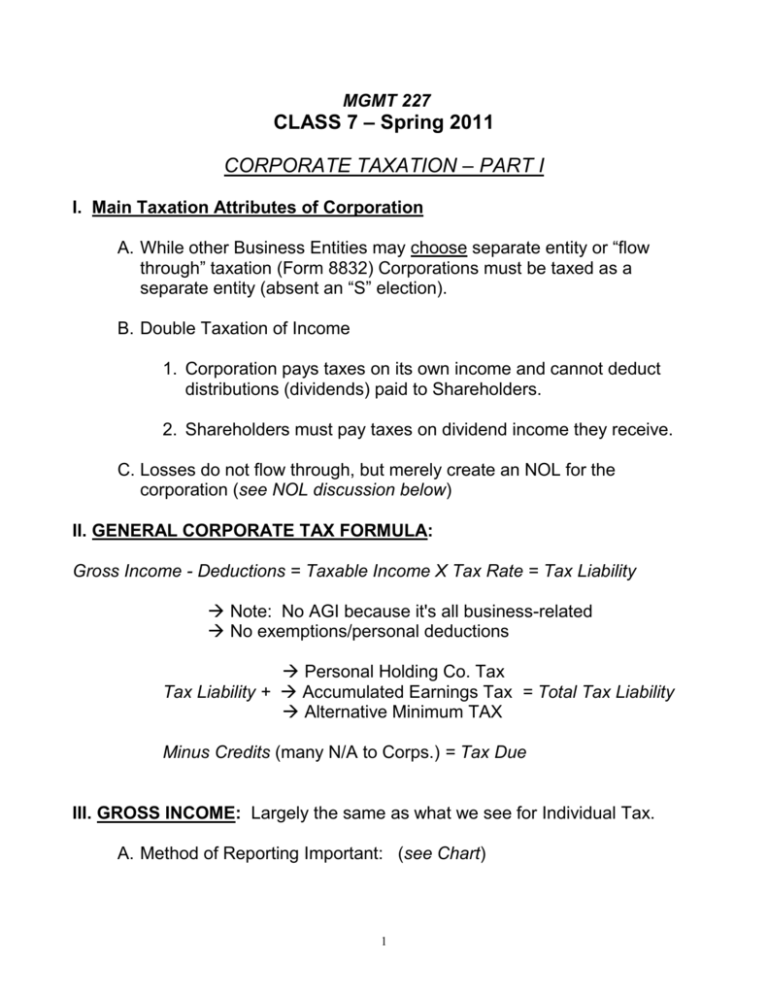

MGMT 227 CLASS 7 – Spring 2011 CORPORATE TAXATION – PART I I. Main Taxation Attributes of Corporation A. While other Business Entities may choose separate entity or “flow through” taxation (Form 8832) Corporations must be taxed as a separate entity (absent an “S” election). B. Double Taxation of Income 1. Corporation pays taxes on its own income and cannot deduct distributions (dividends) paid to Shareholders. 2. Shareholders must pay taxes on dividend income they receive. C. Losses do not flow through, but merely create an NOL for the corporation (see NOL discussion below) II. GENERAL CORPORATE TAX FORMULA: Gross Income - Deductions = Taxable Income X Tax Rate = Tax Liability Note: No AGI because it's all business-related No exemptions/personal deductions Personal Holding Co. Tax Tax Liability + Accumulated Earnings Tax = Total Tax Liability Alternative Minimum TAX Minus Credits (many N/A to Corps.) = Tax Due III. GROSS INCOME: Largely the same as what we see for Individual Tax. A. Method of Reporting Important: (see Chart) 1 Income Deductions CASH BASIS ACCRUAL BASIS When Received When Earned When Paid When Incurred** ** if paid within 2 ½ mos. of next tax year B. Accrual Basis = Most corps. (and inventory-based businesses) must use this & NOT cash basis. Cash Basis allowed for corps. only for S Corporations Farming/Timber Qualified PSC’s (Personal Service Corporations) Corporations earning $ 5 million or less per year (average the last 3 years) IV. DEDUCTIONS: Similar to Individuals, but some differences: A. Rule: All reasonable operating expenses and certain special deductions can be taken by corporation. SEE CHART OF CORPORATE DEDUCTIONS ON NEXT PAGE B. Special Deductions: Some deductions are considered “special deduction” with unique rules (discussed in more detail later): 1. 2. 3. 4. Dividends Received Deduction Charitable Deductions NOL Net Capital Losses 2 CORPORATE DEDUCTIONS DEDUCTIBLE NOT DEDUCTIBLE General Business Expenses Fines, Penalties, Punitive Damages Compensation to workers Executive Compensation: Maximum of $1 million each for top 5 executives Bad Debts on Accounts Receivable (Corporation = Accrual Basis) Bad Debts on A/R (Corporation = Cash Basis) 50% Meals & Entertainment Club Dues Goodwill purchased – Amortize over 15 years Self-created goodwill (e.g. trademark registered) Organizational Costs – Deduct first $5K, amortize remainder 15 years Stock Issue Costs (includes underwriter’s fees) State and Local Taxes Federal Taxes Life Insurance Premiums – Corporation NOT Beneficiary Life Insurance Premiums – Corporation is Beneficiary C. Dividends Received Deduction: dividends paid to corp A by corp B 1. Problem: Triple Taxation….ABC, Inc. XYZ Inc. XYZ S.H. 2. Solution: Receiving Corporation may deduct amount of dividends received from its income as follows: 70% if Corp. owns <20% of stock 80% if Corp. owns 20-80% of stock 100% if Corp. owns 80% or more of stock BUT…% may apply to Income if Income is < Dividend Rec'd 3 3. Four Step Approach to Compute: a. Step One: Multiply DIVIDEND x %age b. Step Two: Taxable Income(B4 DRD) – Step One Answer (1) If NEGATIVE number results: Stop – Back to S-1 (2) If POSITIVE number results: Proceed to S-3 c. Step Three: Multiply %age x Taxable Income (B4 DRD) d. Step Four: Take the lesser of the two as as the DRD C. Net Operating and Capital Losses: 1. NOL - Net Operating