proof-of-income-form - Kent Family Mediation Service

advertisement

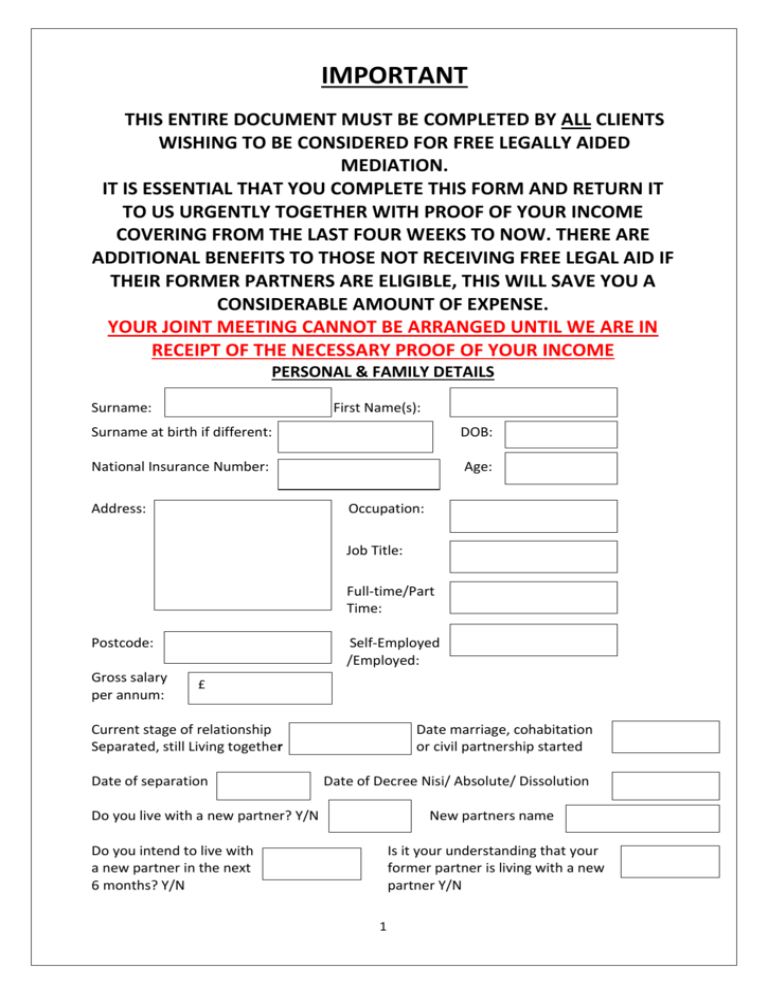

IMPORTANT THIS ENTIRE DOCUMENT MUST BE COMPLETED BY ALL CLIENTS WISHING TO BE CONSIDERED FOR FREE LEGALLY AIDED MEDIATION. IT IS ESSENTIAL THAT YOU COMPLETE THIS FORM AND RETURN IT TO US URGENTLY TOGETHER WITH PROOF OF YOUR INCOME COVERING FROM THE LAST FOUR WEEKS TO NOW. THERE ARE ADDITIONAL BENEFITS TO THOSE NOT RECEIVING FREE LEGAL AID IF THEIR FORMER PARTNERS ARE ELIGIBLE, THIS WILL SAVE YOU A CONSIDERABLE AMOUNT OF EXPENSE. YOUR JOINT MEETING CANNOT BE ARRANGED UNTIL WE ARE IN RECEIPT OF THE NECESSARY PROOF OF YOUR INCOME PERSONAL & FAMILY DETAILS Surname: First Name(s): Surname at birth if different: DOB: National Insurance Number: Age: Address: Occupation: Job Title: Full-time/Part Time: Postcode: Gross salary per annum: Self-Employed /Employed: £ Current stage of relationship Separated, still Living together Date of separation Date marriage, cohabitation or civil partnership started Date of Decree Nisi/ Absolute/ Dissolution Do you live with a new partner? Y/N New partners name Do you intend to live with a new partner in the next 6 months? Y/N Is it your understanding that your former partner is living with a new partner Y/N 1 Details of any children of the family (if more than 4 please add sheet or write overleaf) Childs name M/F Date of Birth Age Who do they live with Which of the following matters do you wish to discuss? Please ‘X’ box Property Finance Children All issues Don’t Know THIS INFORMATION WILL BE SHARED WITH YOUR FORMER PARTNER IF EITHER OF YOU WISHES TO BE ASSESSED. PART A & B CAPITAL See page 12 for evidence required for each question The Main Home 1. Do you rent? Y/N (Includes living with parents) If no go to next section - Shared Ownership 2. Name of Landlord You 3. Amount of rent paid per month 4. Amount of housing benefit received each month 5. If in receipt of housing benefit, how much do you actually pay towards your rent? Shared Ownership 6. Do you pay rent under a shared ownership scheme? Yes/ No If no go to next section – Home Owner 2 Main home 7. Amount of rent paid per month 8. Amount of mortgage paid per month 9. Name of lender 10. Property 1 Property 2 Property 3 What is the % share between you and the shared ownership provider Home Owner 11. Do you own your own house? Yes / No 12. What is the approx. value of the house? 13. Is house in joint names? Yes/ No 14. If yes, what is the name of the other joint owner? 15. Is there a mortgage the property? Y/N 16. Who is the mortgage lender? 17. Whose name is on the Mortgage? 18. Is there any other person on the mortgage besides you or your new partner? If Yes, please state name 19. What is their relationship to you? 20. Type of mortgage Main home Property 1 Interest only Repayment Other (specify) 3 Property 2 Property 3 21. Amount of mortgage outstanding? 22. Amount of mortgage paid per Month? 23. Amount of endowment Insurance etc. paid p/cm 24. Does your former partner or anyone else pay towards the mortgage? If Yes how much? 25. Name & relationship to you? 26. If there are any secured loans on the property, please complete below:Name of the lender Amount O/S £ You pay p/m Main home Property 1 Property 2 Property 3 27. Do you have any interest in any other properties that are not being claimed on? Y/N This form caters for 4 properties, if you have an interest in more than this attach separate page. Where there are properties owned by someone other than you or by your former partner, copies of the deeds specifying their percentages of ownership are required as evidence. PART C INCOME DETAILS For Proof of income see page 8 28. Are you on any of the following? If so, please ‘X’ box Income Support Income Based Job Seekers Allowance Income Based Education Support Allowance Pension Credits Universal Credit If you are in receipt of any