Corporate Finance

advertisement

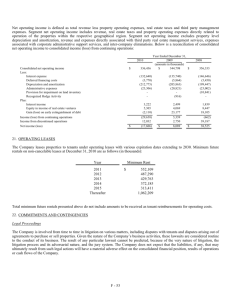

Financial Statement Analysis P.V. Viswanath Based on Damodaran’s Corporate Finance Questions we would like answered… As financial analysts… Assets Liabilities What are the assets in place? How valuable are these assets? Assets in Place How risky are these assets? Debt What is the value of the debt? How risky is the debt? What are the growth assets? Growth Assets How valuable are these assets? Equity What is the value of the equity? How risky is the equity? However, the information we have comes from the firm’s financial statements… P.V. Viswanath 2 Basic Financial Statements The balance sheet, which summarizes what a firm owns and owes at a point in time. The income statement, which reports on how much a firm earned in the period of analysis The statement of cash flows, which reports on cash inflows and outflows to the firm during the period of analysis P.V. Viswanath 3 The Balance Sheet Figure 4.1: The Balance Sheet Assets Long Lived Real Assets Short-lived Assets Investments in securities & assets of other firms Liabilities Fixed Assets Current Liabilties Current Assets Debt Debt obligations of firm Financial Investments Other Liabilities Other long-term obligations Equity Equity investment in firm Assets which are not physical, Intangible Assets like patents & trademarks Short-term liabilities of the firm This is what we can see from the firm’s balance sheet… P.V. Viswanath 4 An example : Maxwell Shoe Company, Inc Maxwell Shoe Company Inc. designs, develops and markets casual and dress footwear for women and children under multiple brand names, each of which is targeted to a distinct segment of the footwear market. The Company offers casual and dress footwear for women in the moderately priced market segment under the Mootsies Tootsies brand name, in the upper moderately priced market segment under the Sam & Libby and Dockers Khakis Footwear For Women brand names and in the better market segment under the Anne Klein 2 and A Line Anne Klein brand names. It also sells moderately priced and upper moderately priced children's footwear under both the Mootsies Tootsies and Sam & Libby brand names. In addition, it designs and develops private label footwear for selected retailers under the retailers' own brand names. Maxwell has licensed the J.G. Hook trademark to source and develop private label products for retailers who require brand identification. P.V. Viswanath 5 An example of an Accountant’s Balance Sheet Maxwell Shoe Company, Inc. As of October 31, 2000 (In ‘000s) ASSETS Current assets: Cash and cash equivalents Accounts receivable, trade Inventory, net Prepaid expenses Prepaid income taxes Deferred income taxes.... Total current assets........ Property and equipment, net. Trademarks, net.. Other assets..... $48,074 34,244 12,036 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable......... Accrued expenses......... Deferred income taxes..... Current portion of Capital lease obligations 536 1,478 798 97,166 Total current liabilities... Long-term deferred income $6,605 taxes........ 15,479 Stockholders' equity Additional paid-in 185 capital.......... Deferred compensation.... Retained earnings........ Total stockholders' equity.. $119,435 P.V. Viswanath $1,863 7,254 479 102 9,698 1,540 88 43,112 -251 65,248 108,197 $119,435 6 Notes on the Maxwell Balance Sheet Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Deferred tax assets are created when future taxable income is expected to exceed pretax income, while deferred tax liabilities occur in the reverse case. If more deductions have been taken in the current period for reporting purposes, then tax payable (according to the GAAP income statement) will be lower than the actual tax paid. Hence it will seem like taxes have been prepaid. This is reflected in the balance sheet as an asset. Deferred tax assets ($798) reflect allowance for doubtful accounts, stock option compensation, inventory capitalization, and inventory reserve. Deferred tax liabilities ($479) reflect amortization of trademarks (long-term) and depreciation of property and equipment (short-term). P.V. Viswanath 7 A Financial Analyst’s Balance Sheet Assets Existing Investments Generate cashflows today Includes long lived (fixed) and short-lived(working capital) assets Expected Value that will be created by future investments Liabilities Assets in Place Debt Growth Assets Equity Fixed Claim on cash flows Little or No role in management Fixed Maturity Tax Deductible Residual Claim on cash flows Significant Role in management Perpetual Lives This is what we would like to see… P.V. Viswanath 8 The Income Statement Figure 4.2: Income Statement Gross revenues from sale of products or services Revenues Expenses associates with generating revenues - Operating Expenses Operating income for the period = Operating Income Expenses associated with borrowing and other financing - Financial Expenses Taxes due on taxable income - Taxes