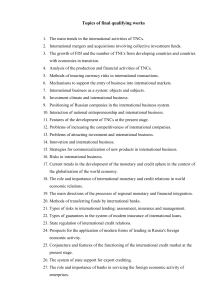

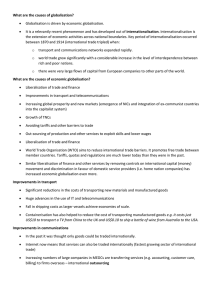

Location of 500 huge TNCs

advertisement

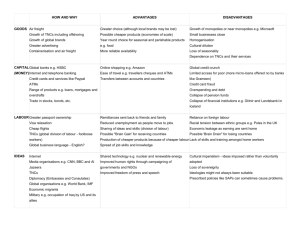

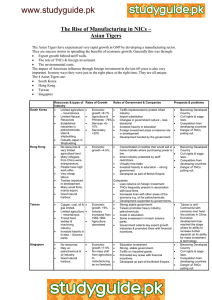

ТNCs and TNBs in IB Evolution 1 Stage Obtaining resources from colonies 2 Stage The period between two wars. Manufacture of the weapon and military engineering 4 Stage Was formed in 1970 — 1980. In conditions of development of the accelerated scientific and technical progress 3 Stage Scientific and technical achievement in the field of the newest branches of a science 5 Stage Purposeful development in the beginning XXI century. In conditions of accelerated processes of regional economic integration Country / Company GDP / sales, in billions of dollars Exxon Mobile 340 Poland 339 Austria 322 Wall-Mart Store 316 Norway 311 Saudi Arabia 310 Royal Dutch Shell 307 Denmark 275 10 Huge TNCs by Ti TNCs Ti Nestle 98% Vodafone Group 81% British Petroleum , BP 77% Exxon - Mobil 68% Viendi - Universal 60% Fiat 57% Royal Dutch Shell 57% Telefonica 54% General Electric 40% Toyota Motor 35% General Motors 31% Source: UNCTADs annual report 2010 Europe 45% USA 35% Japan 15% Other 5% Source: The Universe of the Largest Transnational Corporations UNITED NATIONS New York and Geneva, 2007 P.32 Role modern TNCs in world economy Stimulate RD Stimulate development of world manufacture and international trade Stimulates competitive struggle in the world market. Stimulate the tendency globalization of world economy, promoting a deepening IDL distribution of the guarantees behind the third persons providing execution of the obligations in the money form; buying of the requirement from the third persons of execution of the obligations in the money form; confidential management of money resources and other property under the contract with the physical and legal entities; realization of operations with precious metals and jewels; granting in rent to the physical and legal entities of special rooms or safes, taking place in them, for a storage of the documents and values; leasing operations; rendering of consulting and information services. Rank 2012 Bank Assets (Billion US$) 1 Royal Bank of Scotland Group 2 801 2 790 2 673 2 950 3 513 2 Barclays 2 740 2 689 2 549 2 737 3 002 3 Deutsche Bank 2 554 2 679 2 453 2 354 2 894 4 BNP Paribas 2 543 2 478 2 324 2 232 2 727 5 HSBC 2 541 2 393 2 266 2 225 2 525 6 JP Morgan Chase 2 447 2 324 2 263 2 221 2 173 7 Credit Agricole 2 429 2 318 2 157 2 194 2 172 8 Citigroup 2 398 2 302 2 116 2 151 1 936 9 Mitsubishi UFJ Financial 2 341 2 262 2 131 2 030 1 920 10 ING Group 2 264 2 245 2 039 1 855 1 856 2012 2011 2010 2009 2008 Market Capitalisation (Billion US$) Rank 2012 Bank 1 Industrial & Commercial Bank of China 241.7 224.2 234.1 269.4 174.2 249.8 2 China Construction Bank 196.6 167.9 223.0 201.8 128.6 171.3 3 Wells Fargo & Co 161.4 150.9 181.0 199.7 118.0 119.6 4 HSBC Holdings 151.6 135.7 166.5 171.5 115.5 99.7 5 Agricultural Bank of China 142.4 131.1 163.4 154.4 98.5 86.3 6 JP Morgan Chase 141.7 123.0 140.6 138.4 98.3 80.0 7 Bank of China 129.5 121.7 138.1 137.0 75.3 74.6 8 Itau Unibanco 88.9 76.9 135.7 130.7 71.0 61.6 9 Citigroup 87.4 76.1 135.2 95.4 70.4 57.4 10 Commonwealth 83.3 75.6 45.4 57.3 2012 2011 2010 2009 2008 2003 98.3 94.6