Loss (occurs when expenses of corporation exceed corporate income). Rules are…. a. Loss cannot be used that year (no flow through to TP) b. But, CARRYBACK 2 years, CARRY FORWARD 20 years (1) Must CB first unless Irrevocable Election is Made (2) Once Irrevocable Election made, no turning back. 2. NCL – Net Capital Losses (remember for corporation): a. Can only use to offset or reduce Capital Gains b. No $ 3,000 per year as ordinary (like individuals can) c. CB 3 years and CF 5 years (all as STL) D. Charitable…need to know: 1. Usually limited to the basis of the asset (unless put to related use by the charity) 4 a. Compare to individuals where FMV is usually used b. Long Term Capital Property & Sec. 1231 Assets: (1) Use FMV of property for deduction (2) Exceptions: Use Basis if Personal Property donated & put to similar use by charity Any property donated to Private NOF c. Ordinary Income Property: (1) Use Basis of property for deduction (2) Ordinary Income Property includes… Inventory Accounts Receivables Portion of Sec. 1231 property that would be ordinary gain on recapture if sold Short Term Capital Property 2. Max of 10% of Adjusted T.I. 3. ATI includes Taxable Income, not counting the Charitable Cont., DRD nor loss carryback deductions (whether NOL or Capital) 4. Carried Forward up to 5 years, but you must use the current year’s contributions first before using carried forward deduction F. Organizational Expenses: 1. Only deductible if taken in the first year of corporation’s existence. 2. Deduct first $ 5,000, amortize remainder over 15 years. 5 3. Danger: Incorporating at the end of the year (e.g. in December): c. In California – you pay $ 800 minimum tax annually (why pay twice? Wait until January) d. If $ 2000 is paid to incorporate in 12/10 and $ 3000 is paid for other incorporation expenses in 1/11, then corporation will only be able to amortize $ 2000. V. TAX CALCULATION: A. Current Tax Rates: (see inside front cover of book) 1. Rates range from15% to 39% to 35% 2. PSC’s = Taxed at a flat rate of 35% (PSC is an employee owned company usually in a service industry) B. Additional Taxes: 1. Alternative Minimum Tax 2. PHC Tax 3. Accumulated Earnings Tax VI. PROCEDURAL MATTERS A. Return always required (unlike individuals who can avoid if income is < standard deduction and exemption). B. Form 1120 usually (special short forms and Sub S forms too) C. Corporations must make Quarterly Payments (just like individuals) and will pay an underpayment penalty if they come up short at end of year. BUT…No underpayment penalty if…. 1. < $ 500 owed 6 2. 100% of previous year - unless 0 tax liability prior year or more than $ 1 million in 1 of last 3 years 3. Annualized Income approach: Pay each quarter taxes due as if income would continue the same during the year. D. Book Income vs. Taxable Income: 1. Adjusted in the M-1 Schedule 2. Examples: The following items are reflected in Book Income or Expenses but are not taxable income or deduction. Book Tax Reporting Municipal Bond Interest Yes No Life Insurance Proceeds Yes No Deduct Federal Taxes Yes No Deduct Charitable Cont. Yes (100%) Up to 10% of ATI Deduct Exec. Compensation Yes (100%) No > $ 1M per exec. (top 5 executives) E. M-2 Supplemental Schedule: Reconciles beginning Retained Earnings Balance to ending balance Corporate Taxation - Organization/Capital Structure I. Corporate Formation Tax Issues: A. BUYING STOCK 1. Potential Gain: SH contributes land with a Basis of $ 10,000 (FMV or $ 25,000) to corporation in exchange for Stock worth $ 25,000 FMV. Has a realized gain of $ 15,000. Should we recognize? 