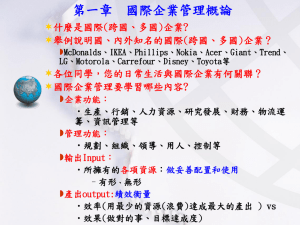

CHAPTER

10

Global Strategy:

Competing Around

the World

McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

Part 2 Strategy Formulation

2–2

2–2

LO 10-1

Define globalization, multinational enterprise (MNE),

foreign direct investment (FDI), and global strategy.

LO 10-2

Explain why companies compete abroad and evaluate

advantages and disadvantages.

LO 10-3

Explain which countries MNEs target for FDI, and how they

enter foreign markets.

LO 10-4

Describe the characteristics of and critically evaluate the

four different strategies MNEs can pursue when competing

globally.

LO 10-5

Explain why certain industries are more competitive in

specific nations than in others.

LO 10-6

Evaluate the relationship between location in a regional

cluster and firm-level competitive advantage.

10–3

Chapter Case 10

Hollywood Goes Global

• Hollywood movie: The quintessential American product

However, non-US sales increased: 50% in 2000,

and 70% in 2010

Altered global strategic focus

Movies that fit the global market by adapting foreign scripts, hiring

international actors/actresses…etc.

• Treat emerging markets as focal targets

Not just filmmaking industries, but also the electronics industry

(example: Korea, China), and auto industry (example: India)

Key questions: How can a company compete effectively in a

global market place?

10–4

What Is Globalization?

•

Globalization is a process of closer integration and

exchange between different countries and peoples

worldwide.

•

Made possible by:

Falling trade and investment barriers

Advanced telecommunications

Reduced transportation costs

Importance of MNEs and FDIs

10–5

What Is Globalization?

• Multinational Enterprise (MNE)

Deploys resources and capabilities in the

procurement, production, and distribution in

at least two countries

Less than 1% of firms, BUT employ 19% of U.S. workforce

– 74% of private sector R&D spending

• Foreign Direct Investment (FDI)

Investments in value chain activities abroad

• Global Strategy

To sustain a competitive advantage

Competing against foreign and domestic companies

around the world

10–6

Why Global?

• Gain access to a larger market

Capitalize on market potential, such as China, India,

and emerging economies

• Gain access to low-cost input factors

Labor, natural resources, technology, logistics

• Managing corporate risk

• Leverage core competencies

• Develop new competencies

Location economies

Unique locational advantages

10–7

STRATEGY HIGHLIGHT 10.1

Stages of Globalization

• Globalization 1.0: 1900–1941

Only sales and distribution took place overseas

• Globalization 2.0: 1945–2000

Duplicating business functions overseas

• Globalization 3.0: 21st century

MNEs become global collaboration networks

(see Exhibit 10.2)

1–8

EXHIBIT 10.2

Globalization 3.0 - Collaboration Networks

10–9

EXHIBIT 10.3

International Sales as % of Total

Data from 2010

10–10

STRATEGY HIGHLIGHT 10.2

Does GM’s Future Reside

in China?

• Market opportunity in China

1.4 billion population, only 1 in 100 people owns a vehicle

• GM entered China in 1997

Joint venture with Shanghai Automotive Industrial Corp

China is 25% of GM’s revenues and GROWING fast

GM China factories are more productive than U.S. plants

• GM’s future relies on China and other emerging economies

$ 250 million on a state-of-the-art R&D center…in Shanghai

Future of GM likely decided in their international HQ…in Shanghai

10–11

1–11

Disadvantages of Expanding Internationally

• Liability of foreignness

Additional cost of doing business in an

unfamiliar cultural and economic environment

Cost of coordinating across geographic distance

Economic development may increase the cost of

doing business

Rising wages with improved living standards

Difficulty in protecting intellectual property

10–12

LO 10-1 Define globalization, multinational enterprise (MNE), foreign

direct investment (FDI), and global strategy.

LO 10-2 Explain why companies compete abroad and evaluate

advantages and disadvantages.

LO 10-3 Explain which countries MNEs target for FDI, and how

they enter foreign markets.

LO 10-4 Describe characteristics of and critically evaluate four

different strategies MNEs pursue when competing globally.

LO 10-5 Explain why certain industries are more competitive in specific

nations than in others.

LO 10-6 Evaluate the relationship between location in a regional cluster

and firm-level competitive advantage.

10–13

Global Expansion: Where

• How does an MNE decide where to go?

National institutions:

Well-established legal and ethical pillars as well as

well- functioning economic institutions such as

capital markets, banks, and infrastructures

National culture: "Programming of the mind"

Geert Hofstede’s Cultural Dimensions

1.

