corporate_finance

advertisement

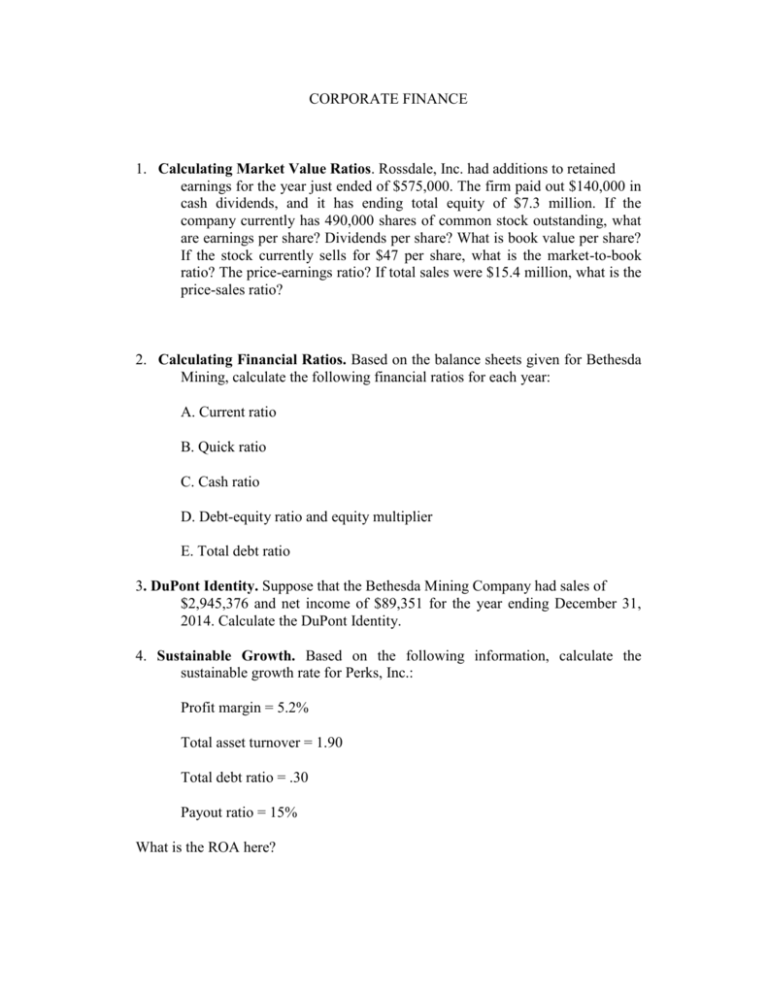

CORPORATE FINANCE 1. Calculating Market Value Ratios. Rossdale, Inc. had additions to retained earnings for the year just ended of $575,000. The firm paid out $140,000 in cash dividends, and it has ending total equity of $7.3 million. If the company currently has 490,000 shares of common stock outstanding, what are earnings per share? Dividends per share? What is book value per share? If the stock currently sells for $47 per share, what is the market-to-book ratio? The price-earnings ratio? If total sales were $15.4 million, what is the price-sales ratio? 2. Calculating Financial Ratios. Based on the balance sheets given for Bethesda Mining, calculate the following financial ratios for each year: A. Current ratio B. Quick ratio C. Cash ratio D. Debt-equity ratio and equity multiplier E. Total debt ratio 3. DuPont Identity. Suppose that the Bethesda Mining Company had sales of $2,945,376 and net income of $89,351 for the year ending December 31, 2014. Calculate the DuPont Identity. 4. Sustainable Growth. Based on the following information, calculate the sustainable growth rate for Perks, Inc.: Profit margin = 5.2% Total asset turnover = 1.90 Total debt ratio = .30 Payout ratio = 15% What is the ROA here? Need a two page report on UPS and FED EX for a portfolio and evaluate their performance during the last 6 months…need info on income statement, balance sheet, cash flow sheet, PE Ratio, PEG, ROI, ROA, and ROIC