PowerPoint Slides - Community Unit School District 308

Bell Ringer 1

Analyze Career Opportunities in…

BUSINSES DEVELOPMENT

• Use the internet to learn more about careers in business and economic development. Choose one of the job titles listed and answer the following questions.

1.

What is the employment outlook for careers in this field?

2.

Is this a career that interests you? What can you do now to help prepare yourself for this career?

*Go to www.bls.gov

and search the Occupational

Outlook Handbook

• Economist

• Transportation

Engineer

• Urban and Regional

Planner

• Survey Researcher

• Statistician

• Budget Analyst

• Microloan Officer

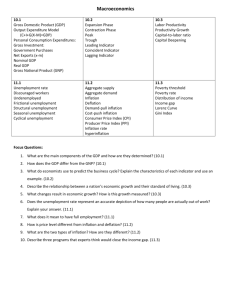

Economic Activity

Chapter 2

Today’s Goals

• Define gross domestic product (GDP) and GDP per capita

2-1

MEASURING ECONOMIC ACTIVITY

Economic Growth

• A steady increase in the production of goods and services in an economic system

• Government collects information from producers to estimate output

Gross Domestic Product (GDP)

• Total dollar value of all final goods and services produced in a country during one year

Consumer

Spending

Exports -

Imports

Components of GDP

Business

Spending

Government

Spending

GDP

• The more the goods and services produced, the healthier an economy is considered to be.

• If GDP increases from year to year, this usually signals that an economy is growing and is healthy.

GDP per Capita

• Output per Person

• GDP ÷ Total Population = GDP per Capita

GDP per Capita

• An increase in GDP per capita means that an economy is growing

• A decrease may mean that an economy is facing difficulties

Use the internet to obtain the GDP and

population statistics for 3 countries. Use the data to calculate the GDP per capita for each country. Show your work. Explain the differences among the countries.

Today’s Goals

• Describe economic measures of labor

• Identify economic indicators for consumer spending

Workers of a country contribute to the economy…

• Over 155 million people work in the US to create needed goods and services

• Wages earned (paychecks) are spent to create demand for items

Labor Activities

• Measured in two areas:

• Employment

• Productivity

Labor Force

• All people above age 16 who are actively working or seeking work

Unemployment Rate

• portion of people in the labor force who are not working

• Unemployed = over 16, looking for work and willing to work but unable to find a job

Main Cause of Unemployment

Demand

For Example…

Productivity production output in relation to a unit of input, such as a worker

For Example…

Doug earns $25/hour. He can complete 2 tax returns per hour at $150 each. How would you measure his output in relation input?

What motivates you to work harder and faster?

How can you increase output per worker?

Productivity

If wages increase faster than gains in productivity, will prices increase or decrease? Why?

Increase

Because the cost of producing goods increases.

Labor Activities Trivia

• In the early 1890s, the average employee in the

United States worked about how many hours per week?

60 Hours

• What is the average number of hours worked per week today?

40 Hours

Goal 2

• The two ways we measure labor are…

• Employment

• Productivity

Consumer Spending

• Measured in two areas:

• Personal Income

• Retail Sales

Personal Income

Salaries and wages as well as investment income and government payments to individuals

Retail Sales sales of durable and nondurable goods bought by consumers

• Measured monthly by USDC

• Include the following:

• Automobiles

• Building materials

• Furniture

• Gas

• Clothing

• Restaurants

• Department stores

• Grocery stores

• Drug stores

NONDURABLE

GOODS

Retail Sales = Economic Growth

Goal 3

• Economic indicators for consumer spending are…

• Personal Income

• Retail Sales

Use descriptive words and pictures to design a collage that illustrates the ways to measure economic activity.

Go to www.photovisi.com

to create and print your collage. You must communicate your understanding of the topic through your collage.

10 Pictures 3 Terms

Bell Ringer 2

1.What is the current unemployment rate?

2. What is the highest and the lowest it has been over the past 10 years?

* Go to www.bls.gov

to research the topic

2-2

ECONOMIC CONDITIONS CHANGE

Today’s Goals

Describe the four phases of the business cycle

Explain causes of inflation and deflation

The Business Cycle

Movement of the economy from one condition to another and back again, recurring ups and downs of GDP

• 4 phases:

• Prosperity

• Recession

• Depression

• Recovery

Prosperity aka Expansions or Booms

• Period in which most people who want to work are working, businesses produce goods and services in record numbers, wages are good, and rate of GDP growth increases

• Highest point of the business cycle

Recession

• Period in which demand begins to decrease, businesses lower production, unemployment begins to rise, and

GDP growth slows for at least 2 quarters (6 months)

• Signals trouble for workers in related businesses, ripple effect

The Great Recession

2007-2009

• Unemployment rose from 4.7% in November

2007 to peak at 10% in October of 2009

Depression

• Prolonged period of high unemployment, weak consumer sales, and business failures

• GDP falls rapidly

The Great Depression

1930-1940

• 25% of US labor force was unemployed,

scarcity for many

Recovery

• Unemployment begins to decrease, demand for goods and services increases, and GDP begins to rise

• May lead back to Prosperity

Goal 1

Prosperity

Recovery

The

Business

Cycle

Recession

Depression

Consumer Prices

Inflation

An increase in the general level of prices

Causes of Inflation

• Demand for goods and services is greater than supply

• If wages go up faster than prices, businesses tend to hire fewer workers and so unemployment worsens (increases)

Name something you regularly buy that has increased in price while decreasing in size.

