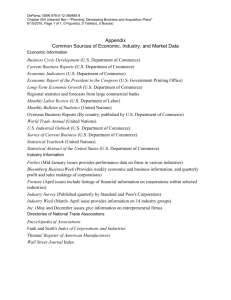

Digital money and electronic banking

advertisement

Electronic Commerce Digital money and electronic payment I. What is money? • What is digital money? • A digital money system • Ecash and stored value cards II. Electronic payment systems • What types of transaction schemes are being used? • How can payments be settled? School of Library and Information Science Electronic Commerce I. What is money? “Money is in reality a symbolic representation of value, rather than true value itself [It is] an institution for a transparent exchange of goods and services based upon a convenient unit of transaction ... universally accepted within a given societal group Today not all money is tangible: increasingly, information about money is becoming more important than money itself” Srivastava, L. and Mansell. R. (1998). Electronic Cash and the Innovation Process: A User Paradigm School of Library and Information Science Electronic Commerce “Money was originally a physical substance .... It could … be alive, as cattle were one of the oldest forms of money. Today although much of the money used by individuals … is still in the form of notes and coins its quantity is small in comparison with the intangible money that exists only as entries in bank records. If experiments with … digital cash succeed then perhaps coins and banknotes will become as obsolete as cowrie shells. If that happens the change in the nature of money will surely have significant effects on society. The challenge … is to ensure that such changes are beneficial to … society in general.” Davies, R. (2003). Electronic Money, or E-Money, and Digital Cash http://www.ex.ac.uk/~RDavies/arian/emoney.html School of Library and Information Science Electronic Commerce “Money” is only a state of Mind; not a reality in, of, or for, itself. Many people often seek it as if it were the real or the only ends to be obtained through one’s efforts. If money remains a state of Mind, therefore a spiritual reality and not an end in itself, then you always will have what you truly need and deserve. Money as an energy principle of spiritual reality, naturally flows to us as we earn a right livelihood. Be concerned with the quality of the service you give to others … and you will be working with the flow. Money flows in unseen channels like electricity flows through wires. Because it is spiritual energy in motion, we never really have “possession” of it. To be preoccupied with possessing it … squanders our own Life energy… McMurphy, J. (2002). What is money? http://www.innerself.com/Money_Matters/What_is_Money.htm School of Library and Information Science Electronic Commerce Paper money is guaranteed by law to have redeemable stored value It is a medium of exchange and a measure of value This gives us confidence to use checks, credit and debit cards and to use electronic transfer of funds In large-scale wholesale transactions, money can be seen as “transactional information” It is transmitted electronically over closed, wire transfer systems Now, money in retail transactions is becoming electronic Digital cash is an electronic “proxy” for paper $ School of Library and Information Science Electronic Commerce Historically, precious metals became the standard of value backing money They became more important than other commodities because they are Portable , divisible, durable Homogeneous, recognizable, secure Stable in value Valuable and available in small amounts The world adopted the gold standard as the basis of the value of money during the 1800s School of Library and Information Science Electronic Commerce Goods and services are no longer purchased with other goods and services (barter), or gold or silver (early money economy) We use paper “fiduciary monies” or credit instruments These instruments are represented by paper, plastic, or metallic tokens Checks, bank notes, government issues A credit card is a written promise to pay They are fully functional forms of money with an exchange value rated in terms of the basic unit of money (usually a fixed quantity of gold or silver) These are offset against each other in the banking system, so little gold or silver needs to be transferred School of Library and Information Science Electronic Commerce Hard currency (notes and coins) is considered the most liquid monetary asset there is It can quickly be turned into money (liquidity) This is very convenient, but currency does not hold its value as well as other assets It does not earn interest and its real value drops during periods of inflation A dollar remains a dollar, but due to inflation its purchasing power will be less Less liquid assets (savings, art, land) earn interest or appreciate in value They are not as affected as money is by inflation, although they are harder to convert to money School of Library and Information Science Electronic Commerce The value of money depends on the confidence of those who use it The dollar has value because it is widely accepted as a means by which to exchange goods and services Money has three main functions: Means of exchange Without money, we would have to exchange goods and services directly (barter) Unit of measurement Money allows us to compare the value of goods and service A standard for pricing goods and the means of buying and selling them School of Library and Information Science Electronic Commerce Money is