Copyright Notice. Each module of the course manual may be viewed online, saved to

disk, or printed (each is composed of 10 to 15 printed pages of text) by students enrolled

in the author’s accounting course for use in that course. Otherwise, no part of the Course

Manual or its modules may be reproduced or copied in any form or by any means—

graphic, electronic, or mechanical, including photocopying, taping, or information

storage and retrieval systems—without the written permission of the author. Requests

for permission to use or reproduce these materials should be mailed to the author.

Module 2

I.

II.

III.

IV.

V.

Table of Contents

Instructions:

The General Ledger of Accounts

Debit and Credit Account Balances

Accounting for Prepaid Expenses

The Accounting Process

Errors, Their Discovery and Correction

Click on any of the

underlined titles in the

table of contents to be

directed to that section

of the module. Click

on the <back> symbol

to return to the table of

contents.

Video Lectures

Because seeing and hearing is sometimes better than just reading, I have prepared three video

lectures for this module. After you read through the sections below, click here to play or to

download the videos:

Debits and Credits, Part 1: http://youtu.be/kbXKZqW-ISk

Debits and Credits, Part 2: http://youtu.be/NWmgt0mDaKY

The General Journal: http://my-accountingtutor.com/Financial/Camtasia/GeneralJournal/Camtasia-GeneralJournal.html

©2012

Craig M. Pence. All rights reserved.

2

Accounting Course Manual

Module 2 Summary

I.

The General Ledger of Accounts.

A.

B.

The simple table-based accounting system that

was presented in the previous module is difficult

to use in an actual business. A table drawn on a

single sheet of paper simply cannot be used to

record thousands of transactions during the

accounting period in a hundred different

accounts. The solution? Devise an accounting

system in which the accounts are set up

individually on separate pages all bound

together to form a book. Another name for a

book is “ledger,” so the “table of accounts”

presented in the previous module now becomes

a book of individual accounts called the

general ledger.

The General Ledger replaces the

previous table of accounts

This general ledger accounting system can accommodate any number of

accounts and any number of transactions. It differs from the table-based

system described in the previous module in two important ways.

1.

Instead of a table with separate columns for each of the accounts,

the general ledger is composed of separate pages for each of the

asset accounts, the liability accounts, and the owner equity

accounts. Owner equity accounts? Yes, there will now be more

accounts used to record the owner’s equity than just a single Capital

(or Common Stock) account. These additional owner equity

accounts are called temporary accounts, and we will explain in

detail why they exist and how they are used a little later on.

2.

Each of the accounts has a debit (left) side and a credit (right)

side. Now, instead of the “plus” entries and “minus” entries that

were used with the accounts in the table-based system, debit and

credit entries will be made to the general ledger accounts. When

we say that an account has been debited, we simply mean that an

amount has been entered on the left side of the account. Likewise, if

an account is credited, the amount is entered on the right side of

the account. Whether the debit entry or the credit entry increases

the account or decreases the account depends on the account type.

With some accounts, debits are increases and credits are decreases,

but with others debits are decreases and credits are increases.

©2012 Craig M. Pence. All rights reserved.

Accounting Course Manual

3

More good news for accounting masochists!

The plus and minus entries that we used in the previous module are logical and intuitive. Debit

and credit entries take a lot of getting used to. Does this sound like another opportunity for

long hours spent studying accounting and working lots of boring practice problems? You bet it

does!

Remember, though, not everyone is willing to go through all that it takes to learn this material,

so complications like these create a lot of job security and high pay rates for bookkeepers and

accountants (the accounting masochists who did the work and learned the material)!

II.

Debit and Credit Account Balances in the General Ledger

A.

The particular set of accounts that is maintained in the ledger is called the

company’s chart of accounts. The number of accounts in the chart of

accounts and their titles are determined by the business owner and the

accountant. They accounts they select will be those that they believe will

best meet the information needs of the investors, creditors and managers

who will use the statements to analyze the business.

