Instructor Lesson Plan – Scenario 4

advertisement

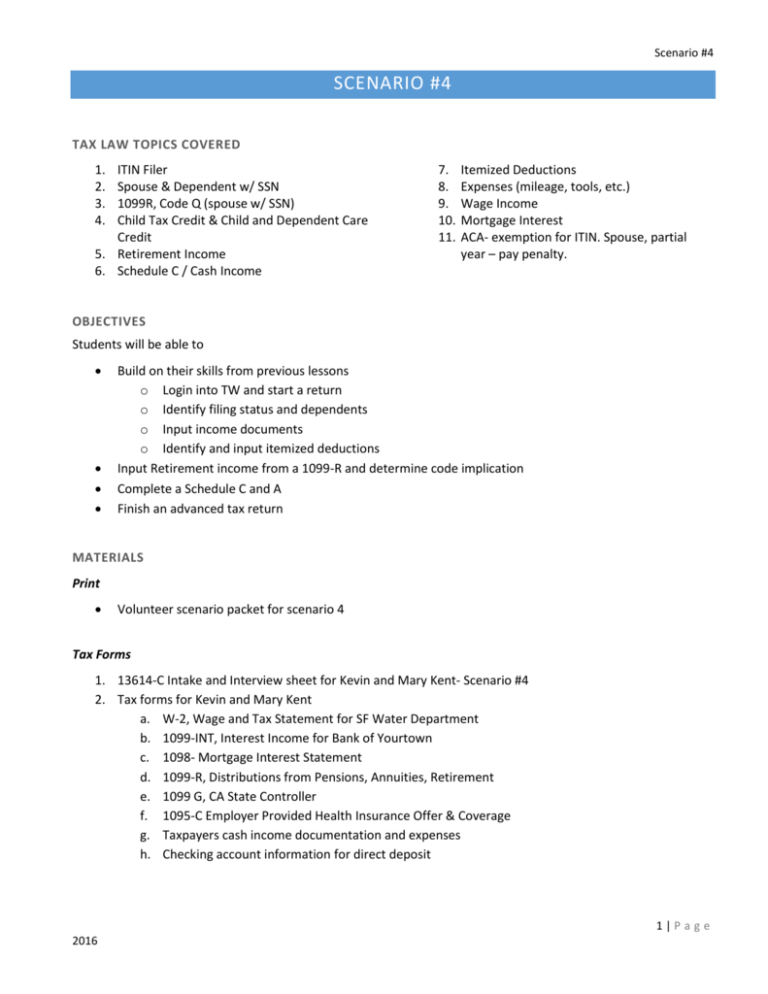

Scenario #4 SCENARIO #4 TAX LAW TOPICS COVERED 1. 2. 3. 4. ITIN Filer Spouse & Dependent w/ SSN 1099R, Code Q (spouse w/ SSN) Child Tax Credit & Child and Dependent Care Credit 5. Retirement Income 6. Schedule C / Cash Income 7. 8. 9. 10. 11. Itemized Deductions Expenses (mileage, tools, etc.) Wage Income Mortgage Interest ACA- exemption for ITIN. Spouse, partial year – pay penalty. OBJECTIVES Students will be able to Build on their skills from previous lessons o Login into TW and start a return o Identify filing status and dependents o Input income documents o Identify and input itemized deductions Input Retirement income from a 1099-R and determine code implication Complete a Schedule C and A Finish an advanced tax return MATERIALS Print Volunteer scenario packet for scenario 4 Tax Forms 1. 13614-C Intake and Interview sheet for Kevin and Mary Kent- Scenario #4 2. Tax forms for Kevin and Mary Kent a. W-2, Wage and Tax Statement for SF Water Department b. 1099-INT, Interest Income for Bank of Yourtown c. 1098- Mortgage Interest Statement d. 1099-R, Distributions from Pensions, Annuities, Retirement e. 1099 G, CA State Controller f. 1095-C Employer Provided Health Insurance Offer & Coverage g. Taxpayers cash income documentation and expenses h. Checking account information for direct deposit 1|P a g e 2016 Scenario #4 SCENARIO OVERVIEW FOR INSTRUCTOR Kevin and Mary are filing a joint return. Kevin is self-employed and runs a small janitorial business. Kevin is an ITIN filer and received cash income. Mary had income from the SF Water Department and retired July 31st. Since her retirement, she has taken distributions from her pension, which does not have a joint survivor annuity. Kevin and Mary provided more than half of the support for their granddaughter, Melissa. They itemized last year and will also itemize this year. If due a refund they would like to deposit the refund in their checking account; if they have a balance, they will mail in the payment. OPENING THE LESSON Hand out Scenario 4 Packet to volunteers Review the objectives of the scenario with the volunteers and tell them what exactly they will be learning. Go over the documents included 1. 13614-C Intake and interview form 2. Supporting documents 3. Scenario Interview Notes Intake & Interview Things you still need to know: 1. As a volunteer you must review form and verify if their answers correspond with documents presented 2. Verify if form is filled out correctly and corrections are made when clarifying questions are asked 3. Determine if the client is eligible for VITA services- see Scope of Service chart in Publication 4012, Pages 8 - 10 WITH CLASS – Ask volunteers: Have the Kent’s completed the following? Met the taxpayer requirements (household income, IDs, and Social Security Numbers for everyone on the return) Completed the intake and interview sheet and have supporting documentation 2|P a g e 2016 Scenario #4 CONDUCTING THE LESSON Starting tax return – Pub 4012, Tab N Now that volunteers have determined that Kevin and Mary are eligible for VITA, it’s time to create a new return. Have all students refer to instructions covered in lesson 1. Remind volunteers that their TaxWise screen should be green for practice. TAXWISE 1. Create a new return and locate the forms tree on the left side of the screen 2. Input information from Part I of Intake Sheet into Main Information sheet. Refer to Pub. 4012, Tab K-6 3. Taxpayers must choose a five digit PIN number (recommend using zip code) and today’s date. This is the client’s e-file approval signature. 