A guide to innovation assistance

advertisement

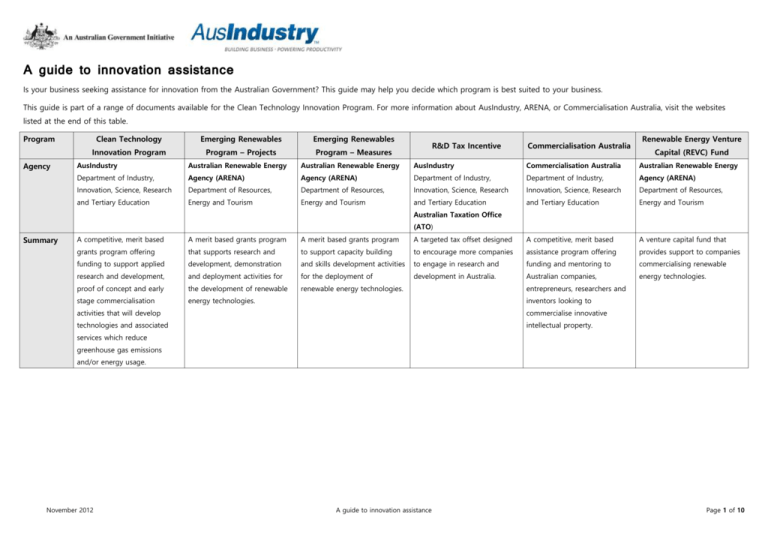

A guide to innovation assistance Is your business seeking assistance for innovation from the Australian Government? This guide may help you decide which program is best suited to your business. This guide is part of a range of documents available for the Clean Technology Innovation Program. For more information about AusIndustry, ARENA, or Commercialisation Australia, visit the websites listed at the end of this table. Program Agency Clean Technology Emerging Renewables Emerging Renewables Innovation Program Program – Projects Program – Measures R&D Tax Incentive Commercialisation Australia Renewable Energy Venture Capital (REVC) Fund AusIndustry Australian Renewable Energy Australian Renewable Energy AusIndustry Commercialisation Australia Australian Renewable Energy Department of Industry, Agency (ARENA) Agency (ARENA) Department of Industry, Department of Industry, Agency (ARENA) Innovation, Science, Research Department of Resources, Department of Resources, Innovation, Science, Research Innovation, Science, Research Department of Resources, and Tertiary Education Energy and Tourism Energy and Tourism and Tertiary Education and Tertiary Education Energy and Tourism Australian Taxation Office (ATO) Summary A competitive, merit based A merit based grants program A merit based grants program A targeted tax offset designed A competitive, merit based A venture capital fund that grants program offering that supports research and to support capacity building to encourage more companies assistance program offering provides support to companies funding to support applied development, demonstration and skills development activities to engage in research and funding and mentoring to commercialising renewable research and development, and deployment activities for for the deployment of development in Australia. Australian companies, energy technologies. proof of concept and early the development of renewable renewable energy technologies. stage commercialisation energy technologies. entrepreneurs, researchers and inventors looking to activities that will develop commercialise innovative technologies and associated intellectual property. services which reduce greenhouse gas emissions and/or energy usage. November 2012 A guide to innovation assistance Page 1 of 10 Program Clean Technology Emerging Renewables Emerging Renewables Innovation Program Program – Projects Program – Measures To support the development Commercialisation Australia Capital (REVC) Fund To support the development of objective new clean technologies and of renewable energy and skills development in the improve productivity across hands-on approach to help active investment management associated services, including technologies as they move renewable energy industry, the Australian economy take new products, processes to encourage the development low emission and energy from early stage research and preparatory activities for and services to market. of Australian companies that are efficient solutions, that reduce development along the Projects or any other industry conduct research and greenhouse gas emissions. technology innovation chain activities to assist the development activities that resources as well as to commercial development and deployment may not otherwise have been networking opportunities to competitiveness. of renewable energy conducted accelerate the business technologies. activities development Proof of concept To provide business with To offer funding and Australian companies, competitively priced complex support entrepreneurs, researchers Development Demonstration Early stage deployment Early stage commercialisation Renewable energy industry capacity building activities Renewable energy industry development activities Preparatory activities for an To improve the incentive for and inventors looking to smaller firms to engage in commercialise innovative research and development. intellectual property. Eligible ‘research and To provide venture capital and commercialising renewable energy technologies. building process for more predictable, less Australia’s total energy mix. Applied research and To encourage industry to the proportion of renewable energy in Eligible To boost competitiveness and To provide an integrated, Renewable Energy Venture Program To contribute to increasing To support capacity building R&D Tax Incentive Skills and knowledge: The Fund can only invest in development activities’ as supports purchase of expert Eligible Investee Companies defined in Subdivision 355-B of advice and services (refer clause 20.1 of REVC the Income Tax Assessment Act Experienced executive: 1997 (Cth.). engagement of an Fund Guidelines) Note that the Fund’s Emerging Renewables experienced Chief Executive investments are to be made Program Project. Officer or other executive on a company basis and are Proof of concept: activities to help establish the commercial not intended to support specific projects. viability of a new product, process or service Early stage commercialisation: activities that will bring a new product, process or service to market Eligible Energy efficient and/or low Renewable energy and enabling Renewable energy and enabling technologie emission technologies, that technologies. technologies. s reduce greenhouse gas Technology priorities are set out Technology priorities