2.

3.

4.

5.

Power distance

Individualism

Masculinity/femininity

Uncertainty-avoidance

Long-term orientation

10–14

EXHIBIT 10.4

Corporate Tax Rates

Institutional Difference Matters

10–15

Global Expansion: How

• Exporting: producing goods in one country to sell

in another country

• Acquisition, strategic alliance are also popular

vehicles for entry into foreign markets

• MNEs sometime prefers greenfield operations

or wholly-owned subsidiaries

Greenfield is building new factories/offices from scratch

Physically and organizationally building from the "ground up."

10–16

EXHIBIT 10.5

Modes of Foreign Market Entry

Market Entry along the

Investment and Control Continuum

10–17

Strategy around the World:

Cost Reduction vs. Local Responsiveness

• Local responsiveness:

Tailor product and service offerings to fit local

consumer preferences and host-country requirements

Higher cost

Example: McDonald’s uses mutton in India

•Cost reduction:

MNEs enter global marketplace with

the intention to reduce operation cost

Example: Toyota Prius

10–19

EXHIBIT 10.6

The Integration-Responsiveness Framework

Four Global Strategies

• International strategy

Leveraging home-based core competencies

Selling the same products or services in both domestic

and foreign markets

Example: Selling Starbucks coffee internationally

• Localization (product differentiation) strategy

Maximize local responsiveness via a

multi-domestic strategy

Consumers will perceive them to be domestic

companies

Example: Nestlé’s customized product offerings in

international markets

10–21

Four Global Strategies

• Global standardization (cost leadership) strategy

Economies of scale and location economies

Pursuing a global division of labor based on best-of-class

capabilities reside at the lowest cost

Example: Lenovo’s R&D in Beijing, Shanghai, and Raleigh;

production center in Mexico, India, and China

• Transnational strategy

Combination of localization strategy (high responsiveness)

with global standardization strategy (lowest cost position

attainable)

Example: German multimedia conglomerate Bertelsmann

: Caterpillar’s earth-moving equipment

Characteristics, Benefits, and Risks

of Four Types of Global Strategy

EXHIBIT 10.7

Characteristics

• Often the first step in

internationalizing.

• Used by MNEs with relatively large

domestic markets (e.g., MNEs from

U.S., Germany, Japan).

International

Strategy

Localization

(Multidomestic)

Strategy

Benefits

• Leveraging core

competence.

• Economies of scale.

• Low-cost implementation

through:

Risk

• No or limited local

responsiveness.

• Highly affected

by exchange rate

fluctuations.

• Well-suited for high-end products

• Exporting or licensing

• IP embedded in product

(such as machine tools) and luxury

goods that can be shipped across

the globe.

• Products and services tend to have

strong brands.

• Main competitive strategy tends to

be differentiation since exporting,

licensing, and franchising add

additional costs.

• Used by MNEs to compete in

host countries with large and/or

lucrative but idiosyncratic domestic

(for products)

• Franchising (for services)

• Licensing (for trademarks)

or service could be

expropriated.

• Highest-possible local

responsiveness.

• Reduced exchange-rate

• Duplication of key

business functions

in multiple countries

markets (e.g., Germany, Japan,

exposure.

leads to high cost of

Saudi Arabia).

implementation.

• Often used in consumer products

and food industries.

• Main competitive strategy is

differentiation.

• MNE wants to be perceived as local

company.

• Little or no economies of

scale.

• Little or no learning across

different regions.

• Higher risk of IP

Expropriation.

10–23

EXHIBIT 10.7

Characteristics, Benefits, and Risks

of Four Types of Global Strategy

Characteristics

Benefits

Risk

Global-

• Used by MNEs that are offering

• Location economies:

• No local responsiveness.

Standardization

standardized products and services

global division of labor

• Little or no product

Strategy

(e.g., computer hardware or

based on wherever best-of-

differentiation.

business process outsourcing).

class capabilities

• Some exchange-rate

• Main competitive strategy is price.

reside at lowest cost.

exposure.

• Economies of scale.

• “Race to the bottom” as

wages increase.

• Some risk of IP

expropriation.

Transnational

• Used by MNEs that pursue an

• Attempts to combine

• Global matrix structure

(Glocalization)

integration strategy at the business

benefits of localization and

is costly and difficult to

Strategy

level by simultaneously focusing on

standardization strategies

implement, leading to high

product differentiation and low cost.

simultaneously by creating

failure rate.

• Mantra: Think globally, act locally.

a global matrix structure.

• Some exchange-rate

• Economies of scale,

exposure.

location, and learning.

