Business Associations Outline - Gillen - Winter 2012

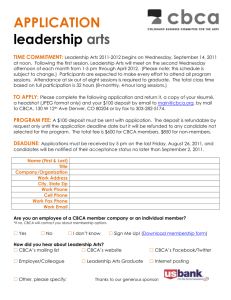

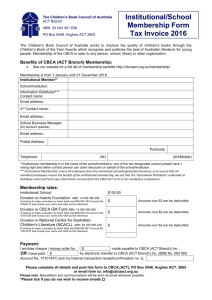

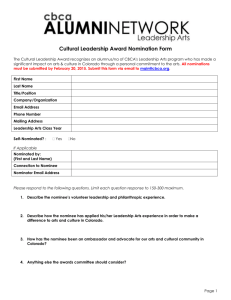

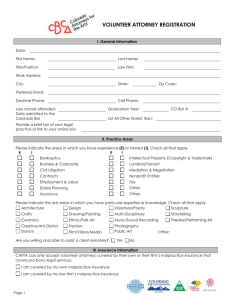

advertisement