are set out emissions. in Appendix B to the Emerging in Appendix B to the Emerging Renewables Program Renewables Program Information Guide (available Information Guide (available from the ARENA website). from the ARENA website). November 2012 Not restricted. A guide to innovation assistance Not restricted. Renewable energy and enabling technologies. Page 2 of 10 Program Budget Clean Technology Emerging Renewables Emerging Renewables Innovation Program Program – Projects Program – Measures R&D Tax Incentive Renewable Energy Venture Capital (REVC) Fund $200 million over 5 years $126 million across both $126 million across both (2012-13 to 2016-17) Projects and Measures Projects and Measures (2011-12 to 2019-20, subject to (2011-12 to 2019-20, subject to investor totalling $200 million availability of ARENA funds) availability of ARENA funds) over 13 years (2012 – 2024) Merit based grants program Merit based grants program Program Competitive, merit based grants type program Not applicable Commercialisation Australia Entitlement program $76.7 million (2012-13) $100 million ARENA investment $82 million per annum ongoing matched 1:1 by a private Competitive, merit based grants Venture capital fund program (investments determined by Fund Manager based on commercial judgment and parameters of the program) Financial Grants from $50,000 to $5 No maximum funding No maximum funding support million. restriction, other than the limit restriction, other than the limit offset (equivalent to a 150 of program funds. However, of program funds. However, per cent deduction) to funding for an individual Project funding for an individual eligible entities with an up to $350,000 over two is expected to be between $2 Measure is expected to be up aggregated turnover of less years million and $30 million. to $3 million. than $20 million per annum available to successful applicants A 45 per cent refundable tax A non-refundable 40 per cent tax offset (equivalent to 133 Payments Skills and Knowledge: grants up to $50,000 Experienced Executive: grants Maximum of $40 million – which is 20 per cent of the Fund's total capital. This can be changed if approved by ARENA. Proof of Concept: grants from $50,000 to $250,000 Early Stage per cent deduction) to all Commercialisation: grants other eligible entities. from $50,000 to $2 million Quarterly grant payments Payments made in instalments Payments made in instalments Benefit received annually – Quarterly grant payments Investment as agreed by following receipt of progress set out in schedules to the set out in schedules to the refundable tax offset for eligible following receipt of progress investors, Fund Manager and reports funding agreement funding agreement entities with a turnover of less reports investee company. than $20 million, or a non- Investee companies may receive refundable tax offset for all an initial investment with other eligible entities. subsequent rounds if they are A quarterly credits system for successful and present high companies with an annual value growth opportunities. turnover of less than $20 million will commence January 2014. None Non- None None None monetary Access to: Fund manager provides active Experienced industry Case management to help develop Manager support investee companies Volunteer Business Network available to of industry experts successful applicants November 2012 A guide to innovation assistance Page 3 of 10 Program Clean Technology Emerging Renewables Emerging Renewables Innovation Program Program – Projects Program – Measures R&D Tax Incentive Applicant At least 50 per cent of total No specified amount. However, No specified amount. However, contribution eligible project costs. applicants seeking 100 per cent applicants seeking 100 per cent 20 per cent of total eligible of project funds are likely to be of project funds are likely to be project costs found to have low merit and found to have low merit and not be funded. not funded. to project costs Not applicable. Commercialisation Australia Skills and Knowledge: At least Renewable Energy Venture Capital (REVC) Fund Not applicable. Experienced Executive: At least 50 per cent of total eligible project costs Proof of Concept: At least 50 per cent of total eligible project costs Early Stage Commercialisation: At least 50 per cent of total eligible project costs Turnover None None None 45 per cent refundable tax limits Less than $50 million per year offset to eligible entities with an for Early Stage aggregated turnover of less Commercialisation grants than $20 million per annum and a non-refundable 40 per cent Less than $10 million per year for all other components tax offset to all other eligible Less than $20 million at time of first investment. Not associate of company with revenue greater than $100 million at time of first investment. entities. Maximum 2 years 6 months. No maximum, however project No maximum, however project Not applicable. Skills and Knowledge: 1 year Projects to be completed by project Projects to be completed by length will be set when the length will be set when the Experienced Executive: 2 2024. length June 2017. successful applicant enters into successful applicant enters into a funding agreement with the a funding agreement with the Proof of Concept: 1 year Commonwealth. Commonwealth. Early Stage years Commercialisation: 2 years November 2012 A guide to innovation assistance Page 4 of 10 Program Eligibility Clean