7 2. Code distinguishes between a Realized Gain (actual money made on the deal) and Recognized Gain (what the tax law requires a TP to declare in his or her return as income). 3. Sec. 351 provides for non-recognition of investing in corporate stock, if certain criteria are met. B. SECTION 351 1. NO GAIN RECOGNIZED where…3 conditions ALL met: Money or Property given/paid for the stock Only Stock is issued to SH’s SH is in “control” 2. GAIN IS RECOGNIZED where…any 1 of the following met: Services given in exchange for stock Boot is received by SH (cash, debt securities, etc.) SH is not “in control” 3. Basis for SH or Corporation a. For SH: Basis of Property Given + Gain Recognized lower of - Boot Received ___________________ SH’s Basis in Stock b. For Corporation: Boot < or Realized Gain Basis of Property from SH + Gain to SH ___________________ Corp’s Basis in Asset 4. What is considered Property? Equipment Accounts Receivables Installment Obligations (Notes Receivable) 8 Intellectual Property Rights **Patents, Copyrights, Trademarks, Trade Names YES **Trade Secrets or Know How – MAYBE NOT 5. Services: Where SH donates services for stock…. a. Gain to SH & Deduction by Corp as either ordinary or organizational cost (dep. 5 years). b. A SH giving predominantly service cannot be “counted” to establish the 80% control factor (see below). c. BUT: If SH gives property and services = Gain on services, but law allows SH to be “counted” to arrive at 80% plateau. (as long as property is not “nominal”: = or >10% of services value) 6. Only Stock Received: No $, property, debt securities or nonqualified preferred stock received by SH trying to qualify under Sec. 351 (issuance of either preferred or common stock typically DOES qualify). 7. Determining CONTROL: SH buying stock must have 80% Voting Power AND 80% of the Shares in the corporation, or the group that invested with said SH together with the SH has a total of 80%.(and no plan for immediate resale). 8. Liabilities Assumed by Corp from SH: Has two effects…. a. Does not count as “Boot” for Gain recognition purposes, unless Done to avoid taxes or for no bus. purposes Liability > Basis (called “excess liability”) b. DOES reduce SH’s basis in stock 9. Avoiding taxation for “sweat equity” or other situations where stock is not issued for cash or property: 9 a. SRF – Substantial risk of forfeiture (if SH does not yet have “unfettered rights” in stock – e.g. subject to redemption unless SH works for the corporation for 3 years). b. Two Classes of Stock: Issue preferred stock only to non service providers and common stock to service providers (therefore value of services can be relatively low and we minimize taxation). c. ISO (Incentive Stock Options): No gain when ISO is issued nor is there gain when exercised. Recognition of Gain only occurs when stock is sold by SH. d. Accounts Receivables: If SH has A/R from unrelated parties, can transfer those in as “property”. e. Contract Rights: E.g. promoter signs favorable lease with landlord before corporation is formed and then transfers the contract to the corporation (it is considered intangible property) II. CAPITAL STRUCTURE: A. DEBT v. EQUITY: 1. Debt: Bonds (secured), Debentures (Unsecured), Notes Interest paid to investors deductible by corporation 2. Equity: Common and Preferred Shares Dividends paid to SH’s are not deductible by corporation. 