aben_faia_nightmares_on_insurance_st_timed_outline

advertisement

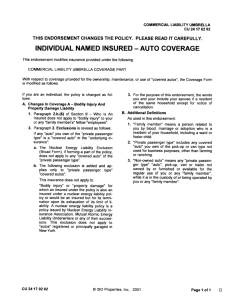

Nightmares On Insurance Street I. Introduction & Unauthorized Entity Information A. B. C. II. Company types 1. Authorized 2. Un-authorized Penalties 1. Loss of license 2. Fines 3. Payment of non-covered claims Solutions 1. DFS Web Page – “Find a Company” 2. DFS Consumer Help Line Business Auto Policy (BAP) – Temporary Substitutes A. B. Dependant upon coverage symbols 1. Symbol 1 2. Symbol 2 3. Symbol 8 Liability coverage 1. C. (10 minutes) Automatic coverage in form, any symbol Physical damage 1. With symbol 2 only a. No coverage b. Comparison to liability (20 minutes) 2. The need for symbol 8 a. D. III. Is there a dollar limit Case study 1. Various symbols 2. Liability compared to physical damage Kid’s Cars A. Statutory issues 1. B. (20 minutes) FS 322.09 a. Vicarious liability b. Age 18 issues Titling Issues 1. Parents’ name a b. Advantages (1) Coverage (2) Price Disadvantages (1) c 2. Corruption of policy if child has accident Comparison of options Kid’s name a. Impact of FS 322.09 b. Advantages (1) c. Insulation of parents assets Disadvantages (1) C. Coverage Issues 1. Separate policies a. b. Analysis of gaps in parents policy (1) Liability (2) Exclusion for use of “family member” auto Medical payments (1) 2. D. Potential coverage gaps Same as liability Recommendations a. Same limits c. Full disclosure to both carriers Case studies 1. Separate policies 2. One policy BREAK IV. Coverage B Issues – Homeowners Policy A. B. The grant of coverage 1. Set apart by clear space 2. On the “residence premises” 3. 10% of Coverage A Excluded structures 1. Rented or held for rental 2. Used to store business property (10 minutes) (10 minutes) 3. C. D. From which a business is conducted Endorsements to fix gaps 1. HO 04 40 2. HO 04 42 4. HO 04 48 Flood insurance issues 1. Detached garage only 2. 10% of dwelling limit a. 3. IV. Not additional coverage Separate policy needed NFIP: RCBAP vs. CPP A. RCBAP 1. B. Property covered a. Building b. Personal property 2. Additions and alterations 3. Foundations CPP (Commercial Property Policy) 1. Property covered a. Building b. Personal property 2. FS 781.111(11) exclusions 3. Property not covered (20 minutes) a. C. V. Foundations Comparison of coverage under both policies 1. Primary excess issues 2. Why the limits are different Drive Other Car (DOC) Coverage A. B. Coverages provided 1. Liability 2. Medical payments 3. Uninsured motorists 4. Physical damage Coverages not provided 1. PIP a. C. Who is an insured 1. Medical payments and uninsured motorists a. 2. 3. E. Name one person, family covered Liability and physical damage b. D. Broadened PIP option Person named and resident spouse Gaps for family members – liability & physical damage Comparison with the Personal Auto Policy 1. Who is an insured 2. Endorsements available Case study (20 minutes) 1. PAP present 2. No PAP present BREAK VI. Employees As Insureds – Business Auto Policy – CA 99 33 A. C. 1. Person/entity named 2. Permissive users of covered autos Exceptions/exclusions Coverage provided via CA 99 33 1. Liability 2. Physical damage Uses 1. 2. VII. Employees driving autos owned by them a. Primary/excess issues b. PAP/BAB analysis Traveling employees – rental cars a. Liability b. Physical damage Uninsured Motorists (UM) on Motorcycles A. B. (10 minutes) Who is an insured under the business auto policy a. B. (10 minutes) Personal auto policy exclusions (FS 627.727) 1. Owed but not insured autos 2. Settling without consent of carrier Stacking vs. non-stacked (10 minutes) C. VIII. 1. Stacked under PAP relating to motorcycle 2. Non-stacked under PAP relating to motorcycle 3. Owned but not insured Case studies 1. Stacked 2. Non-stacked 3. Analysis of coverage differences Fair Credit Reporting Act (FCRA) A. Supplying Motor Vehicle Reports (MVRs) to Commercial Clients B. Considerations 1. 2. 3. 4. MVR contract supplier a. Contract wording b. Personal lines compared to commercial lines FCFA a. Reports pulled for insurance underwriting b. Reports pulled for employment purposes Employer responsibilities a. Prior permission b. Pre-adverse action notice c. Adverse action notice Agency responsibilities a. 5. Insure employer complies with FCFRA Penalties for agency (10 minutes) 6. IX. Case studies and analysis PEO (Professional Employer Organization) Tricks & Traps A. (20 minutes) Co-employer relationship 1.Primary employer a. Pays employees b. Pays taxes c. Pays SUTA & FUTA d. Offer benefits? (1) Health (2) Section 125 (3) 401K (4) Ancillary benefits 2.Worksite employer a. Hires / fires b. Salary determination c. Supervises d. Offers benefits 3.Defined by CSA in lieu of policy B Client Services Agreements “Gaps” 1. Newly hired employees a. b. 2. Client must notify PEO New employee not covered until PEO is notified AND accepted Uninsured subcontractors a. CSA does not recognize subs as employees b. Client is “naked”—no WC coverage B. Other PEO “Tricks” 1. Can be many hidden costs a. Set up and change fees b. WC claims fees c. Garnishment fees d. Other hidden administration fees 2. State Unemployment Tax (SUTA) a. Tax cutoffs not honored b. Rates increased without notice 3. High Administration Fees X. a. Lead with WC…low pricing for high risk accounts b. Increase admin to cover WC loss c. Rates for master health plans manipulated Business Income and Extra Expense A. B. Coverage options 1. Business income with extra expense 2. Business income without extra expense 3. Extra Expense only Methods to provide coverage 1. Coinsurance method a. Business income worksheet (10 minutes) 2. Waiving coinsurance a. Maximum period of indemnity b. Monthly limit c. (1) 1/3 limit (2) 1/4 limit (3) 1/6 limit Agreed value