A unit of measurement (more) We can compare costs, income, and profit across time It is a foundation of the accounting system and allows us to plan and make economic decisions A means of storing purchasing power for future use As a reserve, money allows us to accumulate savings over time and to lend those savings to someone else It makes it much simpler for us to make contracts We use it to promise to do something now for payment in the future The Bank of Canada (2002). What is money? http://www.bankofcanada.ca/en/backgrounders/bg-m1.htm School of Library and Information Science Electronic Commerce “Electronic money and electronic payments systems for retail transactions are commanding widespread attention. These systems, wherein neither legal tender, nor paper checks, nor credit-card numbers change hands at the time of purchase, have already started to spread across the globe. They offer significant and profitable opportunities for changing the way consumers pay for the widest possible range of goods and services.” United States Department of the Treasury Conference (1996). An Introduction to Electronic Money Issues. Toward Electronic Money and Banking: The Role of Government. p. 1. School of Library and Information Science Electronic Commerce Electronic money is a store of monetary value, held in digital form, which is available for immediate exchange in transactions It is a new form of currency that acts as a generalized medium of exchange Gold --> Paper $ --> Plastic --> Digital cash It is an electronic replacement for physical cash (a file) It is easily stored, transferred, and difficult to forge It has no intrinsic value: “numbers are money” As with paper $, there is a “promise” to convert it to physical cash School of Library and Information Science Electronic Commerce “Commodity money circulates because the stability of the society gives ground for confidence that the money will continue to be accepted habitually in exchange for goods and services. Similarly, the credit instruments of any government, bank, corporation, firm, or individual will circulate more or less widely in proportion to public confidence in its promises to pay. Likewise, a possible introduction of a digital cash system will require a period of long-term trust” Kienzle, J, and Perrig, A. (1996). Digital Money: A divine gift or Satan's malicious tool? http://lglwww.epfl.ch/~jkienzle/old/Digital_Money/node10.html School of Library and Information Science Electronic Commerce Digital cash is a “payment message bearing a digital signature which functions as a medium of exchange or store of value” It is an idea recorded in the hard drive of a computer To have value, digital cash must be exchangeable for ordinary cash It must be be exchangeable for goods or services priced in terms of ordinary or digital cash Like a typical check, it represents an obligation of a private company rather than the central bank or treasury Typically it will not be issued by the government School of Library and Information Science Electronic Commerce Berentsen, A. (nf). Digital Money and Monetary Control. ISOC. http://www.isoc.org/inet98/proceedings/ 3f/3f_2.htm School of Library and Information Science Electronic Commerce There are two types of e-money Identified e-money Contains information revealing the identity of the person who originally withdrew it from the bank It enables the bank to track the money as it moves through the economy (like credit cards) You request digital cash from your bank The bank signs a file (an amount of emoney) with its secret key and sends it to you The amount is debited from your account You verify this signature with the bank’s public key You know it’s valid and you can spend it School of Library and Information Science Electronic Commerce Banks will have multiple private keys Different denominations would be signed with different private keys When the bank issues the cash it Subtracts that amount from your account Records the identifying number of the electronic note and who it was issued to When making a purchase, the shop contacts the bank to verify that the money is a valid The bank checks its records to see if it is a valid note and to ensure that the note has not already been spent If the verification occurs, the bank credits the shop’s account, debits your account, and you get the stuff School of Library and Information Science Electronic Commerce This system provides security for all parties Because of the bank’s digital signature, the customer knows that the bank note is valid The shop can verify that the note is legal tender The bank can ensure that the note is not spent more than once The spender of the electronic note can be traced because the bank keeps a record of each note spent In this way anybody who cheats can easily be tracked down Since all financial transactions can be traced, law enforcement can more easily investigate fraud, money laundering, tax avoidance and other irregularities School of Library and Information Science Electronic Commerce Anonymous e-money is known as digital cash and works like real paper cash Once withdrawn from an account, it can be spent or given away without leaving a transaction trail It is created with blind signatures A blind signature allows a person to get a file digitally signed by another party without revealing information about the file to the other party It involves multiplying the file