Car and Truck Sales

advertisement

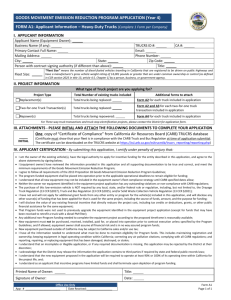

Econonomic Indicator Car and Truck Sales ECON 435 Jesse Walia Christoph Lilienfein 1 Table of Content Introduction Content of the report Economic Importance Data sets (past and current) Data Analysis Conclusion 2 Car and Truck Sales Published by: Motor Vehicle Manufacturers and Importers Frequency: Monthly Period Covered: Prior month Market significance: moderate (due to frequency) Leading indicator of economic activity. Undergoes revisions. 3 What is it? Auto and Truck Sales measure the monthly sales of all domestically and foreign produced vehicles. Important indicator of consumer demand, accounting for roughly 25% of total retail sales. Demand for big ticket items such as autos and trucks tends to be interest rate sensitive, making the motor vehicle sector a leading indicator of business cycles 4 What is it in the report? Provides unit data On unadjusted and seasonally adjusted auto and truck sales Domestic auto production Canadian and Mexican auto imports, auto exports, and Domestic auto inventories. 5 Why is it important? 25% equals to a large percentage of annual total retail sales (annually adjusted). It’s a good reflection of consumer spending, which accounts for nearly two-thirds of all economic activity. This monthly report provides significant clues as to the pace of quarterly gross domestic product (GDP), one of the primary indicators used by the Federal Reserve in setting monetary policy. 6 Impact on the Economy 7 How is the data gathered The individual vehicle manufacturers report their sales results during the first three or four days of the month. A day after the last manufacturer reports the Bureau of Economic Analysis (BEA) releases its estimate of unit auto sales. About a week after that the BEA releases its estimate of unit truck sales. The Census Bureau releases its retail sales report, including a measure of sales at automotive dealers, usually around the 13th of the month. Roughly two weeks after that the BEA releases its personal income and outlays release, including a measure of spending on motor vehicles and parts. 8 Latest Release Auto Sales Continued decrease in domestic vehicle sales: Autos (all passenger cars, including station wagons): Sales are down .084* units from the previous month (April). Light Trucks (trucks up to 14,000 pounds gross vehicle weight): Sales are down .472* units from the previous month (April). Heavy Trucks (trucks more than 14,000 pounds gross vehicle weight): Sales are down .052* units. (* in thousands) 9 Latest Release Auto Sales [Seasonally adjusted at annual rates (Millions)] Domestic Foreign Mar. Apr. ∆ Mar. Apr. ∆ 5.104 5.02 -0.084 2.473 2.303 -0.17 Light Trucks 7.711 7.239 -0.472 1.416 1.45 0.034 Autos 10 Historical Data 11 Historical Data 700.0 700.0 600.0 500.0 400.0 300.0 200.0 100.0 0.0 600.0 500.0 2007 - Q1 400.0 2000 - Q1 2000 - Q1 2007 - Q1 300.0 200.0 100.0 1 2 3 0.0 1 2 3 12 Data Analysis (historical) Truck sales ↑ car sales ↓ why? Incentive of 0 APR financing, despite rising gas prices. → shift in consumer spending to domestic manufacturers (light trucks, trucks) 13 Data Analysis 2000 vs. 2007 2000 (recession) increase in MS → IR ↓ → C, I ↑ → loans ↑ > consumer spending ↑ 2007 high(er) IR → C, I ↓ → loans ↓ > consumer spending ↓ Conclusion Good gauge for economic well being > accounts to large portion of retail sales > direct effect on other “branches” of the economy e.g. banking, loans, labor market, etc. > strong correlation with actual IR Thanks for your attention