Group 2 Fedex

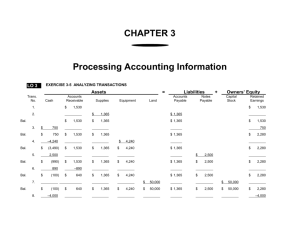

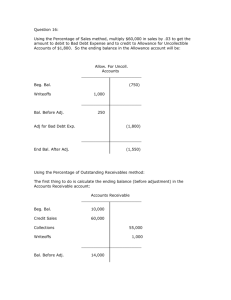

advertisement

Financial Statements Presented by: Leo Ashley Tony David Sungtae Account balances on June 30,2006 (in millions of dollars) Account Flight & ground equipment Retained earnings Accounts payable Prepaid expenses Accrued expenses payable Long-term notes payable Contributed capital Receivables Other assets Cash Spare parts, supplies & fuel Other noncurrent liabilities Balance $3,476 970 554 64 761 2,016 702 923 1,011 155 164 790 Asset Stockholders’ equity Liability Asset Liability Liability Stockholders’ equity Asset Asset Asset Asset Liability T-Account Assets Cash 155 155 Bal. Bal. Prepaid expense 64 64 Bal. Receivable 923 923 Bal. Other assets 1,011 1,011 Spare parts, supplies, and fuel 164 164 Bal. Flights/ground equipment 3,476 3,476 Bal. Liabilities Bal. Long-term note payable Accrued Expense payable Accounts payable 554 554 Bal. 761 761 Bal. 2,016 2,016 Stockholders' equity Bal. Retained earnings Contributed capital Other noncurrent liablilities 790 790 Bal. 702 702 Bal. 970 970 Transactions occurred the next year ending June 30, 2007(in millions of dollars) Provided delivery service to customers, receiving $7,200 in accounts receivable and $600 in cash. (+A: cash +600; accounts receivable +7,200; +R: +7,800) Purchased new equipment costing $816; signed a long-term note. (+L: long-term note payable +816; +A: equipment +816) Paid $744 cash to rent equipment and aircraft, with $648 for rental this year and the rest for rent next year. (+A: Prepaid expenses +96; rental expenses: +648; -A: cash -744) Spent $396 cash to maintain and repair facilities and equipment during the year. (+E, -SE: maintenance expense +396; -A: cash -396) Collected $6,524 from customers on account. (+A: Cash +6,524; -A: account receivable 6,524) Borrowed $900 by signing a long-term note. (+A: cash +900; +L: long-term note payable +900) Issued additional stock for $240. (+A: cash +240; +L: contributed capital +240) Paid employees $3,804 during the year. (-A: cash -3,804; +E, -SE: wages expense: +3,804) Purchased for cash and used $492 in fuel for the aircraft and equipment during the year. (-A: cash -492; +E, -SE: utilities expense: +492) Paid $384 on accounts payable. (-A: cash -384; -L: account payable -384) Ordered $72 in spare parts and supplies. (No transaction) T-Account Flight and ground equipment 3,476 Beg. 816 (b) 4,292 Bal. Beg. ( c) Bal. Prepaid expense 64 96 160 Beg. (a) (e) (f) (g) Bal. Cash 155 ( c) 600 (d) 6,524 (h) 900 (i) 240 (j) 2,599 744 396 3,804 492 384 Beg. (a) Bal. Receivables 923 (e) 7,200 1,599 Beg. Bal. Other assets 1,011 1,011 6,524 Spare parts, supplies, and fuel 164 Beg. 164 Bal. Liabilities (j) Accounts payable 554 384 Beg. 170 Bal. Accrued expense payable 761 Beg. 761 Bal. Long-term note payable 2,016 Beg. 816 (b) 900 (f) 3,732 Bal. Other noncurrent liablilities 790 Beg. 790 Bal. T-Account Stockholders' equity Contributed capital Beg. (g) Bal. 702 240 942 Retained earnings Beg. Bal. 970 970 Revenues Service revenues Beg. (a) Bal. 0 7,800 7,800 Expenses Beg. ( c) Bal. Rental expense 0 648 648 Beg. (i) Bal. Utilities expense 0 492 492 Maintainance expense Beg. 0 (d) 396 Bal. 396 Wages expense Beg. 0 (h) 3,804 Bal. 3,804 Income Statement Federal Express Corporation Income Statement For the Month Ended June 30, 2007 (dollars in millions) Revenue Gross Sales Net Sales 7800 7800 Expenses Rent Repairs and Maintenance Utilities Wages Total Expenses Net Operating Income 648 396 492 3804 5340 2460 Statement of Retained Earnings Federal Express Corporation Statement of Retained Earnings Month Ended June 30, 2007 (dollars in millions) Beginning balance, June 30, 2006 Net income Ending retained earnings 970 2460 3430 Balance Sheet Federal Express Corporation Balance Sheet at June 30, 2007 (dollars in millions) ASSETS LIABILITIES Current Assets Current Liabilities Cash Accounts receivable Pre-paid expenses Total Current Assets $2,599 1,599 160 $4,358 Accounts payable Accrued expense payable Total Current Liabilities Long-term Liabilities Other noncurrent Liabilities $170 761 $931 3,732 790 Fixed Assets Flight and ground equipment Spare parts, supplies and fuel Other assets Total Net Fixed Assets TOTAL ASSETS $4,292 Shareholders' Equity 164 Contributed capital 1,011 Retained earnings $942 3,430 $5,467 Total Shareholders' Equity $4,372 $9,825 TOTAL LIABILITIES & EQUITY $9,825 Statement of Cash Flows Federal Express Corporation Statement Cash Flows For the Month Ended June 30, 2007 (dollars in millions) Operating Activities Cash from: Customers Cash to: 7124 Suppliers (2016) Employees (3804) Net cash provided by operating activities 1304 Investing Activities Net cash provided by investing activities 0 Financing Activities Issued stock Borrowed from banks Net cash provided by financing activities Net increase in cash Cash at beginning of month 240 900 1140 2444 155 Cash at end of month 2599 Total Asset Turnover Ratio Total Asset Turnover Ratio = Sales Revenues / Average Total Assets = 7800 / [(5793 + 9825) / 2] = 7800 / 7809 = 1.00 Conclusion: This ratio measures the sales generated per dollar of assets. It reflects how efficiently one company utilize its assets. Here, the ratio is 1.00, which means that Federal Express uses every 1 dollar of asset to generate 1 dollar of revenue.