Chapter 2

Estates: Legal Foundations

Real Estate

FIN 331

Fall 2015

REAL PROPERTY AS A BUNDLE OF

RIGHTS

A. Learning Objectives

1. What do we mean by Rights?

2. How do property rights differ from personal

rights?

3. How does real property differ from personal

property

4. What do we do when the difference is not

clear?

REAL PROPERTY AS A BUNDLE OF

RIGHTS

A. What do we mean by rights?

1. Claims that the government is obligated to

enforce

a. Derived from the Constitution & Bill of Rights

2. Non revocable and Enduring

3. Can be reduced in the interest of health, safety,

and welfare

4. Not limited to the memory of owners or others

5. Cannot be nullified by other persons or by

government

REAL PROPERTY AS A BUNDLE OF

RIGHTS

B. How do personal rights differ from property

rights?

1. Personal rights

a. Freedoms guaranteed by Constitution

b. Supreme Court interpretations of Constitution

2. Property rights

a. Exclusive possession

b. Enjoyment of the use or benefit: Use, collect rents,

harvest.

c. Freedom to dispose as one pleases (within limits of

safety): sell, convert, rebuild, etc.

REAL PROPERTY AS A BUNDLE OF

RIGHTS

C. How does real property differ from personal

property?

1 Real property: Rights in land and its permanent

structures (see Exhibit 2-2)

a Surface of the earth and improvements

a Air, up to reserved air space or tallest structure

b Beneath the earth as far as technology allows: Minerals, oil

and gas, water

2 Personal property: All other property

a Personal and household goods

b Intellectual property

c Music

REAL PROPERTY AS A BUNDLE OF

RIGHTS

D. How do we distinguish real from personal

property?

1. Fixtures (Real): typically something not

readily movable.

Examples: custom screens & draperies, kitchen

appliances such as radar ranges, garbage disposals

(attached to property)

2. Personal: typically something moveable

Examples: furniture, pictures, “customary

assumptions of the realm”

REAL PROPERTY AS A BUNDLE OF

RIGHTS

3. Special rule for “Fixtures”

a. The manner of attachment

b. The character of the article and manner of

adaptation

c. The intention of the parties

d. Relation of the parties: landlord and tenant

relationships

1) Trade fixtures considered personal property

2) Agricultural fixtures at taxes are considered property of

the tenant

3) Same rules apply for residential tenants

Estates in Land: Possessory Rights

Freehold

Leasehold

A. Possessory

A. Possessory

1.

The right to possess the

property

B. Indeterminate Duration

C. Holds Title

1.

The right to occupy the

property (tenancy)

B. Limited Duration

C. Does not hold title

Both can exist at the same time on the same property: i.e., the

owner of the property (the freeholder) may lease the property to

a tenant. The tenant has a leasehold estate

Non Possessory Rights

A. Non Possessory Interests in Property

1. Does not include the right to possess and

occupy the property

2. Examples

a. Liens

b. Easements

Possessory Interests [Estates]

A. Freehold Estates

1. Fee Simple Absolute - all possible rights

2. Fee Simple Conditional - all rights, but revocable

if specific condition is violated

3. Life Estate – limited to life of specified person or

persons

a. Estate in Reversion: property reverts to grantor (or

heirs)

b. Estate in Remainder: property goes to person other

than the grantor (the remainderman)

c. Life tenants have the same rights as the fee simple

except may not sell the property.

Possessory Interests [Estates]

B. Leasehold Estates

1. “Less-than-Freehold”: holder is a tenant

2. Tenant has right to exclusive possession for

specified period

3. Created by a lease [agreement]: Landlord (lessor)

& Tenant (lessee)

4. 4 Types

a.

b.

c.

d.

Estate for years

Periodic tenancy

Tenancy at will

Tenancy at sufferance

Leasehold Estates

A. Tenancy for Years: tenancy for fixed term.

Created by expressed agreement.

Automatically expires at end of term.

Landlord-Tenant relationship determined

by lease agreement.

