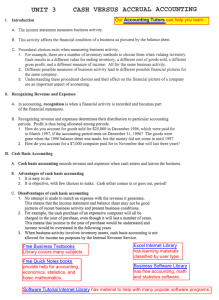

Chapter 3 - Fisher College of Business

advertisement

Accrual Accounting Concepts Chapter 3 Why is Accrual Accounting Needed? Cash received or paid Revenue earned Expense incurred Accruing Revenue Service provided Customer invoiced Cash received Revenue Recognized Accruing Expense Materials purchased Receive invoice for purchase Invoice paid Expense Recognized Family Health Care’s November Transactions To illustrate accrual concepts of accounting, we will use the following November 2013 Family Health Care transactions. a. On November 1, received $1,800 from ILS Company as rent for the use of Family Health Care’s land as a temporary parking lot from November 2013 through March 2014. b. On November 1, paid $2,400 for an insurance premium on a 2year, general business policy. c. On November 1, paid $6,000 for an insurance premium on a six-month medical malpractice policy. d. Dr. Landry invested an additional $5,000 in the business in exchange for capital stock. e. Purchased supplies for $240 on account. Family Health Care’s November Transactions Cont. f. Purchased $8,500 of office equipment. Paid $1,700 cash as a down payment, with the remaining $6,800 ($8,500 - $1,700) due in five monthly installments of $1,360 ($6,800/5) beginning January 1. g. Provided services $6,100 to patients on account. h. Received $5,500 for services provided to patients who paid cash. i. Received $4,200 from insurance companies, which paid on patients’ accounts for services that have been provided. j. Paid $100 on account for supplies that had been purchased. k. Expenses paid during November were as follows: wages, $2,790; rent, $800; utilities, $580; interest, $100; and miscellaneous, $420. l. Paid dividends of $1,200 to stockholders (Dr. Landry). Summary of Accruals and Deferrals Deferrals Revenue earned Cash received or paid Deferrals or expense incurred Accruals Revenue earned or expense incurred Accruals Cash received or paid Adjustments for Family Health Care We now analyze the accounts for Family Health Care at the end of November to determine whether any adjustments are necessary. Specifically, we will focus on the following adjustment data, which are typical for most businesses. Deferred expenses: 1. Prepaid insurance expired, $1,100. 2. Supplies used, $150. 3. Depreciation on office equipment, $160. Deferred revenue: 4. Unearned revenue earned, $360. Accrued expense: 5. Wages owed but not paid to employees, $220. Accrued revenue: 6. Services provided but not billed to insurance companies, $750. Summary of Transactions for Family Health Care Accrual Accounting and the Accounting Cycle Identify Record Record Transactions Transactions Adjustments The Accounting Cycle Prepare Financial Statements Adjustment for Supplies Answer each of the following questions concerning supplies and the adjustment for supplies. (a) The balance in the supplies account, before adjustment at the end of the year, is $1,475. What is the amount of the adjustment if the amount of supplies on hand at the end of the year is $241? (b) The supplies account has a balance of $418 (after adjustment), and the supplies expense account has a balance of $1,943 at December 31, 2004. If 2004 was the first year of operations, what was the amount of supplies purchased during the year? Wages The balances of the two wages accounts at December 31, after adjustments at the end of the first year of operations, are Wages Payable, $1,960, and Wages Expense, $87,430. Determine the amount of wages paid in cash during the year.