Presentation Outline

advertisement

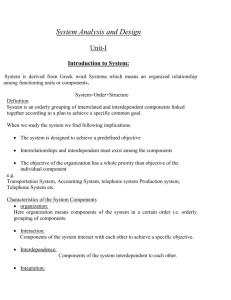

Accounting Information Systems: An Overview Presentation Outline I. The Users of Accounting Information II. Information Systems III. Transaction Processing Cycles IV. The Internal Control Process V. Organization Interaction with Information Systems VI. The Development of Systems I. The Users of Accounting Information A. External Users of Accounting Information B. Internal Users of Accounting Information C. Mandatory vs. Discretionary Information A. External Users of Accounting Information Creditors Investors Stockholders Customers and Vendors Government Agencies B. Internal Users of Accounting Information Characteristic of Information Source Level of Aggregation Time Horizon Required Accuracy Lower Level Managers Operational Control Largely internal Middle Managers Management Control Top-Level Managers Strategic Planning External Detailed Historical Aggregate Future High Low C. Mandatory vs. Discretionary Information Mandatory Information Certain types of information must be generated regardless of the cost: Government reports Payroll Basic bookkeeping Evaluation Criteria For mandatory information, the primary concern is minimization of cost. In contrast, discretionary information should provide greater benefits than the cost of generating it. II. Information Systems The term information system suggests the use of computer technology in an organization Information System Information for Decision Making Hardware Data Software A. Electronic Data Processing (EDP) or Data Processing (DP) B. Management Information Systems (MIS) C. Decision Support Systems (DSS) D. Expert Systems (ES) E. Executive Information Systems (EIS) F. Accounting Information Systems (AIS) A. Electronic Data Processing (EDP) or Data Processing (DP) Use of computer technology to perform an organization’s transaction-oriented data processing. DP systems serve routine, recurring, general information needs. B. Management Information Systems (MIS) Use of computer technology to provide managers with decision-oriented information beyond what a normal DP system provides. Subsystems include: Marketing information system Manufacturing information system Human resource information system Financial information system Functional MIS subsystems provide a logical rather than physical way of implementing the MIS concept in organizations. C. Decision Support Systems (DSS) Processes data into a decision making format for end users. Decision support systems (DSS’s) process nonroutine information requests on an ad hoc basis. Requires the use of decision models and specialized databases beyond what is in a DP system. D. Expert Systems (ES) Emulates an experts decision making process to provide a decision. Different from DSS which only provides information for making a decision. Two components of the ES are as follows: Knowledge base – special knowledge that an expert possesses in the decision area. Inference engine – process by which expert makes the decision. I know the answer . E. Executive Information System (EIS) Executive information systems tailor information to the strategic needs of toplevel management. Much of the information used by top-level management comes from sources outside the organizations information system. (i.e., meetings, memos, television, periodicals, and social activities). Which direction? F. Accounting Information Systems (AIS) A computer-based system designed to transform accounting data into information. Can also include transactions processing cycles, the use of information technology, and the development of information systems. III. Transaction Processing Cycles The transaction processing cycles provide a means of viewing the activities of a business. A. Revenue Cycle B. Expenditure Cycle C. Production Cycle D. Finance Cycle E. Financial Reporting Cycle A. Revenue Cycle Events related to the distribution of goods and services to other entities and the collection of related payments B. Expenditure Cycle Events related to the acquisition of goods and services from other entities and the settlement of related obligations. C. Production Cycle Events related to the transformation of resources into goods and services. D. Finance Cycle Events related to the acquisition and management of capital funds, including cash. The treasurer is responsible for the finances of the business. E. Financial Reporting Cycle Not an operating cycle This cycle obtains accounting and operating data from other cycles and processes this data so that financial reports can be prepared. A controller is in charge of the accounting function. IV. The Internal Control Process Since management is far removed from the scene of operations in a large organization, personal supervision of employees is often replaced with various control techniques. A. Definition of Internal Control B. The Five Elements of the Internal Control Process C. Segregation of Accounting Functions D. The Internal Audit Function A. Definition of Internal Control Internal control is a process designed to provide