Lesson 4.3 January Simulation Solutions

advertisement

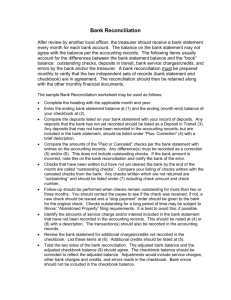

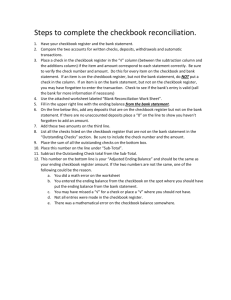

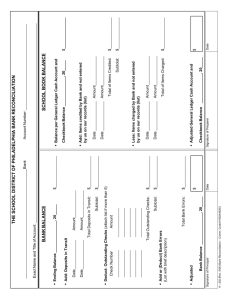

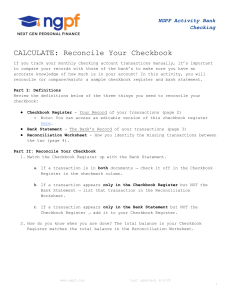

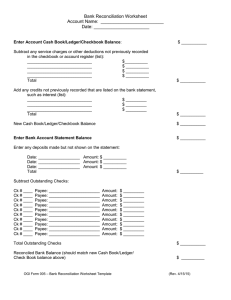

Objective: analyze the checking account transactions made in our banking simulation January 1- 31st Check Register January Date No. Checkbook Entry 1/3 D Deposit paycheck + $50 Cash 1/8 101 National Electric Company 35.24 681.96 1/9 102 Reader’s Service, INC 24.00 657.96 1/15 103 Ticket Forum 40 617.96 1/15 104 Verizon 41.80 576.16 1/19 105 Hilltop Garage 120.24 455.92 1/22 106 Seasons Unlimited 33.93 421.99 1/28 107 KMT Insurance 314.12 107.87 1/31 D Deposit paycheck – $60 cash 1/31 108 Colonial Apartments-rent 1/31 Debit (-) Credit (+) Balance 717.20 717.20 692.37 450 800.24 350.24 Reconciliation • Definition: to have two items agree • Review handout on reconciliation basics • Definition: adjusted balance- New balance for checkbook and bank statement after the reconciliation process has been completed. What do we do with the following exercise? • Student with cards move to the front of the room. Reconciliation Example • Reconcile the following bank statement and checkbook register. You must have your adjusted balance completed to receive full credit. Note: the numbers on both sides must equal. • Bank Statement Ending Balance: $5,000 • Check Register Ending Balance: $5,800 • Reconcile the differences—use tick marks! Continued • The following items were not found in both the checkbook register and the bank statement. • Service Fees $4.00 • Interest Earned $ 12.00 • Check Fees $8.00 • Outstanding Deposits $850.00 • Outstanding Checks $ 85.00 • Checkbook error (forgot to record in register a check for $35.00) Final Assessment • Test Chapter Four– Wednesday, • Key terms from notes and handouts, reconciliation, and checking account simulation Closure • What happens when the adjusted balances don’t agree? • What should you do first? • How often does the bank make mistakes? Reconciliation Bank Statement -$5,000 • + 850.00 (OD) • - 85.00 (OC) Checkbook Balance- $5,800 • - 4.00 (SF) • +12.00 (I) • - 8.00 (CF) • -35.00 (E) • = 5765.00 • = 5765.00 (adjusted balance) (adjusted balance) Practice Problem 2 Bank $6000 • Adjusted Balance= 6765 Checkbook $6,800 • Adjusted Balance = 6765