MARKETS CAN DO UNEXPECTED THINGS: WHY ARE INTEREST

advertisement

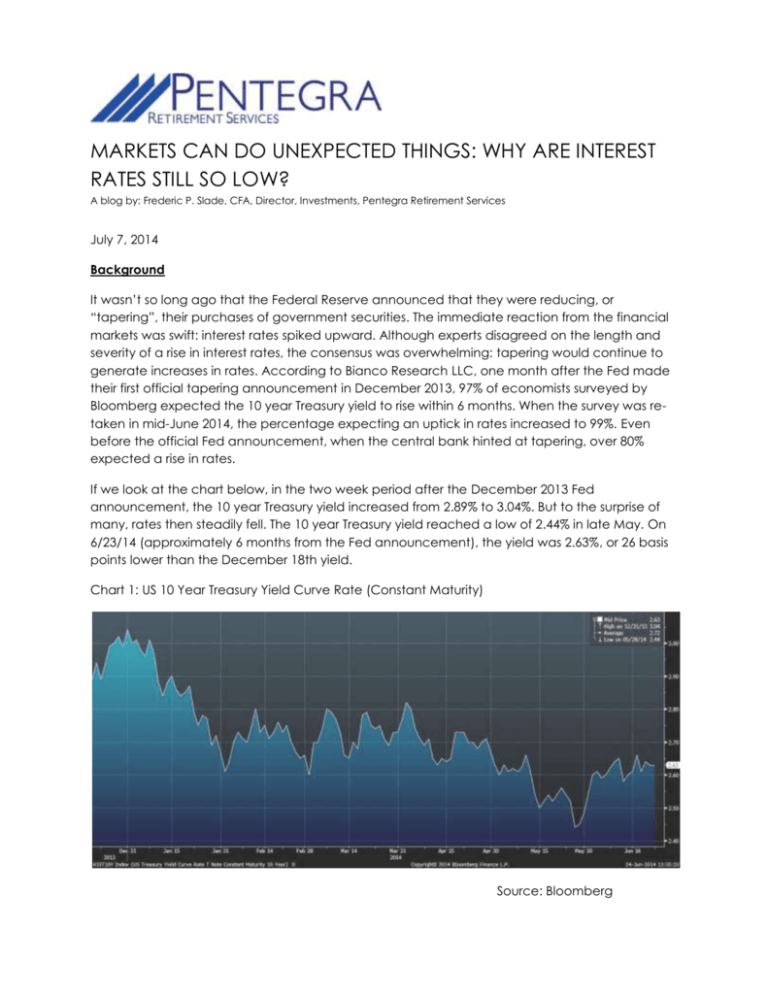

MARKETS CAN DO UNEXPECTED THINGS: WHY ARE INTEREST RATES STILL SO LOW? A blog by: Frederic P. Slade, CFA, Director, Investments, Pentegra Retirement Services July 7, 2014 Background It wasn’t so long ago that the Federal Reserve announced that they were reducing, or “tapering”, their purchases of government securities. The immediate reaction from the financial markets was swift: interest rates spiked upward. Although experts disagreed on the length and severity of a rise in interest rates, the consensus was overwhelming: tapering would continue to generate increases in rates. According to Bianco Research LLC, one month after the Fed made their first official tapering announcement in December 2013, 97% of economists surveyed by Bloomberg expected the 10 year Treasury yield to rise within 6 months. When the survey was retaken in mid-June 2014, the percentage expecting an uptick in rates increased to 99%. Even before the official Fed announcement, when the central bank hinted at tapering, over 80% expected a rise in rates. If we look at the chart below, in the two week period after the December 2013 Fed announcement, the 10 year Treasury yield increased from 2.89% to 3.04%. But to the surprise of many, rates then steadily fell. The 10 year Treasury yield reached a low of 2.44% in late May. On 6/23/14 (approximately 6 months from the Fed announcement), the yield was 2.63%, or 26 basis points lower than the December 18th yield. Chart 1: US 10 Year Treasury Yield Curve Rate (Constant Maturity) Source: Bloomberg The impact of the bond market’s reaction (in addition to confounding many experts) has been to keep mortgage rates low, money market rates near zero, longer term bond returns positive and stock prices growing despite relatively slow economic growth in 2014. Why have rates stayed low? There are a number of possible explanations, but here are a few: The Fed has maintained a relatively “dovish” stance on interest rates. Fed Chair Yellen has indicated the Fed won’t raise short-term rates any time soon (the market is expecting the Fed to wait until at least 2015). The Fed is seeking improvement in the labor market and is not overly concerned about inflation at present. Therefore, the Fed policy is likely remain relatively friendly to lower interest rates in the near to intermediate term. The economic recovery has been slow. Despite recent job growth, United States Gross Domestic Product (GDP) declined (2.9%) in the first quarter of 2014. The World Bank reduced its 2014 global growth forecast from 3.2% to 2.8%. Included in the slowing economies is China. China’s slowdown has helped dampen energy demand and reverse prior increases in commodity prices. In short, a slow economic recovery makes it less likely that interest rates will rise. Money has begun to flow into fixed income mutual funds. After seeing negative flows in 2013, inflows into taxable and municipal bond funds in March 2014 and April 2014 have nearly equaled flows into equity mutual funds. If this trend continues, it would lend further support to fixed income prices and help keep yields low. US interest rates, while low, still look attractive compared to many developed countries. The current US 10 year Treasury yield of 2.6% actually ranks 10th highest among developed countries (source: Bloomberg). Countries with lower yields include Japan, Germany and France. Even among Euro nations such as Spain, Italy and Portugal, yields are less than 100 basis points higher than US yields. These metrics should continue to help keep the US fixed income markets attractive to investors. According to DoubleLine and the US Treasury, the first quarter of 2014 represented the strongest quarter of foreign investment in long-term Treasury securities in two and a half years. Conclusion It is, of course, possible that interest rates could begin rising again. China and Japan could curtail their purchases of US Treasuries. Inflation could rear its head, making it more difficult for the Fed to keep rates low. However, thus far, Fed policy and the underlying dynamics in the fixed income markets have kept rates lower than most analysts and the “taper” headlines would have predicted. Indeed, markets can do unexpected things at times. NOTE: Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Past performance is not a guarantee of future results. About Frederic Slade Fred Slade has over 25 years of experience in the investment management and retirement services industries. He is Director, Investments for Pentegra Retirement Services, a leading provider of retirement services to financial institutions and organizations nationwide, founded by the Federal Home Loan Bank System in 1943. Mr. Slade manages over $1 billion in internal bond portfolios and provides analytics and strategy for Pentegra’s Defined Benefit and Defined Contribution Plans. Mr. Slade holds a Ph.D. in Economics from University of Pennsylvania and a CFA, and has presented at a number of seminars and conferences.