3. Thin Capitalization: Where shareholders/investors don’t put in enough money or assets to fund initial corporate obligations (e.g. where little money put in for stock) the IRS can reclassify debt securities as equitable securities and treat distributions as “dividends” and not “interest.” 10 B. INVESTOR LOSSES: 1. Remember basic RULE: Individuals can take only $ 3000 per year as ordinary. Remainder carries forward indefinitely. Some special rules apply to special situations… 2. Worthless Securities: If stock becomes completely worthless during the year, treat worthlessness as having occurred last day of the tax year (e.g. 12/31) and take as Capital Loss. 3. Related Party Sales: No losses can be taken by Seller. EXAMPLE: Mom sells to son…..3 basic rules: a) Mom can’t recognize the loss b) Son’s basis = Sales price c) If Son later sells at gain, can use Mom’s loss to offset gain (but not to create his own loss). 4. Small Corporation Stock: Government wants to promote investment in small business, so two types of Small Corporation Stock situations were created….(we already reviewed this) a. Section 1244: (1) To qualify: Issue < $ 1 million stock (2) Benefit: If stock is later sold at a loss, a STP can take $ 50K and MFJ can take $ 100K as Ordinary Loss. b. Section 1202: (1) To qualify: Invest in co. with <50 million in assets. Only the original SH’s in the initial stock issuance of company will qualify. Must hold stock for 5 years. (2) Benefit: Exclude 50% of income from any gain on sale and the rest is Capital Gain (but at 28% rate). Cannot exclude any more than THE GREATER OF… $ 10 Million or 10 Times the basis of stock sold. 11 ADDITIONAL CORPORATE TAXES I. ALTERNATIVE MINIMUM TAX A. Basically it is an alternative FLAT TAX charged against a corporation after certain adjustments are made to its income. B. The tax is 20% and there is an exemption. C. If the AMT is higher than the Regular Income Tax, then the corporation pays the higher of the two. D. Not imposed on “small corporations” (< $5 million per year in income for the last 3 years) II. ACCUMULATED EARNINGS TAX: A. Why the Tax? 1. Problem: Corporation helps a SH avoid taxation by retaining earnings instead of paying them out in dividends. 2. Solution: Accumulated Earnings Tax (AET) when a corporation keeps “too much” of its earnings and doesn’t distribute to SH’s. B. Basics: 1. Retained earnings for purposes of avoiding SH taxation will be subject to the maximum tax for individuals (now 35%). 2. INTENT is required: a. Usually a problem for small or closely-held corporations where SH’s & corporate board have close interactions and can plan "tax avoidance schemes”. b. If the corporation is a holding company or investment company = presumed to be for tax avoidance (although remember: The 12 PHC and AET tax will not BOTH be imposed. Only one or the other). C. The Tax: 1. Not applicable to… a. Subchapter S corporations b. PHC c. Non-profit corporations 2. Imposed ON TOP OF regular income tax and alternative minimum tax (so a TP corporation could easily pay 50% of its income to the IRS if it doesn’t plan carefully). 