by a random number and encrypting it with the other’s public key They decrypt the file, sign it and return it Divide by the random number and restore the file with the signature School of Library and Information Science Electronic Commerce Blind signatures You create your own emoney “coins” which are tagged with ID numbers randomly generated by your emoney software The coins are “blinded” by a random number used to multiply the ID numbers (but not the value of the coins) They are sent to the bank, each in its own digital “envelope” The bank encodes the blinded numbers with its private key, debits your account, and sends them back to you Your emoney software removes the “blinding” You now have a valid emoney and since your software has removed the “envelope,” the bank can’t track the your use of the money School of Library and Information Science Electronic Commerce There are two varieties of each type of e-money Online emoney requires interaction with a bank via modem or network to conduct a transaction with a third party Offline emoney means you can conduct a transaction without having to directly involve a bank This type of e-money (true digital cash) is the most complex form of e-money because of the doublespending problem Once I give it to you, I should not be able to spend it again How can we prevent this? School of Library and Information Science Electronic Commerce Types of emoney Online Identified Anonymous Offline Exists as a file On a smart card Traceable to you Traceable Tracked by bank Renewable Exists as a file On a smart card Not traceable Not traceable Tracked by bank Hard to track School of Library and Information Science Electronic Commerce A digital money system requires Security Two people should be able to exchange digital cash without any party being able to alter or reproduce the electronic token The transaction protocol must ensure high-level security with sophisticated encryption techniques This involves using private key encryption The authentication of sender and receiver involves digital signatures Online verification can prevent double-spending, or other off-line techniques must be used School of Library and Information Science Electronic Commerce User-friendliness Users should not have to understand the cryptographic techniques involved in the exchange The workings of the protocol should be transparent to them Digital cash should be simple to use It should be easy to spending perspective and to accept as a form of payment Complicated systems are difficult to administer and raise the failure rate due to errors of the user Simplicity leads to a critical mass of users and this leads to wide acceptability School of Library and Information Science Electronic Commerce Portability People should be able to easily carry their digital cash and exchange it within alternative delivery systems Non-computer-network delivery channels should be able to handle digital money The security and use of digital cash should not be dependent on any physical location The cash can be transferred through computer networks and off the computer network into other storage devices Digital wealth should not be restricted to a unique, proprietary computer network School of Library and Information Science Electronic Commerce Transferability Digital cash should be transferable to other users If I pay the bill for three friends, they should be able to easily transfer their share of the bill to me Peer-to-peer payments should be possible without a third party Neither party should be required to have registered merchant status Neither party should have to be online to do this Digital money can then be used for gifts, charity, or tips Other person-to-person payments become possible, like payments to children, friends, colleagues or neighbors School of Library and Information Science Electronic Commerce Anonymity Anonymous digital cash allows personal financial privacy It is untraceable A digital cash withdrawal cannot be associated with its subsequent deposit Transactions made with it are unlinkable. It is impossible to associate two different digital cash transactions made by the same person with each other Grabbe, J.O. (nd). Digital Cash and the Future of Money http://www.aci.net/kalliste/dcfutmo.htm School of Library and Information Science Electronic Commerce Digital money has to preserve the privacy of those engaged in the transaction The anonymity of physical cash should be carried into this world Encryption separates payment information from buyer identity Only the value is transferred It must be non-refutable Electronic receipts can be stored on the device It must be divisible Digital cash in a given amount must be able to be subdivided into smaller amounts (fungible) School of Library and Information Science Electronic Commerce You must be able to write a digital check You should be able to fill in the amount of money that you want to pay onto some sort of digital form This form can be easily transferred to another party There must be a record of this transaction Digital cash should last forever You should be able to store it somewhere safe for years and then be able to retrieve it for use It should not expire It should maintain value until lost or destroyed provided that the issuer has not debased the unit to nothing or gone out of business School of Library and Information Science Electronic Commerce It must have