of the above benefits, please do not complete any further questions in relation to income. However, it is essential that you provide proof of these benefits (see page 8) 4 Part C Income Details continued from page 4 If you are not on any of the above benefits and you do not wish to provide any of the following details then you cannot receive legal aid. 29. Income from Employment (Calendar Monthly) Yourself New Partner Salary/ Wages (gross) Bonus/Commission (not included above) Part time/ casual earnings/other Dividends 30. Other income (Calendar Monthly) Yourself New Partner Child Benefit Child Tax Credit Working Families Tax Credit Incapacity Benefit Contribution Based Job Seekers Allowances Contribution Based ESA Child Incapacity Benefit Carers’ Allowance Any other benefits that are not in The above list – please list below Yourself 31. Dividends of interest received 32. Rental income (including monies paid by any older children still living at home (Inc. lodgers) 33. State Pension 5 New Partner 34. Private Pension 35. Income from Trusts 36. Child Support (Inc. child care costs and costs) CSA Letter/ bank 37. Maintenance from any prior partner including contribution towards mortgage/ rent/ bills etc. Any other income from any source (please specify below) I.e. mortgage, bills, school fees etc. Who 38. 39. 40. If you are self-employed please go to next section on page below. 6 Amount SELF EMPLOYED PLEASE SEND THIS COMPLETED FORM, TOGETHER WITH ALL THE RELEVANT EVIDENCE, TO US BY RETURN SELF-EMPLOYED DRAWINGS Please list all money you have spent from your self-employed or any other income for your personal use over the last four weeks i.e. cash withdrawals, household bills, food, credit cards, mortgage, child/spousal maintenance, petrol etc. If your bills are shared between personal and business, please insert the figure your accountant would provide to the Inland Revenue (e.g. 50%) not the entire amount. Please also attach your bank statement and number entries on the statement to correspond with the list below. Date on Number Statement Drawings (examples above) 1 Amount £ 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Continue overleaf or on additional sheet if necessary We will require your most up to date accounts, tax assessment bill, bank statements and cash book 7 Proof of Income/ Documentary Evidence Required Sheet Section A & B Capital You must provide evidence of the following for each property No’s The Main Home 1-3 Tenancy Agreement * Bank Statement for last 30 days 4 Housing Benefit letter 5 Bank statement for last 30 days Shared Ownership 6-10 Mortgage statement No’s Home Owner 11-25 Mortgage statement * Bank statement for last 30 days * Estate agents property valuation dated * Mortgage redemption statement 26 Loan agreements * Bank statement for last 30 days 27 Same proof as in 11-25 above including:* Bank statement for last 30 days Section C Income 34-35 Pensions * Letter from pension provider confirming amount of pension paid * Bank statement dated within last 30 days 28 State Benefits * Bank statements dated within last 30 days and showing name/ type of benefit ------------------------------------------------* Original DWP benefit notification letter * Latest DWP advising change in benefit amount if amount has recently changed * Tax Credits award notice (most recent) * Other HMRC letter confirming amount received (must be less than 6 months old) * Letter from paying agency i.e. DWP, Job Centre Plus, Pension Service 31 Dividends Certificates/ share letter 32 Rental Income * Rental agreement * Bank statement for last 30 days Rent book Self Employed 36-37 Child Support & Maintenance * CSA letter/ statement * Court Order * Bank statement for last 30 days 38-49 Other income * Bank statements/payment receipt books/ signed letter from source of income For self-employed evidence please see page 7 8 9