Downloading - Surety Association of Canada

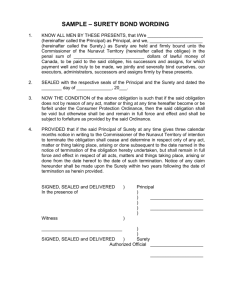

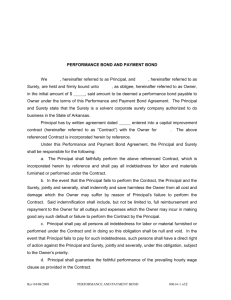

advertisement

Name of Event Organization Date Surety Bonds &General Contractors Agenda I Construction Risk II Bonds; A Brief Introduction III How to Establish and Maintain a Strong Surety Relationship IV What’s New in Surety Bonds? V E-Bonding VI A Few Points to Ponder I – Construction Risk “Then You Shall be his Surety” William Shakespeare Merchant of Venice Construction Risk 2015 Construction Risk = Risk of Contractor Failure. The number and severity of contractor failures increased in recent years. Recent Challenges: Reduction of available work; oversaturated market = tighter margins Onerous contract conditions. Downloading of risk Paradigm Shift: AFP’s, P3’s Construction Risk 2015 From 2010-14, the Surety industry paid out almost $800 million in claims; more than all of the previous decade. 2013 a year to forget: Loss ratio; 52% - industry unprofitable Premiums flat after two years of decline Across all lines and all sectors of the country 2014 showed improvement with lower loss ratios and premium growth … but…. 2015 ? Impact of Oil Prices in western Canada and political and economic instability Construction in Canada 2015 Canada the new construction “mecca”. Ongoing commitment to infrastructure Federal commitment $48B over 10 years. By 2020 Canada to be world’s 5th largest construction market (9th in 2010) Increased foreign investment from depressed areas (e.g. Europe) Larger and longer projects Challenges to small and mid-sized contractors Protect Against Construction Risk Surety Bonds Performance Bonds Labour & Material Payment Bonds Liquid Security Irrevocable Letters of Credit Cash/Negotiable instruments on Deposit Default Insurance Products II – Surety Bonds What are They? How do they Work? Surety is not Insurance Surety is not Insurance INSURANCE 2 party agreement; Insured & Insurer Premiums actuarially determined Losses anticipated No recourse against insured in the event of loss SURETY 3 party agreement; Principal, Surety & Obligee Premiums only a service charge No losses anticipated Recourse against the Principal via indemnity agreement Surety Bonds: 2 Essential Services Prequalification: Assurance that the bonded contractor is qualified for the job for which they are contracted. Security: Financial Protection in the event that the bonded contractor should default on its obligation. Prequalification Surety Company’s Standard Minimum Checklist: Good character Experience matching contract requirements Financial strength Excellent credit history Established banking relationship Line of credit Necessary equipment Standard Construction Bonds Prequalification Prequalification Letter Bid Bond Consent of Surety Security Performance Bond Labour & Material Payment Bond Renewable Multi-Year Bonds (service contracts) Prequalification Letter Not a bond but a letter from bonding company to the project owner confirming “bondability”. Used during the pre-tender phase; i.e before contract terms, scope or pricing details are known. Non-binding – surety and principal reserve the right to review the details before firm commitment. Typically refer to the project at hand. SAC standard form available on SAC website. Bid Bonds protection from the “lowest irresponsible bidder” provide assurance that contractor will: enter into contract provide the required security Typically required in the amount of 10% of tender if contractor defaults, surety pays the difference between successful bid and second bidder Tender must be accepted within time frame set out in tender documents seven months to file suit Consent of Surety Not a bond at all; a letter of commitment from the Surety to the Obligee to execute performance and/or payment bonds No penal sum set out; payment not an option Typically, bonds must be required within 30 days following award No standard (CCDC) form in existence, many variations in wording Performance Bonds Guarantees Contractor will perform contract in accordance with its terms & conditions. Contractor must be in default and the default must be declared Owner must perform their obligations 4 options available to Surety: Remedy the default Complete the Contract Arrange for new contractor to complete Tender Payment Two years to file suit Labour &Material Payment Bonds Guarantee that the contractor will pay all direct subcontractors, suppliers for materials and services provided to bonded project. Obligee is trustee on behalf of the claimants Claimant must have a direct contract with the Principal Claimants may only claim for goods