10-5-10 Answer Key

advertisement

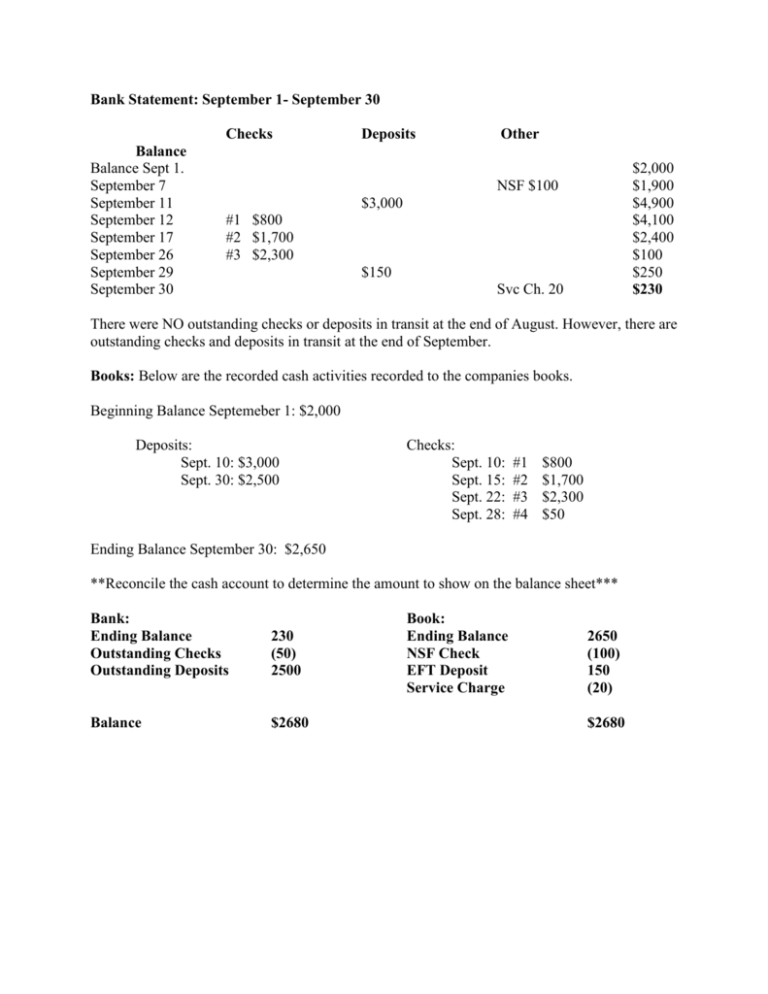

Bank Statement: September 1- September 30 Checks Balance Balance Sept 1. September 7 September 11 September 12 September 17 September 26 September 29 September 30 Deposits Other $2,000 $1,900 $4,900 $4,100 $2,400 $100 $250 $230 NSF $100 $3,000 #1 $800 #2 $1,700 #3 $2,300 $150 Svc Ch. 20 There were NO outstanding checks or deposits in transit at the end of August. However, there are outstanding checks and deposits in transit at the end of September. Books: Below are the recorded cash activities recorded to the companies books. Beginning Balance Septemeber 1: $2,000 Deposits: Sept. 10: $3,000 Sept. 30: $2,500 Checks: Sept. 10: Sept. 15: Sept. 22: Sept. 28: #1 #2 #3 #4 $800 $1,700 $2,300 $50 Ending Balance September 30: $2,650 **Reconcile the cash account to determine the amount to show on the balance sheet*** Bank: Ending Balance Outstanding Checks Outstanding Deposits 230 (50) 2500 Balance $2680 Book: Ending Balance NSF Check EFT Deposit Service Charge 2650 (100) 150 (20) $2680 After receiving your bank statement, you notice a bank service charge. Which of the following actions need to be taken to reconcile your cash account? a. Increase the book balance; no change to the bank’s balance. b. Decrease the book balance; decrease the bank’s balance. c. Decrease the book balance; no change to the bank’s balance. d. No change to either account. Company Y sells notebooks, pencils, pens, and books. What type of business is Company Y? a. Service b. Manufacturer c. Merchandiser d. None of the above. List the 3 Types of Businesses Service Manufacturer Merchandiser For each of the following, list whether your company or the bank needs to make an adjustment and whether its +/- : Out Standing Checks NSF Checks Bank; subtract Book; subtract EFT (Electronic Funds Transfer) Deposits in Transit Bank; add Interest earned on cash in checking Bank Service Charge Book; add Book; add Book; subtract Company A had beginning Inventory of $4800. In the month of August they purchased $700 worth of inventory. Their ending inventory at the end of the month is $3500. How much was their COGS for the month of August? Beginning Inventory Purchases Ending Inventory COGS 4800 700 (3500) 2000 Company B had an ending inventory of $2000. In the month of August they purchased $1700 worth of inventory and sold $2500. How much was their beginning inventory at the beginning of August? Beginning Inventory Purchases Ending Inventory COGS X + 1700 – 2000 = 2500 Beginning Inventory = 2800 x 1700 (2000) 2500