405 — Financial Accounting II - Darla Moore School of Business

advertisement

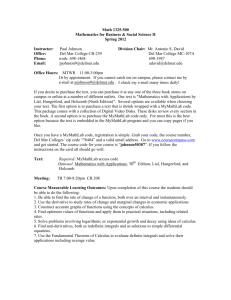

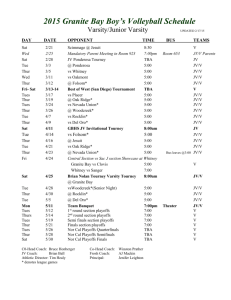

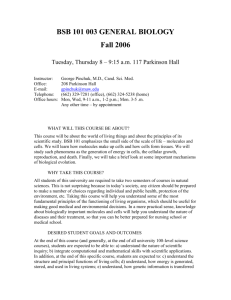

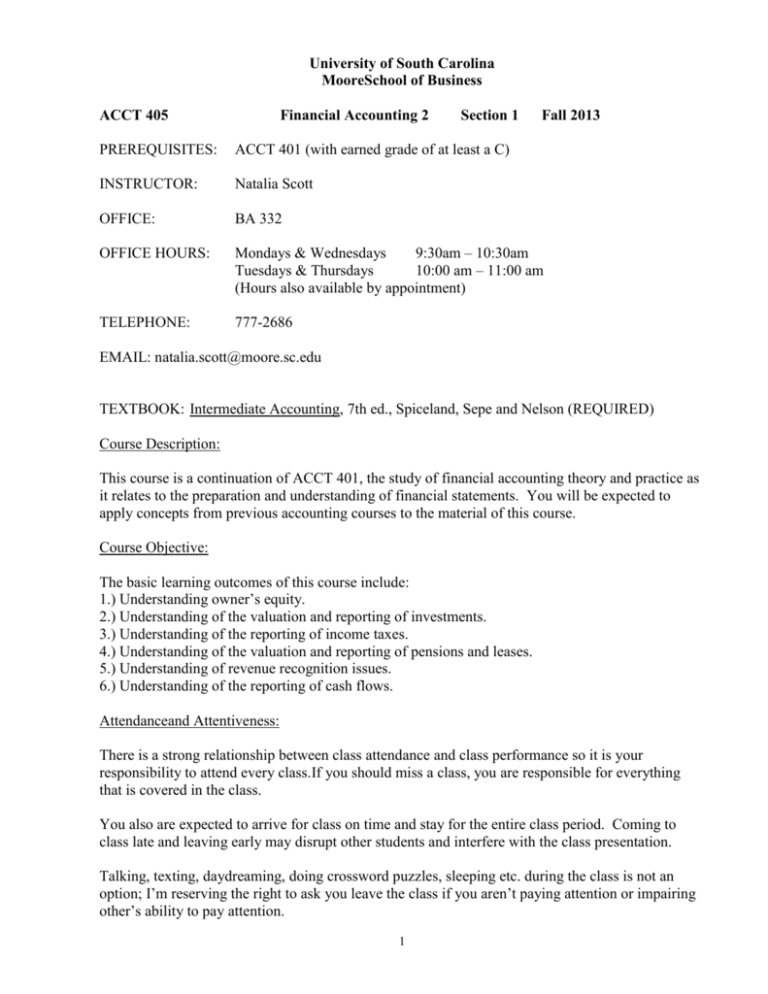

University of South Carolina MooreSchool of Business ACCT 405 Financial Accounting 2 Section 1 Fall 2013 PREREQUISITES: ACCT 401 (with earned grade of at least a C) INSTRUCTOR: Natalia Scott OFFICE: BA 332 OFFICE HOURS: Mondays & Wednesdays 9:30am – 10:30am Tuesdays & Thursdays 10:00 am – 11:00 am (Hours also available by appointment) TELEPHONE: 777-2686 EMAIL: natalia.scott@moore.sc.edu TEXTBOOK: Intermediate Accounting, 7th ed., Spiceland, Sepe and Nelson (REQUIRED) Course Description: This course is a continuation of ACCT 401, the study of financial accounting theory and practice as it relates to the preparation and understanding of financial statements. You will be expected to apply concepts from previous accounting courses to the material of this course. Course Objective: The basic learning outcomes of this course include: 1.) Understanding owner’s equity. 2.) Understanding of the valuation and reporting of investments. 3.) Understanding of the reporting of income taxes. 4.) Understanding of the valuation and reporting of pensions and leases. 5.) Understanding of revenue recognition issues. 6.) Understanding of the reporting of cash flows. Attendanceand Attentiveness: There is a strong relationship between class attendance and class performance so it is your responsibility to attend every class.If you should miss a class, you are responsible for everything that is covered in the class. You also are expected to arrive for class on time and stay for the entire class period. Coming to class late and leaving early may disrupt other students and interfere with the class presentation. Talking, texting, daydreaming, doing crossword puzzles, sleeping etc. during the class is not an option; I’m reserving the right to ask you leave the class if you aren’t paying attention or impairing other’s ability to pay attention. 1 Academic Dishonesty: You are expected to practice the highest possible standards of academic integrity. Any deviation from this expectation will result in a minimum academic penalty of your failing the assignment, and will result in additional disciplinary measures including referring you to the Office of Academic Integrity. Violations of the University's Honor Code include, but are not limited to improper citation of sources, using another student’s work, and any other form of academic misrepresentation. For more information, see the Carolina Community Student Handbook. Class Participation and Chapter Introduction Quizzes: You are expected to be prepared for every class so you can contribute to classroom discussion. The quality of your learning experience is determined in large by your active participation in the classroom. In order for you to be prepared to better process accounting concepts and participate in discussion during the lecture, you need to go over the assigned chapter reading before we will cover it in class. Attendance and participation is required in this course and is part of calculation for your final grade. Class attendance will be taken at beginning of each class. If you are coming to class late, it is your responsibility to see me after class so I mark you tardy instead of absent. I