Familiarization Training

advertisement

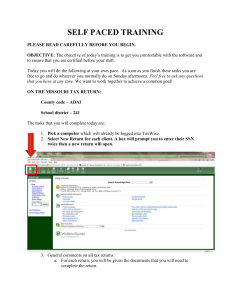

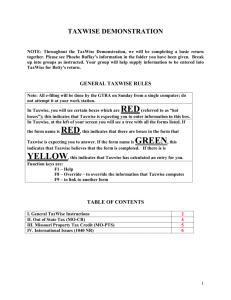

Morris County AARP TaxAide TaxWise Familiarization Module NJ A01E Morris County AARP TAX-AIDE PROGRAM Welcome to the Class of Tax Year 2009 3/12/2016 NJ Integrated Training - 2007 Tax Season 2 OVERVIEW WHO WE ARE INSURANCE COVERAGE ORIENTATION WHO YOU ARE WHO WE ARE Charitable, non-profit program administered by AARP Foundation Free, nationwide confidential service Help low-to-mid income taxpayers with special attention to age 60+ Committed to high-quality service Answer tax questions/prepare returns Funded 1/3 AARP; 2/3 IRS TCE INSURANCE COVERAGE Travel accident insurance coverage if on TaxAide business Supplemental secondary only Notify District Coordinator ASAP 3/12/2016 NJ Integrated Training - 2007 Tax Season 5 ORIENTATION Rest Rooms Lunch Name Tags – First Name Only in Sites Sign-in List Roster – Check off that information is correct Put Your Names on Your Training Material Agenda Welcome & Introduction to MC TaxWise (Nancy) Introductions Forms TaxWise Online Software Overview Practice Exercises Homework Goal Familiarize students with TaxWise Software prior to Integrated Tax Law/ TaxWise Training in December ◦ Open TaxWise Online using user ID and Password ◦ Walk around the software ◦ Start a return ◦ Complete main information sheet ◦ Enter income types ◦ Schedules A & B ◦ Some NJ entries Tell Us About Yourself Name Home town Occupation Current or pre-retirement Computer experience ◦ Computer Geek to I just do E-mail Tax experience ◦ CPA to I never did a tax return What are your expectations of the AARP TaxAide Program Forms Intake & Interview Form IRS Form 1040 IRS Schedule A W-2 Wage & Tax Statement W-2G Gambling Winnings 1099INT, 1099DIV, 1099R, SSA-1099 AARP Intake & Interview Form Completed by the client Page 1 includes general information for taxpayer, spouse and dependents Page 2 summary of income and deductable expenses and tax credits Page 2 Quality review questions Page 2 retain data signature (not required for 2009) For 2009 we will use IRS Intake Form Intake Form Page 1 Intake Form Page 2 IRS Form 1040 Everyone files a 1040 or a version of the 1040 (1040A, 1040EZ, etc) Split up into 4 general areas ◦ ◦ ◦ ◦ Taxpayer information Income Taxes & Credits Payments/Refunds Due and Signature Taxpayer Information Information from Intake Sheet & Client Interview Input into TaxWise on the Main Information Sheet Includes ◦ ◦ ◦ ◦ Personal information for taxpayer & spouse Filing status Dependent information Exemptions Form 1040 Page 1 Taxpayer Personal Information Information Presidential Election Campaign Question Filing Status Exemptions Dependent Information Income All sources of income included in this section Income derived from various forms usually issued by employer, financial institution, government agency, etc Information from forms entered into the respective form in TaxWise TaxWise puts the appropriate values into the 1040. Final line on page is “Adjusted Gross Income” Income 1040 Page 1 Income Adjustments to Income Taxes & Credits Page 2 Starts with “Adjusted Gross Income” Deduct Itemized or Standard Deduction Deduct Personal Exemptions Arrive at “Taxable Income” Calculate Tax Alternative Minimum Tax (Out of Scope) Apply non-refundable tax credits Add other taxes Bottom line is “Total Tax” 1040 Page 2 Taxes & Credits Taxes Calculated Itemized or Standard Deduction Exemptions Other Taxes Nonrefundable Credits Payments/Refund/Owe/Sign Start with “Total Tax” Apply tax withheld and estimated payments Apply refundable credits Bottom line ◦ A refund ◦ You owe Direct deposit information Signature line Payments/Refund/Owe/Sign Refundable Credits Pre-Paid Taxes Refund Owe Signature Box Schedule A Itemized Deductions Everyone is allowed a standard deduction Test to see if greater than “standard deduction” Includes Medical, Taxes, Mortgage Interest, Charitable Contributions, Misc. Entered in TaxWise on Schedule A and Schedule A Detail For this class we will use medical and property tax deduction Schedule A Medical Expenses Property Taxes Mortgage Interest Contributions Misc Deductions W-2 Wage and Tax Statement Employer issues to employee for tax year Employer identification information Employee identification information Wages earned Taxes withheld All information to be copied to TaxWise EXACTELY as shown on the form TaxWise puts information entered in proper place W-2 Wage & Tax Statement NJSUI NJSDI W2G Issued by gambling establishment to report gambling winnings Payer and payee information Amount won Federal & state taxed withheld Type & date of wager Copy information from W2G to TaxWise W2G TaxWise enters amount on 1040 line 21 Label line 21 “Gambling” Gambling loses on schedule A W-2G Payer & Payee Information Winnings Type Wager Taxes Withheld 1099-DIV, 1099-INT Received from financial institution for dividends and/or interest received Information from these forms are entered in TaxWise on Schedule B Interest or Dividend Statement TaxWise puts information into Schedule B Interest & Ordinary Dividends and then to 1040. 1099-DIV 1099-INT 1099-R Distribution from pension, IRA, annuities, etc. Enter information in TaxWise 1099R TaxWise puts the proper information on the correct 1040 lines 1099-R If taxable amount not determined, there is more to do Distribution Codes on Back or in Help SSA-1099 Amount from Box 5 is input into TaxWise 1040 Wkt 1 Medicare Part B entered into TaxWise 1040 Wkt 1 Medicare Part D entered into Schedule A Detail Box 6 Federal Income Tax Withheld into 1040 Wkt 1 SSA-1099 Medicare Part B If there is Medicare Part D it is entered into Sch A Detail Box 5 Amt to Wkt 1 Federal Tax Withheld TaxWise Flow Chart TaxWise Online Web site for training: https://twonline.taxwise.com/training/ .Client Name: 2106185 .User Name Student: STUDENTXX .User Name Coach: COACHXX .Password: Same as user name for first logon. Reset your Password. Social Security Number Key SSN in the problems are shown as: ◦ ###-XX-YYYY ### = numbers shown in problem ◦ Example:123 XX=numbers at the end of your user ID YYYY= 0910 Caution Anything you enter is TWO can be viewed by instructors and coaches