Earnings to Common & Preferred Equity for Current Period = Net Income before extraordinary items Profits and Losses not associated with operations - (+) Extraordinary Losses (Profits) Profits or losses associated with changes in accounting rules - Income Changes Associated with Accounting Changes Dividends paid to preferred stockholders - Preferred Dividends = Net Income to Common Stockholders P.V. Viswanath 9 The Income Statement Maxwell Shoe Company, Inc. For the year ended October 31, 2000 (In ‘000s) Net sales.... Cost of sales Gross profit. Operating expenses: Selling. General and administrative.. Operating income.. Other expenses (income) Interest income, net... Amortization of trademarks.. Other, net... Income before income taxes.. Income taxes. Net income... P.V. Viswanath $158,205 116,991 41,214 11,584 16,141 27,725 13,489 -3,039 367 -310 -2,982 16,471 6,589 $9,882 10 The Income Statement The Income Statement provides us with information about changes in the balance sheet from one year to another. Hence it is crucial to creating the financial balance sheet that we want. However, the income statement is prepared according to GAAP. Underlying GAAP are certain principles, such as revenue recognition when the service for which the firm is being paid has been performed substantially, the matching principle governing recognition of expenses, a historical cost-based approach, and a basic conservatism in the recognition of assets. This leads to certain accounting practices that need to be corrected, from a financial analyst’s point of view… P.V. Viswanath 11 Desirable Modifications to Income Statement There are a few expenses that are consistently miscategorized in financial statements. In particular, Operating leases are considered as operating expenses by accountants but they are really, partly, financial expenses R&D expenses are considered as operating expenses by accountants but they are really capital expenses. The degree of discretion granted to firms on revenue recognition and extraordinary items is used to manage earnings and provide misleading pictures of profitability. P.V. Viswanath 12 Dealing with Operating Leases A Lease is a long-term rental agreement Leases can either be capital leases or operating leases A capital lease is often for as long as the life of the equipment, or there may be an option for the lessee to buy the equipment at the end of the contract period. Capital leases have to be capitalized and shown on the balance sheet. In an operating lease, typically, the contract period is shorter than the life of the equipment, and the lessor pays all maintenance and servicing costs. Operating leases do not have to be shown on the balance sheet. However, operating leases also represent expected fixed periodic payments, and thus function similar to debt. As such, a financial analyst would want to see operating leases capitalized as well P.V. Viswanath 13 Dealing with Operating Lease Expenses How do we do this? First, we compute the “debt” value of the operating lease as the PV of the operating lease expenses, using the pretax cost of debt as the discount rate. This now creates an asset - the value of which is equal to the debt value of operating leases. This asset now has to be depreciated over time. Second, the operating income has to be adjusted to reflect these changes. P.V. Viswanath 14 Dealing with Operating Leases: Adjusting Operating Income Note that the operating lease expense has two components an operating expense component, i.e. the reduction in the value of the asset being used, represented by the depreciation, and a financing component, i.e. the cost of financing the asset. Using this model, we assume that Interest expense on the debt created by converting operating leases = Operating lease expense - Depreciation on asset created by operating lease. Then, Adjusted Operating Income = Operating Income - Depreciation on operating lease asset + operating lease expenses = Operating Income + Imputed Interest expense on operating leases. = Operating Income + Debt value of Operating leases x Cost of debt P.V. Viswanath 15 Example: Capitalizing Operating Leases at Maxwell Shoe From the 10-K filing made by the company with the SEC on 1/29/2001: The Company leases equipment and office and warehouse space under long-term non-cancelable operating leases which expire at various dates through January 31, 2007. At October 31, 2000, future minimum payments under such leases were as given below (in ‘000s). Minimum Payments Present Value at 7% 2001 1488 1390.65 2002 1008 880.43 2003 917 748.55 2004 650 495.88 2005 600 427.79 Later Years 750 498.08 Minimum payments are capitalized using an assumed pre-tax cost of debt of 7% p.a. This will be the value of the Lease Asset/Liability on the Oct. 31, 2000 balance sheet. Later years refer to 2006 and 2007. P.V. Viswanath 16 Example: Capitalizing Operating Leases at Maxwell Shoe I assume that payments are made at the end of the fiscal year, ending in October. Since