CHAPTER 34 - The Influence of Monetary and Fiscal Policy on

advertisement

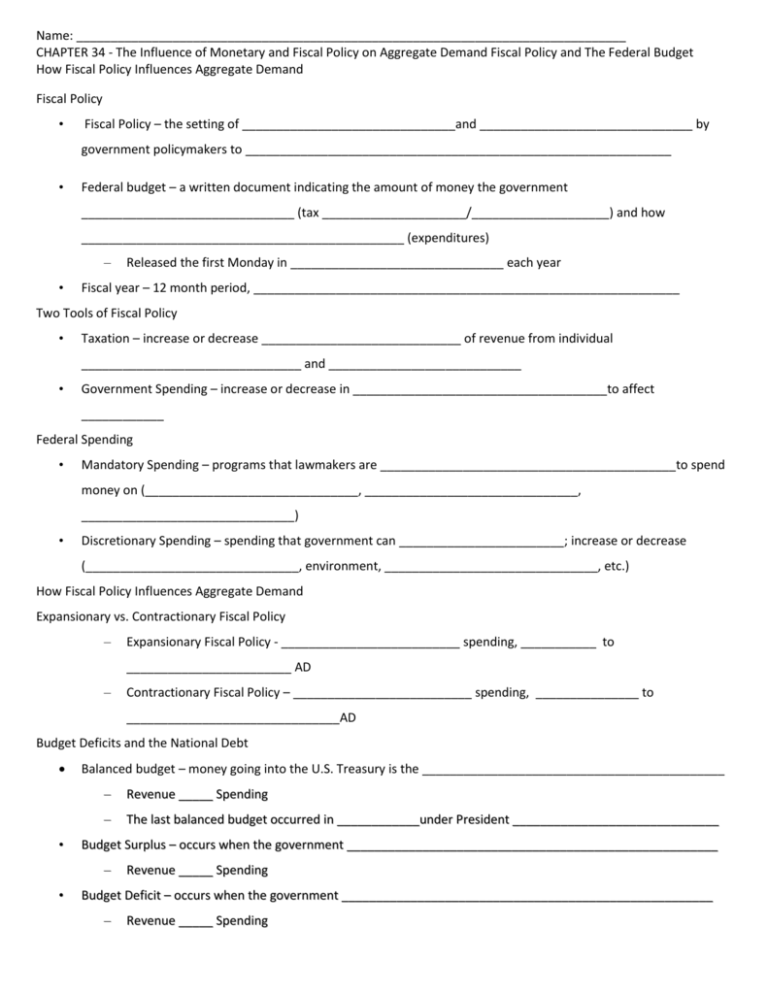

Name: ________________________________________________________________________________ CHAPTER 34 - The Influence of Monetary and Fiscal Policy on Aggregate Demand Fiscal Policy and The Federal Budget How Fiscal Policy Influences Aggregate Demand Fiscal Policy • Fiscal Policy – the setting of _______________________________and _______________________________ by government policymakers to ______________________________________________________________ • Federal budget – a written document indicating the amount of money the government _______________________________ (tax _____________________/____________________) and how _______________________________________________ (expenditures) – • Released the first Monday in _______________________________ each year Fiscal year – 12 month period, ______________________________________________________________ Two Tools of Fiscal Policy • Taxation – increase or decrease _____________________________ of revenue from individual ________________________________ and ____________________________ • Government Spending – increase or decrease in _____________________________________to affect ____________ Federal Spending • Mandatory Spending – programs that lawmakers are ___________________________________________to spend money on (_______________________________, _______________________________, _______________________________) • Discretionary Spending – spending that government can ________________________; increase or decrease (_______________________________, environment, _______________________________, etc.) How Fiscal Policy Influences Aggregate Demand Expansionary vs. Contractionary Fiscal Policy – Expansionary Fiscal Policy - __________________________ spending, ___________ to ________________________ AD – Contractionary Fiscal Policy – __________________________ spending, _______________ to _______________________________AD Budget Deficits and the National Debt • Balanced budget – money going into the U.S. Treasury is the ____________________________________________ – Revenue _____ Spending – The last balanced budget occurred in ____________under President ______________________________ Budget Surplus – occurs when the government ______________________________________________________ – • Revenue _____ Spending Budget Deficit – occurs when the government ______________________________________________________ – Revenue _____ Spending Dealing with a Budget Deficit • Create money – the government can ______________________or ________________________________________ • Borrow money – government borrows money by ________________________________ – Bond is a type of loan with a ____________________________________________ – Bonds sold ____________________________________________ – China owns ______________________dollars in U.S. bonds The National Debt • National debt – the total amount of money the federal government ______________________________________ • • Combination of all ____________________________ over time Budget deficit – the amount of money the government owes to __________________________________________ Keynesian Economics • Keynesian economics - macroeconomic theory of ______________________________________________________ – Laissez Faire (no government interference) in private sector can lead to _____________________________ _____________________________, namely unemployment and unused resources – Advocates ______________________________ responses by the ______________________________ (______________________ policy and ______________________ policy) to stabilize the ____________________________________ • Advocates a ___________________________ economy, predominantly ____________________________________, but with a large role of ____________________________________ and public sector • Served as the economic model during the _____________________________________________, World War II, and the ____________________________________ ______________________(1945–1973) • Lost influence until the global financial crisis in 