wrfm09tp_chp15

advertisement

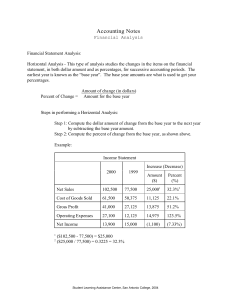

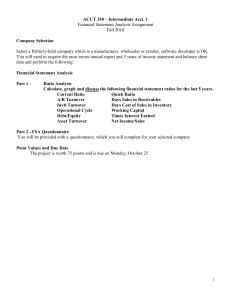

In looking for the success of WilliamsSonoma, Inc., should you just look at the net income on the income statement? 1. Yes 2. No 50% 1 50% 2 Are there accounting tools to help perform financial analysis? 1. Yes 2. No 50% 1 50% 2 Does the management of Williams-Sonoma, Inc. also use financial analysis to evaluate performance and develop strategies for the company? 1. Yes 2. No 50% 1 50% 2 Is it possible to explain the change in the stock price for Williams-Sonoma, Inc. through the financial analysis of the company financial data? 1. Yes 2. No 50% 1 50% 2 Should you perform financial analysis for a company only if you are deciding to invest in the company? 1. Yes 2. No 50% 1 50% 2 The percentage analysis of increases and decreases in related items in comparative financial statements is called horizontal analysis. 1. True 2. False 50% 1 50% 2 The ability of a business to meet its financial obligations (debts) is called turnover. 1. True 2. False 50% 1 50% 2 Quick assets are Cash and all other fixed assets. 1. True 2. False 50% 1 50% 2 Profitability analysis focuses on the relationship between operating results and the resources available to a business. 1. True 2. False 50% 1 50% 2 Solvency analysis focuses on the ability of a business to pay or otherwise satisfy the returns expected by its stockholders. 1. True 2. False 50% 1 50% 2 The number of days’ sales in inventory is calculated by multiplying average inventory by the average daily cost of goods sold. 1. True 2. False 50% 1 50% 2 The price-earnings ratio is an indicator of a firm’s future earnings prospects. 1. True 2. False 50% 1 50% 2 A type of analysis in which a percentage analysis is used to show the relationship of each component to the total within a single statement is called 25% 25% 25% 25% 1. ratio analysis 2. common size analysis 3. vertical analysis 4. horizontal analysis 1 2 3 4 An investor and/or stockholder will be interested in a business that has the ability to 25% 25% 25% 25% 1. pay regular dividends 2. pay obligations of the business 3. survive over a long period of time 4. all of these choices 1 2 3 4 The working capital of a business is defined as 1. 2. 3. 4. the excess of current assets over current liabilities the excess of total assets over current liabilities the excess of total assets over total liabilities the excess of total assets over stockholders’ equity 25% 1 25% 2 25% 3 25% 4 Which of the following is not considered a component of solvency analysis? 25% 25% 25% 25% 1. Current position analysis 2. Rate earned on total assets 3. Accounts receivable analysis 4. Inventory analysis 1 2 3 4 Accounts Receivable Turnover is computed by which of the following formulas? 1. 2. 3. 4. Net sales multiplied by total accounts receivable Net sales divided by total accounts receivable Net sales multiplied by average accounts receivable Net sales divided by average accounts receivable 25% 1 25% 2 25% 3 25% 4 To assess the efficiency in the management of inventory, a business would use a(n) 25% 25% 25% 25% 1. current ratio 2. quick ratio 3. inventory turnover ratio 4. working capital ratio 1 2 3 4 Which of the following is not a measure of the profitability of a business? 25% 25% 25% 25% 1. Earnings per share on common stock 2. Working capital ratio 3. Rate earned on total assets 4. Ratio of net sales to assets 1 2 3 4 Public corporations are required to issue to its stockholders and interested parties 25% 25% 25% 25% 1. annual reports 2. dividends 3. the personnel policy 4. financial analysis reports 1 2 3 4 Which one of the following is not a tool in financial statement analysis? 25% 25% 25% 25% 1. Horizontal analysis 2. Vertical analysis 3. Circular analysis 4. Analysis of various ratios 1 2 3 4 Which of the following financial statements would not be used to perform financial analysis for a business? 25% 25% 25% 25% 1. Comparative balance sheet 2. Comparative income statement 3. Comparative retained earnings statement 4. Worksheet 1 2 3 4