B. Periodic Tenancy: no fixed termination

date in sense that it renews automatically

for similar successive periods - unless one

party gives notice (state law applies).

Assignable unless expressly forbidden.

Leasehold Estates

C. Tenancy at Will: tenant has possession of

property with landlord’s consent for an indefinite

period. Generally an oral agreement between the

tenant and the landlord

D. Tenancy at Sufferance: when tenant holds on to

property after the lease has expired. This does not

constitute trespassing because of the previous

leasehold interest

Are These Houses Really Alike?

A. Implied easements?

B. Prescriptive easements?

C. Easements in gross?

2-

Nonpossessory Interests in Land

A. Easements: The right to use land for a specific and

limited purpose

1. Affirmative easements:

a.

b.

c.

d.

Driveway or access right-of-way

Sewer line

Drainage

Common wall

2. Easements Appurtenant

a. Involves the relationship between 2 adjacent parcels of land

b. The dominant parcel benefits from the easement

c. The servient parcel is constrained or diminished by the

easement

d. May be positive (some intrusion) or negative (no intrusions)

Nonpossessory Interests in Land

3. Easements in Gross (Commercial

Easements): right to use land unrelated to

other parcels

a. Extract natural resources, harvest timber/crops

b. Add roadways, ditches, pipeline, etc.

c. May be transferred separately from land title or

ownership

Nonpossessory Interests

Examples:

On parcels A and C is a common

driveway easement.

On parcel C is an implied

easement of access in favor of

parcel B.

Parcel E as an involuntary

driveway easement known as an

easement by prescription.

Parcel F has an implied easement

for access to extract oil.

The power lines and the roadside

electric lines are easements to

permit installation and

maintenance.

The wildlife preserve on parcel G

may be protected by a conservation

easement.

Nonpossessory Interests in Land

A.

B.

C.

License

1.

2.

An easement is the right to use another’s land for a specific and limited purpose

A license is permission to do so and is revocable by the grantor

Restrictive Covenants

1.

2.

3.

4.

In a deed for a single parcel of land OR an entire subdivision

Enforceable in court of law or by “parties at interest” ~ HOA

Type of building and materials, minimum square footage, fences, etc.

Can only be enforced by those who hold a legal interest in the property

Liens: An interest in property as security for an obligation

1.

General Liens: Arise from events unrelated to the property

a.

b.

2.

Court awarded damages

Federal tax liens

Specific liens: Arise from ownership and use of the property

a.

b.

c.

Mortgage

Mechanics’ lien

Property tax, assessment or Community Development District (CDD) lien

Liens

A. An interest in property that serves as security for an

obligation

1. General Liens: Arise from events unrelated to the

property

a. Court awarded damages

b. The lien is security for the payment of the judgment

2. Property Tax and Assessment Liens

a. Enjoy top priority among liens

b. Assessment liens can last for several years

3. Community Development District (CDD) lien

4. Specific liens: Arise from ownership and use of the

property

a. Mortgage

b. Mechanics’ lien

Liens: Priority

FORMS OF CO-OWNERSHIP

A. Indirect: Through business organizations

or trusts

1.

2.

3.

4.

5.

General Partnerships

Limited Partnerships

Limited Liability Companies

Corporation (Co-op)

Trust

Entity holds title. Ownership passes through the entity.

Interest may not be divided.

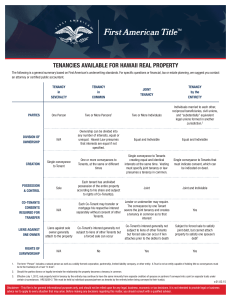

FORMS OF CO-OWNERSHIP

B. Direct:

1.

Tenancy in Common

a.

b.

2.

Joint Tenancy

a.

b.

c.

3.

Two or more individuals are joint and equal owners of property

On death of one of the owners, ownership passes to other joint owners (right of

survivorship)

Property passes free and clear from any liabilities of the deceased partner.

Community Property

a.

b.

4.

All have undivided fee simple interest

Death of one owner: ownership share passes to his/her estate (heirs)

In certain states, ownership by married couples subject to community property laws.

