Chapter 10

Monetary Policy

and Aggregate

Demand

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

Preview

• To understand the positive relationship

between real interest rates and inflation,

which is called the monetary policy (MP)

curve

• To develop the aggregate demand curve

using the monetary policy curve and the

IS curve

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-2

The Federal Reserve and

Monetary Policy

• The Fed of the United States conducts

monetary policy by setting the federal funds

rate—the interest rate at which banks lend to

each other

e

r

i

• Because the real interest rate is

(Chapter 2), and if prices are sticky, changes

in monetary policy does not immediately

affect inflation and expected inflation

• When the Federal Reserve lowers the federal

funds rate, real interest rates fall; and when

the Federal Reserve raises the federal funds

rate, real interest rates rise.

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-3

The Monetary Policy Curve

• The monetary policy (MP) curve shows

how monetary policy, measured by the real

interest rate, reacts to the inflation rate, :

r r

where

r autonomous component of r

responsiveness of r to inflation

• The MP curve is upward sloping: real interest

rates rise when the inflation rate rises

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-4

FIGURE 10.1 The Monetary Policy

Curve

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-5

The Taylor Principle: Why the Monetary

Policy Curve Has an Upward Slope

• The key reason for an upward sloping MP

curve is that central banks seek to keep

inflation stable

• Taylor principle: To stabilize inflation,

central banks must raise nominal interest

rates by more than any rise in expected

inflation, so that r rises when rises

• Schematically, if a central bank allows r to

fall when rises, then (Y ad =AD) :

r Y

ad

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

r Y

ad

10-6

Shifts in the MP Curve

• Two types of monetary policy actions that

affect interest rates:

1. Automatic (Taylor principle) changes as

reflected by movements along the MP curve

2. Autonomous changes that shift the MP curve

–

–

Autonomous tightening of monetary policy that

shifts the MP curve upward (in order to reduce

inflation)

Autonomous easing of monetary policy that

shifts the MP curve downward (in order to stimulate

the economy)

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-7

FIGURE 10.2 Shifts in the Monetary

Policy Curve

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-8

Policy and Practice: Autonomous Monetary

Easing at the Onset of the 2007-2009

Financial Crisis

• When the financial crisis started in August 2007,

inflation was rising and economic growth was

quite strong

• The MP curve would have suggested that the

Fed would continue to keep raising the federal

funds rate

• Instead the Fed lowered the federal funds rate

• This reflects that the Fed pursued autonomous

monetary policy easing, thus shifting the MP

curve down, because the Fed perceived the

economy to weaken in the near future due to

the financial crisis

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-9

FIGURE 10.3 The Inflation Rate and

the Federal Funds Rate, 2007-2010

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-10

The Aggregate Demand Curve

• The aggregate demand curve represents the

relationship between the inflation rate and

aggregate demand when the goods market

is in equilibrium

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-11

Deriving the Aggregate Demand

Curve Graphically

• The AD curve is derived from:

– The MP curve

– The IS curve

• The AD curve has a downward slope: As

inflation rises, the real interest rate rises, so

that spending and equilibrium aggregate

output fall

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-12

FIGURE 10.4 Deriving the AD Curve

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-13

Box: Deriving the Aggregate Demand

Curve Algebraically

• The numerical version of the AD curve can be derived from (1)

the numerical IS curve from Chapter 9 (Y 12 r ) , and (2)

then substituting in for r from the numerical MP curve

(r 1.0 0.5) :

Y 12 (1.0 0.5) (12 1) 0.5 11 0.5

• Similarly, the general version of the AD curve can be derived by

substituting in for r from the MP curve

using

the

(r r

)

algebraic version of the IS curve in Chapter 9:

Y [C I G NX mpc T ]

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

1

cdx

(r )

1 mpc 1 mpc

10-14

Factors that Shift the Aggregate

Demand Curve

• Shifts in the IS curve

1.

2.

3.

4.

5.

Autonomous consumption expenditure

Autonomous investment spending

Government purchases

Taxes

Autonomous net exports

• Any factor that shifts the IS curve shifts the

aggregate demand curve in the same

direction

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-15

FIGURE 10.5 Shift in the AD Curve

From Shifts in the IS Curve

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-16

Factors that Shift the Aggregate

Demand Curve (cont’d)

• Shifts in the MP curve

– An autonomous tightening of monetary policy,

that is a rise in real interest rate at any given

inflation rate, shifts the aggregate demand

curve to the left

– Similarly, an autonomous easing of monetary

policy shifts the aggregate demand curve to the

right

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-17

FIGURE 10.6 Shift in the AD Curve From

Autonomous Monetary Policy Tightening

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-18

The Money Market and Interest

Rates

• The liquidity preference framework

determines the equilibrium nominal

interest rate by equating the supply of and

demand for money

• John Maynard Keynes developed a theory

of money demand that he described as

liquidity preference theory

• Real money balances—the quantity of

money in real terms—reflect how much

money people want to hold (demand)

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-19

Liquidity Preference and the Demand

for Money

• According to Keynes, the demand for

money can be expressed in the form of the

liquidity preference function:

M d / P L(i , Y )

where

i = nominal interest rate

Y = nominal income

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-20

Liquidity Preference and the Demand

for Money (cont’d)

• Why are real money balances negatively

related to i?

– i represents the opportunity cost of holding

money

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-21

Liquidity Preference and the Demand

for Money (cont’d)

• Why are real money balances positively

related to Y?

