Aggregate Demand

advertisement

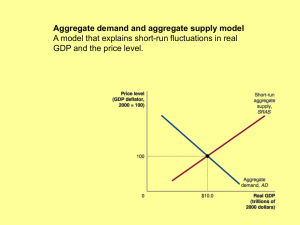

AGGREGATE DEMAND and AGGREGATE SUPPLY I So far, we’ve been using the IS-LM model to analyze the short run, when the price level is assumed fixed. The intersection of the IS curve/equation, Y= C (Y-T) + I (r) + G and the LM curve/equation M/P = L(r, Y) determines the level of aggregate demand. The intersection of the IS and LM curves represents simultaneous equilibrium in the market for goods and services and in the market for real money balances for given values of government spending, taxes, the money supply, and the price level. the IS-LM model - used for short-run analysis the AD-AS model - used for long-run analysis Jean Baptiste Say’s Law : «supply creates its own demand» (the supply-side of the economy is what really matters for final output determination) Say’s law may hold in the long run, when prices are flexible. However, in the short-run, when prices are sticky, the Keynesian version is probably more appropriate as a description of an economic system. Economist use the model of aggregate demand and aggregate supply to explain short-run fluctuations in economic activity around its long-run trend. The aggregate-demand curve shows the relationship between the price level and the quantity of output demanded by households, firms, and the government. The quantity equation is given by: MV = PY (1) Or, written differently: P = MV/Y (2) For given value of M and V, equation (2) gives us a negative relationship between P and Y. Equation (2) can be interpreted as an Aggregate Demand function. Suppose that P increases. Therefore real balances, defined by M/P must decrease. According to the quantity theory the demand for real money balances is given by: The Interest Rate Effect or Keynesian effect The impact of the price level on investment is known as the interest-rate effect. The Wealth Effect or Pigou Effect The impact of the price level on consumption is called the wealth effect. The destabilizing effects of expected deflation: e r for each value of i I because I = I (r ) planned expenditure & aggregate demand income & output The destabilizing effects of unexpected deflation: debt-deflation theory P (if unexpected) transfers purchasing power from borrowers to lenders borrowers spend less, lenders spend more if borrowers’ propensity to spend is larger than lenders’, then aggregate spending falls, the IS curve shifts left, and Y falls The aggregate supply curve shows the relationship between the price level and the quantity of output supplied. In the long run, the aggregate-supply curve is vertical. In the short run, the aggregate-supply curve is upward sloping. The full-employment or natural level of output The level of output at which the economy’s resources are fully employed. Output is determined by aggregate demand. The force that moves the economy from the short run to the long run is the gradual adjustment of prices. Shocks temporarily push the economy away from full employment. Two types of shocks: Aggregate demand shocks: the shocks that can affect the IS or the LM curves. A negative demand shock tends to decrease aggregate demand, while a positive demand shock tends to increase AD. Aggregate supply shocks: alter production costs and affect the prices that firms charge. A point like B describes a situation known as Stagflation because it combines stagnation in output (low output) with high inflation. A negative supply shock shifts up the SRAS. The central bank can raising the money supply (shock) and shifting the AD curve to the right. In this case the real income will be back to the natural level but P is now higher than in point A. This means that monetary policy can stabilize the effect of a negative shock but the price of doing that is to increase permanently the price level. Use given IS-LM and AD-AS diagrams to answer following questions. a. What happens if monetary authority increases M. Show the short-run effects on your graphs. b. Show the transition from the short run to the long run. c. How do the new long-run equilibrium values of the endogenous variables compare to their initial values?