Quiz 1 Answers

advertisement

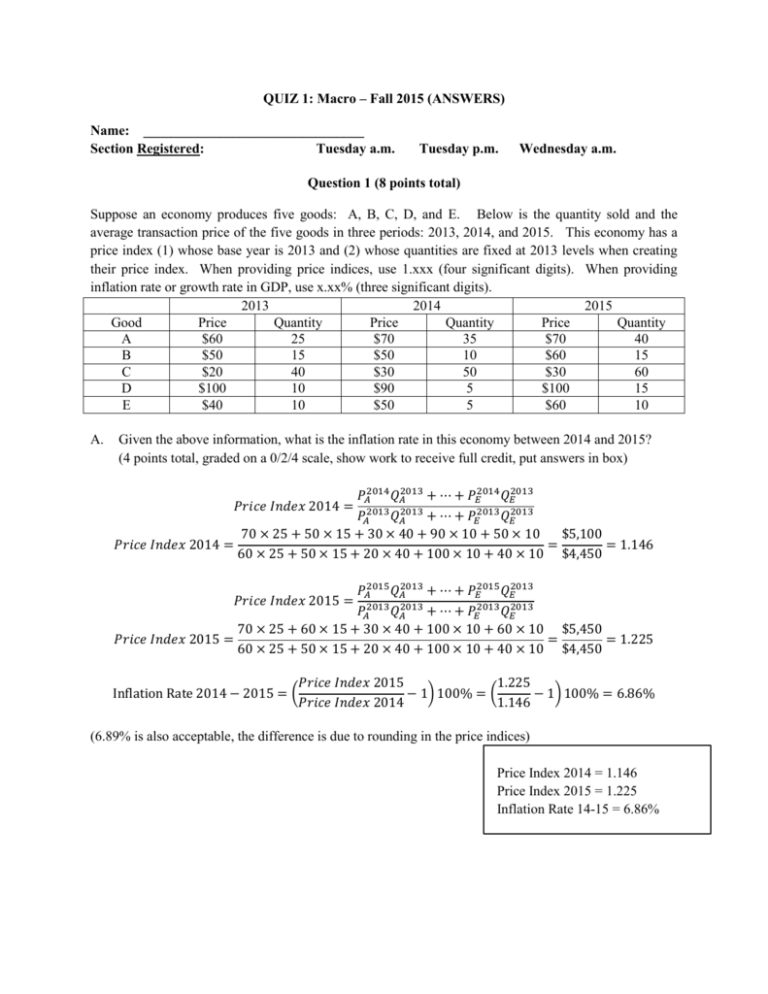

QUIZ 1: Macro – Fall 2015 (ANSWERS) Name: ________________________________ Section Registered: Tuesday a.m. Tuesday p.m. Wednesday a.m. Question 1 (8 points total) Suppose an economy produces five goods: A, B, C, D, and E. Below is the quantity sold and the average transaction price of the five goods in three periods: 2013, 2014, and 2015. This economy has a price index (1) whose base year is 2013 and (2) whose quantities are fixed at 2013 levels when creating their price index. When providing price indices, use 1.xxx (four significant digits). When providing inflation rate or growth rate in GDP, use x.xx% (three significant digits). 2013 2014 2015 Good Price Quantity Price Quantity Price Quantity A $60 25 $70 35 $70 40 B $50 15 $50 10 $60 15 C $20 40 $30 50 $30 60 D $100 10 $90 5 $100 15 E $40 10 $50 5 $60 10 A. Given the above information, what is the inflation rate in this economy between 2014 and 2015? (4 points total, graded on a 0/2/4 scale, show work to receive full credit, put answers in box) 𝑃𝐴2014 𝑄𝐴2013 + ⋯ + 𝑃𝐸2014 𝑄𝐸2013 𝑃𝐴2013 𝑄𝐴2013 + ⋯ + 𝑃𝐸2013 𝑄𝐸2013 70 × 25 + 50 × 15 + 30 × 40 + 90 × 10 + 50 × 10 $5,100 𝑃𝑟𝑖𝑐𝑒 𝐼𝑛𝑑𝑒𝑥 2014 = = = 1.146 60 × 25 + 50 × 15 + 20 × 40 + 100 × 10 + 40 × 10 $4,450 𝑃𝑟𝑖𝑐𝑒 𝐼𝑛𝑑𝑒𝑥 2014 = 𝑃𝐴2015 𝑄𝐴2013 + ⋯ + 𝑃𝐸2015 𝑄𝐸2013 𝑃𝐴2013 𝑄𝐴2013 + ⋯ + 𝑃𝐸2013 𝑄𝐸2013 70 × 25 + 60 × 15 + 30 × 40 + 100 × 10 + 60 × 10 $5,450 𝑃𝑟𝑖𝑐𝑒 𝐼𝑛𝑑𝑒𝑥 2015 = = = 1.225 60 × 25 + 50 × 15 + 20 × 40 + 100 × 10 + 40 × 10 $4,450 𝑃𝑟𝑖𝑐𝑒 𝐼𝑛𝑑𝑒𝑥 2015 = Inflation Rate 2014 − 2015 = ( 𝑃𝑟𝑖𝑐𝑒 𝐼𝑛𝑑𝑒𝑥 2015 1.225 − 1) 100% = ( − 1) 100% = 6.86% 𝑃𝑟𝑖𝑐𝑒 𝐼𝑛𝑑𝑒𝑥 2014 1.146 (6.89% is also acceptable, the difference is due to rounding in the price indices) Price Index 2014 = 1.146 Price Index 2015 = 1.225 Inflation Rate 14-15 = 6.86% B. Given the above information, what is real GDP growth in this economy between 2014 and 2015? Use the exact formula. (4 points total, graded on 0/2/4 scale, show work to receive full credit, put answers in box) Real GDP in 2014 (2013 Base Year) = 𝑁𝑜𝑚𝑖𝑛𝑎𝑙 𝐺𝐷𝑃 2014 𝑃𝑟𝑖𝑐𝑒 𝐼𝑛𝑑𝑒𝑥 2014 = 70×35+50×10+30×50+90×5+50×5 5100/4450 5150 = 5100/4450 = 4493.627 Real GDP in 2015 (2013 Base Year) = 𝑁𝑜𝑚𝑖𝑛𝑎𝑙 𝐺𝐷𝑃 ′15 𝑃𝑟𝑖𝑐𝑒 𝐼𝑛𝑑𝑒𝑥 ′15 = 70×40+60×15+30×60+100×15+60×10 5450/4450 𝑅𝑒𝑎𝑙 𝐺𝐷𝑃 2015 − 𝑅𝑒𝑎𝑙 𝐺𝐷𝑃 2014 Real GDP Growth 2014-2015 = ( = 7600 5450/4450 = 6205.505 6205.50−4493.63 ) 100% 4493.63 1) 100% = ( = 38.10% (Notice, we solved for real gdp in 2013 prices. You may have used a different year. This will not affect the growth rate, but will affect the levels in 2014 and 2015. We gave credit if you put real gdp answers in 2014 prices or 2015 prices). Real GDP in 2014 = $4,493.627 Real GDP in 2015 = $6,205.505 Real GDP Growth 14-15 = 38.10% Question 2 (6 points, 2 points each) For each of the following, circle the true answer. There is only one true answer to each question stem. A. Given the Cobb-Douglas production function developed in class, which of the following is true? i. ii. iii. iv. Capital and labor are substitutes in production. Jointly doubling labor, capital and TFP will double output. Both (i) and (ii) are true. Neither (i) nor (ii) are true. Neither of these statements is true. Capital and Labor are COMPLEMENTS in Cobb-Douglas. See supplemental notes for details. Additionally, doubling all factors will more than double GDP. Doubling only labor and capital will double GDP. There are constant returns in TFP and there are constant returns in N and K (jointly). There are NOT constant returns in TFP, K, and N (jointly). This came off the practice quizzes. B. Given