Slides Lillo

advertisement

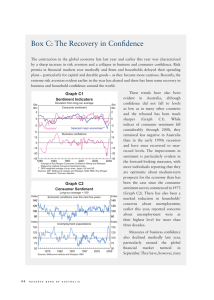

BigData@SNS: Air traffic & Financial Markets Fabrizio Lillo Scuola Normale Superiore di Pisa Quantitative Finance group • • • • Faculty: Giacomo Bormetti, Fabrizio Lillo, Stefano Marmi 7 PostDocs 13 PhD students 2 Master students Vision: – Mixture of theoretical and empirical approach – Interdisciplinary approach to finance and economics (math, computer science, physics) – Big data www.crisis-economics.eu Empirically grounded agent based models for the future Air Traffic Management scenario Collaborations • Oxford, Ecole Polytechnique, Princeton, ETH, CUNY, Central European University Budapest, Perm State University,… • S. Anna, Bologna, IMT, Venezia, Palermo, Ancona,… Interaction with industry and regulators • JP Morgan London • Unicredit Milan (x2) – Dynamics and Information Research Institute • • • • • HSBC London Yahoo Barcelona Capital Fund Management (Paris) Banca d’Italia List (Pisa) Research areas • Systemic risk and financial instabilities • Financial and socio-economic networks • Econometrics, stochastic processes, and option pricing • High frequency finance and market microstructure • Data mining and data clustering • Long-horizon predictability of the market and value investing • Firm’s growth • Transport networks • Agent based models in economics and finance Air Traffic • Through funding from EUROCONTROL (the European agency for air traffic control) we have access to the database of all the planned and actual 4D trajectories of all the flights in Europe for more than one year – Stylized facts of the air traffic networks – Optimal design of air spaces for traffic control – Identification of “hot spots” in the airspace, i.e. points where flights are rerouted more frequently) – Agent based models of air traffic control: toward the new SESAR scenario Air Traffic Management and networks From traffic data to design of air traffic control by using community detection in networks Whole European air traffic over more than one year Design of sectors from traffic data Design of airspace from traffic between sectors Average number of communities Multiresolution community detection 10 3 May 60, 2010 Nc 90 Nc FABs NA 2 10 1 10 (c) 0 10 10 0 g Ecology of real agents in financial markets Systemic instability at high frequency in financial market 2000 2010 May 6, 2010 Flash Crash News, sentiment, and finance Users clicking data for measuring the importance of a news • In financial markets, news should help predicting stock prices • Sentiment analysis typically performs badly • Access to clicking data of Yahoo Finance • We claim this is due to very heterogeneous importance of news • # of clicks to weight importance • Granger causality • Coupling news sentiment with web browsing data predicts intraday stock prices Systemic risk in the interbank market • Multiplex representation of the interbank network • What are the most “systemically important” financial institution? • Statistical models for the interbank networks: Maximum Entropy approach Statistical inference of high dimensional data (Maximum Entropy, Belief Propagation)