FreeResponseAnalysis

advertisement

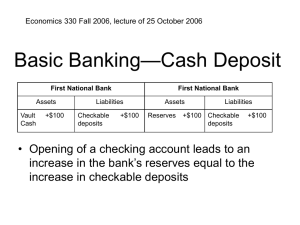

Free Response Macro Unit #4 Free Response Problem #1 a) Assets Required Reserves Loans b) $100,000 d) Liabilities $1,000,000 Deposits Money Supply would increase by less: Banks would lend less money out Money Multiplier works on less dollars $900,000 Total Assets Total Liabilities $1,000,000 $1,000,000 $10,000 Deposit $9,000 Excess Reserves 1/.10 = 10 Multiplier $9,000 * 10 = $90,000 c) $10,000 Deposit $9,000 Excess Reserves 1/.10 = 10 Multiplier $9,000 * 10 = $90,000 + $10,000 = $100,000 e) $10,000 Banks could not lend out money Fed money is “new” money Free Response Problem #2 a) Assets b) Liabilities Required Reserves $2,000 Assets Deposits $20,000 Required Reserves $1,800 $18,000 Loans Loans Total Assets $20,000 $18,000 Deposits $16,200 Total Liabilities Total Assets $20,000 $18,000 c) Assets Required Reserves $1,620 Loans Liabilities Liabilities $16,200 Deposits $14,580 Total Assets $16,200 Total Liabilities $16,200 Total Liabilities $18,000 Free Response Problem #3 E) A) Price Level LRAS ---------- P1 ----------P2 -------- SRAS 1 A Y2 Y1 B) Contractionary 1 i2 AD2 AD 1 MS 2 Nominal Interest Rate MS1 --------- i1 ----------- MD Qty of $ Real GDP C) i) R.R. increases ii) Disc. Rate increases iii) Sell Bonds d) Fed Sells Bonds => MS => Interest Rates => Investment => AD => GDP Free Response Problem #4 a) MV = PQ i) No change in real output. ii) Double iii) Double Explanation: Qty theory of money claims Money is neutral and Velocity is constant. Therefore an increase in money supply will increase price level by the same amount. (one doubles, the other must double) A double of the price level will double nominal output (P * Q) B) If the Velocity of money fell 50%, then real money supply also declined by 50% So you would double the money supply which would keep real output the same Example: M = 10 V =2 MV = 20 M=10 V = 1 = MV = 10 c) i) Nominal rates must rise 5% ii) real rates remain unchanged According to the Fisher effect real interest rates are constant: Real i-rates = nominal rate – expected inflation