Public good

advertisement

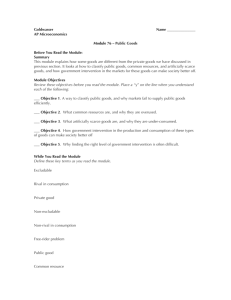

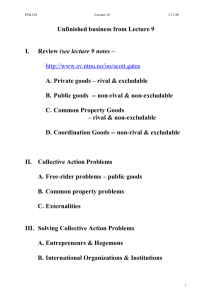

CHAPTER 16 Public Goods and Tax Policy Goods Classifications: Excludable – can prevent people from consuming without paying Rival in consumption – can not be consumed by more than one person at the same time Four types of goods Private goods: – excludable and rival in consumption Collective goods (Artificially scarce goods): – excludable and non-rival in consumption Commons goods (common resources): – non-excludable and rival in consumption Public goods: – non-excludable and non-rival in consumption Four types of goods Goods Classification Rival Excludable Non-excludable Non-rival Private good (wheat) Collective good (pay-per-view TV) Commons good (fish in the ocean) Public good (national defense) From Table 16.1, P.365 HW5 Explain the characteristics of the 4 types of goods 4 types: private; collective; common; public List 5 goods that belong to each of the 4 types and explain Private Goods: Excludable and rival in consumption Non-payers can be easily excluded Each unit consumed by one person means one less unit available for others the only goods that can be efficiently produced and consumed by market Collective Good: (Artificially Scarce Goods) Excludable but non-rival in consumption – It is not really scarce: use by one person does not reduce its availability to others – But it can be excludable: people who do not pay can be prevented from using it Artificially Scarce Goods An artificially scarce good is excludable and non-rival in consumption. It is made artificially scarce because producers charge a positive price but the marginal cost of allowing one more person to consume the good is zero. Common Goods: (Common Resources) Non-excludable and rival in consumption – Non-payers cannot be easily excluded – Each unit consumed by one person means one less unit available for others The problem of overuse - a user depletes the amount of the common resource available to others but does not take this cost into account when deciding how much to use the common resource A Common Resource Fishing in a public river: Each fisherman’s individual marginal cost does not include the cost that his or her actions impose on others: the depletion of the common resource the marginal social cost curve, MSC, lies above the supply curve; in an unregulated market, the quantity of the common resource used, QMKT, exceeds the efficient quantity of use, QOPT. The Efficient Use and Maintenance of a Common Resource Use taxes Make it excludable and assign property rights Create of a system of tradable licenses for the right to use the common resource Public Good: A good or service that, at least to some degree, is both non-rival and nonexcludable – Non-rival Good • A good whose consumption by one person does not diminish its availability to others – Non-excludable Good • A good that is difficult, or costly, to exclude nonpayers from consuming If non-excludable: Rational consumers won’t be willing to pay for the good People who do not pay can not be prevented from consuming Free-rider problem: individuals have no incentive to pay for their own consumption Inefficiently low production If non-rival in consumption Marginal cost = 0 Price should be 0 Inefficiently low consumption What goods and services should government provide? Pure Public Good – A good or service that, to a high degree, is both non-rival and non-excludable Pure public goods should be provided by government because: – For-profit private firms would find it difficult to recover their costs of production. – Since the MC of serving additional users is zero once the good has been produced, then charging for the good would be inefficient. Cost-Benefit Analysis Social costs and social benefits People have no incentive to pay for efficient quantity of public goods People tend to overstate the value of public goods (people tend to prefer too much of the goods when they don’t have to pay for it: marginal cost is 0) Advantages of Using Government to Provide Public Goods Cost of adding a tax is relatively low Minimizes the difficulty in determining who will bear what share of the tax burden May be the only feasible provider Government Provision A pure public good should be provided by the government only when the benefit exceeds the cost. The cost of the public good is the sum of the explicit and implicit costs incurred to produce it. The benefit of the public good is the sum of the reservation prices of all people who want the good. Government taxes: the way to finance public goods Paying for Public Goods – Not everyone benefits equally from a public good or service. – Therefore, the most equitable way to pay for the public good or service is to tax people in proportion to their willingness to pay. Tax System Head Tax – A tax that collects the same amount from every taxpayer – A head tax rule will rule out the provision of many worthwhile public goods. Proportional Income Tax – A tax under which all taxpayers pay the same proportion of their incomes in taxes Tax System Regressive Tax – A tax under which the proportion of income paid in taxes declines as income rises Progressive Tax – One in which the proportion of income paid in taxes rises as income rises. Alternatives to using taxes to fund public goods: Funding by donation Development of new means to exclude non-payers Private contracting Sale of by-products Tax System Trade-off between equality and efficiency – Equity: fairness, the “right” people actually bears the tax burden – Efficiency: minimizes the direct and indirect tax collection costs to the economy Tax Efficiency Minimizing administration costs (direct costs) Reducing deadweight loss (indirect costs) Recall: excise tax To Reduce Deadweight Loss Taxes decreases the price the producers receive and increases the price the consumers pay The incidence of tax is determined by the elasticities of demand and supply To reduce the deadweight loss caused by tax, impose taxes on the ones who have the most inelastic responses To Lower Administration Costs Administration costs: the resources actually spent on collecting and paying the taxes The difficulties of calculating, collecting and paying the taxes Tax Fairness The benefits principle –The ones who benefit from the spending should pay for it The ability to pay principle –The ones who are more able to pay should pay for it The Tax System Tax bases: the income or property value that determines how much tax an individual pays Tax Structure: how the tax depends on the tax base – Proportional – Progressive – Regressive Tax Bases (表一) 工资、薪金所得; 2. 个体工商户的生产、经营所得 3. 对企事业单位的承包经营、承租经营所得 4. 劳务报酬所得 5. 稿酬所得 1. 劳动所得 6. 特许权使用费所得; 自有资产 7. 利息、股息、红利所得; 所得 8. 财产租赁所得; 9. 财产转让所得; 偶然所得 10.一些偶然性所得 其他所得 11.经国务院财政部门确定征税的其他所得 Income Redistribution through Taxes and Government Spending Progressive taxes: taking more money away from the rich to provide supports for the poor Government Spending: transfer payments – Welfare – In-kind transfers – Negative income tax Income Redistribution: Social Security Progressivity (vertical equity) Individual equity Horizontal equity Economic efficiency Progressivity: Redistribution from the better-off to the less well-off Redistribute resources to the elderly from the rest of the population (intergenerational redistribution Higher rate of return on the contributions of workers with lower wages than for those with higher wages Individual Equity Ensuring a fair return on contribution Individuals should be paid retirement benefits that, on average, equal their contributions plus a fair interest rate The allocative and distributive functions of government are combined into a single program Benefits are paid out before adequate contributions have been built up Horizontal Equity Equal treatment for equals Equal assessment of payroll taxes on those with equal earnings Equal benefits to those born in the same year, with equal earnings histories, and of the same family type Economic Efficiency Achieving maximum benefit to society from available resources Minimize any losses of efficiency that might arise unintentionally