UCP 600 – An Overview

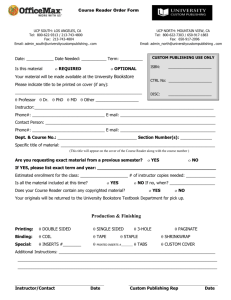

advertisement