Revenue and Financial Statement Restatements

advertisement

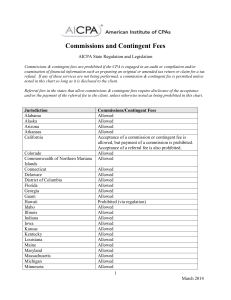

Revenue-Related Financial Statement Fraud Copyright 2014-2015 AICPA Unauthorized copying prohibited Revenue and Financial Statement Restatements Revenue is the biggest reason that financial statements are restated Restatements by Reason (June 1997 - 2002) IPR&D Reclassification 4% 5% Related-party transactions 3% Revenue 38% Securities-related 5% Acquisition/merger 6% Restructuring/ assets/ inventory 9% Other 14% Cost/Expense 16% Copyright 2014-2015 AICPA Unauthorized copying prohibited Why Revenue-Related Financial Statement Frauds Are So Prevalent There are many alternatively accepted revenue recognition procedures and many situation-specific ways to interpret and apply each of these procedures It is easy to manipulate net income using revenue and receivable accounts. A common revenue problem occurs when organizations stuff their distribution channels ahead of demand, prematurely recognizing revenue. Copyright 2014-2015 AICPA Unauthorized copying prohibited COSO-sponsored study found that over half of all financial statement frauds involved revenues and/or accounts receivable accounts. The COSO study also found that recording fictitious revenues was the most common way to manipulate revenue accounts, and that recording revenues prematurely was the second most common type of revenue-related financial statement fraud. Copyright 2014-2015 AICPA Unauthorized copying prohibited A study by the Deloitte Forensic Center that reviewed SEC enforcement releases from 2000 to 2008 found that revenue recognition was the most common financial statement fraud scheme. The study also found that company officers were named in 81% of the enforcement releases and that the six most common revenue recognition fraud schemes include: Recording of fictitious revenue. Recognition of revenue when products and services were not delivered. Recognizing inappropriate amounts of revenue from swaps, bartering or other types of arrangements. Recognition of revenue where there were contingencies associated with the transactions that had not yet been resolved. Recognition of revenue from sales that were billed, but not yet shipped (‘bill and hold' schemes). Recognition of revenue in an inappropriate period. Copyright 2014-2015 AICPA Unauthorized copying prohibited There are also various other ways that revenues can be used to falsify financial statements: Revenues can be recognized earlier than they should in cases of long-term construction-type contracts where revenues recognized depend upon the percentage of completion of a project. Revenues can be improperly recognized from sales transactions billed without shipping the goods (bill and hold). Revenue can be created through adding fictitious documentation, sales, or customers to make it appear that actual sales were higher than they were for the period. Contracts upon which revenue recognition is based can be altered or forged. Topside journal entries, without underlying documentation, can be used to create fictitious revenues and receivables. Copyright 2014-2015 AICPA Unauthorized copying prohibited Identifying Revenue-Related Exposures One of the easiest ways to understand how revenue- related financial statement frauds can be perpetrated is to first focus on the various kinds of revenue transactions that exist. And, one of the easiest ways to understand revenue-related transactions is to diagram the various interactions between an organization and its customers, analyzing the accounts that are involved in each transaction, and trying to determine how misstatement could occur with each transaction. Copyright 2014-2015 AICPA Unauthorized copying prohibited Revenue-Related Transactions 1. Sale Goods and/or Services 2. Estimate Uncollectible Accounts Receivable 3. Accept Returned Goods Yes Goods Returned? No Receivable Paid? No 4. Write-off Receivable Yes Discount Taken? No 5. Collect Cash Yes 6. Collect Cash Minus Discount Copyright 2014-2015 AICPA Unauthorized copying prohibited Matrix for Identifying Revenue-Related Fraud Transactions Transaction 1. Sell goods and/or services to customers Accounts Involved Accounts receivable, 1. revenues (e.g., sales revenue) 2. 3. 2. Estimate uncollectible accounts receivable 3. Accept returned goods from customers 4. Write-off receivables as uncollectible Bad debt expense, allowance for doubtful accounts 4. Sales returns, accounts receivable 5. 