Technology Emerging Renewables Emerging Renewables Innovation Program Program – Projects Program – Measures R&D Tax Incentive Renewable Energy Venture Commercialisation Australia Capital (REVC) Fund Applicants must be: Applicants must satisfy the Applicants must satisfy the Only ‘R&D entities’ can register Applicants must be: For a company to be an eligible A non tax-exempt company following criteria: following criteria: research and development A non tax-exempt company investee company, it must be a At the time of entering into a At the time of entering into a (R&D) activities and claim R&D incorporated under the company which: incorporated under the Corporations Act 2001 (Cth); Funding Agreement, be an Funding Agreement, hold an tax offsets. An R&D entity is a Corporations Act 2001 (Cth) a) At the time the Licensed or Australian entity incorporated Australian Business Number corporation that is: that meets the turnover Fund first invests in it, is under the Corporations Act (ABN). Incorporated under an requirements; incorporated under the A wholly or majority owned Commonwealth or State 2001 (Cth). Government body that either: Be able to demonstrate to - - - Be able to demonstrate to the satisfaction of ARENA Australian law; or Incorporated under foreign A researcher applying Corporations Act 2001 (Cth)and through the has an Australian Business Derives its income the satisfaction of ARENA that the activity described in law but an Australian resident commercialisation office of an Number (ABN); primarily from that the project described in the Measure application for income purposes; or Australian University; or b) Is commercialising commercial sources; the proposal meets the meets the definition of a Incorporated under foreign Researchers or individuals Does not receive definition of a Project (as Measure (as described in the law and: significant recurrent described in the Information Information Guide). - government funding; or Guide). Returns any part of a Be able to demonstrate to Renewable Energy Technologies applying through a or will, under the investment A resident of a country commercialisation office of a arrangement with the Licensed with which Australia has a University, Publicly Funded Fund, be required to the satisfaction of ARENA double tax agreement, Research Agency or Eligible commercialise Renewable Partner Entity; or Energy Technologies; Be able to demonstrate to trading surplus to a the satisfaction of ARENA ownership of, access to or including a definition of government in the form that the Project will take the beneficial use of, any ‘permanent of an annual dividend or place primarily in Australia. intellectual property establishment’; and who agrees to form a non seed, start-up or early Carrying on business in tax-exempt company expansion stage of its Australia through a incorporated under the development, at the time the permanent establishment Corporations Act 2001(Cth) if Licensed Fund first invests in it; the application is successful. d) Is providing all of the goods similar payment. Be able to demonstrate to necessary to carry out the - All applicants must also the satisfaction of ARENA demonstrate that they: ownership of, access to, or Can match the grant funding the beneficial use of, any organisation that has not as defined in the double on a 50:50 basis throughout intellectual property complied with the Equal tax agreement. the life of the project; necessary to carry out the Project. Have access to, and/or the beneficial use of, any Not be named as an Measure. Not be named as an An individual or researcher c) Has business activity at the All applicants must also and services it produces Opportunity for Women in demonstrate that they: through commercialising the Workplace Act 1999 (Cth). Can match the grant funding Renewable Energy Technologies Be able to demonstrate to at the required ratio over the to persons who are not life of the project; Associates; intellectual property organisation that has not the satisfaction of ARENA, the necessary to carry out and/or complied with the Equal applicant’s need for funding commercialise the proposed Opportunity for Women in for the Measure taking into beneficial use of, any employees (by number) and project; and the Workplace Act 1999 (Cth). account the extent of funding intellectual property assets (by value) inside Australia for the Measure from other necessary to carry out and/or at the time the Licensed Fund sources. commercialise the proposed first invests in it, or will use the project; and whole of the proceeds from Must comply with their Be able to demonstrate to Have access to, and/or the e) Has a majority of its obligations under the Equal the satisfaction of the ARENA, Opportunity for Women in the applicant’s need for the Workplace Act 1999 funding for the Project, taking requirements in section 4.4 of (Cth). into account the extent of the Emerging Renewables obligations under the Equal Australia; funding for the Project from Information Guide Opportunity for Women in f) November 2012 other sources. Comply with the requirements in section 3.4 of Comply with the A guide to innovation assistance Must comply with its that initial investment within At the time the Licensed the Workplace Act 1999 (Cth). Fund first invests in it, has5an Page of 10 average annual revenue over the previous two years of Program Clean Technology Emerging Renewables Emerging Renewables Innovation