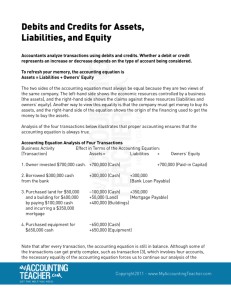

B.

Each of the general ledger accounts is divided into two sides. The left side

of the account is called the debit side. The right side of the account is the

credit side.

The Account

Debit Side

Credit Side

When an account is debited, an amount is entered on the left side of the

account. When an account is credited, an amount is entered on the right

side. Whether the debit or credit increases or decreases the account

balance depends on the account type.

Luca Pacioli, the “father of accounting,” is credited with popularizing the

concept of debit and credit accounting systems in the 15th century. You can read

more about Pacioli by clicking the link below.

http://en.wikipedia.org/wiki/Luca_Pacioli.

C.

The debit and credit "rules" refer to the side of the account that is used to

record increases (positive entries) and the side that is used for decreases

(negative entries). This varies by type of account

The general rules regarding debit and credit entries to the

accounts are as follows:

©2012 Craig M. Pence. All rights reserved.

4

Accounting Course Manual

1. The left side (debit side) of the account is used to record

increases in assets, and decreases in liabilities and

owner's equity.

2. The right side (credit side) of the account is used to

record decreases in assets, and increases in liabilities

and owner's equity.

The General Rule for Debit and Credit Entries

Account Type

Debit

Credit

Asset

Liability

Owner's Equity

Assets

Increase

Decrease

Decrease

Liabilities

Debits

Credits

Debits

Credits

+

-

-

+

Decrease

Increase

Increase

Capital

(or Common Stock)

Debits

Credits

-

+

Here’s an Example! Suppose Jackson contributes $1,000 of cash to start his business. We

understand from the previous module that contributions increase assets and increase owner’s equity.

We would record this transaction by turning to the “Cash” account page in our general ledger, and

entering a debit in the account for the $1,000. We would then turn to the “Capital” account page (or

“Common Stock” if the business is a corporation) and credit the account for $1,000:

Cash

Debits

Credits

1,000

Capital

(or Common Stock)

Debits

Credits

1,000

Example, continued.

Note above that we entered the $1,000 without the dollar sign (everyone knows that the amounts

recorded in an accounting system are dollar values). Also, we did not put a plus sign in front of the

amount, since all bookkeepers and accountants know that debits to Cash and credits to Capital

represent increases.

Suppose now that Jackson provides $500 of services to a customer on account. We will need to record

revenue since the revenue has been earned, and revenues increase business assets and increase owner’s

equity. Therefore, we will now enter a debit in the Accounts Receivable account and a credit in Capital:

©2012 Craig M. Pence. All rights reserved.

Accounting Course Manual

Accounts Receivable

Debits

Credits

500

5

Capital

(or Common Stock)

Debits

Credits

500

Suppose now that Jackson receives a $50 utility bill, and also withdraws $100 of business cash for

personal use. We need to record an expense, since the expense has been incurred, and record the

obligation to pay the bill in the future. Therefore, we will need to increase Accounts Payable with a

credit and decrease owner’s equity with a debit. We also need to decrease the Cash account and decrease

owner’s equity to record the withdrawal. Our entries are as follows:

Accounts Payable

Debits

Credits

50

Cash

Debits

Credits

100

Capital

(or Common Stock)

Debits

Credits

50

Capital

(or Common Stock)

Debits

Credits

100

The account balances are now as follows. Note that the debit balances equal the credit balances. In

this example, the debit balances are asset accounts, and the credit balances are liability or owner’s

equity accounts, so assets are equal to liabilities plus owner’s equity. This must always be the case, so

preparing a trial balance, such as illustrated below, is a good way to check your work!

Account:

Cash

Accounts Receivable

Accounts Payable

Capital (or Common Stock)

Total

Debit

$900

500

$1,400

Credit

$50

1,350

$1,400

Video Lecture

These videos present the same information that is printed below. Some students are “visual learners,”

and a video lecture format works well for them. Some students learn well by reading.