value, acceptability, availability, security, and convenience Many retailers and banks must accept it We trust that it can be converted It must be easy to use It should minimize transaction costs Non-cash payments involve verification and authentication for each transaction (ex: checks) Offline, cash is used for 85% of all transactions, even though it accounts for 5% of the value of these transactions Digital money will serve a similar function School of Library and Information Science Electronic Commerce How is electronic money (e-money) possible? Cryptography and digital signatures make it possible Banks and customers have public-key pairs They use public keys to encrypt (security) and private keys to sign (identification) blocks of digital data that represent money orders A bank “signs” the orders using its private key and customers and merchants verify the signed money orders using the bank’s public key Customers sign deposits and withdraws using their private keys and the bank uses their public keys to verify the signed withdraws and deposits Miller, J. (2002). E-money mini-FAQ (release 2.0). http://www.ex.ac.uk/~RDavies/arian/emoneyfaq.html School of Library and Information Science Electronic Commerce E-cash transmutes between digital and actual money as transactions proceed between various entities http://www.byte.com/art/9801/img/018cs7a2.htm School of Library and Information Science Electronic Commerce A typical ecash transaction http://filebox.vt.edu/users/ licai/ch2.htm School of Library and Information Science Electronic Commerce Guiding principles of ecash Independence: its security must not depend on its existence in any physical location Security: it can’t be reusable and can’t be respent Privacy: it can’t be traced and must protect the privacy of the users Offline payment: merchants should not have to have a net connections to make it work Transferability: it must be able to be moved from one person to another without traces of identity Divisibility: it must be able to be broken into smaller amounts School of Library and Information Science Electronic Commerce How it might work It depends on public-key cryptography and digital signatures Banks and customers have public-key encryption keys They use their keys to encrypt (for security) and sign (for identification) blocks of digital data that represent money orders A bank “signs” money orders using its private key Customers and merchants verify signed money orders with the bank's widely published public key Customers sign deposits and withdraws using their private key and the bank uses the customer's public key to verify the signed withdraws and deposits School of Library and Information Science Electronic Commerce How ecash works Customer generates an electronic banknote with a random serial number A “blinding factor” is applied to the serial number so the bank cannot trace the banknote in the future A third party to handle and sign the message without being able to see the actual message. The blinded message is untraceable Customer sends the blinded e-banknote to the bank The bank deducts the amount from the customer's account, signs the banknote (encrypts it) and sends it back to the customer School of Library and Information Science Electronic Commerce Customer removes the blinding factor from the note and uses it to make a purchase at a shop The shop verifies the authenticity of the note using the bank’s public key and sends it to the bank The bank checks the note against a list of notes already spent If it’s good, it deposits the money into the shop’s account, and sends back a confirmation to the shop The shop then sends out the goods to the customer School of Library and Information Science Electronic Commerce How ecash works http://www.cs.newcastle.edu.au/.../ ecash/ecash.html School of Library and Information Science Electronic Commerce Why use digital $? Greater efficiencies and lower costs for businesses Ecash eliminates the costs of handling coins and paper The estimated cash handling cost for U.S. retailers and banks is over $60 billion annually “Studies have shown that a financial institution saves between $.75 and $1.25 for each payment converted from a deposit made with a teller to Direct Deposit” “Annual costs savings to the banking industry as a result of these new electronic payments should run between $350 million and $500 million.” -National Automated Clearing House Association School of Library and Information Science Electronic Commerce Ecash provides merchants with cost savings from Reduced collection and deposit float associated with coin, currency, and checks Faster funds availability Increased sales due to faster throughput at checkout Consumer tend to spend more with stored value cards Less tangible cash on hand Reductions in some forms of fraud, since devices can be fitted with tamper-resistant chips and strong crypto protocols Micromarketing School of Library and Information Science Electronic Commerce Expanding electronic government payments The Debt Collection Act of 1996 mandated government. use of EFT for all govt. payments, except tax refunds, by 1999 It includes anyone who, on or after July 26, 1996: Applies for federal or retirement benefit payments; Begins employment with a federal agency; Enters into a contract or purchase order with the govt. Files or renews a grant application After 1/1/99, all payments to individuals and