and services supplied to the bonded job Claim must be filed within 120 days of the last day worked or the date material shipped One year to file suit III – Surety Bonds How to Establish & Maintain a Strong Surety Relationship Who Obtains the Bond? Project Owner is not responsible for obtaining the required bonding or other contract security. Owner only has to include bonding requirement in tender documents or contract specifications The contractor obtains the bonding Selects a professional surety bond broker or agent who assists in submitting case to a surety underwriting company How is a Bond Obtained? Contractor Submits Financial Statements and other background information to Surety Participates in prequalification process: an in-depth look at contractor’s business operations and financial structure. Surety’s Financial Analysis Balance Sheet Working Capital / Net Worth Ratio Analyses Receivable/Payables aging analysis Work on hand; profitability, maturity, trending Income Statement Profitability Revenue Trend Analysis; 3 to 5 years Cash Flow Analysis Accountant’s Opinion/Explanatory Notes What Else does a Surety Need? Complete details on Affiliated / Related Companies; ownership, financial information, etc. Detailed Work on Hand Schedules Aged Listing of Receivables and Payables Organization Chart of Key Employees Detailed Resumes of Principal & Employees Business Plan & Contingency Plans Subcontractor & Supplier References What Else does a Surety Need? Details of construction operations; areas of expertise, list of key projects, key people, etc. Letters of Recommendations from Owners Evidence and details of a Line of Credit from a Financial Institution Details of business continuity plans in the event of death or incapacity of owners/key people Reports on Similar Completed Projects Owner, contract price, date completed, profit earned The Care & Feeding of Sureties (four tips) 1. Establish a relationship with a professional broker (SAC can help). 2. If you’re declined, FIND OUT WHY!! Many problems can be solved. 3. Work With The Bonding Company; it is truly a relationship 4. There IS competition among sureties. IV – New & Improved… What’s the Latest in the World of Surety Bonds? SAC Performance Bond SAC consultations with Owners & Contractors; More “certainty” in the claims process. More responsiveness to a claim More frequent and effective communication between sureties and owners. New “enhanced” performance bond provides construction buyers with more timely &responsive claim service. Has been used by owners across the country and will be adopted by CCDC as the new standard. Provides more responsive services to owners by….. SAC Performance Bond Pre-Demand Conference to allow surety and owner to prevent problems from turning into a default. Timelines for Surety’s Response: 5 days to acknowledge a response & request info. 21 days (from receipt of information) for surety to respond to owner with their response. Emergency Remedial Work: Allows Owner to address urgent issues (e.g. safety) under the bond. Post-Demand Conference: Mechanism to minimize or eliminate work stoppages while surety investigates. Contact Coordinates: Contact information for all parties to facilitate notices and communication. Surety Bonds & P3 Projects Comprehensive performance & financial security against construction default on mega-P3 projects. Sufficient capacity for mega-projects. Broad and flexible protection packages which include: Professional surety prequalfication Specialty P3 bonds designed by member sureties: Provide liquid / cash on demand protection. Built-in “fast-track” dispute resolution Early Response; surety involved pre-default. Protection for trades & suppliers via the payment bond. Called for on Infrastructure Ontario Build-Finance and Design-Build-Finance projects. Renewable Multi-Year Bonds Only applicable to service contracts; e.g. Waste Management, Snow Removal, etc. Initial Term is open. Renewal Terms are typically 1 year periods can be extended to two. Surety issues an annual Renewal Certificate. Failure to renew the Bond is not a ‘default’ under the Contract or the Bond 2-year suit limitation – runs from earlier of expiry of latest bonded ‘Term’ or date default declared Can be modified to address O&M components of P3’s Headstart Performance BondTM Created by The Guarantee Co of N.A. to protect GCs from sub default (competitive alternative to SDI) Industry Solution: available for use by other sureties. Flexibility: Obligee given two mitigation options: o Traditional Option: Surety investigates and implements solution (as in standard bond); or, o Headstart Option: Obligee implements its own solution upon surety’s acceptance of Obligee’s completion proposal. Responsiveness: o First dollar protection(no deductible or co-payment). o Surety will respond in 3 days from receipt of Claims letter. o Standard claims notice and mitigation agreement. Electronic Delivery of Bonds E-Commerce: the buzzword of the new millennium; every aspect of commercial activity Delivery of bonds via internet technology. Advantages: Accuracy / built-in safeguards Ease & economy of transmission Smaller “Carbon Footprint” SAC can provide assistance to owners as they move to automated tenders and bonds. V – e-Bonding Did someone mention “paperless” ??!!! Electronic Delivery of Bonds Issues and Challenges Commercial Legal Technological SAC’s Efforts to Address the Issues & Challenges Commercial Issues & Challenges SAC encourages and promotes electronic delivery of surety bonds. Don’t Act on your own. Will only work with industry buy-in. Flexibility; evaluate; establish criteria and standards, leave it to others to find a way to meet them.. Electronic equivalent of a courier. Legal Issues & Challenges PIPEDA passed by parliament in 2000. Umbrella legislation Each jurisdiction followed with its own legislation over the next two years Challenge: What about seals? Deed vs Contract - “Deemed” sealed, overt act of sealing will constitute seal equivalent. Verbiage not sufficient. Friedmann Equity vs Final Note – Supreme Court of Canada Technological Issues & Challenges Technology is in place; systems have been developed and marketed in Canada and U.S. All systems are NOT created equal; different focus; different capabilities Criteria: Integrity of content; Secure access Verifiable / enforceable SAC & e-Bonding Publications on SAC website: Designing Electronic Pathways Together. Vendors Guideline. Criteria checklist. Position Paper: Surety Bonds in a Digital World. Working with owners and vendors: Mock Tender – Defense Construction Development of template language for inclusion in tender documents. Six e-Tendering Tips for Owners 1) Consult Consult Consult: Without Buy-in from other stakeholders, the advantages can be squandered. 2) Don’t Reinvent the Wheel: Learn from what’s been done. Are you in the software development business? 3) Insist on Verifiability… whatever the approach, know that the bond is valid and enforceable. Six e-Tendering Tips for Owners 4) … But be Flexible About Everything Else: Allow vendors to find ways to meet the criteria and standards you set. 5) It’s Up to You: Initiative has to come from owners and end-users. SAC can provide guidance but only you can start the journey 6) Take the Time to Get it Right: Pilot projects; Phase-in implementation. Allow for time to work out the kinks and for the industry time to adjust. Mock Tenders. VI – Surety Bonds A few Points to Ponder A few Points to Ponder Point #1: Bonds: Benefits to General Contractors Eliminate unqualified competition; critical in tough times when too much capacity in the marketplace. Non-intrusive; do not tie up liquidity or borrowing power (in contrast to letters of credit) Respond only upon actual default; protect contractors from arbitrary action by project owner Can provide assistance (technical or financial) should contractor encounter difficulties on bonded project A few Points to Ponder Point #2: Bonds a “Barrier” to small contractors? Barrier? Bonding companies need to write bonds. Sometimes a time problem – for contractors without a bond company it takes time to establish a facility. Some sureties will ONLY bond small contractors, others have small contractor divisions Small firms will secure bonding for jobs within their realm of expertise Bonds are a barrier to unqualified contractors A few Points to Ponder Point #3: Advantages of bonding subcontractors and suppliers Provides unintrusive and complete first dollar protection against subcontractor default Surety Prequalification process ensures better quality of subcontractor/supplier working on your project. Can expand your own bonding capacity. Nominal cost for total protection Headstart alternative to SDI provides full first dollar protection without deductibles or co-payment. SURETY ONLINE LEARNING CENTRE The Surety Online Learning Centre accessible from SAC website; www.suretycanada.com. Five learning modules that introduce the basics of surety bonds and the suretyship process Learn at your own pace. Ideal for review or for colleagues who can’t attend a “live” information session. It’s FREE Contact Us Phone: 905-677-1353 Fax: 905-677-3345 email: surety@suretycanada.com or visit our website: www.suretycanada.com