How does this affect your decision to purchase the item?

Measuring Inflation

• Mild inflation(2 or 3 percent a year) can stimulate economic growth

Inflation is harmful to…

• People living on fixed incomes

• Retired people

• Those whose income does not change

Price Index

• Number that compares prices in one year with prices in some earlier base year

• For example: 5% increase makes something that cost $100 last year, now $105

Cost of Living

Year

1950s-1960s

1970s-1980s

Inflation Rate

1-3%

10-12%

Deflation

A decrease in the general level of prices

• Usually occurs in periods of recession and depression

Goal 2

What is the main cause of inflation?

Demand for goods and services is greater than supply

Go to www.bls.gov

Click Subject Areas > Inflation & Prices Overview, and take a look at the different price indexes

•

•

Click CPI inflation calculator

Use the calculator to find the buying power of

$100 in 2014 compared to the year you were born and years before that.

Write a one paragraph summary that relates your findings to inflation or deflation and how this will affect you as a consumer.

Bell Ringer 3

1.What is a credit score?

2. List 3 things you can do to help your credit score.

3. List 3 things you can do to hurt your credit score.

Today’s Goals

Identify the importance of interest rates

Interest Rates

• Represent the cost of money

• Higher interest rates mean higher business costs

• Lower interest rates = consumer spending power which increases demand, productivity, and employment

Interest Rates

• People with poor credit ratings pay a higher interest rate than people with good credit ratings

Types of Interest Rates

• Prime Rate – rate commercial banks make available to their best business customers, such as large corporations

• Discount Rate – rate financial institutions are charged to borrow funds from Federal Reserve banks

• T-bill Rate – yield on short-term (13 week) U.S. government debt obligations

• Treasury Bond Rate – yield on long-term (20 year) U.S. government debt obligations

Types of Interest Rates

• Mortgage Rate – amount individuals pay to borrow for the purchase of a new home

• Corporate Bond Rate – cost of borrowing for large U.S. corporations

• Certificate of Deposit Rate – rate for time deposits at savings institutions

Influence on Interest Rates

• Supply and demand for money

• As amounts saved increase, interest rates decrease (banks have more money)

• As borrowing increases, interest rates increase

(banks have less money)

Bell Ringer 4

• Go to the following website and review the “Investing Your Money Basics” lesson.

• http://money.cnn.com/magazines/money mag/money101/lesson4/index.htm

• Take the test at the end of the lesson and record your results.

2-3

OTHER MEASURES OF BUSINESS

ACTIVITY

Today’s Goals

Explain borrowing activities by government, business, and consumers

Describe future concerns of economic growth

Investment Activities

• Capital Spending

& Projects

• The Stock Market

• Personal Savings • The Bond Market

Capital Spending money spent by a business for an item that will be used over a long period of time (more than one year)

• Examples:

• Buildings

• Machinery

• Equipment

• Vehicles

Capital Projects spending by businesses for items such as land, buildings, equipment, and new products

• Money for Capital Projects comes from:

• 1. personal savings

• 2. stock investments

• 3. bonds

Personal Savings

• Major source of investment funds for companies

• Companies use money you deposit in a bank to buy expensive equipment or create new products

• Savings rate is a factor for economic growth

The Stock Market

• Stock = ownership in a corporation

• Equity = stock ownership

• Stockholder = stock purchaser

• Value of shares is affected by:

• Supply and demand

• Company earnings

The Bond Market

• Bond = debt for an organization

• Creditor = lent money to the organization, bond purchaser

• Creditors are paid interest for the use of their money

Goal 1

• The money for capital projects comes from three main sources:

• Personal Savings

• The Stock Market

• The Bond Market

Borrowing

• “Buy now, pay later”

• Done by:

• Governments

• Businesses

• Consumers

• Influential on the economy

Government Debt

• Federal, state and local governments borrow to fund projects

• Used for:

• New schools

• Public buildings

• Highways

• Parks

Budget Surplus

(under budget, extra money)

• When a government spends less than it takes in

• May lead to:

• Tax reductions

• Increased spending on programs

Budget Deficit

(over budget, overdrawn)

• When a government spends more than it takes in

• May lead to:

• Tax increases

• Cutbacks or termination of programs

• Layoffs

National Debt

• Total amount owed by the federal government

Business Debt

• Loans

• Bonds

• Mortgages

+ Proper use of debt can help expand sales and profits

- Poor use of debt can lead to going out of business

Consumer Debt

• Credit cards

• Auto loans

• Home mortgages

• Improper use can result in financial difficulties and legal action

• Careful use can result in economic growth

Goal 2

• What is the cause of a budget deficit?

• Government or organizations spend more than they take in