Chapter 3 slides

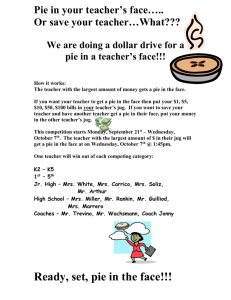

advertisement

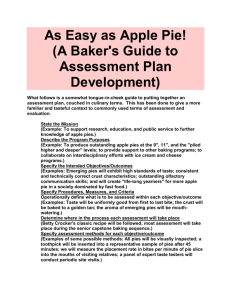

Basic Profit Models Chapter 3 Part 1 – Influence Diagram 1 In building spreadsheets for deterministic models, we will look at: ways to translate the black box representation into a spreadsheet model. recommendations for good spreadsheet model design and layout suggestions for documenting your models useful features of Excel for modeling and analysis 2 Example 1: Simon Pie Two ingredients combine to make Apple Pies: Fruit and frozen dough The Pies are then processed and sold to local grocery stores in order to generate a profit. Follow the three steps of model building. Step 1: Study the Environment and Frame the Situation Critical Decision: Setting the wholesale pie price Decision Variable: Price of the apple pies (this plus cost parameters will determine profits) 3 Step 2: Formulation Using “Black Box” diagram, specify cost parameters Pie Price Unit Cost, Filling Unit Cost, Dough Unit Pie Processing Cost Fixed Cost Model profit The next step is to develop the relationships inside the black box. A good way to approach this is to create an Influence Diagram. An Influence Diagram pictures the connections between the model’s exogenous variables and a performance measure4 (e.g., profit). To create an Influence Diagram: start with a performance measure variable. Decompose this variable into two or more intermediate variables that combine mathematically to define the value of the performance measure. Further decompose each of the intermediate variables into more related intermediate variables. Continue this process until an exogenous variable is defined (i.e., until you define an input decision variable or a parameter). 5 Start here: Profit performance measure variable Decompose this variable into the intermediate variables Revenue and Total Cost 6 Profit Revenue Total Cost Now, further decompose each of these intermediate variables into more related intermediate variables ... 7 Profit Total Cost Revenue Processing Cost Ingredient Cost Required Ingredient Quantities Pies Demanded Pie Price Unit Pie Processing Cost Unit Cost Filling Unit Cost Dough Fixed Cost 8 Step 3: Model Construction Based on the previous Influence Diagram, create the equations relating the variables to be specified in the spreadsheet. 9 Profit Revenue Total Cost Profit = Revenue – Total Cost 10 Profit Revenue Revenue = Pie Price * Pies Demanded Pies Demanded Pie Price 11 Profit Total Cost Processing Cost Ingredient Cost Total Cost = Processing Cost + Ingredients Cost + Fixed Cost Fixed Cost 12 Profit Total Cost Processing Cost Pies Demanded Processing Cost = Pies Demanded * Unit Pie Processing Cost Unit Pie Processing Cost 13 Profit Total Cost Ingredients Cost = Qty Filling * Unit Cost Filling + Qty Dough * Unit Cost Dough Ingredient Cost Required Ingredient Quantities Unit Cost Filling Unit Cost Dough 14 Simon’s Initial Model Input Values Pie Price $8.00 Pies Demanded and sold 16 Unit Pie Processing Cost ($ per pie) $2.05 Unit Cost, Fruit Filling ($ per pie) $3.48 Unit Cost, Dough ($ per pie) $0.30 Fixed Cost ($000’s per week) $12 15 Chapter 3 Part 2 Break-Even and Cross-Over Analysis MGS 3100 16 Background • The Generalized Profit Model: – A decision-maker will break-even when profit is zero. – Set the generalized profit model equal to zero, and then solve for the quantity (Q). – For simplicity, assume that the quantity produced is equal to the quantity sold. This assumption will be relaxed in the module on decision analysis. 17 Basic Relationships • Profit (π) = Revenue (R) - Cost (C) • Revenue (R) = Selling price (SP) x Quantity (Q) • Cost (C) = [Variable cost (VC) x Quantity (Q)] + Fixed Cost (FC) • Remember quantity produced = quantity sold 18 Basic Relationships con’t • By substitution: • π = (SP x Q) – ((VC x Q) + FC) • π = SP*Q - VC*Q – FC Notice sign reversal when parentheses are removed! • π = (SP-VC)*Q - FC Just a bit of algebraic reorganization… 19 Contribution Margin • If Contribution Margin (CM) = SP-VC, then by substitution… • π = CM*Q – FC • In case you want to figure the quantity at break-even, you just need to rearrange 20 Break-Even Quantity • • • • • • π = CM*Q – FC π + FC = CM*Q (π + FC)/CM = (CM*Q)/CM (π + FC)/CM = Q Q = (π + FC)/CM In the case of break-even, where π =0, the formula boils down to: • Q = FC/CM 21 Quantity and Profit Example • Again, Q = (FC + π)/CM • If fixed cost is $150,000 per year, selling price per unit (SP) is $400, and variable cost per unit (VC) is $250, what quantity (Q) will produce a profit of $300,000? • Q = ($150,000+$300,000)/($400-$250) • Q = $450,000/$150 • Q = 3000 22 Cross-Over Point • The cross-over point (or indifference point) is found when we are indifferent between two plans. • In other words, the quantity when profit is the same for each of two plans. 23 Cross-Over Point, con’t • To find the cross-over point for Plan A and B, set the profit formulas for each plan equal to each other: • πplanA = πplanB, so • (CM*Q – FC) planA = (CM*Q – FC)planB • QAtoB = (FCA - FCB)/(CMA – CMB) 24 Cross-Over Point, con’t • So all you need are the fixed costs and contribution margins (selling price and variable cost) to solve. • For example, here are three plans FC VC SP Plan A 150,000 250 400 } 150 Plan B 450,000 150 400 250 } Plan C 2,850,000 100 400 300 } 25 Cross-Over Point, con’t Breakeven Points for each plan are: QBE = Plan A 150,000/(400-250) Plan B 450,000/(400-150) = 1000 units = 1800 units Plan C 2,850,000/(400-100) = 9500 units What is the profit at each of these points? Cross-Over Points QCO A to B B to C (150,000-450,000)/(150-250) (450,000-2,850,000)/(250-300) = 3000 units = 48,000 units 26 Calculating Profit at the Cross-Over • After calculating cross-over, we have a quantity that can be plugged back into the formula to find profit at the cross-over point πA = CMA*Q – FCA = 150(3000) - 150,000 = $300,000, or πB = 250(3000) - 450,000 = $300,000 πB = CMB*Q - FCB = 250(48,000) - 450,000 = $11,550,000, or πC = 300(48,000) - 2,850,000 = $11,550,000 27