businesses, including those without accounts at a financial institution, must be made electronically School of Library and Information Science Electronic Commerce Digital money is information stored on a computer chip in a plastic card or on a personal computer so that it can be transmitted over the net These products differ in their technical aspects from conventional forms of payment There are two basic ways of representing the value of funds stored on an ecash device: Balance-based: a single balance is stored and updated with each transaction Note-based: electronic “notes,” each with a fixed value and serial number, are transferred from one device to another School of Library and Information Science Electronic Commerce Stored value cards Digital money is a claim on a party, most commonly, the issuer, stored in the form of computer code on a credit card sized card or on the hard drive of a computer Consumers purchase the claim with traditional money Consumers exchange the claims for goods and services with merchants who are willing to accept the claim as payment Cards representing such claims often go by the name “stored value cards” (SVCs) Cards containing computer chips are called “smart cards” School of Library and Information Science Electronic Commerce SVCs represent either “closed” or “open” systems Closed SVCs are limited to a few outlets regardless of location or to many in a relatively small geographic area An example of a closed-system SVC is the “merchantissuer” model system The card issuer and the seller of the goods and services are one and the same Examples include: The farecard used by riders of the subway system in Washington, D.C. Student smart cards or merchant credit cards School of Library and Information Science Electronic Commerce The user buys a claim on the merchant issuer with traditional money and receives digital money in return When the user buys goods or services from the merchant-issuer, special point of sale (POS) devices record the transactions with the merchant The POS device reduces the value of the digital money recorded on the card by the amount of the purchase Although consumers make purchases with digital money, the system is linked to the payment system by the merchant-issuer’s relationship with its bank School of Library and Information Science Electronic Commerce SVCs that consumers can use at many different businesses over a large geographic area are an open system They work in the same manner as bank-issued closedsystem SVCs One difference is that a greater variety of businesses over a relatively larger geographic area accept them Another is that there can be third party sellers of digital money This means bypassing banks in transactions School of Library and Information Science Electronic Commerce There is a second type of open system Digital money systems can operate independently of banks and outside traditional payments systems The user buys digital money from issuers using traditional money She “spends” it at a merchant, who then sends the digital money to the issuer It is redeemed with some form of traditional money such as a check on a bank balance In this system, the digital money does not pass through the traditional payments clearing system, but circulates outside it School of Library and Information Science Electronic Commerce In expansive open systems, digital money circulates among users before being used with merchants, in much the same manner as traditional cash Users have their own special computer equipment allowing them to transfer digital money from one user’s card to another This “peer-to-peer” transfer does not clear the traditional payment system (in contrast to peer-to-peer transfers involving paper checks) The only points of contact between traditional payment systems and digital money is the initial purchase of digital money from the issuer with the use of traditional money and redemption of digital money by merchants School of Library and Information Science Electronic Commerce Smart cards are a technology for carrying digital money Memory cards: data storage space and password/PIN access Shared key cards: contain a secret key and can exchange data with other cards sharing the key Signature transporting cards: contain digital “blank checks” that can be used in transactions They are large pregenerated random number sequences that can be assigned a denomination and signed These are $1.50-$3.50 for the chips and production Signature creating cards: can generate the random number sequences to use as checks School of Library and Information Science Electronic Commerce Most digital money systems are aiming at universal accessibility This will depend on the widespread public acceptance of electronic cash To reach this level of acceptance will require a considerable investment by the financial services industry and by merchants It is expected that these costs will be transferred to the end-user School of Library and Information Science Electronic Commerce Digital money and electronic payment I. What is digital money? • Why use it? • Ecash and Stored value cards II. Electronic payment systems • What types of transaction schemes are being used? • How can payments be settled? School of Library and Information Science Electronic Commerce Electronically based payment systems have been around since the 1960s Banks use electronic funds transfer (EFT) to exchange “money” It