After you read through the section below, click here to play or to download the videos:

Debits and Credits, Part 1: http://youtu.be/kbXKZqW-ISk

III. Income Statement and Balance Sheet Accounts.

A.

The debit and credit rules that we set out above seem simple enough at

first glance, but a complication occurs because of the use of separate

©2012 Craig M. Pence. All rights reserved.

6

Accounting Course Manual

temporary owner’s equity accounts. These are new accounts, and they

were not used in the previous module.

B.

Temporary accounts are used to record three of the four kinds of

transactions that can affect owner’s equity: revenues, expenses, and

withdrawals. The fourth transaction type, a contribution to the business

by the owner, is the only transaction that will be recorded directly in the

Capital (or Common Stock) account. Temporary accounts are also called

income statement accounts (even though withdrawals are not listed on the

income statement).

C.

Here is a summary of the temporary accounts and the debit/credit rules

that apply to them:

1.

2.

3.

C.

Revenue Accounts. Since revenues represent increases in owner

equity, increases in revenue accounts are recorded with credits and

decreases with debits.

Expense Accounts. Since expenses represent decreases in owner

equity, the expense account balances are increased with debits and

decreased with credits

Withdrawals. Owner withdrawals are recorded in the Drawing

account (corporations use a Dividends account for the

distributions they make to their stockholders). Since withdrawals

also represent decreases in owner equity, the Drawing account

balance is increased with debits and decreased with credits.

Why are temporary accounts used? Well, for one thing, they do

complicate the accounting process a good deal, which means they add a lot

of job security and create some pretty high pay rates for accountants and

bookkeepers!

But there is another reason. By recording the revenues and expenses in

their own separate accounts, it is much easier to identify them and

determine the amount to report when preparing the income statement. If

they were simply recorded directly in the Capital account, along with

investments and withdrawals, sorting through hundreds of entries to

determine the amount to report on the income statement for Services

Revenue, Rental Revenue, Utilities Expense, Wages Expense and so on

would be next to impossible.

D.

Why are the Revenue, Expense, and Drawing accounts called temporary

accounts? Because they are only used to "store" the revenue, expense, and

withdrawal information temporarily. Think of them as “temporary

parking.” Once the income statement has been prepared at the end of the

©2012 Craig M. Pence. All rights reserved.

Accounting Course Manual

7

accounting period, it is no longer necessary to keep these balances in the

temporary accounts. At that time, we can move them out of “temporary

parking” and into the account where they will stay permanently, the

Capital account. This process is called closing, and it is the temporary

accounts that will be closed.

The Capital account, along with all the asset and liability accounts, is

never closed. These accounts maintain their balances permanently, and

they are called permanent accounts or balance sheet accounts. (You will

find a complete illustration of the closing process in Module 4.)

E.

The complete set of rules regarding Debit and Credit entries to

all the accounts are:

The left side (debit entries) of the account is used to record

increases in Assets, Expenses and the Drawing account; and

decreases in Liabilities, the Capital account, and Revenues.

The right side (credit entries) of the account is used to

record decreases in Assets, Expenses and the Drawing

account; and increases in Liabilities, Revenues, and the

Capital account.

Specific Rules for Debit and Credit Entries

Account Type

Debit

Credit

Asset

Liability

Capital

Revenue

Expense

Drawing

Increase

Decrease

Decrease

Decrease

Increase

Increase

Assets

Debits

Credits

+

-

Revenues

Debits

Credits

-

+

Liabilities

Debits Credits

-

+

Expenses

Debits Credits

+

©2012 Craig M. Pence. All rights reserved.

-

Decrease

Increase

Increase

Increase

Decrease

Decrease

Now, only

contributions

are recorded

in Capital.

Capital

Debits Credits

-

+

Drawing

Debits Credits

+

-

All other

owner’s equity

transactions are

recorded in

these temporary

accounts.

