Money, Demand, and Supply Solutions

ECO 106 MONEY DEMAND AND MONEY SUPPLY – Solutions (Ch. 15)

1.

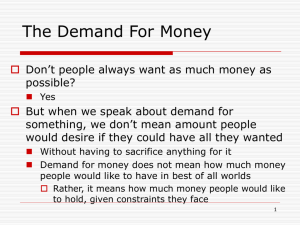

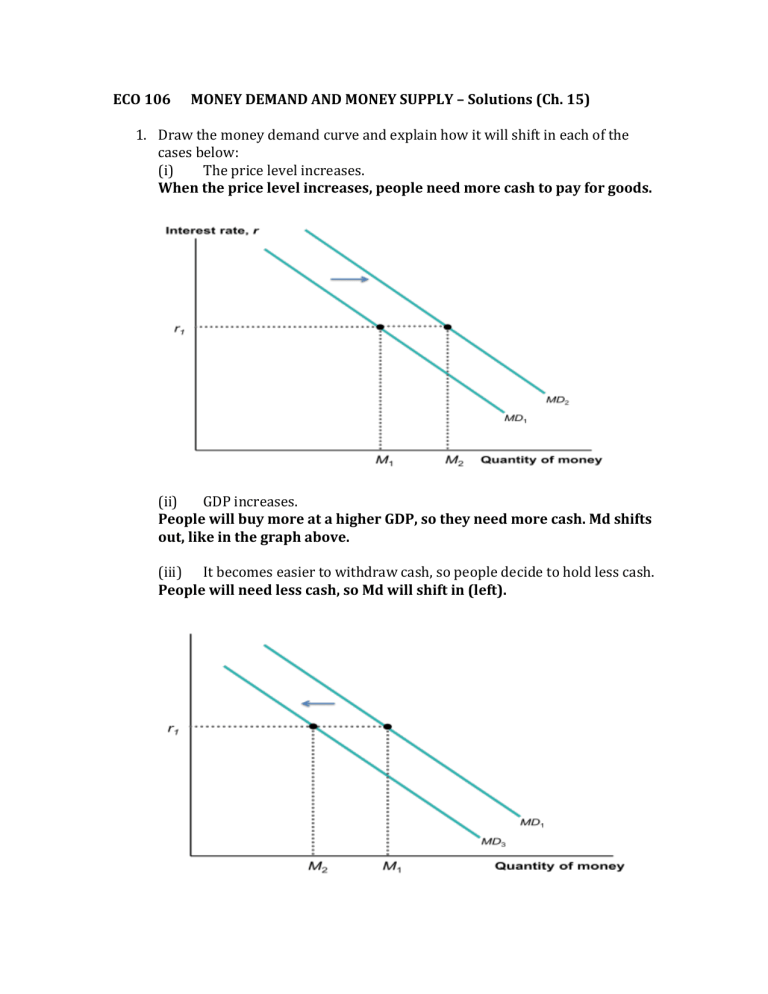

Draw the money demand curve and explain how it will shift in each of the cases below:

(i) The price level increases.

When the price level increases, people need more cash to pay for goods.

(ii) GDP increases.

People will buy more at a higher GDP, so they need more cash. Md shifts out, like in the graph above.

(iii) It becomes easier to withdraw cash, so people decide to hold less cash.

People will need less cash, so Md will shift in (left).

(iv) The Fed raises the federal funds rate.

A change in the interest rate will cause a movement along the Md curve with no shift in the curve.

2.

Draw the demand and supply for money and show how the demand and/or the supply curve will shift in each case below:

(i) The Fed buys Treasury bonds.

When the Fed pays for the bonds, the money supply will increase. The

Ms curve shifts out, and the interest rate falls.

Interest rate

(ii) The Fed sells Treasury bonds.

When the Fed sells bonds, banks will pay with money, and the money supply will decrease. (The graph will be the reverse of Fig. 2, i.e. change around Ms1 and Ms2 and r1 and r2.)

(iii) The Fed decides to lower the target for the federal funds rate from the current level.

The Fed will increase the money supply to reach its new and lower target. See the graph in question (i) above.

(iv) Assume that it becomes faster and cheaper to buy and sell bonds, so people decide to hold less cash.

Md will shift in, and the interest rate will decrease.

Quantity of Money

(v) Bonds become riskier, so people want to keep more of their wealth in cash.

Md will shift out, and the interest rate will increase.

Quantity of money

3.

We will look more closely at demand and supply for money. The economy changes all the time, so the Federal Reserve needs to use open market operations every day to stabilize the market for money.

(i) Draw again the demand and supply for money.

(ii) Assume that the price level increases. How will the increase in the price level affect money demand and/or supply? Draw the shift(s) in the diagram above. Mark clearly the new equilibrium interest rate.

Md will shift out, and the interest rate will increase. See the graph in question 2v.

(iii) Assume that the Fed wants the interest rate to stay the same as before. What does the Fed need to do to get the interest rate back to the initial level? Illustrate in the same graph again. Explain how the Fed uses open market operations to get there.

To get the interest rate back to r1, the Fed will need to increase the money supply. The Fed will buy bonds.

Quantity of money