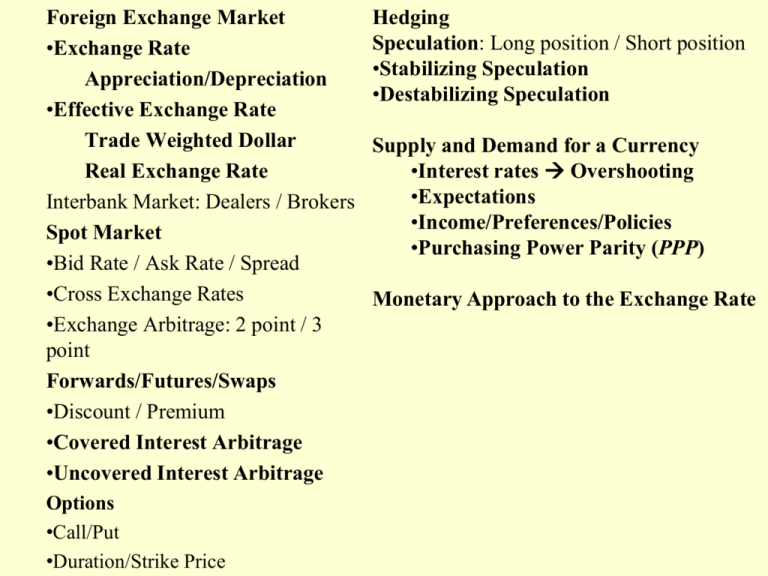

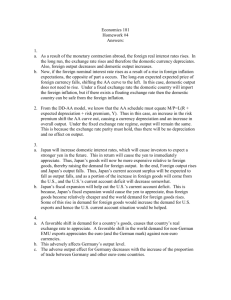

Foreign Exchange Market

•Exchange Rate

Appreciation/Depreciation

•Effective Exchange Rate

Trade Weighted Dollar

Real Exchange Rate

Interbank Market: Dealers / Brokers

Spot Market

•Bid Rate / Ask Rate / Spread

•Cross Exchange Rates

•Exchange Arbitrage: 2 point / 3

point

Forwards/Futures/Swaps

•Discount / Premium

•Covered Interest Arbitrage

•Uncovered Interest Arbitrage

Options

•Call/Put

•Duration/Strike Price

Hedging

Speculation: Long position / Short position

•Stabilizing Speculation

•Destabilizing Speculation

Supply and Demand for a Currency

•Interest rates Overshooting

•Expectations

•Income/Preferences/Policies

•Purchasing Power Parity (PPP)

Monetary Approach to the Exchange Rate

Flavors of exchange rates and contracts

• Spot rates: for currency exchanges “on the spot”

• Forward rates: for currency exchanges that will occur at a future

(“forward”) date.

– Forward contracts can be customized.

• Forward dates are typically 30, 90, 180, or 360 days in the future.

• Rates are negotiated between two parties in the present, but the exchange

occurs in the future.

• Foreign exchange swaps: a combination of a spot sale with a

forward repurchase.

• Futures contracts: designed by a third party for a standard amount

of foreign currency delivered/received on a standard date.

– Contracts can be bought and sold in markets

– Only the current owner is obliged to fulfill the contract.

• Options contracts: designed by a third party for a standard amount

of foreign currency delivered/received on or before a standard date.

– Pay a premium for the option, but not obligation, to buy (call option) or sell a

currency (put option) at a strike price before the option’s expiration date.

Covered Interest Arbitrage

1) purchase foreign currency at spot rate and use it to

finance purchase of foreign assets (bonds)

2) contract in the forward market to sell amount of

foreign currency that will be received

because of activity in the forward market such

investment opportunities quickly disappear

Uncovered Interest Arbitrage

o moving funds into

foreign currency to

take advantage of

higher rate of

return without

forward contract

o Extra return:

UK

U.S.