the figure for "Later Years," $750, is larger than the declining sequence of amounts for previous years, I assume that this reflects the amounts for both 2006 and 2007. Since the leases expire in January 2007, which is 3 months past the fiscal year end, I have prorated the amounts for 2006 and 2007, viz. $600 for 2006 (payable at the end of October 2006) and $150 for 2007 (payable at the end of January 2007). Hence the $498.08 computed as the present value for the row “Later Years” equals 600/(1.07)6 + 150/(1.07)6.25. The present value of the minimum payments (as of Oct. 31, 2000) works out to $4441.38. P.V. Viswanath 17 Imputed Interest Expenses on Operating Leases Lease payments in 2000 were $1024. Hence the PV of operating leases as of end 1999 would be (PV of Op. Leases as of end 2000 + Lease expenses for 2000)/1.07 = (4441.38+1024)/1.07 = $5107.83. The imputed interest expense is the Debt Value of Operating Leases x Interest rate. PV(Operating Leases) as of Oct. 31, 1999 Interest rate on debt Imputed Interest expense on PV of operating leases 5107.83 7% 357.55 Adjusted Operating Income = Operating Income + Imputed Interest Payment = $13,489 + $357.55 = $13,846.55 Net Income is not affected because the imputed interest expense will be subtracted from Operating Income, just as any other interest expense would be. P.V. Viswanath 18 The Effects of Capitalizing Operating Leases Debt: will increase, leading to an increase in debt ratios used in the cost of capital and levered beta calculation Operating income: will increase, since operating income will now be before the imputed interest on the operating lease expense Net income: will be unaffected since it is after both operating and financial expenses anyway Return on Capital will generally decrease since the increase in operating income will be proportionately lower than the increase in book capital invested P.V. Viswanath 19 R&D Expenses: Operating or Capital Expenses Accounting standards require us to consider R&D as an operating expense even though it is designed to generate future growth. It is more logical to treat it as capital expenditures. An approach to capitalizing R&D (cost-based), Specify an amortizable life for R&D (2 - 10 years) Collect past R&D expenses for as long as the amortizable life Sum up the unamortized R&D over the period. (Thus, if the amortizable life is 5 years, the research asset can be obtained by adding up 1/5th of the R&D expense from four years ago, 2/5th of the R&D expense from four years ago...: P.V. Viswanath 20 Capitalizing R&D Expenses: Boeing Assuming a ten year life; thus, R&D expenses for 1998 will be amortized over the 1999-2008 period. Year Unamortized Portion at end 1998 R&D Outlay Value Amortization for 1998 1988 751 0 0 75.1 1989 754 0.1 75.4 75.4 1990 827 0.2 165.4 82.7 1991 1417 0.3 425.1 141.7 1992 1846 0.4 738.4 184.6 1993 1661 0.5 830.5 166.1 1994 1704 0.6 1022.4 170.4 1995 1300 0.7 910 130 1996 1633 0.8 1306.4 163.3 1997 1924 0.9 1731.6 192.4 1998 1895 1 1895 0 Capitalized value of R&D for 1998 = 9100.2 Total R&D Amortization Expense for 1998 = P.V. Viswanath 1381.7 21 Boeing’s Corrected Operating Income For 1998 Operating Income* $1,720.00 + Research and Development Expenses** $1,895.00 - Amortization of Research Asset** $1,381.70 = Adjusted Operating Income $2,233.30 * Data obtained from Income Statement ** Data obtained from Income Statement; see also previous slide In principle, it could be argued that R&D capitalized values should be restated in 1998 dollars, instead of using the raw unamortized portions of R&D outlays in past years; however, the current procedure may be defended on the grounds of conservatism. P.V. Viswanath 22 Boeing’s Corrected Balance Sheet There will be the following modifications on the balance sheet: There will be a new asset, R&D, that will show on the assets side. If one wants to show the gross value of R&D and accumulated amortization, however, that will require computation of the amortization in each year for as many years as the amortizable life of the R&D. Corresponding to that, the value of stockholder’s equity will be higher by the same amount. In our example, this amount will be $9,100. P.V. Viswanath 23 The Effect of Capitalizing R&D Operating Income will generally increase, though it depends upon whether R&D is growing or not. If it is flat, there will be no effect since the amortization will offset the R&D added back. The faster R&D is growing the more operating income will increase. Net income will increase proportionately, depending again upon how fast R&D is growing. Adjusted Net Income will also have to take the tax deductibility of R&D into account. Book value of equity (and capital) will increase by the capitalized Research asset Capital expenditures will increase by the amount of R&D; Depreciation will increase by the amortization of the research asset; for all firms, the net cap ex will increase by the same amount as the after-tax operating income. P.V. Viswanath 24