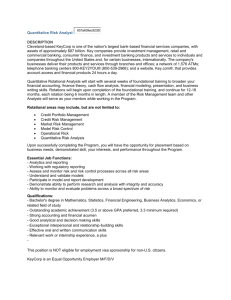

Top Down and Bottom Up Reconcilement - 18

advertisement

KeyCorp’s Top Down & Bottom Up Capital Reconcilement Integration • Bottom up economic capital estimations must be melded with top down economic requirements • Regulatory needs must be reconciled with true risk 2 Eric Falkenstein 4/14/99 KeyCorp’s Solution • Key’s main capital ratio target is for a 6.25% tangible equity/tangible asset ratio • This is influenced by peer comparisons and regulatory requirements • To make this consistent with the bottom up approach, we adjust the economic capital estimates proportionally to match our top-down target 3 Eric Falkenstein 4/14/99 Peer Comparisons 4 Eric Falkenstein 4/14/99 KEYCORP RISK-BASED CAPITAL RATIOS 8% 7% 6% 5% Dec-97 Mar-98 Jun-98 Sep-98 Dec-98 Mar-99 Tier 1 Capital Ratio Tangible Equity to Tangible Assets Tangible Equity + TAPS To Tangible Assets 4/14/99 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Banks Comprising the S&P Major Regional Bank Index (1) Capital Ratios And Double Leverage Ratios Sorted From Highest To Lowest As of September 30, 1998 Tier I Tangible Total Double Capital Equity/Tang. Leverage Risk-Based Leverage Institution Ratio Assets (2) (3) Ratio Capital Ratio 4.38 124.04 State Street Corporation 14.30 5.50 14.60 8.52 95.84 Union Planters Corporation 13.49 9.29 17.07 5.91 138.00 Republic New York Corporation 13.45 5.95 22.22 10.00 104.26 Synovus Financial Corp. 12.84 10.94 14.11 9.81 86.59 Fifth Third Bancorp (OH) 12.34 10.22 14.57 7.64 105.38 Regions Financial Corporation 11.04 8.49 12.93 7.71 94.01 Summit Bancorp 11.00 7.40 12.20 8.08 119.61 BB&T Corporation 10.00 7.10 14.80 6.70 121.10 Mercantile Bancorporation Inc 9.87 7.12 12.75 6.69 106.47 Northern Trust Corporation 9.40 6.90 12.70 8.70 94.04 Bank One Corporation 9.23 9.06 13.58 7.50 104.96 National City Corporation 8.81 7.42 12.69 7.97 115.24 Wachovia Corporation 8.22 8.67 11.30 5.91 107.10 Firstar Corporation 8.11 6.75 11.36 7.22 108.15 Wells Fargo & Company 8.06 6.19 9.92 8.02 133.27 SunTrust Banks, Inc. 7.49 7.10 12.83 5.70 122.99 PNC Bank Corp. 7.48 7.18 10.92 7.86 144.62 Bank of New York Company Inc. 7.48 7.24 11.59 8.11 108.75 Huntington Bancshares Inc. 7.37 6.52 11.19 5.78 111.84 KeyCorp (9/30/98) 7.01 6.88 11.61 5.93 113.84 KeyCorp (12/31/98 - estimate) 7.01 6.95 11.35 6.39 123.00 BankBoston Corporation 7.00 6.80 11.30 6.47 111.07 Fleet Financial Group, Inc. 6.88 7.16 11.21 5.60 119.13 U.S. Bancorp 6.80 7.00 11.40 4.86 138.31 Mellon Bank Corporation 6.78 7.06 11.22 8.55 108.21 Comerica, Inc. 6.38 7.64 10.66 Average: (Excluding KeyCorp) 6Median: (Excluding KeyCorp) 9.33 8.52 7.26 7.57 7.53 7.14 12.88 12.44 113.92 109.91 Moody's Senior Debt Rating (4) A1 Baa1 A1 A3 A1 A1 A2 A2 A2 A1 Aa3 A1 Aa3 A3 Aa3 A1 A2 Aa3 A3 A1 A1 A2 A2 A1 A2 A2 Eric Falkenstein 4/14/99 Key’s Top Down View 7 Eric Falkenstein 4/14/99 Optimal Capitalization Range The optimal capitalization range is dependent on the business mix and management targets for debt rating and beta. Given KeyCorp’s current business mix, a target debt rating of single-A, and a beta of around 1.1, KeyCorp estimates that its optimal capitalization range is a tangible equity/tangible asset ratio between 6.0% and 6.5%. The charts below show how the impact of leverage on ROE and required return results in an optimal capitalization range for maximizing shareholder value. HOW LEVERAGE IMPACTS ROE, REQUIRED RETURN, AND STOCK PRICE High High ROE High Increasing Decreasing Credit Rating Low 8 LEVERAGE Beta Low High KeyCorp Tangible Equity Ratio Target: 6-6.5% M B + Ke Low . . .resulting in an “optimal” leverage area for maximizing shareholder value: . . .while the post-tax math of leverage versus required return follows a different pattern . . . Higher leverage initially leads to higher ROE, but eventually high debt costs put a cap on this . . . Low Low High Optimal Leverage Range Beta: 1.1 Target Debt Rating: A Low High Eric Falkenstein 4/14/99 Summary of Management Targets/Estimates The following is a summary of the targets and estimates that KeyCorp management has initially adopted for the purpose of calculating economic capital allocations. They should be reviewed at least annually and reaffirmed or amended, as required. Management Target/Estimate 9 Target debt rating Single-A Risk coverage level 99.5% Optimal capitalization range Tangible equity ratio between 6.0% and 6.5% Eric Falkenstein 4/14/99 Capital Allocations Are A Function of the Risk Coverage Level, Which Is Driven By Keycorp’s Target Debt Rating. . . Implied risk coverage level* Rating agency Tenor (Years) risk rating (S&P/Moody’s) 1 AA/Aa 99.97% 3 99.90% 5 99.63% 7 99.34% 10 98.99% A/A 99.96% 99.79% 99.47%** 99.13% 98.47% BBB/Baa 99.88% 99.28% 98.43% 97.53% 96.06% * - A risk coverage level of 99.5% implies that economic capital will cover 99.5% of potential loss outcomes ** - FMCG recommends using the 5-year implied risk coverage level because five years is a mid-range maturity for the senior debt that banks most frequently issue 10 Eric Falkenstein 4/14/99 Top-Down Target Top-Down Total 6.25% Tangible Equity .50% Acquisition Reserve .75% Special Loss Reserve 5.00% 11 Risk-Based Regulatory Minimums Eric Falkenstein 4/14/99 Reconcilement 12 Eric Falkenstein 4/14/99 Reconcile Bottom-up Capital Allocations To The Top-down Optimal Capitalization Range $1.3B $1.2B Fixed Assets and Goodwill Other Intangible Asset Risk $200 Operational/Operating Leverage Risk $200 Interest Rate/ Market Risk $200 Credit Risk $500 Capital ($mm) $200 Fixed Assets and Goodwill* $110 Other Intangible Asset Risk $220 Operational/Operating Leverage Risk $220 Interest Rate/ Market Risk $550 Credit Risk $100 Bottom-Up Allocation (First-Cut) Optimal Capitalization Level (Final Capital Allocation) ------------------------ * -- Fixed assets and goodwill capital allocations are not adjusted as they are assigned using what is in essence a top-down methodology. 13 Eric Falkenstein 4/14/99 Technical Point • Since only up to 100% of an asset can be funded by equity, items receiving 100% equity allocations are not affected by the proportional adjustment (e.g., goodwill) 14 Eric Falkenstein 4/14/99 Example • Assume Key has $100 in assets, and thus a $6.25 top down capital target commercial consumer goodwill Sum Original $ 2.00 $ 1.00 $ 1.00 $ 4.00 Adjusted $ 3.50 $ 1.75 $ 1.00 $ 6.25 • Note after adjustment, the bottom up equals the top down target 15 Eric Falkenstein 4/14/99 Strategy Motivation • The essence of the top down numbers is their relative proportions, not their absolute levels • As long as the bottom up numbers are close to the top down numbers, distortions are secondary • If bottom up and top down diverge too much, this should motivate strategic behavior at the corporate level to bring things back into balance 16 Eric Falkenstein 4/14/99 The Future • The Federal Reserve’s Board of Governors has put out a discussion paper concerning the move towards internal models for capital for credit, just as they use now for market risk • Our capital allocations anticipate this movement so that we can hit the ground running when any change occurs 17 Eric Falkenstein 4/14/99