8

Accounting Course Manual

Another Example! Now that temporary accounts have been introduced, let’s return to our earlier

example and record the same transactions all over again. This time, though, we will use the temporary

accounts. When Jackson contributes the $1,000 of cash to the business, we will again debit Cash for

$1,000 and credit Capital. Contributions are the only owner equity transactions that are recorded

directly in the Capital (or Common Stock) account, so our entry is the same as it was before:

Cash

Debits

Credits

1,000

Capital

(or Common Stock)

Debits

Credits

1,000

Example, continued.

When Jackson provides $500 of services to a customer on account, we will again record an increase in

owner’s equity, but this time we will use a separate Services Revenue temporary account. Therefore, we

will debit Accounts Receivable and credit Services Revenue:

Accounts Receivable

Debits

Credits

500

Services Revenue

Debits

Credits

500

When Jackson receives the $50 utility bill we will again reduce owner’s equity, but this time we will do

so by recording a debit in the Utilities Expense account. We will then credit Accounts Payable.

We also need to decrease the Cash account with a credit, and decrease owner’s equity by debiting the

temporary Drawing account in order to record the withdrawal. Our entries are as follows:

Accounts Payable

Debits

Credits

50

Cash

Debits

Credits

100

Utilities Expense

Debits

Credits

50

Drawing

Debits

Credits

100

The account balances are now as shown on the trial balance below. Note that the debit balances still

equal the credit balances. In this example, though, the debit balances represent asset, expense, and

the drawing accounts. The credit balances are in liability, revenue, and the Capital accounts. The

owner’s equity is still $1,350, just as it was earlier, but it is now spread out over four different

accounts ($1,000 in Capital, plus $500 in Services Revenue, minus $50 in Utilities Expense, minus

$100 in Drawing = $1,350).

©2012 Craig M. Pence. All rights reserved.

Accounting Course Manual

Account:

Cash

Accounts Receivable

Accounts Payable

Capital (or Common Stock)

Drawing

Services Revenue

Utilities Expense

Total

Debit

$900

500

100

9

Credit

$50

1,000

500

50

$1,550

$1,550

Video Lecture

These videos present the same information that is printed below. Some students are “visual learners,”

and a video lecture format works well for them. Some students learn well by reading.

After you read through the section below, click here to play or to download the videos:

Debits and Credits, Part 2: http://youtu.be/NWmgt0mDaKY

F.

As basic to accounting as the accounting equation (Assets = Liabilities +

Owner's Equity), is the axiom that debits must equal credits. This will

be true since the sum of the debit balances in the general ledger accounts

(assets) must equal the sum of the credit balances (liabilities and owner's

equity). Also, since the changes in assets caused by transactions during the

period must equal the changes in liabilities and owner's equity, each

transaction, if recorded correctly according to the debit and credit rules,

will have total debits equal to total credits.

G.

Because accounts will generally not have negative balances, the normal

balance of an account is the side on which increases are recorded: debits

for assets, credits for liabilities and the Capital account, credits for

revenues, and debits for expense and the Drawing accounts. A nonnormal, negative balance in an account is shown by enclosing the balance

figure in parentheses, circling it, or by writing it in red (hence, the

expression, “being in the red”).

Assets

Debits

Credits

Liabilities

Debits Credits

Capital

Debits Credits

Normal

Balance

+

Normal

Balance

+

Normal

Balance

+

©2012 Craig M. Pence. All rights reserved.

10

Accounting Course Manual

Revenues

Debits

Credits

Normal

Balance

+

H.

Expenses

Debits Credits

Normal

Balance

+

Drawing

Debits Credits

Normal

Balance

+

Chart of Accounts Numbering System.

according to the type of account:

Assets:

Liabilities:

Capital and Drawing:

Revenues:

Expenses:

The accounts are numbered

Numbered in the 100's (or 1,000’s, etc.)