Percentage

= Interest - Interest ± Appreciation/Depreciation

Rate

Rate

of Pound

Factors influencing exchange rates:

Supply and Demand for a Currency

Short – run … financial transactions

• Market fundamentals

– Current account balances

– Real interest rates

• Market expectations

– News about future market fundamentals

– Speculative opinion about future exchange rates

Factors influencing exchange rates

Medium – run

– Real income … business cycle

– Monetary policy and fiscal policy

– Product availability

Long – run

– Inflation rates

– Consumer preferences for domestic or foreign

products

– Productivity changes affecting production costs … and

prices

– Profitability and riskiness of investments

– Government trade policy

Impact of interest rate differentials: drop in US

interest rate $ depreciation

S1

Dollars

per Yen

S0

B

.0080

.0075

A

D1

D0

30

35

40

45

50

55

Millions of Yen

60

65

70

FIGURE

12.6

Interest rate differentials and exchange rates

An increase in the U.S. real interest rate increases the expected return on dollar assets, such as Treasury bills

and certificates of deposit. This increase encourages flows of foreign investment into the United States, thus

causing the dollar’s exchange value to appreciate. Conversely, a decrease in the U.S. real interest rate reduces

the expected profitability on dollar assets, which promotes a depreciation of the dollar’s exchange value.

8

© 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except

Impact of expectations:

expectation of $ depreciation $ depreciation

S1

Dollars

per Pound

S0

B

1.70

1.50

A

D1

D0

60

65

70

75

80

85

90

Millions of Pounds

95

100

Overshooting Exchange Rate Volatility

From Uncovered Interest Arbitrage:

Expected depreciation of $ = ius – iuk

•From S-D analysis, if ius falls, the $ depreciates

•But why hold any $ assets if ius < iuk?

•Only if you expect $ to appreciate in the future.

•How can you expect $ to appreciate in the future when it

depreciates owing to the drop in ius?

•If $ depreciates so much when ius falls that, looking into the

future, $ can be expected to appreciate

•Immediate $ depreciation overshoots eventual depreciation.

Impact of real income differentials:

increase in US income $ depreciation

S0

Dollars

per Pound

B

1.60

1.50

A

D1

D0

0

5

10

15

20

25

Millions of Pounds

30

35

40

Impact of inflation rate differentials:

high US inflation $ depreciation

S1

Dollars

per Pound

S0

B

1.70

1.50

A

D1

D0

60

65

70

75

80

85

90

Millions of Pounds

95

100

Purchasing power parity (PPP):

The Law of One Price

• A good should cost the same in all countries (aside from

tariffs or transportation costs)

• Exchange rates should make prices equal across countries

P = ER x P*

($/bourbon) = ($/£) x (£ /scotch) = ($/scotch)

• If two countries have different inflation rates, exchange

rates will move keep prices the same

• The currency of the high inflation country will depreciate

(P/P*) ER ($/£)

Purchasing power parity: United States - United

Kingdom, 1973–2003

This figure suggests that the predictive power of the purchasing-power-parity theory is most

evident in the long term. In the short term, the theory has negligible predictive power.

15

Inflation differentials and the dollar’s exchange

value

16

Alternative approaches to exchange rates

Monetary approach

• In long run, exchange rate depends on

– Demand for money, Md = L(Y, P, i)

• Md depends on real income, prices, interest rates

– Supply of money, Ms

• Ms is controlled by central banks

• Ms $ depreciates

• Real income Md $ appreciates

• Interest rate Md $ depreciates ??!?

– Why should i rise in long-run?

• Inflation and expectations of inflation!

• It follows that $ will depreciate if i rises

Nominal and Real Exchange Rates

Real Exchange Rate Index = Nominal Index x (Our CPI/Their CPI)

If our prices are rising faster than foreign prices yet our nominal

exchange rate hasn’t depreciated, we’re really getting a better deal

The Dollar’s Exchange Rate:

The Floating Rate Era

Basket of major currencies

per dollar:

Up $ appreciation

Down $ depreciation