will evaluate each student over the course of the semester and assign the grade for participation at the end of the semester. Also, to encourage you to read assigned chapter before we go over it in class, you will be required to take chapter introduction quizzes posted on Blackboard under Assignments tab. The quiz will consist of about 10 conceptual multiple choice questions and will be counted as part of you course grade. Since the quiz is designed to be taken before you come to class, it will only be available till midnight on the day before we are scheduled to start a new chapter. Once you start the quiz you have to complete it in one sitting for which you are given an hour of time. There is only one attempt allowed for each quiz. Homework: Homework assignment for each chapter and the day it is due is listed in the schedule of events table included below. To help you with the homework preparation I posted practice problems on blackboard which are listed in the schedule of events table as well. The best practice is to go over those practice problems before attempting the homework. The homework will be collected at beginning of class on the day we are scheduled to go over it.You are expected to be prepared for class and be ready to participate in solving the homework problem in the classroom. I willonly post solutions to the homework problems on Blackboard if we did not have time to work or finish the problem in class. The homework is graded based on effort so you will either receive a full credit or a zero if you do not turn it in at the time collected orif you do not demonstrate effort in the preparation or show your work. 2 Academic Accommodations: The University of South Carolina provides upon request appropriate academic accommodations for qualified students. Such accommodations should be requested near the beginning of the semester. More information is available athttp://www.sa.sc.edu/sds/. Student Grading: Your grade for this course will be computed as follows: Item Homework Chapter Introduction Quizzes Participation Exam #1 Exam #2 Final Exam Total Percent of final grade 5% 5% 5% 25% 30% 30% 100% Exams: Exams will be about 50% multiple choice type questions with the remaining 50% to be word problems. These word problems may require journal entries, financial statement preparation, computations, and/or written explanations. You cannot use a calculator that stores text on an exam. If you do so, you will receive a grade of -0-. CELL PHONES MUST BE TURNED OFF AND PUT OUT OF SIGHT DURING ALL EXAMS. If you are caught with an electronic device out during an exam, your exam or quiz will be taken from you and you will receive a grade of -0- and will be reported for academic dishonesty. Graded exams will be reviewed in class. Exams may also be reviewed in my office for seven days after the date reviewed in class. After seven days, exam scores are final and exams are not available for review. The exams for this course are non-disclosed and are not returned. Any access to or possession of an exam or specific exam contents outside of our classroom will be considered to be an act of academic dishonesty. If you are caught taking a picture of or copying exam questions, you will receive a grade of -0- on that exam as well as being reported for academic dishonesty. No makeup exams will be given and a missed exam will generally result in a grade of zero. In the case of unforeseen emergencies, your final exam grade will be weighted for the missed test. Approval to be absent from an exam will be granted only in cases of extreme personal emergency. Written documentation must be provided. 