2007, which caused a resurgence in Keynesian thought. – President George W. Bush was heavily ____________________________________ (except in 2007) – President Barack Obama, used Keynesian economics through ____________________________________ programs to attempt to assist the economic state. Aggregate Supply and Demand Classical, Keynesian, and NeoClassical Models Multiplier Effect • Multiplier effect – additional shifts in _______ that result when ____________________________________ increases income, which leads to ____________________________________ • Investment accelerator – increase demand leads to ____________________________________ – Boeing example, pg. 787 Marginal Propensity to Consume (MPC) • Marginal Propensity to Consume (MPC) – fraction of ________________________ that a household ____________________________ rather than ___________________ • – ¾ = household spends ________ and saves ________ – ½ = household spends ________ and saves ________ – ¼ = household spends ________ and saves ________ Investment accelerator – increase ___________________________ leads to _______________________________ Multiplier Formula • Multiplier = 1/(1 – MPC) – ¾ MPC, MM = 1/(1-_____) = _______ – Government spending is $20 billion – 20 Billion x 4 = ___________________________ Crowding-Out Effect • Crowding-out effect – when ___________________________fiscal policy increases __________, which in turn raises ___________________________ • This “___________________________” potential ________________________________________ by firms • High interest rates are a ________________________ to borrowing Changes in Taxes • Government __________________, or offers ________________________, increases households’ _____________________________________ – Tax cuts shift AD to the ________________ because “_______” goes up – Multiplier effect can depend on the perception of tax ___________________________ (Bush Tax Cuts, Payroll Tax Cut, Stimulus) – Raise taxes, decreases households’ ___________________________ – Tax hikes shift AD to the _______________ because “_______” goes down Active Stabilization Policy • Active policies by the _______________ and ___________________________________ to interrupt ________________________ trends in the ________________________ • • • Respond to changes in ________________________to stabilize _____________ • _______________________________________ to offset reduction in spending • Increased money supply lowers ________________________ Fed Federal Government • ________________________, ________________________ • Increase ________________________ Automatic Stabilizers • Automatic Stabilizers –_____________________________, changes in ___________________________ policy that ___________________________ when economy goes into a ___________________________ w/out policymakers having to take deliberate action – Tax system, recession __________________________________ collected – Government spending ___________________________ during recession (___________________________, ___________________________, other cash transfers) automatically stabilize the economy Tools of Fiscal Policy Chart Fiscal Policy Expansionary/ Contractionary Explanation (direct effect, component of GDP, AD) 1. The government cuts business and personal income taxes and increases its own spending. 2. The government increases the personal income, Social Security and corporate income tax. 3. Government spending goes up while taxes remain the same. 4. The government reduces the wages of its employees while raising taxes on consumers and businesses. Scenario 1. National unemployment rate rises to 12% 2. Inflation is strong at a rate of 14% per year. 3. Surveys show consumers are losing confidence in the economy, retail sales are weak and business inventories are increasing rapidly 4. Business sales and investment are expanding rapidly, and economists think strong inflation lies ahead. 5. The government eliminates the deductibility of interest expense for tax purposes Expansionary/ Contractionary Effect on Federal Budget Objective for Aggregate Demand Action on Taxes Action on Gov’t Spending Effect on the National Debt