Chapter 3 Reading Guide * pp. 56-83

advertisement

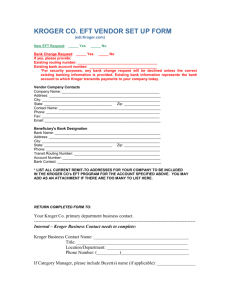

Chapter 3 Reading Guide – pp. 56-83 Section 1 1. What are the characteristics of a sole proprietorship? 2. What are 2 advantages to a partnership? 2 disads? 3. What is the structure and 2 features of a corporation? Section 2 4. How can businesses reinvest their profits to grow and expand? 5. Why might firms want to merge? 6. What are two different types of mergers? Section 3 7. What is a non-profit organization? 8. What is the role of our government in our economy? True/False Indicate whether the statement is true or false. ____ 9. Limited liability is one characteristic of the corporate form of business organization. ____ 10. One advantage of a corporation is the ease of obtaining a charter. ____ 11. One disadvantage of a general partnership is each partner’s responsibility for the acts of all other partners. ____ 12. Many schools, medical care facilities, and churches operate as nonprofit organizations. ____ 13. Labor unions use collective bargaining to negotiate job-related issues with management. ____ 14. Social Security is an example of government's role in the economy. ____ 15. Sole proprietorships must request a charter from the state in which they are organized. ____ 16. Investors in corporations have unlimited liability for the company's debts. ____ 17. The dividends of stockholders in a corporation are subject to double taxation. ____ 18. One of the principal reasons that companies merge is to diversify their product lines. ____ 19. A professional association tries to improve the working conditions, skill levels, and public perceptions of the profession. Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 20. The local chamber of commerce works to a. promote the welfare of its members and the community. b. earn dividends for members. c. protect its members from consumer complaints. d. aid member companies in negotiating with labor unions. Chapter 3 Reading Guide – pp. 56-83 ____ 21. An advantage of a corporation is that a. owners pay fewer taxes than owners of other forms of business. b. the business is subject to little government regulation. c. owners have limited liability for debt. d. owners have direct and immediate control over daily management of the business. ____ 22. What form of business organization does this organizational chart depict? a. partnership c. corporation b. proprietorship d. joint venture ____ 23. According to this organizational chart, to whom does the treasurer report? a. president c. stockholders b. board of directors d. secretary ____ 24. Partnerships, 1997-1999 Business Receipts Business Expenses Profit In billions of dollars 1997 $1,354 $1,186 X 1998 $1,603 $1,416 Y 1999 $1,907 $1,679 Z Source: Statistical Abstract of the United States, 2002. What number should appear in place of the X in the table? a. $2,540 c. $3,019 b. $187 d. $168 Chapter 3 Reading Guide – pp. 56-83 ____ 25. Which letter represents the proper location on the diagram for “unlimited liability”? a. T c. V b. W d. Y ____ 26. Which letter represents the proper location on the diagram for “owners earn dividends”? a. W c. Y b. X d. Z ____ 27. What type of merger created Mega Corporation in the illustration? a. horizontal merger b. vertical merger c. diagonal merger d. conglomerate merger Chapter 3 Reading Guide – pp. 56-83 ____ 28. In the 20th century, the Soviet Union collapsed because its command-and-control economy couldn’t keep up with the West’s free market. In the 21st century, the same fate will befall companies whose CEOs [chief executive officers] attempt to control everything. In a world that is becoming ever more chaotic and dependent on brainpower, teams at the top will make more sense than a single outrageously paid CEO who sits behind a “buck stops here” plaque. Source: “The Global Corporation Becomes the Leaderless Corporation,” Business Week, August 30, 1999. The author of this passage believes that global corporations should have a. no clear leader. c. leadership teams. b. Soviet-style leadership. d. lower paid leaders. Scott Melton thinks he got a raw deal. Melton, who recently opened Sushi Nights on Main Street in Deep Ellum [Texas], filed for Chapter 11 bankruptcy in April for Sushi Deep Ellum Inc., the general partnership he formed to operate Deep Sushi.... Last June, Deep Sushi’s limited partners, a group of 10 or so anesthesiologists and other human meat menders, gave Melton the boot. Not only that, they stiffed him, he says. “They left me holding the bag for $57,000 worth of unpaid taxes...including utilities and vendor bills....” Source: “Raw Feelings,” Dallas Observer Online, May 20-26, 1999. ____ 29. What form of business organization operated Sushi Nights, the restaurant discussed in the passage? a. proprietorship c. general partnership b. limited partnership d. corporation ____ 30. Based on the passage, what characteristic of Sushi Nights’ form of business organization left Scott Melton “holding the bag.” a. unlimited life c. double taxation b. unlimited liability d. limited liability of stockholders Grocery store giant Kroger Co. agreed Monday to purchase rival Fred Meyer Co. in a $12.8 billion deal that will enable Kroger to reclaim its status as the nation’s largest supermarket company.... [Analysts say] the merger is a good deal for both companies, one that should create the economies of scale necessary to remain competitive in the tough supermarket industry. The merger also will enable Kroger to [stay] ahead of rival Albertson’s, which otherwise would have eclipsed Kroger through its $11.7 billion buyout of American Stores Co. in August.... Combined with Meyer, currently the fifth-largest grocery chain, Kroger will operate 2,200 supermarkets in 31 states, boasting $43 billion in annual sales. Source: “Kroger Bags Fred Meyer,” CNNfn, October 19, 1998. ____ 31. What type of merger does the passage describe? a. vertical c. multinational b. conglomerate d. horizontal ____ 32. According to the passage, the merger enabled Kroger to a. diversify. b. acquire new product lines. c. become the industry’s largest company. d. acquire a new corporate identity.