Numbered in the 200's (or 2,000’s, etc.)

Numbered in the 300's (or 3,000’s, etc.)

Numbered in the 400's (or 4,000’s, etc.)

Numbered in the 500's (or 5,000’s, etc.)

III. Accounting for Prepaid Expenses

<back>

A.

Prepaid Expenses are asset accounts that have not been discussed

previously. Recall that assets represent things the business owns that will

benefit the business in the future. Supplies, equipment, buildings and any

other assets that are used up in operating the business really do represent

“prepaid” expenses, though we do not call them by that title. However,

they are assets that are purchased and paid for in advance of being used,

and so they do represent an item that has been “prepaid” and that will

become expense later on as they are used up.

C.

The two new “prepaid expense” asset accounts introduced here are

Prepaid Rent and Prepaid Insurance. If rent is paid for the coming

year or if an insurance policy is acquired that provides a year’s coverage,

assets are being purchased that will provide benefits to the business

through the coming year. After the year has passed all the benefit these

assets provide will have been consumed, at which point the assets will

have become expenses. At the time of their purchase two asset accounts,

Prepaid Rent and Prepaid Insurance, would be debited.

<back>

IV.

The Accounting Process (The Steps of the Accounting Cycle).

A.

In order to ensure objectivity (remember the objectivity concept discussed

in Module I?), entries should be based upon the information contained in

source documents (purchase invoices, deposit receipts, etc.). These

©2012 Craig M. Pence. All rights reserved.

Accounting Course Manual

11

source documents prove that the transaction did, indeed, occur, and they

also document and verify the amounts involved.

B.

While source documents are the foundation for all the entries that are

made in the general ledger accounts, the entries in the general ledger

accounts cannot be made directly from them. There are two reasons for

this:

a.

It is inefficient to try to record entries in the ledger accounts when

working from a pile of paper receipts. Errors are likely to be made,

and a lot of time will be lost sorting through the scraps of paper.

a.

The source documents vary, and there are many, many of them.

After the transactions are recorded, they will be filed away and

later, if errors are discovered in the general ledger, it will be very

difficult to trace back to the original source document and use it to

identify the problem and make the correction.

C.

Therefore, in order to provide (1) an explanation for ledger account

entries, (2) a check for the equality of debits and credits used to record a

transaction, and (3) a "trail" from the entries in the general ledger

accounts back to the source documents; transactions should be recorded

in a general journal (this is referred to as journalizing the transaction)

before being entered the ledger accounts.

1.

A sample page from the general journal is shown below, and the

transactions from the previous example have been recorded in it.

GENERAL JOURNAL

Page ___ 1

Date

Account Title / Explanation

20XX

Jan

1 Cash

T. Jackson, Capital

First Bank Deposit Receipt , #00058251

Post.

Ref.

2 Accounts Receivable

Services Revenue

Invoice #00001

3 Utilities Expense

Accounts Payable

Com Ed Bill 008883231

4 T. Jackson, Drawing

Cash

First Bank, Check #00001

©2012 Craig M. Pence. All rights reserved.

Debit

1

Credit

0

0

0

1

5 0 0

0

0

0

5 0 0

5 0

5 0

1 0 0

1 0 0

12

Accounting Course Manual

D.

When transactions that have been entered in the general journal are

recorded in the general ledger accounts, the general journal entries are

said to have been posted to the general ledger. To provide references

between the journal and the ledger accounts, dates and posting

references are used. The page number of the general journal is used as a

reference from the ledger to the journal; the general ledger account

number is used as a reference from the journal to the ledger.

Video Lecture

This video presents additional information about the general journal.

After you read through the section below, click here to play or to download the video:

The General Journal: http://my-accountingtutor.com/Financial/Camtasia/GeneralJournal/Camtasia-GeneralJournal.html

E.

As noted in the previous module, if all the transactions were recorded and

posted according to the debit and credit rules, the sum of the debit

balances in the general ledger accounts must equal the sum of the credit

balances. To prove this equality, a trial balance is prepared following

posting.