4. Have volunteers enter all income documents for Mary: W-2 1099-INT 1098 Mortgage Interest Statement - Schedule A Individual Taxpayer Identification Number (ITIN) – Publication 4012, Tab L THINGS YOU NEED TO KNOW ABOUT ITIN RETURNS 1. IRS issues ITINs to individuals who do not have a Social Security Number but who need to file taxes - undocumented immigrants and others 2. These individuals must apply using form W-7 3. An ITIN: a. Is formatted like the SSN and contains nine digits b. Starts with a number 9 c. Note that someone with an ITIN might have a mismatched SSN on the W2. In this case, use the ITIN on the Main Information Sheet, but use the SSN that appears on the W-2 when inputting information onto TaxWise d. ITIN documentation comes either as a letter or a card, similar to a SSN card 4. ITIN filers are not eligible for the EITC 3|P a g e 2016 Scenario #4 5. If the client needs an ITIN, refer the client prior to preparing their taxes to a Certifying Acceptance Agent VITA Site. There are many CAA sites throughout our 7 counties. The taxpayer applies for an ITIN by completing IRS form W-7 and attaching a tax return. If you are volunteering at a CAA Site, talk to your site coordinator for appropriate protocol. TAXWISE1. Input Kevin’s ITIN number on the Main Information Sheet 2. Prepare the return as you have in the previous scenario 3. Continue to input income documents (W-2s and 1099-INT) Itemized Deductions - Publication 4012, Tab F THREE THINGS YOU NEED TO KNOW ABOUT ITEMIZED DEDUCTIONS Schedule A must be prepared when itemizing deductions 2. First clue that a taxpayer may benefit from itemizing is if they have mortgage interest (usually several thousand dollars and likely to exceed the standard deduction amount). That’s the first question to ask the taxpayer before preparing a Schedule A. If unsure whether to itemize or take the standard deduction, use Publication 4012, Tabs F-3 and F-4 interview 3. Itemized deductions include: Medical and Dental expenses- Only deduct amount that is more than 10 % of their AGI (7.5% for taxpayers 65 or older) and must be paid by the taxpayer. They must be unreimbursed. Certain taxes you paid (real estate/property, part of DMV car registration) Mortgage Interest- 1098 Gifts to Charity Miscellaneous Deductions 1. For more information on deductible and non-deductible expenses visit https://www.irs.gov and search for Publication 17. Itemized Deductions can be found in Chapter 21 With class – 1. Determine if the Kent’s should take the standard deduction or itemize their deductions. HINT: Do they have those two big ticket items: mortgage interest and/or high unreimbursed medical expenses? Mortgage Interest TAXWISE – 1. Open Schedule A from the forms tree. Refer to Pub 4012, Tab F-5 2. Have class enter: 4|P a g e 2016 Scenario #4 Mortgage interest - Schedule A, Line 10 Mortgage insurance premiums – Schedule A, Line 13 Property taxes (see notes for the amount) - Schedule A, Line 6 (there are several lines, input on 3 Charitable donations and medical expenses on A detail State Refund as Income, Publication 4012, Tab D 13-15 THINGS YOU NEED TO KNOW ABOUT STATE INCOME: 1. When a taxpayer itemized their deductions, they can use state income tax paid as a deduction 2. In turn, any refund received that year needs to be reported as income and will be reported on a 1099 G. 3. In order to properly report this information on the tax return, you will need the taxpayer’s prior return to fill in: taxable income, itemized deductions total and state income tax paid. TAXWISE – 1. Input 1099-G, link from 1040 line 10 to State Tax Refund worksheet. 