Formula Sheet

advertisement

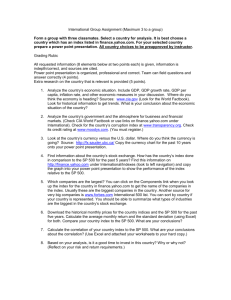

Monetarism and Growth Monetarism is NOT the same thing as Monetary Policy from the Fed Quantity Theory of Money (M x V = P x Y) or M x V = P x Q (Money, Velocity, Price, GDP Output, Quantity) Monetarist’s belief that Money Velocity is Stable in the Short Run Rule of 70: Number of years for variable to double = ____70____ Annual Growth Rate of the Variable Growth in Productivity Labor Productivity Human Capital Physical Capital Technology Development Natural Resources Development Dollarization The term was invented to describe the move by some countries to officially declare that they would use the US dollar as their own domestic trade currency. They would simply abandon their old currency and trade in dollars. Recently, the term "dollarization" has been used by economists to describe the move by any country to use the currency of some other country. An example might be a country abandoning its domestic currency for the Euro. Countries listed as "officially" Dollarizing to the US Dollar (as of 2005): British Virgin Islands East Timor (keeping local coins) Ecuador (keeping local coins) El Salvador Marshall Islands The Federated States of Micronesia Palau Panama (keeping local coins) Pitcairn Island Turk and Caicos Island Why Dollarize? Currency stability Draw for investors No money flight or attacks on currency values Risks of Dollarization? Loss of domestic profits Loss of domestic monetary policy options Reduction of central bank "lender of last resort" options Reliance on US Monetary and Currency Policies Access to holdings of US dollars US policy decisions that help the US but hurt the other country Basic Formulas: AP Macroeconomics GDP (expenditure approach): C + Ig + G + Xn (income approach: W + R + I + P + SA) NI = NDP –Indirect business taxes + American income earned abroad - Foreign income earned in US ( = “net foreign factor income”) or NI = NDP – statistical discrepancy, + net foreign factor income NDP = GDP – CFC (consumption of fixed capital) (depreciation) PI = NI – Taxes on production and imports, - social security contributions, - corporate income tax, - undistributed corporate profits, + transfer payments DI = PI – Personal Income Tax + Credit Card Expenditures above income CPI: Price of market basket Price of index year basket x100 GDP deflator/real GDP: Nominal GDP Price index x100 C = DI – Savings - Credit Card Interest Payments CPI (also): Current yr. index – prev. yr. index previous yr. index x100 GDP Price Index: Price of GDP goods and services in select. yr. Price of GDP goods and services in base yr. Okun’s Law for GDP Gap: 1 to 2 % ratio of excess unemployment leading to lost GDP Doubling Rate/Rule of 70/72 70/72 -or70/72_________ Inflation % Interest Rate collected Real Income Measure: Nominal income Price index (in .00) Real Interest Rate: Nominal Interest rate –actual inflation rate APC: Consumption Income MPC: Change in consumption Change in income Aggregate Expenditures/Domestic Output Assumption: GDP = C + Ig GDP Multiplier: Change in real GDP Initial change in spending Ricardian Equivalence Theorem: Public budget deficit creates greater private saving M 2: M 1 + non-checkable savings + “small” time deposits (< $100,000) Price Value of the Dollar: _____1_________ Price level (in .00) Reserve Ratio of Deposits: Required Reserves Demand –Deposit Liabilities Monetary Multiplier: 1____________ required reserve ratio ( R ) Unemployment Rate: Unemployment # Labor Force # x100 Inflation Rate: Current CPI -Index CPI Index CPI x100 Per Unit Production Cost: Total input cost Units of output Inflation Premium (for lenders): Interest rate + anticipated inflation % Nominal Interest Rate: % increase in money the lender receives APS: Savings Income APC + APS = 1 MPS: Change in savings Change in income MPC + MPS = 1 Leakages and Injections Assumption: S = Ig Marginal Analysis Multiplier: _1__ -or- __1_ MPS 1-MPC M 1: Currency + Demand Deposits (checkable) M 3: M 2 + “large” time deposits (> $100,000) Interest Yield on Bonds: Annual Interest % Bond Selling Price Excess Reserves: Actual Reserves –Required Res. Monetarist Equation of Exchange: MV = PQ