1.

The trial balance is merely a listing of all the accounts along with

their debit and credit balances.

2.

The balances are then added to prove that the sum of the debit

balances equal the sum of the credit balances.

3.

If the trial balance does balance, then we know that no obvious

errors were made in the journalizing and posting process.

F.

The steps of the accounting cycle, as covered to date, may be

summarized as follows:

1.

During the accounting period, journalize transactions from source

documents as they occur.

2.

At end of the accounting period, post debit and credit entries from

the general journal to the general ledger accounts.

3.

Total account balances and prepare a trial balance.

4.

Prepare financial statements and present them to the users.

Following step 4, the process begins all over again in the next accounting

period, with the accountant “cycling back” to step 1. That’s why the process

is called the accounting cycle!

<back>

©2012 Craig M. Pence. All rights reserved.

Accounting Course Manual

V.

13

Errors, Their Discovery and Correction.

A.

Note that some errors, such as transpositions ($540 is accidentally

entered as $450) or slides ($1,000 is accidentally entered as $100) may

cause the trial balance to be out of balance. Other types of errors, such as

the omission of an entire entry, posting to the wrong account, etc., will not

cause the trial balance to be out of balance (though the information in the

accounts and on the statements will then be incorrect).

B.

Another of the accounting principles is introduced here, the materiality

concept. Material information is information that is important enough

to change the user's decision. If accounting reports are to be useful to its

users (investors, creditors and managers), material information must, of

course, be reported. But immaterial information is not useful, because it

is information that “doesn’t matter.” In this discussion, the concept is

applied in determining whether errors need to be corrected. If the effect is

so small as to be immaterial, an error does not have to be corrected. But

if the effect is material, then the error must be corrected.

C.

Errors should be corrected in a non-computerized accounting system by

simply lining out the error and writing in the correction. However, if the

entry has been journalized and posted, the original error should be left

intact in the accounting records, and a correcting entry should be made.

<back>

VI.

Horizontal Analysis of Financial Statements

A.

As shown in the illustration below, financial statements in the annual

report are presented for the current year and for one or more previous

years. They are usually displayed in columns, and each year's figures are

listed in a separate column for that year.

B.

Horizontal analysis of the information on the statements is so called

because the analyst works across the statements horizontally (i.e., from

side to side), calculating the changes in the balances reported and

computing the percentage increase or decrease.

C.

From these changes the analyst looks for interrelationships that reveal the

"story" behind any improvement or deterioration in the "bottom-line"

figures reported by the company. To illustrate this, consider the horizontal

analysis of the XYZ income statements in the table below. Here, the

bottom line net income has fallen dramatically (by 33%). This occurred

despite a 20% increase in revenues. A horizontal analysis reveals that the

major factor responsible for the loss of profitability was the increase in the

©2012 Craig M. Pence. All rights reserved.

14

Accounting Course Manual

wages expense during the year. It, along with the slight increase in

telephone expense, more than offset the increase in revenues and the small

savings in supplies expense. Why did this happen? Perhaps the company

needs to downsize its labor force. Or perhaps the company is expanding

and needed to hire more employees to staff the new stores it has built.

Financial analysis seldom really tells the analyst what has happened. But it

does tell the analyst what questions to ask!

Horizontal Analysis of XYZ Company

Consolidated Statements of Income

for the Years Ended December 31, 20X1 and 20X2

20X2

20X1

Services Revenue

$120,000

$100,000

+20,000

+20%

Wages Expense

(80,000)

(50,000)

+30,000

+60%

Utilities Expense

(10,000)

(10,000)

0

0%

Telephone Expense

(10,000)

(8,000)

+2,000

+25%

(4,000)

(8,000)

-4,000

-50%

16,000

24,000

-8,000

-33%

Office Supplies Expense

Net Income

-END-

©2012 Craig M. Pence. All rights reserved.

Amount

Percent