is a transfer of debt from one bank to another Much of the money held by banks is in the form of debts owed by them or to them The evidence for this debt is in the bank’s computers EFT systems manage the information concerning these monetary debts They allow rapid and efficient transmission of data about these debts between banks and the updating of the debt records School of Library and Information Science Electronic Commerce EFT systems and retailer point of sales systems combine as EFTPOS (Electronic Funds Transfer at Point-of-Sale) The amount of the buyer’s purchase is entered into a POS terminal using a plastic card The data relating to this purchase are sent to the appropriate bank using a telecommunication link This bank then deducts the funds from the buyer’s account and transfers the amount to the seller’s account The buyer’s bank credits the seller’s account and takes on a debt to the seller The system immediately changes the information concerning indebtedness and starts charging interest School of Library and Information Science Electronic Commerce General Issues in the banking environment Banking regime is a highly complex and interrelated global system Multiple forces affect the evolution of banking: Consumer spending habits Interest rates/cost of money Federal Reserve policy Regulatory regime In general, the large and stable banks are losing ground to more non-traditional companies and services School of Library and Information Science Electronic Commerce Different components of the banking process are electronic to differing degrees Risk is an impediment, but not a driver The elimination of risk through security is not sufficient to promote home banking Banking is regulated by many different agencies (state governments, Federal Reserve, Office of the Comptroller of the Currency, FDIC) School of Library and Information Science Electronic Commerce How can payments be settled? Debit/Credit This refers to the way banks deal with transactions Credit: The bank pays the creditor before receiving payment from the purchaser Debit: The bank receives funds from purchaser before paying creditor This is a “pre-paid” system School of Library and Information Science Electronic Commerce Immediate/Delayed Settlement Here there is a time lag between the clearing of the payment and its settlement There is a time lag between the payer and the intermediary (the bank) When you pay off your credit card There is also a lag between the receiver and the intermediary When the merchant gets paid The purchaser benefits from the “float” The bank charges interest to cover the costs of assuming risk for completing the transaction School of Library and Information Science Electronic Commerce Gross/Net This is a relationship between clearing and settlement Gross payment is a one-to-one relation Each transaction has its own settlement Net payment is many-to-one Transactions are “batched” Net payment systems have lower operational costs (fewer settlements) but higher risks School of Library and Information Science Electronic Commerce Anonymous/Identified To what extent must the parties be identified in the transactions and settlements? Anonymous work well for small transactions but are riskier There is more need for authentication with large transactions Fixed/Fraction What is the fee structure of the transaction? Fixed fees cover the fixed costs of the transaction Fractional fees more efficient for risk fees and short term credit (microtransactions) School of Library and Information Science Electronic Commerce Types of Services: What do people do? Bill payment Purchasing instruments Transfer of money Borrow money Seek information (Inquiries, Statements) Cheat, steal, and defraud! School of Library and Information Science Electronic Commerce Bill Payment Becoming one of the most frequently performed activities on home computers Drivers include: need for more time, decreasing costs of software and hardware, bank promotion Generally a replacement for writing a check to pay a bill This is being extended to mortgage and loan payments as well School of Library and Information Science Electronic Commerce Bill Payment: institutions generally charge by the transaction (or a flat fee for a fixed number of transactions) Banking institutions, clearinghouses/brokers Checkfree http://www.checkfree.com e-Bills are delivered right to your computer Involves 100s of companies e-Bills give you a real-time payment history who you paid, when you paid them and for how much You schedule to pay e-Bills at a specific time each month or make payments whenever you want e-Bill payments are guaranteed School of Library and Information Science Electronic Commerce Purchases Focus of most discussions about Internet and other electronic commerce Payments for purchases tend to be made by Credit card Debit card Stored value card Electronic money School of Library and Information Science Electronic Commerce Stored-Value Cards Value is actually stored in computer chips embedded in a card SVCs are considered more secure than credit or other bank cards Requires specialized hardware at the vendor’s point of sale Mondex (recently purchased by MasterCard) is one of the largest manufacturers School of Library and Information Science Electronic Commerce Experiments have included road tolls and university financial aid Advantages to merchant include: Increased security (both from