3 Grading scale: The grading scale will be: A B+ B C+ C D F 89.5-100 86.5-89.49 79.5-86.49 76.5-79.49 69.5-76.49 59.5-69.49 Below 59.5 The grading scale is set by the School of Accounting and your instructor will not be able to make any changes to it. There will be no deviations from the grading scale. For example, a student with a weighted average of 69.50 would receive a C, and a student with a weighted average score of 69.49 would receive a D.A grade of D+ is not awarded in this course. Any business major scoring a D or F must retake the course. Withdrawal from course: It is your responsibility to be familiar with university policy governing withdrawal. 4 ACCT 405 Schedule of Events (Subject to Change) Date Thur. 8/22 Chapter and Topic Introduction Practice Problems Tue. 8/27 Chapter 5: Income Measurement and Profitability Thur. 8/29 Chapter 5: Income Measurement and Profitability Tue. 9/3 Chapter 5: Income Measurement and Profitability --Homework Problems Due: P5-9 Thur. 9/5 Chapter 12: Investments Tue. 9/10 Chapter 12: Investments Thur. 9/12 Chapter 12: Investments --- Homework Problems Due: P12-7; P12-9 Tue. 9/17 Thur. 9/19 Tue. 9/24 E5-5; E5-6; E5-11; E5-13; E5-14; E5-16; E15-18; E5-21 E12-5; E12-9; E12-14; E12-19; E12-21; E12-23 Chapter 16: Accounting for Income Taxes Chapter 16: Accounting for Income Taxes Chapter 16: Accounting for Income Taxes --- Homework Problems Due: E16-26, P16-10 Thur. 9/26 Chapter 17: Pensions and Other Postretirement Benefits Tue. 10/1 Exam 1:Chapters 5,12 and 16 Thur. 10/3 Chapter 17: Pensions and Other Postretirement Benefits Tue. 10/8 Go over Exam1 in class Thur. 10/10 Chapter 17: Pensions and Other Postretirement Benefits -- Homework Problems Due:P17-16 Friday 10/11 Last Day to Withdraw Without a Grade of “WF” 5 E16-10; E16-14; E16-15; E16-16; E16-19; E16-22; E16-24; E16-29 E17-2, E17-4, E17-5; E17-11; E17-19, E17-20; P17-2 Date Tue. 10/15 Thur. 10/17 Tue. 10/22 Chapter and Topic Practice Problems Chapter 18: Shareholders’ Equity Fall Break – no class Chapter 18: Shareholders’ Equity Thur. 10/24 Chapter 18: Shareholders’ Equity --- Homework Problems Due: P18-12 Tue. 10/29 Chapter 19: Share-Based Compensation and Earnings Per Share Thur. 10/31 Chapter 19: Share-Based Compensation and Earnings Per Share Tue. 11/5 Chapter 19: Share-Based Compensation and Earnings Per Share --- Homework Problems Due: P19-9;P19-20 Thur. 11/7 Exam 2:Chapters 17-19 Tue. 11/12 Chapter 15: Leases Thur. 11/14 Go over Exam 2 in class Tue. 11/19 Chapter 15: Leases Thur. 11/21 Tue 11/26 Thur. 11/28 E18-5; E18-12; E18-14; E18-19; P18-5; P18-9 Chapter 15: Leases Homework Problems Due: P15-16 E19-2; E19-6; E19-7; E19-11; E19-17; E19-19; E19-20; E19-23; P19-16; Additional Problem E15-1; E15-3; E15-4; E15-5; E15-12; E15-15; E15-17; E15-18; E15-19; E15-21 Chapter 21: Statement of Cash Flows No Class – Thanksgiving Holiday Tue. 12/3 Chapter 21: The Statement of Cash Flows--- Homework Problems Due: P21-11, P21-17 Thur. 12/5 Final Exam Review Monday Dec 16 at 9:00 am Final Exam 40% of final exam covers Chapters 15 and 21 and 60% covers Chapters 5, 12, 16,17,18,19. 6 E21-1; E21-14; E21-16; E21-27; E21-28; E21-31; P21-4; P21-16 7