the Cobb-Douglas production function developed in class, which of the following are true? Assume the parameters of the production function are exogenously given. i. ii. iii. iv. The share of aggregate income going to workers is constant over time. The employment rate in the economy is constant over time. Both (i) and (ii) are true. Neither (i) nor (ii) are true. Only the first answer is true. The CD production function implies that (W/P*N)/Y is constant. We proved this in class last week. See supplemental notes for details. The CD production function does not imply anything about the aggregate employment rate. As we will see in class this week, the aggregate employment rate is a function of labor demand (which is determined by CD production function) and labor supply. Shocks to labor supply could cause employment rate to move that has nothing to do with labor demand. The key to this is that we only talked about share of income going to workers being constant in class. C. Given what we have learned in class, which of the following are true about macroeconomic equilibrium? i. ii. iii. iv. Aggregate income per person equals aggregate expenditure per person. Total savings in the economy equals total investment in the economy (if the economy is closed). Both (i) and (ii) are true. Neither (i) nor (ii) are true. Both of these are true. Aggregate Income = Aggregate Expenditure in macroeconomic equilibrium. Also, S = I in the economy in equilibrium (when NX = 0; we defined a closed economy as having NX = 0). Question 3 (3 points) Many countries attempt to grow through increasing the capital stock (holding TFP and N fixed). While this does lead a country to experience a growth in income per capita, it does not lead to sustained increases in income per capita. Why does a policy of sustained increase in K/N not lead to sustained economic growth? Your answer should be cast in terms of concepts learned in class. Your answer should not exceed 10-12 words. My preferred answer is 5 words. Diminishing marginal product of capital. This was straight out of the notes and mentioned in class. If you keep increasing K holding N and A fixed, you eventually run into diminishing marginal product of capital. As a result, the change in Y/N gets smaller and smaller as K increases. Some people talked about “deprecation” as well. That is another acceptable answer (as discussed in the slides). As K increases, depreciation on the capital stock keeps increasing. That means more and more I is needed to just replace depreciation (which slows down the change in K). See slides for additional details. One or two people talked about depreciation – most everyone else had diminishing marginal product of capital. Question 4 (3 points total) For this question, circle the answer to the following question. There is only one true answer. In the Economist Article “Right on Target” (7/18/2015), there was a discussion about the mismeasurement of macroeconomic statistics within China during the recent year. Which of the following statistics did the article suggest was likely misreported during the first quarter of 2015? a. Employment statistics d. Export statistics b. Price statistics e. Nominal GDP statistics c. Consumption statistics This came straight from the readings. Basically, the article talked about how REAL GDP GROWTH was too high because the inflation rate was too low. The stated government inflation rate (which was negative) didn’t match other types of data in the economy. If the inflation rate was reported accurately, real gdp growth would have been lower.