Some limitations; inherited property or property bought with separate funds, prenuptials

Tenancy by the Entirety: similar to 3 above but in non community property

states

a.

b.

Typ. Husband and wife. Protection against liens & judgments if against one spouse

Right of survivorship

FORMS OF CO-OWNERSHIP

5. Ownership interests from marriage

a. Dower/Curtesy: common law granting of one third life

estate to survivor in the real property of the decedent

b. Dower covers the widow’s claim, curtesy the widower

c. Life estate is not marketable

6. Elective Share

a. In law, grants the surviving spouse a share of most of

the wealth of the decedent

b. Elective share applies to both real and personal

property

c. Elective share law may not encompass all of the

decedent’s wealth

Two Main Forms of Marital Property Rights

FORMS OF CO-OWNERSHIP

C. Common Interest Developments

1. Condominiums: single ownership (fee

simple) with tenancy in common (of

communal elements). Bylaws define owner

rights

2. Cooperatives: Cooperative; a proprietary

corporation – each owner has a proprietary

lease (in effect ownership of a specific

portion) and can be sold, transferred, or

bequeathed.

FORMS OF CO-OWNERSHIP

3. Timeshare

a. Multiple individuals having use of property but

not simultaneous interests

b. the estate is divided into separate time intervals

c. Timeshare rights

1) any contract that may convey any level of real property

interest

2) Buyer often acquires a leasehold interest rate fixed

number of years

3) A buyer may also acquire a license for partial use

SPECIAL ISSUES REGARDING LAND

A. Rights to Water (Riparian Rights)

1. Who owns the land under a body of water?

2. Who controls use of land under a body of

water?

3. Who has the right to use the surface?

4. Who has the right to use the water itself?

5. Who has the right to use groundwater?

Appurtenances: Water Rights

A. Riparian Rights

1. Rights to water when water flows through or adjacent to

property

2. Property owner has right to make reasonable use of

stream’s natural flow: drinking, bathing, watering a

personal use garden.

3. Upstream owners not allowed to use water in ways that

would deprive downstream owners of its use.

4. How about ownership of the land under the water?

a. Is the stream navigable? Navigable = large enough for

commercial use.

b. If YES, does not own. If No – owns the land under the stream.

c. If stream is border between two adjacent pieces of property,

ownership extends to mid-stream.

Dr. D.P. Echevarria

All Rights Reserved

29

Appurtenances: Water Rights

A. Riparian Rights (cont.)

5. Littoral Property

a. Property located next to a lake.

b. Owners have right to have lake maintained at its

natural level.

c. To use the lake for fishing and recreation.

d. To have the quality of the water maintained.

e. If the lake is not navigable, each littoral owner

owns a portion of the lake bed adjacent to their

property.

Dr. D.P. Echevarria

All Rights Reserved

30

Appurtenances: Water Rights

A. Appropriative Rights

1. Dose not depend on ownership of property next to

body of water.

2. Appropriative rights depend on priority of use.

3. The first person to make use of water had right to

continue that use: prior appropriation.

4. In time of scarcity, the first user had priority over

later users.

5. In most western US states, the state or federal

government holds the water in trust.

a. Water is allocated by permit

b. Water can be used on property not adjacent to the source of

water.

Dr. D.P. Echevarria

All Rights Reserved

31

SPECIAL ISSUES REGARDING LAND

B. Rights to Oil, Gas, and Minerals

1. Rights to the subsurface include rights to

minerals

2. Mineral rights can be separated from land

ownership

3. In some states, mineral rights imply ownership

of the space minerals occupy

4. Oil rights

a. Ownership states: Oil is simply another mineral

b. Traditional “rule of capture” (If you can remove it, it’s

yours) is being limited due to extensive secondary

recovery methods.

HOMEWORK ASSIGNMENT

A. Key terms: Dominant vs. Servient parcel,

Types of Liens, Property rights, Restrictive

Covenants, Forms of Tenancy, Fee Simple

types, Easements, Mineral Rights – Rule of

Capture

B. Study Questions: 1, 3, 5, 7