2. Fill out appropriate information requested on the worksheet, pulling the information from the 2014 tax return. Retirement Income, Publication 4012, Tab D THINGS YOU NEED TO KNOW ABOUT RETIREMENT INCOME: 4. Some 1099-Rs will have the taxable amount reported in box 2b. In this case, all the necessary information will flow from the 1099-R to the 1040. 5. If there is no taxable amount in 2b, you will need to know: a. total employee contribution (found in box 9b) b. when the taxpayer first started receiving the pension and the age(s) of the annuitant(s) at that time c. if the pension is a joint/survivor annuity 6. If the taxpayers pension is partially taxable, the excludable amount is spread out over their life expectancy 7. If the taxpayer’s pension taxable amount is not determined (2b), you will need to complete the Simplified Method Worksheet using information mentioned above. TAXWISE – 1. Input 1099-R, link from 1040 line 16 to existing 1099-R. See Publication 4012, Tab D-20 5|P a g e 2016 Scenario #4 2. Note the red fields in the 1099-R Exclusion Worksheet – Pub 4012, Tab D 23. 3. Go back to the 13614-C and scenario notes to “interview” the taxpayer to determine the answers to the red fields (see #2 above for questions). 4. Note the 1099-R, box 2b is checked. When taxable amount is not determined, the Simplified Method must be used. See Pub 4012, Tab D-24 for instruction. 5. Complete the Simplified Method worksheet, following the instructions outlined in Pub 4012, D-24 Schedule C – Publication 4012, Tab D-10 THINGS YOU NEED TO KNOW ABOUT COMPLETING A SCHEDULE C 1. Many VITA clients do not realize they are self-employed and may check “no” on line 7 of the 13614-C. 2. Types of business income reported on a Schedule C or C-EZ are: a. 1099-MISC, box 7 non-employee compensation b. Income with no documentation (cash, check, etc.) 3. All allowable expenses under $10,000 must be claimed 4. Taxpayers must have records to support income and expenses, or be able to reasonably reconstruct that information, Pub 4012, Tab F-13. Review business expenses Pub 4012, Tab F 9-12. WITH CLASS – 1. Review Schedule C-EZ requirements with the volunteers in Publication 4012, D-13 2. Point out that volunteers may be preparing returns using the Schedule C, but limited to the criteria of the Schedule C-EZ with the exception of reporting expenses up to $25,000. 3. Review Kevin’s business expenses and determine if they are allowable. Refer to D14 side note for non-deductible expenses and Tab F 9-14 for allowable expenses. TAXWISE – 1. 2. 3. 4. 5. 6. Link from 1040, line 12 to Schedule C Link from Schedule C, line 1 to 1099-MISC Input 1099-MISC Go back to Schedule C, line 1 and link to New Scratch Pad Input cash income on Scratch Pad- “cash income for landscaping -$$” Input mileage in Part IV of Schedule C – see interview notes for details. For more information on deductible transportation expenses, see Publication 4012, Tab F12 7. Input expenses in Part V of Schedule C. 8. Fill in all red fields on Schedule C, lines A-J. See Publication 4012, D-13 a. Business code information can be found on the home page of TaxWise, under Quick References: Business 1099-R and Country Codes link 6|P a g e 2016 Scenario #4 b. c. d. e. f. 9. 