5. Collect cash after discount period Cash, accounts receivable 6. Collect cash within discount period Cash, sales discounts, accounts receivable Allowance for doubtful accounts, accounts receivable Fraud Schemes Record fictitious sales (related parties, sham sales, sales with conditions, consignment sales, etc.) Recognize revenues too early (improper cutoff, percentage of completion, etc.) Overstate real sales (alter contracts, inflate amounts, etc.) Understate allowance for doubtful accounts, thus overstating receivables Not record returned goods from customers 6. Record returned goods after the end of the period 7. Not write-off uncollectible receivables 8. Write-off uncollectible receivables in a later period 9. Record bank transfers as cash received from customers 10. Manipulate cash received from related parties 11. Not recognize discounts given to customers Copyright 2014-2015 AICPA Unauthorized copying prohibited Identifying Revenue-Related Fraud Symptoms Analytical Symptoms: These involve things that are unusual – too big, too small, wrong time, wrong person, and so on Accounting or Documentary Symptoms: These involve discrepancies in the records Lifestyle Symptoms: Fraud perpetrators often improve their lifestyles, especially in small companies Control Symptoms: Breakdowns in the control environment Behavioral and Verbal Symptoms: Fraud perpetrators change their behavior to cope with their stress and guilt Tips and Complaints: Tips or complaints from employees, spouses, vendors, customers, and others Copyright 2014-2015 AICPA Unauthorized copying prohibited Analytical Symptoms Reported "revenue or sales" account balances that appear too high. Reported "sales discounts" account balances that appear too low. Reported "sales returns" account balances that appear too low. Reported "bad debt expense" account balances that appear too low. Reported "accounts receivable" account balances that appear too high. An unusual increase in "accounts receivable." Reported "allowance for doubtful accounts" account balances that appear too low. Too little cash collected from the revenues that are being reported. Copyright 2014-2015 AICPA Unauthorized copying prohibited Accounting or Documentary Symptoms Revenue-related transactions not recorded in a complete or timely manner or improperly recorded as to amount, accounting period, classification, or entity policy. 1.Unsupported or unauthorized revenue-related balances or transactions. 2.Last minute revenue adjustments by the entity that significantly improves financial results. 3.Missing documents in the revenue cycle. 4.Unavailability of other than photocopied documents to support revenue transactions when documents in original form are supposed to exist. 5.Significant unexplained items on bank and other reconciliations. 6.Revenue-related ledgers (sales, cash receipts, etc.) that do not balance. 7.Unusual discrepancies between the entity's revenue-related records and corroborating evidence (such as accounts receivable confirmation replies). Copyright 2014-2015 AICPA Unauthorized copying prohibited Control Symptoms Management override of significant internal control activities related to the revenue cycle. New, unusual, or large customers that appear not to have gone through the customer-approval process. Copyright 2014-2015 AICPA Unauthorized copying prohibited Behavioral or Verbal Symptoms Inconsistent, vague, or implausible responses from management or employees arising from revenue inquiries or analytical procedures. Denied access to facilities, employees, records, customers, vendors, or others from whom revenue-related audit evidence might be sought. Undue time pressures imposed by management to resolve contentious or complex revenue-related issues. Unusual delays by the entity in providing revenue-related, requested information. Untrue responses by management to queries made by auditors. Suspicious behavior or responses from members of management when asked about revenue-related transactions or accounts. Copyright 2014-2015 AICPA Unauthorized copying prohibited Actively Searching for Revenue-Related “Analytical” Symptoms Focusing on Changes in Recorded Amounts From Period to Period The specific analyses that can be conducted usually include: Analyzing financial balances and relationships within financial statements. Comparing financial statement amounts or relationships with other things. There are two common ways to perform within-statement analysis: Looking for unusual changes in revenue-related account balances from period to period (looking at trends—horizontal analysis). Looking for changes in revenue-related relationships from period to period. Copyright 2014-2015 AICPA Unauthorized copying prohibited Two primary types of analyses to compare financial statements with other information: Comparing financial results and trends of the company you are analyzing with those of similar