Program Program – Projects Program – Measures R&D Tax Incentive Commercialisation Australia Renewable Energy Venture Capital (REVC) Fund Collaborativ Eligible – national and Eligible – national and Eligible – national and Eligible. Eligible – national and Fund manager invests in one e projects international. international. international. Each eligible entity in the international. company per investment. Lead applicant must be an Lead applicant must be an Lead applicant must be an collaboration that wants to Lead applicant must be an eligible entity at the time of eligible entity at the time of eligible entity at the time of receive the benefit must register eligible entity at the time of entering into a funding entering into a funding entering into a funding their activities. entering into a funding agreement. agreement. agreement. Companies can collaborate with agreement. Research Service Providers. November 2012 A guide to innovation assistance Page 6 of 10 Program Clean Technology Emerging Renewables Emerging Renewables Innovation Program Program – Projects Program – Measures Extent of the reduction in Merit criteria Potential of the renewable Contribution of the Measure R&D Tax Incentive Not applicable Commercialisation Australia Need for funding greenhouse gas emissions or energy technology to the development of the Only applications that energy consumption encompassed in the Project renewable energy industry in demonstrate a need for funding associated with the project to deliver economic benefits Australia. are assessed against the Commercial potential of the project Technical strength of the project (including the technical capability and from lowering the cost and Capability of the applicant and any proposed supporting Market opportunity renewable energy in Australia consortium to implement the Value proposition over the long term. Measure as set out in the Execution plan proposal. Management capability resources available to the Project to deliver clearly applicant) defined technical outcomes Program for the Measure to progress the renewable compared with the total cost energy technology along the of the Measure. Management capability of the applicant technology innovation chain Funding sought from the Capital (REVC) Fund Not applicable remaining criteria: increasing the supply of the Technical strength of the Renewable Energy Venture National benefits Overall risk associated with and the national and the Measure as set out in the international significance of proposal, including without the technical innovation limitation: compliance, involved. technical and financial risks. Contribution of the Project to the renewable energy technology priorities, as set out in Appendix B to the Emerging Renewables Program Information Guide (available from the ARENA website). Capability of the applicant and any proposed supporting consortium to implement the Project set out in the proposal. Funding sought from the Program for the Project compared with the total cost of the Project. Overall risk associated with November 2012 the Project as set out in the proposal, including without limitation: compliance, A guide to innovation assistance Page 7 of 10 Program Clean Technology Emerging Renewables Emerging Renewables Innovation Program Program – Projects Program – Measures Dealing with Written consent must be Must obtain ARENA’s written Must obtain ARENA’s written R&D Tax Incentive Not applicable Commercialisation Australia For grants of $500,000 or intellectual obtained before a successful consent before any change of consent before any change of less, written consent must be property/ applicant deals with project control events. control events. obtained before a successful change of control intellectual property during applicant deals with project the project period. intellectual property during For overseas change of Renewable Energy Venture Capital (REVC) Fund Refer fund manager the project period. control events that occur For all other grants, written during the project period consent must be obtained there is a requirement to before the applicant deals repay grant funds paid to with project intellectual date. property until 5 years after the project completion. Innovation Australia Merit assessment - ARENA Board (with applications ARENA Board (with applications Self assessment. Clean Technology over $50 million going to the over $50 million going to the Risk assessment and compliance Innovation Committee Minister for Resources and Minister for Resources and reviews undertaken by (Applications over $3 Energy) Energy) AusIndustry and the ATO. Innovation Australia - Applications for investment Commercialisation considered by fund manager Australia Board and determined by fund manager’s investment million will also be committee considered by the Innovation Australia Board) Application Two stage – applicant Two stage – an initial Expression One stage – only Measures of R&D activities must be Two stage – applicant process completes a Registration of of Interest, followed by an high merit will be offered registered with AusIndustry completes a Stage 1 Application Interest form. AusIndustry invitation for selected applicants program funding. within 10 months of the end of Form for an initial assessment contacts the customer to to submit an Application for Continuous application process. the financial year in which they of eligibility. Commercialisation