fraudulent customers and from fraudulent employees) Lower transaction costs No online authorization required Avoids costs associated with cash and check handling Can be efficient for microtransactions School of Library and Information Science Electronic Commerce Credit Cards Consumer is issued credit card by issuer (generally a bank or its agent) Merchant has an account with an “acquiring” institution (which allows it to accept credit cards) Acquiring Institutions: Citicorp, NaBanco, First Data, Bank One, GE Capital, First USA, EDS, Discover, American Express The processing agent actually generates the authorization and processes the charges: First Data, Global Payment Systems, VisaNet/Vital, Wells-CES , Nova, Checkfree School of Library and Information Science Electronic Commerce How can these transactions be carried out over the web? 1. Customer sends his ID or encrypted credit card number to the shop Shop sends request for payment to the Credit card company, which confirms customer by e-mail After the confirmation, payment is made and customer is billed, typically conventionally Card number itself never goes through the net unencrypted Security X Peer-to-peer - Low fees - Untraceability School of Library and Information Science Electronic Commerce 2. Person “A” issues an electronic check He sends it to person “B” and informs the bank of his check Person “B” asks for payment from the Bank After the confirmation, the bank transfers money from person A’s account to person B’s account Security X Peer-to-peer X Low fees X Untraceability - School of Library and Information Science Electronic Commerce Checks are closer to cash than to credit cards, because peer-to-peer transfers are possible Micro-payments are possible but banks are reluctant to process them (high cost of check clearance) CyberCash, NetCheck, and others offer digital checks which are transferable between individuals A customer opens an account in a netbank and issues an electronic check to pay a bill The recipient of this digital check sends it to the netbank to confirm and cash it Security is guaranteed by encryption and the bank's confirmation process with the issuer of the check (although the check can be traced across users) School of Library and Information Science Electronic Commerce 3. Person “A” asks the bank to issue digital cash The bank issues digital cash and reduces the account by that amount “A” sends it to person “B” “B” asks the bank for payment After confirming that the digital cash is not doublespent, the bank increases “B’s” account by that amount Note that the bank cannot know who sent that digital cash to person “B “ Security X Peer-to-peer X Low fees X Untraceability X School of Library and Information Science Electronic Commerce First, an Internet user opens an account with real money at a netbank The customer asks the bank to issue a certain amount of digital cash for use on the Internet The bank issues this digital cash using encryption and deducts the funds from the established account When an individual uses digital cash, the encrypted data that defines the actual electronic currency is given to the merchant The merchant in turn sends this data to the bank to confirm it School of Library and Information Science Electronic Commerce If the bank confirms that the digital cash is real, the bank credits the merchant's bank account by that amount It can also issue the merchant a sum of digital cash in the same amount Only the bank can confirm that this data - or, digital cash - is legitimate and actually issued by the bank Only the bank can verify that this that this data has not been used elsewhere, or double-spent The bank cannot know who used the digital cash, as long as customers of the bank do not use it twice School of Library and Information Science Electronic Commerce Digital cash will make transactions more efficient It will make transactions less expensive because the cost of transferring digital cash is low Traditional money transfer requires branches, clerks, ATMs, and specific electronic transaction systems Overhead is paid for by from fees for money transfers and credit card payments Ecash uses the net network and the computers of its users, so the cost of digital cash transfer is close to zero With the transaction completed on the net, the transfer fee and bank tips are zero School of Library and Information Science Electronic Commerce This low cost for transactions enables micro-payments, like 10 cents or 50 cents, to be possible This may encourage a new distribution system and fee structure for music, video, and software This is “super distribution” This ability to finally handle micro-payments might also provide a solution for the payment of fees to authors and publishers for use of copyrighted materials in electronic form School of Library and Information Science Electronic Commerce Also, digital cash is also borderless The cost of transfer within a state is almost equal to the cost of transfer across different states The cost of international money transfers, now much higher than transfers within a given state, will be reduced dramatically It may take more than a week to send a small amount of money to a foreign bank If a given foreign bank accepts digital cash, this delay is significantly reduced (as are the costs) School of Library and Information Science Electronic Commerce Digital cash payments potentially can be used