reasonable assurance regarding the achievement of objectives relating to: Reliability of financial reporting Effectiveness and efficiency of operations Compliance with applicable laws and regulations The concept of internal control structure is based on two major premises: management’s responsibility and reasonable assurance. B. Five Elements of the Internal Control Process Control environment – Overall values and integrity of organization. Risk assessment – Identification and evaluation of risks (Potential loss x Probability = Exposure). Control activities – Activities undertaken to reduce probability of loss due to significant risks. Information and communication – Communicating information about the control environment and control activities. Monitoring – Keeping watch over and changing internal controls so that they function effectively and efficiently. C. Segregation of Accounting Functions I kept the records and the cash. Segregate the following duties: Authorization Record keeping Custody of assets D. Internal Audit Function Internal auditing is an independent appraisal function charged with monitoring and assessing compliance with organizational policies and procedures. V. Organization Interaction With Information Systems A. The Steering Committee B. End-User Computing C. Quick-Response Technology A. The Steering Committee A committee advising the Chief Information Officer that is composed of high-level members of user functions such as manufacturing and marketing. The committee provides a means by which managers from other areas can influence the information services process. B. End-User Computing (EUC) Functional end users do their own information processing activities through an EUC application such as a database that uses a query language feature to generate specific information needed by the end user to make decisions. (See Fig. 1.7 on p. 13) Potential EUC Problems Inadequate system development – May solve wrong problem or have poor documentation. Ineffective use of resources – Underutilized equipment or inefficient design. Data integrity and security problems – Inadvertent alteration of data or failure to implement security controls. See contrast to traditional approach in Figure 1.8 on page 14. C. Quick-Response Technology 1. Just-In-Time 2. Web Commerce 3. Electronic Data Interchange 4. Extensible Business Reporting Language 5. Computer Integrated Manufacturing 6. Electronic Payment Systems 1. Just-in-Time Purchase orders for inventory items are made on a “demandpull” basis rather than a fixed interval “push” basis to restock store inventory levels. Adds flexibility to meet customer needs and reduces product rework. 2. Web Commerce Provides worldwide availability of products on a single computer. Specially trained CPAs offer the Web Trust seal to sites that meet certain security and privacy criteria. 3. Electronic Data Interchange Electronic data interchange (EDI) is the direct computer-to-computer exchange of business documents via a communications network. EDI differs from e-mail in that EDI messages are created and interpreted by computers without human intervention. Also makes use of universal product code (UPC) bar code. (See Fig. 1.10 on p. 15) 4. Extensible Business Reporting Language Extensible Business Reporting Language (XBRL) is a language that facilitates the exchange over the Internet of all kinds of business documents and financial statements. The SEC permits companies to file their financial reports electronically using XBRL format. 5. Computer-Integrated Manufacturing (CIM) Components of CIM typically include computer-aided design (CAD) workstations, realtime production monitoring and control systems, and order inventory and control systems. Makes use of scanner technology and machinereadable bar codes. 6. Electronic Payment Systems Electronic funds transfer (EFT) systems are electronic payment systems in which processing and communication are primarily or totally electronic. VI. The Development of Systems A. Blueprinting B. Systems Development C. Behavioral Considerations A. Blueprinting The company uses generic or industry standard stock blueprints rather than designing its own system. B. Systems Development A systems development project ordinarily consists of three phases: systems analysis, systems design, systems implementation. The procedure attempts of improve information quality, internal control, and minimize cost. The systems approach consists of six steps: The Result of Poor Systems Development 1. Statement of system objective(s) 2. Creation of alternatives 3. Systems analysis 4. Systems design 5. Systems implementation 6. Systems evaluation C. Behavioral Considerations The users of systems should be included throughout the steps of systems development. Users provide valuable input into what is needed and must accept the system that is developed. Summary I. II. Five Types of Information Systems Five Transaction Processing Cycles III. The Internal Control Process IV. Steering Committee and EUC V. Quick-Response Technology VI. The Steps of Systems Development