• Higher risk of IP expropriation.

STRATEGY HIGHLIGHT 10.3

Wal-mart Retreats

from Germany

• Wal-mart entered Germany

Acquisition of 21 stores and 74 hypermarkets

• Wal-mart duplicated its U.S. policies and applied them in Germany

Employees refused to accept those policies

• Wal-mart faced significant cultural differences

• Wal-mart could not develop efficient economies of scale and distribution

centers to drive cost down

• The result is a defeated Wal-mart that sold its stores to Metro,

Wal-mart’s key rival in Germany

• ALDI, another of Wal-mart’s competitors in Germany, is now expanding

aggressively in the U.S.

1–25

LO 10-1 Define globalization, multinational enterprise (MNE), foreign

direct investment (FDI), and global strategy.

LO 10-2 Explain why companies compete abroad and evaluate

advantages and disadvantages.

LO 10-3 Explain which countries MNEs target for FDI, and how they

enter foreign markets.

LO 10-4 Describe the characteristics of and critically evaluate the

four different strategies MNEs can pursue when

competing globally.

LO 10-5 Explain why certain industries are more competitive in

specific nations than in others.

LO 10-6 Evaluate the relationship between location in a regional

cluster and firm-level competitive advantage.

10–26

National Competitive Advantage

• Death-of-distance hypothesis

Geographic location alone should not lead to firm-level

competitive advantage because firms are now more able

to source inputs globally (ex: capital, commodities, etc.)

Labor markets also have become more global.

Computer manufacturers – China & Taiwan

Consumer electronics – Japan & South Korea

Mining companies – Australia

• Why are certain industries in some countries more

competitive than in others?

Answer: National Competitive Advantage

10–27

EXHIBIT 10.8

Porter’s Diamond Model of National

Competitive Advantage

Porter American

Future Video

10–28

National Competitive Advantage Framework

• Factor conditions

A nation’s endowments in terms of national, human, and other

resources as well as supportive infrastructure and institutions.

• Demand conditions

Specific characteristics of demand in a firm’s domestic market

• Competitive intensity

Highly competitive environments tend to stimulate

firms to outperform others (e.g., German car industry)

• Related and supporting industry

Leadership in related and supporting industries can also foster

world-class competitors in downstream industry

Complementarity

10–29

Regional Clusters

• Regional cluster

A group of interconnected companies and

institutions in a specific industry, located

near each other geographically and linked

by common characteristics

Knowledge spillover

Positive externalities that are

regionally constrained

Exchange of ideas among firms

in a cluster

10–30

EXHIBIT 10.9

Mapping a Regional Cluster: Research Triangle

10–31

Geographical Distribution of Clusters

Boise

Boston

Wisconsin / Iowa / Illinois

Minneapolis

Information Tech Agricultural Equipment

Mutual Funds

West Michigan

Western Massachusetts

Cardio-vascular Office and Institutional

Farm Machinery

Medical Devices

Polymers

Omaha

Equipment

Mgmt. Consulting

Furniture

Seattle

Rochester

Telemarketing

and Services

Biotechnology

Aircraft Equipment and Design

Imaging Equipment

Hotel Reservations

Software and

Michigan

Software

Credit Card Processing

Networking

Clocks

Warsaw, Indiana

Coffee Retailers

Venture Capital

Detroit

Orthopedic Devices

Auto Equipment

Hartford

and Parts

Insurance

Oregon

Electrical Measuring

Providence

Equipment

Jewelry

Woodworking Equipment

Marine Equipment

Logging / Lumber Supplies

New York City

Financial Services

Silicon Valley

Advertising

Microelectronics

Publishing

Biotechnology

Multimedia

Venture Capital

Pennsylvania / New Jersey

Pharmaceuticals

Las Vegas

Pittsburgh

Amusement /

Advanced Materials

Casinos

Energy

Small Airlines

North Carolina

Household Furniture

Los Angeles Area

Synthetic Fibers

Defense Aerospace

Hosiery

Entertainment

Wichita

Cleveland / Louisville

Light Aircraft

San Diego

Paints & Coatings

Farm Equipment

Baton Rouge /

Golf Equipment

New Orleans

Biotech/Pharma

Dalton, Georgia

Dallas

Specialty Foods

Carpets

Real Estate

Southeast Texas /

Development

Nashville / Louisville

Louisiana

Colorado

Hospital Management

South Florida

Chemicals

Computer Integrated Systems / Programming

Health Technology

Engineering Services

Computers

Mining / Oil and Gas Exploration

10–32

Source: Adapted from Professor Michael E. Porter, Harvard Business School