firms in the same industry Comparing recorded amounts in the financial statements with assets they are supposed to represent Copyright 2014-2015 AICPA Unauthorized copying prohibited Focusing on Changes in Revenue-Related Relationships Two primary ways to examine changes in relationships from period to period: Focus on changes in various revenue-related ratios from period to period Convert financial statements to common-size statements (converting balance sheet and income statement numbers to percentages—vertical analysis) Copyright 2014-2015 AICPA Unauthorized copying prohibited Most Commonly Used Ratios Gross Profit (Margin) Ratio Sales Return Percentage Sales Discount Percentage Accounts Receivable Turnover Number of Days in Receivables Allowance for Uncollectible accounts as a Percentage of Receivables Asset Turnover Working Capital Turnover Operating Performance Ratio Earnings Per Share Copyright 2014-2015 AICPA Unauthorized copying prohibited Actively Searching for “Accounting and Documentary” Symptoms In the past, the major way to search for accounting and documentary symptoms was to take samples from populations of documents and make inferences about the population Now we use data query programs and languages (such as Audit Command Language – ACL) to data mine entire databases very quickly Copyright 2014-2015 AICPA Unauthorized copying prohibited Fictitious Revenues Customers not approved Invoices out of sequence Duplicate sales invoices Sales invoices without corresponding shipping invoices Sales volume by customer Patterns of sales (e.g., immediately prior to period end) Large amounts of sales returns Lack of taking sales discounts Sales invoices without bills sent to customers Missing sales invoices Excessive voids or credits Several customers with the same name Several customers with the same address Increased past due accounts receivable Ledgers that do not balance Copyright 2014-2015 AICPA Unauthorized copying prohibited Recognizing Revenues Too Early Volume of sales immediately before and after year-end Sales returns and sales discounts of year-end sales compared with other sales periods Matching of sales invoice dates with shipping dates Large “topside” journal entries made after the financial statements have been prepared Copyright 2014-2015 AICPA Unauthorized copying prohibited Actively Searching for “Control” Symptoms Fraud examiners and investigators usually consider a control breakdown not only as something that must be fixed “for the future,” but something that must be examined to see if it has been abused in the past It is often the control environment, rather than specific control activities or procedures, that is weak and must be examined Copyright 2014-2015 AICPA Unauthorized copying prohibited Actively Searching for “Behavioral or Verbal” and “Lifestyle” Symptoms If there is one fraud detection tool that is under-used by auditors and others, it is making verbal inquiries and personal observations Lifestyle symptoms are much more common in employee fraud than financial statement frauds because most financial statement frauds usually do not benefit the perpetrators directly Liberal communication with a manager who is committing financial statement fraud will often reveal inconsistencies in responses that can help you understand that everything is not the way it is being represented toCopyright you2014-2015 AICPA Unauthorized copying prohibited Actively Searching for “Tips and Complaints” Symptoms The best way to search for tips and complaints is to institute an ombudsman, hotline, or toll-free phone number that people can contact or call with tips In most organizations, there are individuals who have knowledge that fraud is occurring but are afraid to come forward because They do not know who to tell or how to come forward They do not want to wrongly accuse someone They are afraid of “whistleblower” repercussions They usually have only suspicions rather than actual knowledge Auditors should have significant communication between themselves and client personnel; you get few tips or complaints, or both, if you do not talk to people Copyright 2014-2015 AICPA Unauthorized copying prohibited Following Up on Symptoms Observed Auditor Exercise Higher Levels of Skepticism Assign Higher Skilled and More Knowledgeable Personnel to the Engagement May Need to Further Consider Management’s Selection and Application of Significant Accounting Policies May Need to Assess Control Risk below the Maximum May Need to Change Nature, Timing, and Extent of Tests Investigator Theft-Act Evidence Concealment Evidence Conversion Evidence Interviews & Interrogation Copyright 2014-2015 AICPA Unauthorized copying prohibited