10. 11. 12. 13. Employer ID number- if applicable Business Address- use home address if none Accounting method- answer will be “cash” in this case Did you materially participate – answer will be “yes” Did you make any payments in 2015 that would require you to file form(s) 1099 – answer will be “no” Review Schedule-C line 31, Net Profit or Loss – figure must be positive. If negative, out of scope. Point out the amount on line 31 flows to form 1040, line 12. Go to 1040, line 57 and point out the self-employment tax and click on link to the existing form Schedule-SE. Explain how self-employment tax has calculated on the net business income Now, go to 1040, line 27 and explain that 1/2 of the self-employment tax is an adjustment to income. Child & Dependent Care Credit- Publication 4012, Tab G 3-5 WITH CLASS – 1. Have volunteers determine if Kevin & Mary can claim the child and dependent care credit for Melissa. Review documents and have volunteers review chart found on Pub 4012 Tab G-3. TAXWISE1. Go to 1040, Line 49 and link to Form 2441. 2. Fill out form, see Pub 4012 Tab G-5 for instructions Affordable Care Act, Publication 4012, Tab D Refer to Lesson 1 on how to interview for ACA procedures With class – 1. 2. 3. 4. 5. 6. Review taxpayer answers on Part VI on 13614-C using the Job-Aid in Pub 4012 K-4 Identify applicable flowchart in ACA tab. Go through flowchart (ACA-1) with students for each person on the return Review Minimum Essential Coverage, on ACA-4 Finish reviewing flowchart (ACA-1) with students Have students complete 13614-C gray box in part VI 7|P a g e 2016 Scenario #4 TAXWISE – 1. Indicate on the ACA worksheet that spouse had partial coverage by checking the boxes for the months she did not have coverage. 2. Enter exemption information on Form 8965 Complete CA State Return See scenario 2 lesson plan for details on how to complete the CA return in TaxWise FINISHING THE RETURN Reviewing the Federal Tax Return Review the 1040, line by line pointing out the different amounts and where they came from. Tie it back to the documents and information input by the volunteers. TAXWISE – 1. Review all lines of the 1040 that have amounts in them. 2. Bank account information needed for direct deposit- refer to Part VII of the Intake Sheet 3. Identity Protection PIN- if client checked the “yes” in box 12 of the Intake Sheet, refer to Pub. 4012, Tab P-1 Finishing the return- Publication 4012, Tab K See scenario 1 on how to further complete the tax return then… 1. Ensure that all federal and state forms are green, then… 2. Click the Run Diagnostics button at the top of the page to check for mistakes or missing information. Address any issues and click the button again until it is clear. 3. Click E-file button below the Diagnostics summary FINISHING THE LESSON 8|P a g e 2016 Scenario #4 After all volunteers have entered all documents into TaxWise for Scenario 4, ask them whether that have any questions about the information that was taught. Review all topics that were covered and be sure to use the questions in the PowerPoint to gauge student comprehension. 9|P a g e 2016