investment incentives and opportunities in the manufacturing

advertisement

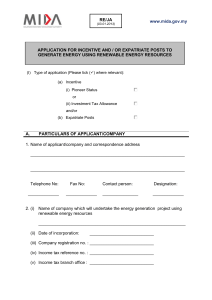

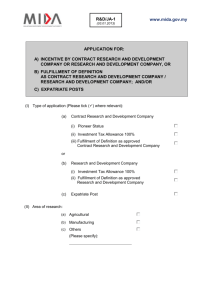

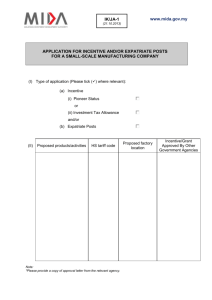

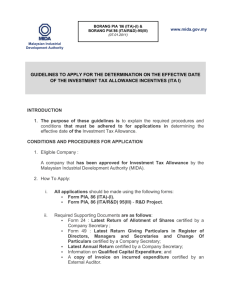

INCENTIVES FOR THE OIL PALM BIOMASS INDUSTRY BY SITI AISHAH GHAZALI AGRO-BASED INDUSTRIES DIVISION MALAYSIAN INDUSTRIAL DEVELOPMENT AUTHORITY 3 December 2008 MIDA 1 MIDA Malaysian Government's principal agency for the promotion and coordination of industrial development in Malaysia. It is the first point of contact for investors who intend to set up manufacturing and related services projects in Malaysia. 2 MIDA PROMOTION •Foreign Direct Investment •Domestic Investment RESEARCH & •Cross-Border Investment PLANNING •Services •Planning for Industrial Development •Recommend policies and strategies on industrial promotion and development EVALUATION • Manufacturing licences • Tax incentives • Expatriate posts • Duty exemption • Other incentives for R&D, software development,technical & vocational training FOLLOW-UP/MONITORING • Assist companies in the implementation and operation of their projects • Facilitate exchange & co-ordination among institutions engaged in or connected with industrial development • Advisory Services 3 • Advisory Services & Assistance Advisory Services Centre Government representatives based in MIDA Immigration Department Customs Department Department of Occupational Health & Safety Department of Environment Ministry of Finance Telekom Malaysia Berhad Tenaga Nasional Berhad 4 BUSINESS INFORMATION CENTRE (BIC) A user friendly centre for visitors to obtain comprehensive information on investment, trade, financing and productivity. 5 POLICY ON THE MANUFACTURING SECTOR Industrial Coordination Act (ICA) 1975 All manufacturing companies with shareholders’ fund of RM2.5 million and above or engaging 75 or more full-time employees are required to apply for a Manufacturing Licence. 6 LIBERALISATION OF THE EQUITY POLICY All new projects in the manufacturing, including for expansion and diversification will be exempted from both equity and export conditions. 7 PROMOTION OF INVESTMENTS ACT, 1986 Provides incentives for the development of selected promoted products/activities in the manufacturing sector. Also provides incentives for development of the SMIs and agriculture sector. the the Cont.. 8 PROMOTION OF INVESTMENTS ACT, 1986 Two main INCENTIVES : Pioneer Status (PS) Investment Tax Allowance (ITA) 9 INVESTMENT INCENTIVES PIONEER STATUS (PS) : Income Tax exemption on 70%* of statutory income for 5 years (Effective rate of tax is 7.8%) * Full exemption (100%) in the case of approved projects in Sabah, Sarawak, Perlis & the designated Eastern Corridor States of Peninsular Malaysia i.e Kelantan, Terengganu, Pahang & the District of Mersing, Johor. Accumulated losses and unabsorbed capital allowance during the pioneer period can be carried forward and deducted from post-pioneer income 10 INVESTMENT TAX ALLOWANCE (ITA) ITA of 60% on qualifying capital expenditure (factory, plant, machinery/equipment excluding land) ITA is to be utilised to offset against 70% of the statutory income ITA of 100% to be utilised to offset against 100% of the statutory income for approved projects in Sabah, Sarawak, Perlis & the designated Eastern Corridor States of Peninsular Malaysia (Effective from 13th September 2003) 11 INVESTMENT TAX ALLOWANCE (ITA) ITA is for 5 years from the date the first qualifying expenditure is incurred Unutilised ITA can be carried forward to the subsequent years 12 PIONEER STATUS (PS) FOR SMALL SCALE COMPANIES Manufacturing companies with shareholders’ funds not exceeding RM500,000 and having at least 60% Malaysian equity undertaking promoted products/activities for small scale companies are eligible for PS with income tax exemption of 100% of statutory income for 5 years. ITA of 60% (100% for promoted areas) on capital expenditure incurred within 5 years to be off set against 100% of statutory income. Cont.. 13 PIONEER STATUS (PS) FOR SMALL SCALE COMPANIES Fulfill one of the following criteria:1. Value added of at least 15% 2. Contribute to socio-economic development of the rural population 14 INCENTIVE FOR REINVESTMENT IN RESOURCE-BASED INDUSTRIES • Pioneer Status/ITA for Malaysian companies (with at least 51% Malaysian equity) which reinvest in rubber, oil palm and wood-based industries. 15 REINVESTMENT ALLOWANCE (RA) Expansion, Modernisation, Diversification & Automation Projects in operation for at least 36 months 60% RA to be utilised to offset against 70%* of the statutory income RA period - 15 years Unabsorbed allowance can be carried forward until it is fully utilised * Can be offset against 100% of the statutory income in the case of approved projects in Sabah, Sarawak, Perlis & the designated Eastern Corridor States of Peninsular Malaysia i.e. Kelantan, Terengganu, Pahang & the District of Mersing, Johor. 