3. AET = 15% of the Retained Earnings & Profits of the corporation to the extent it is “not needed” for legitimate business purposes. a. “Credit”: From the AET taxable income, there are two possible “credits” that can reduce the taxable income base. The corporation takes usually takes the “Minimum Credit”. This credit means that regardless of business needs, corporations can keep the following amounts even if not “needed” for business reasons, and there will be no tax… (1) $ 250,000 for trading company (inventory, goods) (2) $ 150,000 for non-trading (service) companies D. Reasonable Needs of Business: Includes the following… 1. Expansion of the business. 2. To retire debt (pay off corporate loans, bonds, etc.) 3. Working Capital needs (there is a formula for this) 4. Extending credit to customers or suppliers 5. Realistic business contingencies (e.g. pending lawsuits) 13 E. Not Reasonable Business Need: 1. Loans to SH or related corporations. 2. Investments unrelated to corporate business (e.g. playing the stock market or speculating on real estate). 3. Retiring stock (redemption). F. Avoiding the AET: To reduce the income subject to the AET, a corporation can do one of 3 things… 1. Pay Actual Dividends before the tax year closes. 2. Pay Consent Dividends (“pretend dividends”) after tax year closes. 3. Pay Deficiency Dividends (actual dividends) after tax year closes. III. PERSONAL HOLDING COMPANY TAX A. Why the Tax: 1. Rich folks will incorporate to lower their tax rate (historically, individuals paid higher rates than corporations). 2. SOLUTION: Penalty Tax = 15% (current dividend tax) for income retained by PHC (and not distributed to its high income SH’s). 3. PHC – What is it? 1. A corporation that meets two tests (both must be met): a. Stock Ownership Test: > 50% of shares held by 5 or fewer SH’s in last ½ of the year. b. Gross Income Test: At least 60% of corporate income is from one of the following sources… (1) Passive income --or-(2) Personal services of a key SH 14 2. Stock Ownership Test: a. If 9 or less SH’s = test is automatically met. No matter how the stock value is held by these 9, there will always be 5 or less holding 50% of the stock value. b. If 10 or more unrelated SH’s each with equal value of stock, then test is automatically not met and corporation is NOT a PHC. c. We look at stock value (FMV of shares) not the number of shares (you could have 2 classes of common stock and one is more valuable). d. Related parties are lumped together and = 1 SH. 3. Gross Income Test: a. 60% of Adjusted Ordinary Gross Income (AOGI) is passive or from services of a key SH (e.g. a carpenter or an accountant). b. Passive includes: rents, dividends, interest, royalties. c. Personal Service of Key SH: Exists if a 25% + SH can be “designated” by customers/clients to perform the service (if the corporation in its retainer specifies that the corporation will determine who does the work, then no PHC problem). B. Calculating the Tax: 1. Penalty Tax (15%) on top of regular income tax. 2. Dividends Paid Deduction: Lower the PHC Income by… a. Dividends actually paid during the tax year IF pro-rata. b. Consent Dividends (= income to SH), even if made after the tax year has closed, as long as made by time return is filed. 15 c. Deficiency Dividends: Paid within 90 days of determination that PHC tax is due. d. Federal Income Taxes Paid C. Avoiding the PHC: 1. Disperse Stock Ownership to > 5 SH’s. 2. Keep passive income/key SH income < 60% 3. Have firm designate the service provider instead of the firm’s client. 16