– As income rises, households and firms conduct

more transactions and so keep more money on

hand to make purchases

– Higher incomes make households and firms

wealthier, and the wealthy tend to hold larger

quantities of all financial assets, including money

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-22

Demand Curve for Money

• In short-run analysis, prices are assumed to

be sticky so the price level is fixed at P

• All else being equal, lower real interest rates

mean the opportunity cost of holding money

falls, so that firms and households desire to

higher quantities of real money balances

• As a result, the demand curve for money

slopes downward

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-23

Supply Curve for Money

• The Fed fixes the money supply by open

market operations

• When the Fed buys (sells) government

securities in open market operations, it

increases (decreases) deposits at banks, so

that bank reserves and liquidity in the

banking system increase (decrease)

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-24

Supply Curve for Money

• An open market purchase leads to an

increase in liquidity and the money supply

• An open market sale of government

securities leads to a decrease in liquidity

and a decrease in the money supply

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-25

Supply Curve for Money (cont’d)

• The supply curve for money (MS) shows the

quantity of real money balances supplied at

each price level

• The line MS is a vertical line because:

– The money supply is fixed by the Fed at M

– The price level in the short run is fixed at P

– Thus, the quantity of real money balances

supplied is M s / P M / P

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-26

FIGURE 10.7 Equilibrium in the

Money Market

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-27

Equilibrium in the Money Market

• Equilibrium in the money market occurs

when the quantity of real money balances

demanded equals the quantity of real money

balances supplied:

Md Ms

P

P

• Graphically, equilibrium occurs where MD

and MS curves intersect at i*

• An excess supply (demand) of money results

in a decrease (an increase) in i

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-28

Changes in the Equilibrium Interest

Rate

• A shift in the MD (or MS) curve occurs when

the quantity demanded (or supplied)

changes at each given interest rate in

response to a change in some other factor

besides the interest rate

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-29

Changes in the Equilibrium Interest

Rate (cont’d)

• Examples of factors that shifts the MD or

MS:

– When income rises, MD shifts to the right and

so interest rates will rise

– When the money supply increases, MS shifts to

the right and so interest rates will decline

– When the price level rises, MS shifts to the

right and so interest rates will rise

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-30

FIGURE 10.8 Response to Shift in the

Demand Curve from a Rise in Income

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-31

FIGURE 10.9 Response to Shifts in

the Supply Curve (a)

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-32

FIGURE 10.9 Response to Shifts in

the Supply Curve (b)

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-33

Chapter 10

Appendix

The Demand

for Money

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

Keynesian Theories of Money

Demand

• Three motives behind the demand for money

in Keynes’ liquidity preference theory:

1. Transactions motive

•

•

People hold money to carry out everyday transactions

Affected by payment technology (e.g., credit cards)

2. Precautionary motive

•

Money holding as a cushion against unexpected needs

•

Proportional to income, Y

3. Speculative motive

•

•

Money as a store of wealth

As the interest rate i rises, the opportunity cost of

money rises (it is more costly to hold money relative

to bonds) and the quantity of money demanded falls

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-35

Putting the Three Motives Together

• Keynes’ liquidity preference function that

combines the 3 motives together:

Md

L(i, Y )

P

• An important implication is that velocity, V, is

not a constant buy will fluctuate with changes

in interest rates. This is because P / M d 1/ L(i, Y ),

so that (assuming Md=M):

V

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

PY

Y

M

L(i, Y )

10-36

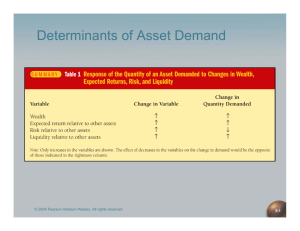

Portfolio Theories of Money

Demand

• In Keynes’ portfolio theories of money

demand, the main determinants of the demand

for an asset:

1. Wealth—total resources owned by individuals,

including all assets

2. Expected return—the return expected on the

asset relative to other assets

3. Risk—the degree of uncertainty associated with

the return on the asset relative to other assets.

Most people do not like risk (risk averse)

4. Liquidity—the ease and speed with which an

asset can be turned into cash relative to other

assets

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-37

Portfolio Theory and Keynesian

Liquidity Preference

• Portfolio theory justifies Keynesian liquidity

preference theory as the demand for real

money balances in both theories is:

– positively related to income

– negatively related to the nominal interest rate

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-38

Other Factors That Affect the

Demand for Money

• Wealth

– Portfolio theory posits that as wealth increases,

investors have more resources to purchase

assets, increasing the demand for money (such

as M1, known as dominated assets because

they are perceived as safe)

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-39

Other Factors That Affect the

Demand for Money (cont’d)

• Risk

– When the stock market becomes more volatile,

the demand for money, which is perceived as

less risky, increases

– An increase in the variability of the real return

on money reduces its money as people shift

into alternative assets as inflation hedges

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-40

Other Factors That Affect the

Demand for Money (cont’d)

• Liquidity of other assets

– The development of new liquidity assets, e.g.,

money market mutual funds, reduces the

relative liquidity of money, so that the demand

for money falls

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-41

TABLE 10A1.1 Factors That

Determine the Demand for Money

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-42

Empirical Evidence on the

Demand for Money

• Is the demand for money sensitive to

changes in interest rates?

– The liquidity trap is an extreme case of

ultrasensitivity in the demand for money to

interest rates, implying that a change in the

money supply has no effect on interest rates

– There is little evidence of a liquidity trap, except

in recent years when interest rates fell to near

zero

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-43

Empirical Evidence on the

Demand for Money (cont’d)

• Is the demand for money function stable?

– By the early 1970s, evidence strongly

supported the stability of the money demand

function.

– After 1973, there is evidence substantial

instability in estimated money demand

functions because of the rapid pace of financial

innovation, which changed which items could be

used for money.

Copyright © 2012 Pearson Addison-Wesley. All rights reserved.

10-44