discuss the project and funding consideration. were carried out. Companies Australia contacts the applicant eligibility. If suitable, Continuous application process. then claim the benefit through to discuss the application. the ATO. Competitive applicants will be AusIndustry will provide the customer with the full then asked to complete a Stage Application Form. 2 Application Form. Continuous application process. Continuous application process. Application to fund manager Further www.ausindustry.gov.au www.arena.gov.au www.arena.gov.au www.ato.gov.au/randdtaxincenti www.commercialisationaustralia. www.arena.gov.au information 13 28 46 02 6243 7054 02 6243 7054 ve gov.au www.sxvp.com www.ausindustry.gov.au 13 22 56 13 28 46 November 2012 A guide to innovation assistance Page 8 of 10 Finding the best program for your needs: Question Response Does your project involve some energy efficiency or greenhouse If No, the Clean Technology Innovation Program is not suitable. gas emission reduction? Does your project involve the development of renewable energy If No, the Emerging Renewables Program is not suitable. technologies? Does your project involve research and development? If Yes, consider the R&D Tax Incentive. If Yes, for applied research and development (as compared to blue sky and/or basic research), consider the Clean Technology Innovation Program. If Yes, some development activities may be supported under Emerging Renewables Program – Projects. If Yes, for development activities focused on achieving a commercial transaction of bringing a product process or service to market, some elements may be supported under Commercialisation Australia. Does your project involve technical proof of concept and/or early stage commercialisation activities? Does your project involve commercial proof of concept and/or early stage commercialisation activities? Do you have any funds available to put towards the cost of your project? If Yes, consider: - The Clean Technology Innovation Program. - Emerging Renewables Program. If Yes, consider: - Commercialisation Australia’s Proof of Concept and Early Stage Commercialisation components. If Yes, The Clean Technology Innovation Program or Commercialisation Australia Program may be suitable. - Under the Clean Technology Innovation Program you need to be able to cover 50% of the total cost of the project. - Under Commercialisation Australia’s Experienced Executive, Proof of Concept and Early Stage Commercialisation components you will need to cover 50% of the cost of your project; whilst under the Skills and Knowledge component you will need to cover 20% of the cost. If Yes, you may be eligible to claim a tax offset of 40% or more on the entire cost of your R&D project under the R&D Tax Incentive If No, the Emerging Renewables Program can fund up to 100% of the project costs. Do you require expert guidance and assistance to commercialise your new technology? Do you need expert advice on how to make the business connections necessary to develop your intellectual property? November 2012 If Yes, Commercialisation Australia provides experienced Case Managers to guide successful applicants through the commercialisation process. Commercialisation Australia Case Managers can: - help identify the skills and knowledge you need; - help you access specialist advice and service; - connect you with Volunteer Business Mentors; - assist you to develop professional networks; - provide strategic and operational advice; and - monitor your progress If Yes, Commercialisation Australia has an established Volunteer Business Mentor network that can provide the advice you need. The network can only be accessed by successful applicants and via a recommendation from a Case Manager. A guide to innovation assistance Page 9 of 10 Question Response Are you a researcher, Australian University or Publicly Funded If Yes, you can apply for Commercialisation Australia assistance through your Commercialisation Office. Research Agency? If Yes, you may be able to participate in the Clean Technology Innovation Program, providing that you: Are you an individual? - form part of a collaborative project with an eligible lead applicant; or - form a non tax-exempt (spin-off) company incorporated under the Corporations Act 2001 (Cth). If Yes, under Commercialisation Australia an individual can apply, but must agree to form a non tax-exempt company incorporated under the Corporations Act 2001 (Cth) if the application is successful. If Yes, under the Emerging Renewables Program an individual can apply - but for Projects they must agree to form a non tax-exempt company incorporated under the Corporations Act 2001 (Cth) if the application is successful; and for Measures they must agree to hold an Australian Business Number (ABN) if the application is successful. Can you receive a grant under one program and then apply for another program grant to continue the project? Yes. However, neither Commercialisation Australia, the Clean Technology Innovation Program, nor the Emerging Renewable Program will fund the same activities (double dipping). Applicants can, however, complete a project under one program and then apply for assistance under the same or different program to further progress the project. Applicants can apply for grants for projects that also receive the R&D Tax Incentive, however clawback provisions apply. November 2012 A guide to innovation assistance Page 10 of 10