16 PALM BIOMASS SECTOR • Industry produces 30 million tonnes of fibrous biomass (dry weight) yearly from the plantation and the processing activities. • Industry estimated that from 100,000 hectares replanted yearly, 13.6 million logs of oil palm trunk available. • They will be used to produce value added products such as panel products, moulded packaging, composites products and pulp & paper. • To date, 73 projects were approved with total investments of RM 816.8 million for processing of palm biomass into value added products. 17 PALM BIOMASS SECTOR 2007 No. of projects approved : 12 projects Total Investments : RM 158.7 million 2006 No. of projects approved : 13 projects Total Investments Products : RM 211.7 million : Moulded products, plywood, veneer, flooring boards, laminated block boards, pellets and briquette charcoal & fibres 18 INCENTIVES FOR THE UTILISATION OF OIL PALM BIOMASS Promoted products such as particleboard, fibreboard, plywood, pulp and paper from oil palm biomass . Incentives :a) PS with 100% tax exemption of income for a period of 10 years; or the statutory b) ITA of 100% to be offset against 100% of the qualifying capital expenditure incurred within a period of 5 years Cont.. 19 INCENTIVES FOR THE UTILISATION OF OIL PALM BIOMASS Existing Companies that Reinvest a) PS with tax exemption of 100% on the increased statutory income arising from the reinvestment for a period of 10 years; or b) ITA of 100% on the additional qualifying capital expenditure be utilised to offset against 100% of the statutory income incurred within a period of 5 years. 20 INCENTIVES FOR COMMERCIALISATION OF PUBLIC R&D A company that invests in its subsidiary company engaged in the commercialisation of resource-based R&D findings will be given tax deduction equivalent to the amount of investment made in the subsidiary. Cont.. 21 INCENTIVES FOR COMMERCIALISATION OF PUBLIC R&D The subsidiary company that undertakes the commercialisation of resource-based R&D findings will be given Pioneer Status with 100% tax exemption on statutory income for 10 years. Criteria : At least 70% Malaysian Company which invests should own at least 70% equity of the company that commercialised the R&D findings Commercialisation of R&D should be implemented within one year from the date of approval of the incentive 22 EXEMPTION FROM IMPORT DUTY AND SALES TAX ON MACHINERY/ EQUIPMENT/SPARE PARTS Used directly in the manufacturing process or agricultural activity Not produced locally (For machinery/equipment produced locally sales tax exemption is applicable) 23 EXEMPTION FROM IMPORT DUTY ON RAW MATERIALS / COMPONENTS For Export Market Not produced locally or Produced locally but specifications / quality / price are not acceptable For Domestic Market Not produced locally or Finished product is non-dutiable (e.g. furniture) 24 EXEMPTION PERIOD 1 year for new application 2 years for extension For Finished Product which is non-dutiable (e.g. Furniture), 2 years for new application & 3 years for extension 25 EMPLOYMENT OF EXPATRIATE PERSONNEL • To promote technology transfer and inflow of foreign skills, manufacturing and related services companies operating in Malaysia are allowed to employ expatriate • To take care of their investment interest in Malaysia foreign companies are also allowed key posts. 26 EMPLOYMENT OF EXPATRIATE PERSONNEL All types of application for expatriate personnel in manufacturing and related services will be considered by MIDA. These include application by NEW or EXISTING Companies for : New Expatriate posts Additional Expatriate Posts; and Other application, e.g.: extension of time, upgrading of term post to key post, change of title, amendments of approval conditions, etc. 27 MANUFACTURING SECTOR - Employment Guidelines: Companies Foreign paid-up : US$ 2 million - Automatic approval for up to 10 expatriate posts, including 5 key posts Foreign paid-up : US$ 200,000 but less than US$ 2 million - Automatic approval for up to 5 expatriate posts, including 1 key posts Companies 28 MANUFACTURING MANUFACTURINGSECTOR SECTOR--Employment Employment Companies Foreign paid-up : Less than US$ 200,000 - A key post can be considered when foreign paid-up capital at least RM 500,000. - Number of expatriate (time post) allowed depends on merits of each case. More than 50% Malaysian equity - Allowed to employ expatriate personnel for technical post including R&D post regardless of the level of paid-up capital. - Consideration is based on merits of each case. Malaysian owned companies 29 MANUFACTURING SECTOR - Employment • Additional key posts and time posts for an existing company which undertakes Expansion/Diversification will depend on the additional value of the foreign paidup capital • An existing company which is exempted from Manufacturing license is required to submit appropriate Business License issued by Local Authorities. 30 DURATION OF POSTS Key Post : Can be permanently held by foreigner as long as the project is in operation Time Post : - Executive Require professional Qualification and Experience Up to 10 years - Non-Executive Require Technical Skills and Experience Up to 5 years 31 Thank You For more information please visit:- www.mida.gov.my 32