Making Your Money Work for You PowerPoint

advertisement

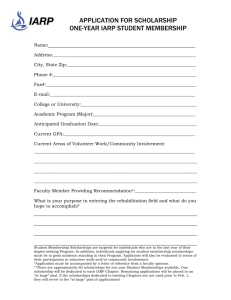

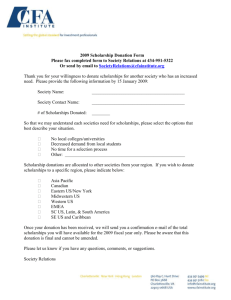

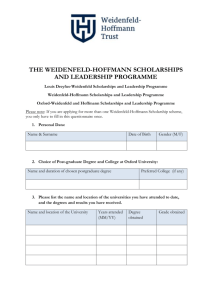

Buying Your Own Food Choosing the Right Bank Budgeting for Success Transportation & Travel Housing Taxes Cost Effective Buying Employment Miscellaneous Expenses Smart Shopping Average monthly food budget - $200 • Using coupons and reward systems (Air miles, Optimum points, Groupon etc). • Keep an eye out for sales • Shop the flyers! • Buying in bulk • Eating healthy on a budget • Common Mistakes Eating out • Not enough time to cook? - Make food in bulk • The little things DO add up • Don’t let “lazy meals” become a regular choice • Find easy-to-make student recipes that fit your budget • IN A BANK IN A LOAN/ LINE OF CREDIT Free Account Usage Free Debit Transactions/Withdrawa ls No Minimum Balance Free Savings/Chequing Account Free Credit Card Branches & ATM’s nearby Online/Mobile Banking Fraud Protection A long payback period & ability to pay off anytime A low interest rate & if it’s fixed Interest only payments while in school Ability to combine (Bank loan + Government loans) Borrowing the right amount Administration charges & other hidden fees Always shop around before choosing • Apply for scholarships! • Entrance Scholarships (automatically awarded) • • • Check for scholarships offered by your parent’s employers or your place of employment (Ex. Team Tim Horton’s Scholarships, McDonalds etc.) You can search for scholarships that apply to you on the myUWindsor portal under the “Financial Matters” tab (click on “Awards” from the menu on the left) Visit www.uwindsor.ca/awards Consider your willpower and ability to budget If you are unable to pay the monthly statement, high interest rates just add to your debt Can help you build a credit score – if you use it wisely They can offer some perks like 1% cash back, points programs, ability to shop online Need to use it responsibly and not spend past your means or it is a hard cycle of debt to break Tips for Using Credit Cards • • • • • • Stick to one Credit Card Make reminders in your phone/calendar to pay off your balance Pay the FULL statement balance Start with a low limit ($500) Don’t use cash back with a Credit Card, only a Debit Card Keep all your receipts and go over your credit statement to ensure accuracy • Try not to make purchases that you know you cannot pay for in the very near future • Assess your financial situation to see if you can afford your credit card purchases Every year, thousands of people are victims of identity theft Here are ways to reduce identity theft: 1. 2. 3. 4. 5. 6. 7. 8. 9. Shred all documents with important information Do not provide any confidential information to unsecured websites or unfamiliar sources Carry the least amount of identification you need Never disclose our credit card number by phone or email Beware of “phishing” scams. These emails are meant to try and get you to wire transfer them money in regards to false events. Beware of emails from unknown senders. Virus’s or Trojans can be used to hack into your computer to take information Keep all your receipts and then go over your credit card statement to ensure accuracy If any of your identification is stolen, report it immediately and close any accounts Choose difficult passwords Your ability to manage your money is crucial to your survival In order to make a budget, you have to calculate how much money you have coming in and how much you need to put out Here are the steps: 1. 2. 3. 4. 5. 6. Establish how much money you have at the moment to put towards your year Calculate your revenue – income for jobs, parents, scholarships Calculate your expenses - insurance, gas, rent + hydro, phone bill, food, tuition, books, travel expenses, social events, miscellaneous costs Once you’ve established your financial situation (Revenue – Expenses), analyze if you need a loan/line of credit Plan a budget per month/week to allocate how much money you should be spending on various things Keep track of your spending and see where your money is going – you may be surprised at how much money is “wasted” on silly things If you have a set plan of how much you’ll spend, only bring that much with you. That way you can’t spend more. If your parents are willing to help you, use that to the fullest! Review your expenses on a monthly basis and ensure you’re on track with your budget Make realistic estimates when budgeting to avoid having insufficient funds Do You Really Need a Car? If you are living near campus or have public transportation available, is it worth having a car? • Assess the cost of insurance, gas, parking and all those unexpected repair costs that you will incur. Explore your “green” options – walking, biking • Visiting home? -Train -Bus -Plane -Carpool Scenario: Round trip to Toronto • Most locations offer discounts on tickets for students By Bus: $89 By Train: $160 OR $60 (Based on • May be expensive to visit home Special Via6 offer) -plan with your family to By Plane: $657 By Car: $60 (approximate if decide how many times you carpooling) can afford to visit • Great way to meet students Heavier involvement with campus life Convenience for campus activities Support and care for establishment Ability to switch rooms if necessary Can be paid for with scholarships targeted at residence Internet is available for free Secured entry Risk of having problems with roommates Smaller living space Possibility of shared bathroom and kitchen Might not have air conditioning Rules you have to abide by Meal plan is compulsory Option to choose roommates Can make food & buy groceries, which can save money If near campus, can be as practical as residence Look for all-inclusive housing May have more freedom in terms of rules Once lease is signed, there is no backing out Problems with roommates can occur Internet/Cable is expensive Have to deal with a landlord for maintenance issues etc. Not as easy to meet other people Might need to buy furniture No secured entry (unless in some apartment buildings) Might not have air conditioning Deadlines & How to file What is income? What is deductible? Forms you need Keep your documents! You’re not the only one Used book sales Online sources Used furniture Resisting temptation Going over the border Alternatives to transportation Overworking Focus on what matters! Working summers & budgeting Working on campus Beware of the dangers of gambling Be realistic and know when to stop Online Poker, Betting, Casino, Bingo & Scratch tickets Prioritize your money – wasting it on gambling is not a smart decision on a budget Consider alternatives to spending money when going out Responsible drinking Budgetised consumption Know how you’re getting home Cheap classes at St. Denis Detroit Tunnel Bus -Renaissance Centre -Detroit Institute of Art Summer Festivals -Beaverfest -Bluesfest -Epicure University Players Concerts at Blind Dog Intramural sports Palace Cinemas – Cheap Tuesday movies Specials happening at your favorite places Odette Sculpture Park Windsor river front Jackson Park Lancer games! Ojibway Park and Nature Centre Art Gallery of Windsor- Free Wednesdays! Summer festivals -Carousel of Nations -Fireworks -Art in the Park Windsor Symphony Orchestra – free summer concerts School of Music – free events Join a club and attend events Volunteer! DRINKING SMOKING / DRUGS Prices Quitting Illegal & consequences Prices e-CHUG challenge Are you paying for only the services you use? Establish what you can cut out and what you may want to add (ex. long distance calling) Use Skype to communicate with friends and family Being a university student doesn’t have to mean being in debt Budget your money, take advantage of services that can help you and spend wisely to ensure financial success