by anyone with access to the net and to an netbank While credit card payments are limited to authorized stores, digital cash makes person-toperson payments possible Even very small businesses and individuals can use digital cash for all sorts of transactions School of Library and Information Science Electronic Commerce Secure Electronic Transactions Standard (SET) Jointly developed by Visa and Mastercard; supported by GTE, Microsoft, Netscape, Verisign, IBM, and others SET is a standard that allows secure credit card transactions on the net Using digital signatures, SET enables merchants to verify that buyers are who they claim to be It protects buyers by providing a mechanism for their credit card number to be transferred directly to the credit card issuer for verification It allows billing without the merchant being able to see the number School of Library and Information Science Electronic Commerce http://www.byte.com/art/9706/img/067csd2.htm School of Library and Information Science Electronic Commerce Microtransactions Concept has generated much interest on the Internet Micropayments are financial transactions for less than $1.00 They are prevalent offline and typically executed using cash Online they are rare, because payment methods are too costly for merchants to process small transaction amounts The costs of processing the transaction must be lower than the cost of the goods and services School of Library and Information Science Electronic Commerce Microtransactions are dependent upon low transaction costs Generally considered most promising for sale of “soft” goods such as information, software, and entertainment Question: Will consumers want to pay for such information? If so, how much? How can the transaction costs be made low enough for the merchant? Strategies could include: batching, giving up verification, giving up retractability School of Library and Information Science Electronic Commerce Peppercoin http://www.peppercoin.com It uses mathematical probability to efficiently and profitably process small transactions Does not use transaction aggregation Using mathematical probability requires far less overhead than traditional transaction-aggregation techniques It reduces merchant transaction costs to a few pennies per transaction They can increase revenue through the sale of lowpriced content Consumers have a single Peppercoin account across multiple merchants School of Library and Information Science Electronic Commerce PepperCoins are: Cryptographically secure: it uses RSA digital signatures Universal and easy-to-use: any consumer can pay any merchant using PepperCoins No subscriptions are needed Sealed and tamper-proof: it functions like pocket change and cannot be altered They can be sent across any channel, including email and text messages Connectivity independent: merchants do not have to check with the bank or payment service provider when receiving a Peppercoin School of Library and Information Science Electronic Commerce Paypal (an eBay Company) http://www.paypal.com It enables individuals or businesses with an email address to securely, easily and quickly send and receive payments online It uses the existing financial infrastructure of bank accounts and credit cards It has a proprietary fraud prevention system to provide a safe, global, real-time payment solutions It has 40 million account members in 38 countries Buyers and sellers on eBay, online retailers, online businesses, and offline businesses transact with PayPal School of Library and Information Science Electronic Commerce Verisign Payflow (was Cybercash) http://www.verisign.com/products/payment.html Payflow Pro accepts credit cards, purchase cards level 2 and 3 (for supported processors) and electronic checks online It can be used to process orders received offline via telephone, fax, e-mail or in person Integrates with shopping carts Merchant purchases and installs software Sets up account with credit card companies and bank School of Library and Information Science Electronic Commerce How it works Install Payflow Pro API client software on server It establishes SSL connection between storefront and VeriSign’s payment processing servers Customer makes a purchase on storefront Storefront passes transaction data to Payflow Pro client The client passes the information to VeriSign Payflow payment processing cycle begins VeriSign securely routes customer information to a network of banks, processors and other financial institutions School of Library and Information Science Electronic Commerce When the transaction is approved, approval information is sent to VeriSign VeriSign sends you and the customer email confirmation that the transaction was approved The entire approval process takes less than three seconds (on average ) The client sends acknowledgement to VeriSign that you have received the approval information You decide to accept or reject the transaction Once you accept, your acquiring bank credits your Internet Merchant Account School of Library and Information Science Electronic Commerce Transfers and Information Examples: Stock brokers: Etrade, e.Schwab Mutual fund companies: Vanguard, AIM Annuities: TIAA/CREF Banks/S&Ls/Credit Unions: IU Credit Union Microsoft, Intuit, and CheckFree have developed a standard for exchange of financial information over the Internet (Open Financial Exchange) School of Library and Information Science